House rejects hard-right immigration bill, baring GOP divide

The House killed a hard-right immigration bill Thursday, and Republican leaders delayed a planned vote on a compromise GOP package with the party’s lawmakers fiercely divided over an issue that has long confounded them. The conservative measure was defeated 231-193, with 41 Republicans — mostly moderates — joining Democrats in voting against it. Those defections — nearly 1 in 5 GOP lawmakers — underscored the party’s chasm over immigration and the election-year pressures Republicans face to stay true to districts that range from staunchly conservative to pro-immigrant. Thursday’s vote set the stage for debate on the second bill, this one crafted by Republican leaders in hopes of finding an accord between the party’s sparring moderate and conservative wings. That compromise was considered too lenient by some conservatives and seemed likely to fall, too, and aides said the final roll call would wait till Friday. Rejection of both would represent an embarrassment for President Donald Trump, who had embraced them. As if the internal GOP turmoil was not enough, the party’s political exposure on the issue has been intensified by heartbreaking images of migrant children separated from families and complicated by opaque statements by Trump. At the White House, Trump defended his administration’s “zero tolerance” policy of prosecuting all migrants caught illegally entering the country, a change that has caused thousands of families to be divided while the parents are detained. He said without it, “you would have a run on this country the likes of which nobody has ever seen.” He said he was inviting Congress’ top two Democrats, House Minority Leader Nancy Pelosi and Senate Minority Leader Chuck Schumer, to the White House for immigration bargaining. He called them “extremist open-border Democrats.” And in a tweet that seemed to undermine House leaders’ efforts to round up votes, he questioned the purpose of their legislation by suggesting it was doomed in the Senate anyway. Trump issued an executive order Wednesday aimed at reversing his own policy of taking immigrant children from their detained parents, but emotions remained high. “I was welcomed here,” a tearful Rep. Norma Torres, D-Calif., said during House debate, describing her journey to the U.S. as a child from Guatemala. “I was not put in a freezing cell.” In an embarrassing detour, the House used an early procedural vote to correct what Republicans called a drafting error — language providing $100 billion more than they’d planned to help build Trump’s proposed border wall with Mexico. Instead of giving initial approval for $24.8 billion spread over the next five years, the legislation said it would open the door to $24.8 billion “for each” of the next five years. The rejected conservative bill would have granted no pathway to citizenship for young “Dreamers” who arrived in the country illegally as children, curbed legal immigration and bolstered border security. The second was a compromise between GOP moderates and the party’s conservatives that included an opportunity for citizenship for the young immigrants. It provides $25 billion for Trump’s wall, restrictions on legal immigration and language requiring the Homeland Security Department to keep migrant families together while they’re being processed for illegal entry to the U.S. Democrats oppose both measures as harsh. “It is not a compromise,” House Minority Leader Nancy Pelosi, D-Calif., told reporters. “It may be a compromise with the devil, but it is not a compromise with the Democrats.” Even before votes began, Trump complicated GOP efforts to round up votes. “What is the purpose of the House doing good immigration bills when you need 9 votes by Democrats in the Senate, and the Dems are only looking to Obstruct (which they feel is good for them in the Mid-Terms),” Trump wrote. “Republicans must get rid of the stupid Filibuster Rule-it is killing you!” In the unlikely event that the House approved the GOP compromise, it seemed certain to go nowhere in the GOP-run Senate. Democrats there have enough votes to use procedural delays to kill it. Sixty votes are needed to end filibusters. On Wednesday, Trump reversed himself and took executive action aimed at curbing the separation of families. His order seemed to stem some of the urgency for Congress to act. But GOP leaders were eager to hold the votes anyway. The roll calls would let Republicans assert to voters that they tried addressing the immigration problem. “Our members wanted to express themselves on an issue they care a great deal about,” Speaker Paul Ryan said. Passage of the GOP compromise was always a long shot, but failure may now come at a steeper price. Republicans and Trump have raised expectations that, in control of Congress and the White House, they can fix the nation’s long-standing immigration problems. When the crisis of family separations erupted at the border, GOP leaders revised the compromise bill to bolster a provision requiring parents and children to be held together in custody. It did so by eliminating the 20-day cap on holding minors and allowing indefinite detentions. Even though Trump has acted unilaterally to stem the family separations, lawmakers still prefer a legislative fix. The administration is not ending its “zero tolerance” approach to border prosecutions. If the new policy is rejected by the courts, which the administration acknowledges is a possibility, the debate could move back to square one. Senate Republicans, fearing Trump’s action will not withstand a legal challenge and eager to go on record opposing the administration’s policy, have unveiled their own legislation to keep detained immigrant families together. In the House, moderate Republicans forced the immigration debate to the fore by threatening to use a rare procedure to demand a vote. Led by Curt Curbelo and Rep. Jeff Denham, R-Calif., many are from states with large populations of young “Dreamer” immigrants who now face deportation threats under Trump’s decision to end the Obama-era Deferred Action for Childhood Arrivals program. A federal court challenge has kept the DACA program running for now. Republished with permission from the Associated Press.

