Manna Beverage to bring over 170 jobs to Montgomery

Gov. Kay Ivey announced today that Manna Beverages & Ventures was going to site a new multi-million dollar facility in the City of Montgomery. Manna is owned by Manna Capital Partners, which was started by NBA legend Ulysses Lee “Junior” Bridgeman. “It is an exciting day for both the State of Alabama and the City of Montgomery,” said Gov. Ivey. “If you are willing to work hard, we are here to help you all the way.” “Announcements like this are a solid sign that in the state of Alabama, we are doing things right,” Ivey continued. “Manna Beverages & Ventures represents a $600 million investment and more than 280 jobs for the state of Alabama and the City of Montgomery. It takes a lot of teamwork to achieve an announcement like this today. In my time as Governor, I have been fortunate to have an all-star team to work with Chambers of Commerce like this and the team at the Alabama Department of Commerce.” “My goal in the next four years is to lean more on public-private partnerships to bring more announcements like this,” Ivey said. “Junior, thank you for bringing your business to the state of Alabama. You will not regret it.” Bridgeman said the $600 million investment will “start with 170 jobs” and “hopefully will get up to 280 jobs.” He said that the company would emphasize working with minority and women-owned businesses. “Thank you to the great State of Alabama and the City of Montgomery,” stated Junior Bridgeman. “Thank you to welcoming me and my team to the beautiful and historic City of Montgomery. We are very excited to be here.” Bridgeman announced that Manna Beverages & Ventures “Will build our first facility in Montgomery to produce beverages for world-class brand owners.” Bridgeman said that the 1.7 million square foot facility would be located at a 180-acre site off of I-65. Bridgeman noted that the facility should open in early 2025. “It is special for me to be here in this special and historic place – the City of Montgomery,” Bridgeman said. “The truth is that the people here in Montgomery are genuine.” “I want to thank Governor Ivey for her leadership and support for jobs and economic development not just for Montgomery and this region; but for the entire state,” said Montgomery Mayor Steven Reed. “Manna Capital Partners launching their $600 million Manna Beverages investment does not just happen overnight. It takes a lot of work. This is another great performance by the city, the county, and the state.” Reed praised Bridgeman and Manna Beverages & Ventures for their commitment to working with Black and women-owned businesses. “That means a lot,” said Reed. “They have already asked about opportunities to partner with our schools and grow the economic ecosystems that are here.” Bridgeman is a retired NBA and college basketball star who invested in dining franchises and later became a Coca-Cola bottler after his retirement. Reed praised Bridgeman for his career with the Milwaukee Bucks. “He has shown the ability to manage the toughest areas of business – the restaurant and hospitality business. He is one of the top ten wealthiest retired athletes in the world. He was number four in 2016. Let’s help him to get to number one,” said Reed. “It is a great day today to be here and celebrate with them coming to Montgomery County,” said Montgomery County Commission Chairman Doug Singleton. “When you are out there recruiting, most of the time, the prospect wants to know what you are going to do for them, but meeting with Manna, they were all about what they would do for our community.” “We are honored this morning to welcome a new business to our community,” said Montgomery Chamber of Commerce Director Cedric Campbell. “ Since first being elevated to Governor in 2017, Ivey has focused on economic development issues to raise employment rates and Alabama household incomes. Ivey is seeking a second term as governor. She faces Democratic party nominee Yolanda Flowers and Libertarian nominee Dr. James “Jimmy” Blake in the November 8 general election. To connect with the author of this story, or to comment, email brandonmreporter@gmail.com.