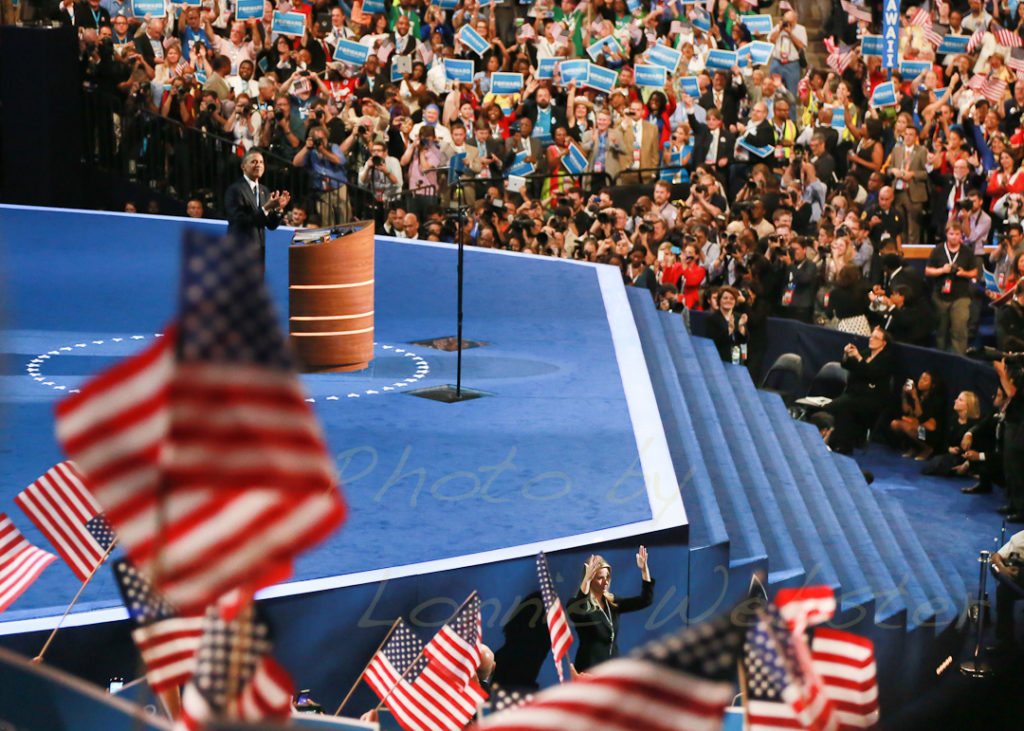

Birmingham out of the running host 2020 Democratic National Convention

It’s official, Birmingham is out of the running for the 2020 Democratic National Convention. In May, media outlets reported the DNC narrowed down potential host cities to Atlanta, Birmingham, Houston, Miami Beach, Milwaukee, New York, and San Francisco. But the mayor’s office said Birmingham never submitted a bid for consideration. “We were honored to receive the encouragement from (Democratic Party) Chairman Tom Perez and Deputy Chairman Rep. Keith Ellison to submit a proposal for Birmingham to host the DNC in 2020,” Rick Journey, director of communications for Mayor Randall Woodfin, told AL.com in an email. “After a closer look, we recognized the huge amount of resources needed to prepare the city to be competitive in the selection process, and successful if we were to be selected as the host. “At this time, we have determined that we must keep our focus first and foremost on our priorities to the people of Birmingham through neighborhood revitalization, workforce development and business growth,” he added. In 2016, the city spent $275,000 to hire a team of consultants to organize and promote the its convention bid. Ultimately Philadelphia was chosen. POLITICO reported on Wednesday the DNC narrowed its 2020 convention locations to Houston, Miami Beach, Milwaukee and Denver. Since that time, Denver has withdrawn its bid. The convention is scheduled for July 13-16, 2020. The site selection committee is expected to visit Houston, Miami Beach, Milwaukee over the summer and announce the host city this fall or early in 2019.

Baldwin County placing police in all schools

One of Alabama’s most populous counties has a plan to put armed police officers in each of its public schools. Officials in coastal Baldwin County say agencies are partnering to provide permanent school resource officers at each of its 46 campuses beginning this August. Currently, only some county schools have officers on duty constantly. Sheriff Huey “Hoss” Mack says Baldwin already has 30 school resource officers, meaning 16 more are needed. The sheriff’s office and city police departments will have to fill those positions. Officials haven’t provided details on how all the new jobs will be funded, but they say new taxes aren’t needed. School board members will consider the plan during a meeting Thursday. Baldwin County has more than 200,000 residents, and it’s located across Mobile Bay from Mobile. Republished with permission from the Associated Press.

Here’s what the SCOTUS ruling that states can collect online sales tax means for Alabama