Katie Britt continues to lead Senate rivals in fundraising

The Federal Elections Commission (FEC) recently released the third quarter campaign finance reports. Republican nominee Katie Boyd Britt has raised more than $1,362,302.23 in the third quarter of 2022. This is more than both of her general election opponents combined. The third quarter filing is the last quarterly filing before the November 8 General Election. According to the FEC, Britt entered the month of October with almost $1.9 million in cash on hand. Britt has raised more than $10.26 million since announcing her candidacy in June 2021. In the third quarter, Britt received a total of 13,892 contributions, with an average contribution amount of $98.06. “I am blown away by the generous, enthusiastic support we’re receiving from hardworking families who love our state and our country,” Britt said. “It is clear that the closer November 8 gets, the more our message is resonating. Americans are getting crushed by the unchecked consequences of one-party Democratic rule in Washington, D.C., and Alabamians are eager to make our voices heard at the ballot box. We are going to continue working hard every single day these next three weeks to secure victory and do our part to retake the U.S. Senate. Together with our incredible Team Britt supporters, we will preserve the American Dream for our children and our children’s children.” Alabama’s Democratic U.S. Senate nominee, Dr. Will Boyd, reported having received $45,072.23 and entered October with $8,260.48 in cash on hand. Alabama Democrats have been very reluctant to support any of their Alabama candidates in 2022 after disappointing finishes in 2020 and 2018. Boyd reported only 48 itemized contributions during the three-month period. Boyd is a pastor. He was the Democratic nominee for Alabama Lieutenant Governor in 2018. Libertarian Party of Alabama John Sophocleus has not raised enough money to need to report a third-quarter report. Sophocles is a retired instructor at Auburn University. He was the Libertarian nominee for Alabama Governor in 2002. Incumbent Sen. Richard Shelby is not running for re-election. Shelby was first elected to the Senate in 1986. Britt is an attorney and former Chief of Staff for Sen. Shelby. Shelby has endorsed Britt, and so has Alabama’s other Senator – Tommy Tuberville. Voters who know they will not be able to go to the polls on November 8 can apply for an absentee ballot. Absentee voting has already begun. To connect with the author of this story, or to comment, email brandonmreporter@gmail.com.

Paul DeMarco: Alabama constitutional amendment on ballot will help protect integrity of future elections

We are now less than thirty days to the November 8th general elections in Alabama. There will be a lot of statewide and local races for voters to choose from when they go to the polls. However, down the ballot, after the candidates for office, there are also ten amendments to the Alabama Constitution to be considered as well. One of those is Amendment 4, and relates to general elections in the state of Alabama. If approved by voters, in the future, Alabama lawmakers would have to enact any changes to election law at least six months before any election that may be affected by the new statute. This amendment was proposed by State Representative Jim Carns after the 2020 presidential election. Some laws governing how votes could be considered or counted were changed around the country close to the last election. Just as in football, the rules of the game should not be changed while they are playing. Election laws should be no different, so voters have confidence in the integrity of the results. It is not fair to candidates or voters when the law governing access to the ballots are altered so close to the days the polls open. Hopefully, this Amendment will pass in November to go into effect before the next set of elections. Paul DeMarco is a former member of the Alabama House of Representatives and can be found on Twitter at @Paul_DeMarco.