In a decision that will impact online shopping for all Alabamians, on Thursday the U.S. Supreme Court upheld a South Dakota law that required online companies to collect and remit state sales taxes, even if that company did not have a ‘physical presence’ in the state. In the landmark ruling, the court reversed a 26-year-old decision and in saying that states can require internet retailers to collect sales and use tax in states where they lack a physical presence. In Alabama Alabama is expected to be among the states most likely to see the biggest percentage increase in revenue based on the Barclays research. The ruling is likely to lead the Yellowhammer State to collect sales tax on purchases from out-of-state online businesses more aggressively. Translation: many consumers will likely pay more at the online checkout. History behind the opinion Justice Anthony Kennedy, who wrote the majority opinion in the 5-4 decision, said the 1992 decision, known as Quill, resulted in “a judicially created tax shelter for businesses that decide to limit their physical presence and still sell their goods and services to a state’s consumers — something that has become easier and more prevalent as technology has advanced.” According to the U.S. Census Bureau, from 1992 to 2018 internet and mobile sales have grown from zero to nine percent of all retail sales. Online sales are growing at four times the rate of total retail sales – 16 percent vs. 4.4 percent. The pre-internet era physical presence rule put “local businesses … at a competitive disadvantage relative to remote sellers,” and it “produced an incentive to avoid physical presence in multiple states,” Kennedy wrote in his opinion. Prior to the SCOTUS ruling In 2015, Alabama was looking for a solution to the problems they were encountering due to the Quill decision. That year, the Alabama Department of Revenue (ADOR) adopted a Simplified Sellers Use Tax program (SSUT) that took effect October 22: “Pursuant to this rule, an out-of-state seller with a substantial economic presence in Alabama will be required to collect and remit Alabama tax on its sales into the state, regardless of whether it has an Alabama physical presence. The rule imposes a collection obligation on out-of-state sellers who engage in one or more of the activities listed in Code of Alabama 1975, Section 40-23-68, activities subjecting out-of-state sellers to the state’s sellers use tax levy, and who had $250,000 or more in retail sales sold into Alabama in the previous year. Out-of-state sellers may satisfy the rule’s requirements by collecting, reporting and remitting tax on sales made into Alabama pursuant to the provisions of Article 2, Chapter 23 of Title 40, Code of Alabama 1975, or by participating in the Simplified Sellers Use Tax Remittance Program.” SSUT allowed, and continues to do so, participating sellers to collect, report, and remit an eight percent simplified sellers use tax on sales of tangible personal property delivered to Alabama purchasers, covering both state and local taxes. If SSUT is collected, neither the purchaser or the seller are liable for any additional use taxes on the transaction, regardless of whether the actual combined local and state rate is higher than eight percent. Before the SSUT was launched in 2015, online sellers with no physical presence in the state had no obligation to collect and remit use taxes on sales made within the state. Not only did this result in millions of dollars of revenue lost, but it also meant that brick-and-mortar retailers in the state, who did collect and remit sales tax, were at a disadvantage. In April 2018, Gov. Kay Ivey signed into law HB470, which amended the 2015 SSUT law by requiring online marketplaces to collect and remit use taxes on sales made through their marketplaces by third-party sellers, or to report such sales to the Alabama Department of Revenue and notify customers of use tax obligations. The legislation also allows existing sellers participating in the SSUT that establish a physical presence in this state, only through the acquisition of an in-state business, to continue to participate in the SSUT program. What the changes mean for Alabama? Since it’s inception, approximately 185 online vendors have voluntarily joined the state’s SSUT program. They are protected from a change in the physical presence rule. Only if the change in law is caused by “the enactment of federal legislation” is their grandfather protection voided (see Ala. Code § 40-23-191 et seq.). What they’re saying “The U.S. Supreme Court has ruled that online-only sellers should have to play by the same rules that in-state retailers do. Local retailers have been playing by the rules and collecting state sales tax on every purchase, every year since the Supreme Court’s original decision,” said Rick Brown, president of the Alabama Retail Association. “This is a victory for Alabama’s Main Street retailers. No longer will the federal government select winners and losers in the retail industry. Our 4,200 retail members and our association have advocated for this decision for decades.” Brown added, “Out-of-state, online-only businesses will no longer have an unfair advantage over our friends and neighbors who own local businesses. This ruling clears the way for a fair and level playing field where all retailers compete under the same sales tax rules whether they sell merchandise online, in-store or both.” Ivey says the decision “will promote parity between our state’s brick and mortar businesses and competing out-of-state sellers.” “Technology and the advent of e-commerce has drastically changed the retail landscape and the states’ ability to collect sales taxes. The Supreme Court’s ruling related to online sales taxes is a common-sense approach that modernizes existing limitations on the taxation of e-commerce sales and will facilitate collections in our global, technology-driven economy,” said Ivey. “The change effected by the Court’s decision will promote parity between our state’s brick and mortar businesses and competing out-of-state sellers.” ADOR has not responded to request for comment at the time of publishing. *This article will be updated as the decision is reviewed further.