Dan Sutter: Digital dollars

The U.S. Treasury and the Federal Reserve are both investigating the potential for issuing a digital currency in the future in place of the dollar. A digital currency would create new policy tools for stabilizing the economy but also poses great threats to privacy and personal freedom. One natural question arising here may be what is truly new here. Banking already occurs mostly electronically, and cryptocurrencies like Bitcoin exist. Indeed, today we have stablecoins, cryptocurrencies linked to reserve assets like the dollar or gold. Is this just another example of Uncle Sam getting to a party late due to the inexorably slow pace of political decision-making? The U.S. government is not alone in exploring a digital currency. Over sixty countries are experimenting with what are being called central bank digital currencies, or CBDC. China has already introduced a digital yuan. Proponents of CBDCs suggest they could lower transaction costs, the costs of carrying out market exchanges. Electronic banking lowers transaction costs, which is valuable. Transaction costs are like friction in physics, and economists often ignore them, just like physics assumes frictionless tables and pullies. Yet over time, the reduction of transaction costs represents an important driver of increasing prosperity. Global supply chains, for example, are possible now due to lower transaction costs. Yet we do not need a digitized dollar to accomplish this. We already have electronic banking and electronic payments. Life is already much better than when you had to go to the bank while it was open to withdraw cash to make purchases. Money is crucially important in an economy; it is half of every exchange. It is in our interest to have “efficient” money. At one time, many transactions had to be done using cash, and there were no ATMs. If you had no cash on you, you might have to wait until your bank opened to make a purchase. Businesses had to send an employee (or armored car) to take cash to the bank. Money and our current dollar allow decentralized exchanges, which has benefits, but also has costs. Cash creates risks of theft. But if you found someone willing to sell you something for $100 cash, you do not need a bank or a government bureaucrat’s permission to make the exchange. Digital dollars create two new ways for the government to potentially control our actions. First, exchanges using digital dollars could be blocked by the authorities. The government already has considerable potential control; for example, payments between banks or through PayPal can be blocked. The Canadian government restricted the sending of money to the Freedom Convoy truckers earlier this year. Without cash, though, the potential exists to control all transactions. Second, digital dollars could have expiration dates or be reduced in value by the Federal Reserve. Money with an expiration date could vanish from your account if not spent. People could be forced to use their money or lose it. An expiration date would create a new tool for monetary policy, namely negative nominal interest rates. A nominal interest rate is the official rate paid on savings or for a loan, not adjusted for inflation; the interest rate, when adjusted for inflation, is the real interest rate. The real rate is the nominal rate minus the inflation rate and can easily be negative. Today nominal rates cannot go below zero because people have the option of holding cash, say by putting dollars in a mattress (or safe deposit box). This provides a zero nominal rate of return. A bank offering a negative 2 percent interest rate will see depositors withdraw their money; nominal rates cannot fall below zero. Some macroeconomists see value in negative nominal interest rates under certain circumstances. Monetary policy stimulates the economy primarily through lower interest rates, which lead to more borrowing and, according to the argument, more spending, perhaps lifting the economy out of recession. After the Great Recession, nominal interest rates were close to zero, with very low inflation as well. The Fed could not use monetary policy to boost the economy, which arguably contributed to the very slow recovery. Business cycles and macroeconomics are not my areas of research, so I will not debate the potential for easy money to stimulate the economy. Certainly, other macroeconomists argue that the Fed’s ability to manage business cycles is quite limited and that monetary policy sometimes makes cycles worse. The benefit to Americans of negative nominal interest rates as a policy tool is likely very small. From a big-picture perspective, we Americans and not the policy-making elite should decide if we will have a digital dollar. Governments control money today, but they did not invent money. Money is one of the economic institutions that evolved spontaneously in the market. People started using rocks or precious metals, or other commodities to buy and sell because it made their lives easier and better – it reduced transaction costs. Money evolved in many different forms in societies across the globe. Governments took over money, which is now viewed as a component of national sovereignty. According to reports, over 60 countries are exploring some form of Central Bank Digital Currency (CBDC). This is an important consideration for policymakers in Washington, who fear that another nation establishing a digital currency first could supplant the dollar as the world’s reserve currency. The U.S., and particularly our government, benefits from the dollar being used for almost 90 percent of international settlements. Use as the international reserve currency boosts the dollar’s value and keeps interest rates low, which is particularly valuable with the national debt now exceeding $31 trillion. Many people might think that a digital dollar is similar to cryptocurrencies. Yet the first cryptocurrency, Bitcoin, was explicitly designed to provide an alternative to government monies due to potential devaluation. The number of Bitcoin is set according to the blockchain and will eventually reach 21 million but no more. The Federal Reserve and U.S. Treasury can increase the supply of dollars at will and without limit, which would reduce

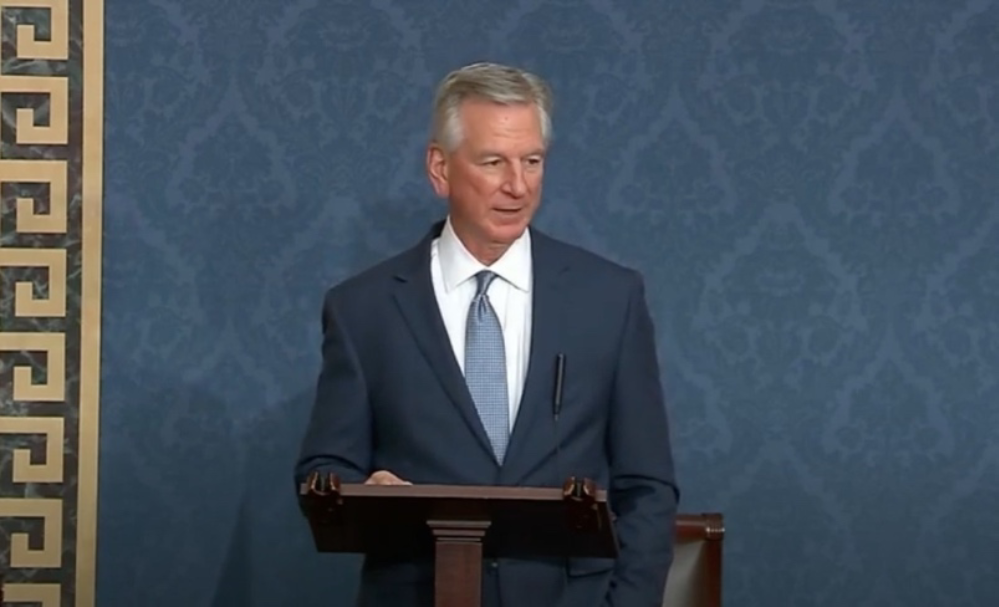

Joe Biden signs Tommy Tuberville’s bill increasing insurance benefits for fallen service members

On Monday, President Joe Biden signed legislation that increases service members’ life insurance coverage for the first time in more than 15 years. This bill was championed by U.S. Senator Tommy Tuberville. The Supporting Families of the Fallen Act, S2794, increases the U.S. Department of Veterans’ Affairs Servicemembers’ Group Life Insurance (SGLI) and Veterans’ Group Life Insurance (VGLI) coverage amount from $400,000 to $500,000. The last time that the government updated SGLI and VGLI coverage amounts was in 2005. “The families of America’s heroes deserve our unwavering support and appreciation,” said Sen. Tuberville. “Increasing the life insurance benefit provided to families of those who pay the ultimate sacrifice was long overdue, and I am proud to see this important legislation signed into law. We can never fully repay our service members and military families for their sacrifice, but I am committed to finding ways to show our appreciation by doing everything I can to support our troops and their loved ones.” Senators Kevin Cramer, Rick Scott, Mike Braun, John Barrasso, Cynthia Lummis, John Cornyn, Mike Rounds, and Roger Wicker co-sponsored the legislation. Tuberville is a member of the Senate Veterans’ Affairs Committee (SVAC). He introduced the Supporting Families of the Fallen Act in September of 2021. The committee passed the bill back in December 2021. The full Senate passed the bill back in March. The U.S. House of Representatives finally passed the bill last month, sending it to the President’s desk. Numerous groups have praised the legislation, including the Military Officers Association of America and the Wounded Warrior Project. “The Supporting Families of the Fallen Act is long overdue and will authorize the Servicemembers’ Group Life Insurance (SGLI) and Veterans’ Group Life Insurance (VGLI) to catch up with inflation,” said the President of the Military Officers Association of America Dana Atkins. “This legislation is ultimately about supporting the families of service members, and MOAA looks forward to growing bi-partisan support for this important modernization of life insurance.” “This bill would raise the coverage amount of VA’s life insurance policies for both Veterans and those currently serving, and provides additional peace of mind and security for military and veteran families,” said Wounded Warrior Project’s Vice President for Government & Community Relations Jose Ramos. The President signed S2794 and several other bills on Monday. “Thank you to Senators Tuberville, Cramer, Braun, Barrasso, and Lummis, Representatives Roy, Miller-Meeks, Mike Levin, and Slotkin, and many others for their leadership,” President Biden stated. Tuberville is a former college football coach, best known in Alabama for his tenure as the head football coach at Auburn University. He is in his first term representing Alabama in the United States Senate, where he is a member of the Senate Armed Services, Agriculture, Veterans’ Affairs, and HELP Committees. To connect with the author of this story, or to comment, email brandonmreporter@gmail.com.