US Supreme Court says online shoppers can be forced to pay sales tax

States will be able to force shoppers to pay sales tax when they make online purchases under a Supreme Court decision Thursday that will leave shoppers with lighter wallets but is a big win for states. More than 40 states had asked the high court to overrule two, decades-old Supreme Court decisions that they said cost them billions of dollars in lost revenue annually. The decisions made it more difficult for states to collect sales tax on certain online purchases. On Thursday, the Supreme Court agreed to overturn those decisions in a 5-4 ruling. The cases the court overturned said that if a business was shipping a customer’s purchase to a state where the business didn’t have a physical presence such as a warehouse or office, the business didn’t have to collect the state’s sales tax. Customers were generally responsible for paying the sales tax to the state themselves if they weren’t charged it, but most didn’t realize they owed it and few paid. Justice Anthony Kennedy wrote that the previous decisions were flawed. “Each year the physical presence rule becomes further removed from economic reality and results in significant revenue losses to the States. These critiques underscore that the physical presence rule, both as first formulated and as applied today, is an incorrect interpretation of the Commerce Clause,” he wrote in an opinion joined by Justices Clarence Thomas, Ruth Bader Ginsburg, Samuel Alito and Neil Gorsuch. In addition to being a win for states, the ruling is also a win for large retailers, who argued the physical presence rule was unfair. Large retailers including Apple, Macy’s, Target and Walmart, which have brick-and-mortar stores nationwide, already generally collect sales tax from their customers who buy online. That’s because they typically have a physical store in whatever state the purchase is being shipped to. Amazon.com, with its network of warehouses, also collects sales tax in every state that charges it, though third party sellers who use the site to sell goods don’t have to. But sellers that only have a physical presence in a single state or a few states have been able to avoid charging customers sales tax when they shipped to addresses outside those states. Online sellers that haven’t been charging sales tax on goods shipped to every state range from jewelry website Blue Nile to pet products site Chewy.com to clothing retailer L.L. Bean. Sellers who use eBay and Etsy, which provide platforms for smaller sellers, also haven’t been collecting sales tax nationwide. Under the Supreme Court’s decision Thursday, states can pass laws requiring sellers without a physical presence in the state to collect the state’s sales tax from customers and send it to the state. The National Retail Federation trade group, said in a statement that the court’s decision was a “major victory” but the group said federal legislation is necessary to spell out details on how sales tax collection will take place, rather than leaving it to each of the states to interpret the court’s decision. Chief Justice John Roberts and three of his colleagues would have kept the court’s previous decisions in place. Roberts wrote that Congress, not the court, should change the rules if necessary. “Any alteration to those rules with the potential to disrupt the development of such a critical segment of the economy should be undertaken by Congress,” Roberts wrote in a dissent joined by Justices Stephen Breyer, Elena Kagan and Sonia Sotomayor. The case the court ruled in has to do with a law passed by South Dakota in 2016. South Dakota’s governor has said his state has been losing out on an estimated $50 million a year in sales tax that doesn’t get collected by out-of-state sellers. Lawmakers in the state, which has no income tax, passed a law designed to directly challenge the Supreme Court’s 1992 decision. The law requires out-of-state sellers who do more than $100,000 of business in the state or more than 200 transactions annually with state residents to collect sales tax and turn it over to the state. South Dakota wanted out-of-state retailers to begin collecting the tax and sued several of them: Overstock.com, electronics retailer Newegg and home goods company Wayfair. The state conceded in court, however, that it could only win by persuading the Supreme Court to do away with its physical presence rule. After the decision was announced, shares in Wayfair and Overstock both fell, with Wayfair down more than 3 percent and Overstock down more than 2 percent. The Trump administration had urged the justices to side with South Dakota. The case is South Dakota v. Wayfair, 17-494. Republished with permission from the Associated Press.

Rauf Bolden: Call for establishing an Ethics Commission in Orange Beach

People rub their eyes at the prospect, having $87 Million on the table for one bridge and $60 Million on the table for another, having $4 Million on the table for a performing arts center and $4 Million on the table for ball fields at the new school, perhaps forming our own Ethics Commission is the least bad option for local oversight, restraining ourselves from an embarrassing scandal, protecting our officials from unwise inclinations, protecting another politician from legal jeopardy. I propose a local ethics commission composed of five volunteers, perhaps lawyers or paralegals from the community, meeting once every three months, providing ethical guidance for officials and employees about their roles interacting with vendors and bidders, accepting gifts like tuna dip at restaurants, VIP tickets for concerts or fishing trips in the Gulf, understanding how lobbying influences the psychology of the Council Chambers. This body would be responsible for opinions from the Alabama Ethics Commission before irreversible mistakes are made. “There isn’t a place in Alabama that contributes more tourism revenue than the cities of Gulf Shores and Orange Beach,” wrote the Mayors in a letter to Lagniappe Mobile, published on 5/16. Their argument is true, bolstering my reasoning for better ethical oversight at the local level, because a lot of money is on the table. Orange Beach took in over $40 Million in revenue last year, according to Mayor Tony Kennon’s State of the City slideshow, given a Lulu’s. “Check our state budgets for the revenue we contribute. Check the studies performed to assess our economic impact to the state,” both Mayors espoused in the Lagniappe. These arguments are meant to convince Montgomery to acquiesce, funding the $87 Million bridge west of the Foley Beach Express, but this bridge will still empty out onto two lanes on Canal Road, perhaps not alleviating traffic, raising the question of motivation for the bridge. Is the Baldwin Bridge meant to put the Foley Beach Express out of business, buying it later for pennies on the dollar? This is an ethical question about the long-term plan, centered on why taxpayer monies should be spent for the bridge, having a local commission responsible for ethical guidance would provide scrupulous professionalism, having leadership, finance and ethics on the same page, because human nature is fickle, seeing an opportunity to peddle a little influence can be irresistible. Financial action is usually based on factual data, but the Mayors hold, “There is no need for additional studies. We’ve listened to the travelers and our residents who must navigate our congested roads,” according to their letter in Lagniappe Mobile. This argues the electorate should have faith in the Mayors’ gut instincts, over well documented studies and due diligence. For me the key solution is obvious, but The Alabama Ethics Commission has not replied to my email for an opinion, outlining how a local municipality would found their own ethics commission. “It’s always amazing how some people can misinterpret the facts,” wrote Mayors Kennon and Robert Craft in a joint letter to Lagniappe Mobile, assuming this was their opening premise. The Mayors also argue, “Those few who oppose it [the new bridge} say there haven’t been enough studies and that it hasn’t been proven to be in the public interest.” Yet not one single piece of factual data or traffic study was