Over 600 Alabamians request medical marijuana applications

The Alabama Medical Marijuana Commission (AMCC) closed its portal on Monday, allowing Alabamians to download application forms to apply to participate in the newly legalized Alabama medical marijuana industry. There were 607 sets of application forms requested and downloaded since the portal opened on September 1. The most popular license appears to be for marijuana dispensaries. According to the Commission, 239 persons or companies downloaded the applications to apply for a marijuana dispensary license. One hundred thirty-three application packets were downloaded for integrated facilities licenses. An integrator grows the marijuana, processes the marijuana into a sellable product, and then markets the cannabis through its own company-controlled dispensaries. One hundred twenty-three downloaded applications to be marijuana growers. A marijuana grower simply grows the plants but then has to sell the buds that they harvest to a processor. They cannot market directly to the consumer or process the product with just a cultivator license. Sixty-nine application packets were downloaded for secure transporters. Marijuana is strictly regulated under Alabama law, from seed to the point of sale. Only a licensed secure transporter may transport the marijuana from the cultivator to the processor or from the processor to the dispensary. Every ounce of marijuana has to be accounted for at every point in the supply chain through the seed-to-sale tracking system. Thirty-five application packets were downloaded for marijuana processor licenses. The Alabama medical cannabis law does not allow for raw plant product to be sold to consumers, and there is no smokable product allowed in the state. Anyone who smokes or sells smokable marijuana products in the state of Alabama is a criminal and will remain a criminal even after this is implemented. All the marijuana sold under the Alabama law must be in the form of a pill, an edible form such as a gummy, an ointment, suppository, tincture, or other approved form. The processors are tasked with taking the raw plant product and transforming that into a marketable product. They buy from the growers and sell to the dispensaries and make sure that the products are uniform and do not exceed the tetrahydrocannabinol limits set by the legislature for non-terminal patients. There were seven applications for state testing labs downloaded. The testing lab tests every batch of marijuana legally grown and marketed in the state. The number of licenses that can be awarded is strictly limited for each category by the legislation. Alabama passed its medical cannabis law in the 2021 Alabama regular legislative session. The legislation was signed into law by Alabama Governor Kay Ivey. Senate Bill 46 created the AMCC and empowered the Commission to set up and regulate the new industry. The completed applications are not due until late December, and the actual licenses will not be awarded until July. Only Alabamians with a demonstrable medical need and a recommendation from a doctor will be able to purchase medical cannabis under this system. The first marijuana products will not be on the market until 2023 – at the earliest. To connect with the author of this story, or to comment, email brandonmreporter@gmail.com.