offered to the public, causing Mr. Jim Ziegler, the State’s Auditor to write a letter to ALDOT’s Director John Cooper, seeking clarification. “I have more questions than I do answers about the proposed additional bridge. I hope to solve that with my specific requests for public records,” Alabama State Auditor Jim Zeigler explained on Twitter. Pillow fights on social media and in the local newspapers underline the need for supervision, ensuring an impartial referee, giving rulings on the bridge-selection process, ensuring lobbyists are coloring between the lines, keeping the ethical interests of the residents in balance with the political aspirations of our leaders. I call for additional oversight, during a period when so much money is on the table, assuming the opposition will not replace the incumbents, lacking the scar tissue of office, simply cutting the cards before the deal is dealt may be enough to sustain an ethical balance. ••• Rauf Bolden is retired IT Director at the City of Orange Beach, working as an IT & Web Consultant on the Beach Road. He can be reached at: publisher@velvetillusion.com.

A look at the Alabama AG’s race in the wake of the CBS News investigation

In a Tuesday night report, CBS News revealed Republican attorneys general on a retreat hosted by the Republican Attorney General Association (RAGA) in April on Kiawah Island, S.C… with lobbyists representing groups like Koch Industries, Reynolds America, Select Management Resources and the National Rifle Association to name a few. Among those attendance was Alabama Attorney General Steve Marshall, a Alabama’s top law enforcement official. To some, that fact means nothing. But to many, lobbyists represent all that is bad in politics. Over the years, lobbyists gotten a bad reputation and have been credited with having created a “culture of corruption” and are associated with words like “manipulation,” “corruption,” and “bribery.” The question for some, like Marshall’s primary runoff opponent — former Alabama Attorney General Troy King — is whether or not lobbyists, at retreats like the one in S.C., are influencing how Marshall runs the AG office. Just last week, King called out Marshall for attending another weekend getaway in N.C. with lobbyists. “He’s at an exclusive golf club in North Carolina… he is standing there with fat cat donors and lobbyists who spent $25,000 to spend the weekend with him. And $5,000 a person to come to a political fundraiser,” King said during a press conference in Montgomery. Marshall fights back But Marshall says he’s done nothing wrong and will not apologize for working with other AGs. “He will not apologize for working with other AG’s around the country,” Marshall’s campaign told CBS 42. The campaign went on to say, “Troy King attended several of these RAGA meetings during his time as attorney general, so these attacks are just dripping in hypocrisy.” Our check of Alabama’s campaign finance reports shows RAGA contributed 435,000 dollars to Marshall’s 2018 campaign for Alabama Attorney General. Political impact? CBS 42 askedAlabama’s leading political columnist Steve Flowers about how RAGA might play into the upcoming runoff. “For those people who are prosecutors to be wined and dined and given very large contributions through a nebulous organization, it looks a little like play for pay. I think Marshall is looking bad with a black eye cause he’s taken a lot of money from those people… and they are really people that he should be investigating.”

Tracy “T.O.” Crane, former candidate, endorses Gerald Dial in Ag Commissioner runoff

A former Republican candidate for the Commissioner of Agriculture and Industries, Tracy “T.O.” Crane threw his support behind Gerald Dial in the office’s runoff election on Wednesday. Crane, who failed to garner enough votes to win the nomination, made the decision to endorse Dial over Rick Pate after assessing the two runoff candidates’ experience, background, and vision for Alabama’s largest industry – agriculture and forestry. “Gerald Dial is an honorable man who will fight the status quo at the Department of Agriculture and Industries,” stated Crane. “I support Gerald Dial in the Republican runoff election on July 17, and I ask my 55,000 supporters to do the same. With Gerald Dial, we can count on food safety and economic growth being at the top of his agenda.” Crane is a 5th-generation farmer from north Jefferson County. He worked for the Federal Bureau of Investigation (FBI) for almost twenty years out of the Birmingham, Ala. field office. Early in his career, he worked with the Office of Independent Counsel on the Whitewater Investigation in Little Rock, Ark., which investigated President Bill Clinton and his wife, Hillary Clinton. “Tracy Crane is one of the leading experts of food safety in the world. His endorsement of my campaign is important to every Alabama family that cares about the safety of our food, a major component of the Agriculture Commissioner’s job,” commented Dial. Dial faces Pate in the July 17 runoff election. In the primary, Pate took home 40.37 percent of the vote, to Dial’s 29.98 percent. “When you go vote on July 17th, keep your family’s safety in mind and vote for Gerald Dial for Commissioner of Agriculture and Industries. Alabama can’t afford any other choice,” Crane concluded.

Mobile City Council asks Kay Ivey for Amtrak money

Members of the Mobile City Council are asking Alabama Gov. Kay Ivey to approve funding to help restart passenger train service between New Orleans and the port city. WALA-TV reports members sent Ivey a letter Wednesday saying renewed Amtrak service would help increase tourism and economic development in Mobile. The governor’s office didn’t immediately respond to an email seeking comment. Alabama, Louisiana and Mississippi must commit almost $35 million total over three years by Thursday to be eligible for the same amount in federal funds that would let Amtrak trains travel the northern Gulf Coast for the first time since Hurricane Katrina. Officials say Louisiana and Mississippi have committed money, but Alabama is refusing. Ivey’s office says she supports renewed rail service but isn’t committing money to the project. Republished with permission from the Associated Press.

Martha Roby introduces legislation to designate National Warrant Officer Day

Alabama 2nd District U.S. Rep. Martha Roby, co-chair of the Army Aviation Caucus, along with the support of the entire Alabama House delegation as cosponsors, this week introduced legislation to designate July 9 as Warrant Officer Day. H. Res. 947 celebrates a century of warrant officer service and “honors and recognizes the contributions of all warrant officers of the Army, past, present, and future.” The Army Warrant Officer Corp was established on July 9, 1918; 2018 marks their 100th year of service to the U.S. Army. Today, Army Warrant Officers serve as technical experts, combat leaders, trainers, or advisers who fall into one of two categories: Aviators or Technicians. Army Warrant Officers serve on active duty, U.S. Army Reserve, and Army National Guard. Candidates attend the Warrant Officer Candidate School (WOCS) administered by the Warrant Officer Career College at Fort Rucker in Alabama’s Second District. “Throughout their 100-year history, Army Warrant Officers have continued to represent the expertise and professionalism that led to their founding on July 9, 1918,” Roby said. “This resolution is a small token of appreciation for the service and sacrifices of our brave men and women who have and are currently serving as Army Warrant Officers. I am proud to lead this effort on behalf of the many men and women who served or are currently serving.” Alabama 1st District U.S. Rep. Bradley Byrne joined Roby’s enthusiasm for the legislation, tweeting he was proud to co-sponsor the resolution. “Proud to co-sponsor this resolution to honor our nation’s @USArmy Warrant Officers. The Army’s Warrant Officer Career College is located at Fort Rucker in Southeast Alabama,” tweeted Byrne. Proud to co-sponsor this resolution to honor our nation’s @USArmy Warrant Officers. The Army’s Warrant Officer Career College is located at Fort Rucker in Southeast Alabama. https://t.co/wzY9T2Aeff — Rep. Bradley Byrne (@RepByrne) June 20, 2018

Daniel Sutter: Are we making the opioid problem worse?