Joe Guzzardi: Cartel-enriching border betrayal

Only a handful of insiders realize the true magnitude of the border crisis and its consequences. Those in the know include defanged Customs and Border Protection (CBP) agents, neutered Immigration and Customs Enforcement officials, journalists whose truthful reporting rarely makes national headlines, Department of Homeland Security Secretary Alejandro Mayorkas, and his White House superiors. Otherwise, the dangers that open borders represent are kept tightly under wraps to avoid bad optics. The world, however, knows that accessing the U.S. interior is merely a matter of getting to the border, crossing, and beginning the journey – often White House-aided and abetted – to the final destination for those who enter illegally. In President Joe Biden’s eyes, the world is welcome. In mid-August, for example, CBP caught ten illegal immigrant adults posing as the ubiquitous unaccompanied alien child (UAC). The phony minors, apprehended at Texas’ El Paso Sector, ranged in age from 18 to 26; by law, UACs must not have reached age 18. All were Guatemalans who claimed to be minors to avoid deportation. Days later, at the Del Rio Valley Sector, agents stopped an 18-wheeler crammed with 150 smuggled aliens that included 17 gang members, one sex offender, and one convicted of murder. MS-13 members were among the identified gangsters. This fiscal year, an estimated 130,000 UACs, some self-defined, have entered. The CBP press release on the DRV action concluded vaguely: “All subjects were processed accordingly.” The Coalition Against Trafficking Women, Latin American branch, estimates that 60 percent of Latin American children who embark on a U.S.-bound journey, either alone or with smugglers, are captured by cartels and then forced into pornography or drug trafficking. In addition to enduring a moral nightmare, those migrants who successfully make it to the U.S. interior will have outstanding debts owed to the coyotes and cartels that will take them a lifetime to pay off. To make sure that smuggling accounts are settled, the aliens are forced to wear GPS wristbands so that the cartel can monitor their movements. Cartels are the world’s most powerful criminal organizations and have created the largest form of modern slavery. The New York Times estimated that cartel revenues reached $13 billion this year, up from $500 million in 2018, a 26x increase in fewer than five years. Over the years, illegal immigration has reached such extraordinarily high levels that it begat more illegal immigration. Decades of porous borders, inadequate interior enforcement, and the current welcoming environment have facilitated today’s historic and continuous wave. In 2018, during interviews in Guatemala’s tiny 17,000 residents-strong Concepción Chiquirichapa, reporters learned that almost everyone has family or knows someone with a family in the U.S. Think about what that amazing statistic conveys: individuals thousands of miles away from Los Angeles, Chicago, and New York, and with few transportation options in their remote villages, have departed for the U.S., confident that they’ll get in, and will remain indefinitely. But neither unlawfully present parents nor their children who are joining them, trafficked or not, deserve a free pass from the Biden administration. In previous UAC waves, 60 percent of the children were handed over to illegally residing parents. U.S. District Judge Andrew Hanen, in the Southern District of Texas, wrote of several instances in which parents “initiated the conspiracy to smuggle minors into the country illegally,” a reference to contracting with traffickers. Then, Hanen continued, instead of enforcing immigration laws, “DHS completed the criminal conspiracy…by delivering the minors into the custody of the parent living illegally in the United States.” Hanen’s message: Nonenforcement encourages parents to pay coyotes to bring their minor children north. UACs will continue to flock to the border as long as their illegal alien U.S. families can criminally bring their children to the U.S. without concern for their own removal. Judge Hanen’s criminal conspiracy allegation is tough talk but accurate. And with the entire U.S. a sanctuary nation, nonenforcement’s failures, and the fallout are painfully obvious. Joe Guzzardi is a nationally syndicated newspaper columnist who writes about immigration and related social issues. Joe joined Progressives for Immigration Reform in 2018 as an analyst after a ten-year career directing media relations for Californians for Population Stabilization, where he also was a Senior Writing Fellow. A native Californian, Joe now lives in Pennsylvania. Contact him at jguzzardi@pfirdc.org.

Polls show gas prices are top concern for midterm voters with price increase looming

New polling shows that gas prices are a top concern for voters these midterms as those prices are poised to rise in the coming weeks. Convention of States Action, along with Trafalgar Group, released the poll, which found that “54.4 percent of voters say rising gas prices will make them more likely to vote for Republican candidates in the 2022 midterm elections.” Notably, 55.5% of independents say the same. The current national average price for a gallon of regular gasoline is $3.89, according to AAA. Those prices have fluctuated in recent weeks but are higher than one month ago when prices were $3.62 per gallon. Earlier this year, prices surpassed a record high of $5 per gallon before dipping down. Now, those prices are rising again and are expected to rise even more after the Organization of Petroleum Exporting Countries, known as OPEC, announced it would cut its oil production beginning in November. At the same time, Joe Biden’s release of oil from the Strategic Petroleum Reserve is coming to an end. Biden’s handling of energy issues has been a source of criticism for Republican lawmakers. “We are the world’s leading producer of oil and gas, and our workers are eager to produce millions of additional barrels of oil per day to lower costs and ensure America’s energy dominance,” said Rep. Cathy McMorris Rodgers, R-Wash. “Instead, President Biden continues to turn to OPEC, Russia, Iran, China, and now Venezuela, who are all emboldened because he is shutting down American energy and ceding our global leadership to their corrupt regimes. “Lifting sanctions to allow Venezuela’s dictator to collect millions of dollars in revenues harkens back to President Biden’s decision to waive sanctions on the Nord Stream 2 pipeline, which strengthened Putin and invited the attack on Ukraine.” The higher energy prices come as Americans are also dealing with soaring inflation. Recently release pricing data shows consumer and producer prices have risen more than 8% in the last 12 months. Energy prices, which rose about 20% in the last twelve months, have been a top pain point for Americans. “The news that inflation surged 8% on the year in September is all too familiar to Pennsylvania families,” said Nathan Benefield, senior vice president of the Pennsylvania-based Commonwealth Foundation. “While we are enjoying a brief reprieve with a seasonal drop in gas prices, the worst is yet to come—with gas prices and home heating costs rising yet again. “Voters consistently report that inflation and the economy is their top issue—and no wonder, as average workers are worse off than they were last year,” he added. The survey queried more than 1,000 voters from October 8 through October 11th. Republished with the permission of The Center Square.