Opioid abuse is taking a tremendous toll on America, with 42,000 opioid-related deaths in 2016. The problem involves both prescription opioid-based painkillers and illegal heroin and fentanyl. Might our public policy response be worsening this terrible problem? Economists have analyzed prohibition, both alcohol in the 1920s and illegal drugs more recently. We evaluate prohibition, or any other government policy, by comparing the world with and without the policy in question. This necessarily involves a state of the world which does not exist. We will never see the toll opioids would have taken in 2018 if we had significantly different policies in place. We must construct an alternative. Rules govern the construction of alternatives to produce meaningful comparisons. One key is allowing only the policy to vary, not other factors, so differences can be attributed to alternative policy. For example, prohibition does not automatically stop people from taking a substance. Some potential users will be deterred because of illegality, but others won’t, as we saw with alcohol in the 1920s. Economic analysis distinguishes harm from the substance itself and those due to prohibition. Drug violence, for example, is almost entirely due to prohibition. Dealers’ cash and drugs are vulnerable to theft, and these thefts will not be reported to the police. Dealers will use violence to protect, steal or retrieve drugs and money. Walgreens and CVS do not have gun battles to control the OxyContin market. Prescription painkillers provide a distinctive twist to the opioid crisis. Introduction of opioid painkillers in the 1990s opened new options for millions of American pain sufferers. Prescription drugs occupy a middle ground in prohibition, legal under government-approved conditions and illegal otherwise. Perhaps the major controversy for policy and lawsuits brought by dozens of states and cities against drug companies is the addictiveness of opioid painkillers. Studies in leading medical journals show that perhaps one or two percent of patients using the drugs as prescribed become dependent. Many of the Americans addicted to painkillers obtained them on the black market or through a bogus prescription. In 2010, the Food and Drug Administration reformulated OxyContin to make the pills harder to crush and make into more potent opioids. Other restrictions on prescribing followed, and pill mills have been shut down. Yet the crisis has become much deadlier since 2010, with heroin- and fentanyl-related deaths increasing by factors of five and six respectively, with only a slight decline in prescription-related deaths. (Overdose victims often used more than one narcotic, so deaths are described only as related to a drug.) Heroin, especially when laced with fentanyl, is far deadlier than prescription opioids. It is tragic when people fall into substance abuse, which often happens after traumatic life events. Rehab is often not effective until people decide to change their lives. Unfortunately, public policy may only be able to limit the harm during a dark period in people’s lives, and ensure the availability of help when requested. Forcing people to turn to heroin by restricting access to painkillers increases harm. Restricting access to prescription opioids is costly. Many people can no longer successfully manage their chronic pain, with tragic consequences. In some documented cases, patients have committed suicide after being denied painkillers. Any policy limiting access for people who do not “need” painkillers will deny some patients in pain needed help because pain is subjective; no doctor or nurse can know if it is tolerable. And a strong argument exists that American adults should be able to decide how to treat their pain without the government’s approval. Libertarian psychiatrist Thomas Szasz argued that free people have a right to drugs. The concentration of the opioid deaths in regions with dwindling manufacturing and mining jobs suggests a significant economic element to the crisis. And this, to me, is the crisis’ most disturbing element. America today boasts tremendous prosperity and opportunity. Given the high overall quality of life today, why is the economy seemingly leading so many Americans to addiction? ••• Daniel Sutter is the Charles G. Koch Professor of Economics with the Manuel H. Johnson Center for Political Economy at Troy University and host of Econversations on TrojanVision. The opinions expressed in this column are the author’s and do not necessarily reflect the views of Troy University.