Dollar General faces new penalties for store safety issues

Dollar General is facing another $1.68 million in fines after government safety inspectors found violations at four of the chain’s stores in Alabama, Florida, and Georgia, the federal regulators announced Monday. During inspections in April 2022, the Occupational Safety and Health Administration found dirty and disorderly storage areas and materials stacked unsafely at locations in Mobile and Grove Hill, Alabama; Tampa, Florida; and Dewy Rose, Georgia. OSHA said those conditions put workers at risk of slipping, tripping, and getting struck by falling objects. The company was also cited for fire hazards, including failing to keep exit routes and electrical panels clear and unobstructed and neglecting to mount and label fire extinguishers. The announcement came two months after OSHA announced $1.3 million in proposed penalties for similar violations at three of Dollar General stores in Georgia. OSHA said Dollar General has faced more than $9.6 million in initial penalties after 182 inspections since 2017. “We will use our full enforcement powers to hold Dollar General accountable for its ongoing pattern of behavior until they show that they take worker safety seriously,” said Assistant Secretary for Occupational Safety and Health Doug Parker in a statement. Dollar General, based in Goodlettsville, Tennessee, has 15 business days to comply or contest the penalties. The company did not immediately reply to a request for comment. Republished with the permission of The Associated Press.

Judge dismisses lawsuit over upcoming lethal injection

A federal judge dismissed an inmate’s claim seeking to block his upcoming execution in Alabama because of reported problems at a recent lethal injection. The judge on Sunday granted Alabama’s request to dismiss the lawsuit brought by Kenneth Eugene Smith, agreeing that Smith waited too long to file the challenge. But U.S. District Judge R. Austin Huffaker Jr. also warned Alabama’s prison commissioner to strictly follow established protocol when officials attempt to put Smith to death next month. “Sanctions will be swift and serious if counsel and the Commissioner do not honor or abide by their representations and stipulations,” Huffaker wrote. Smith is set to be executed by lethal injection November 17 after being convicted in the murder-for-hire killing of Elizabeth Dorlene Sennett, 45. Smith’s attorneys pointed to a July execution, which an anti-death penalty group claims was botched, to argue that Alabama’s lethal injection process creates a risk of cruel and unusual punishment. The July 28 execution of Joe Nathan James Jr. was carried out more than three hours after the U.S. Supreme Court denied a request for a stay. State officials later acknowledged the execution was delayed because of difficulties in establishing an intravenous line but did not specify how long it took. A doctor who witnessed a private autopsy paid for by an anti-death penalty group said it appeared officials might have attempted to perform a “cutdown,” a procedure in which the skin is opened to allow a visual search for a vein. Huffaker noted that Corrections Commissioner John Hamm “represents in his brief and during oral argument that the ADOC did not employ a cutdown procedure or intramuscular sedation during the James execution and denies any present intent to employ any such procedure in the future.” Huffaker ruled that Smith missed the time frame to challenge Alabama’s lethal injection process. Smith missed the 2018 deadline to request execution by nitrogen hypoxia, an execution method that Alabama has authorized but not developed a process to use. Smith’s attorneys argued that the state violated his due process rights by not providing him the information necessary to make a knowing and voluntary waiver of his nitrogen hypoxia election right in 2018. ADVERTISEMENT His attorneys argue that Smith did not know nitrogen hypoxia “would not be implemented for years, if ever.” Huffaker said that complaint also could not overcome a “clear statute-of-limitations hurdle.” Prosecutors said Smith was one of two men paid $1,000 to kill Sennett on behalf of her husband, the Rev. Charles Sennett, who was deeply in debt and wanted to collect on insurance. Smith maintained it was the other man who killed Sennett, according to court documents. Smith was initially convicted in 1989, and a jury voted 10-2 to recommend a death sentence, which a judge imposed. His conviction was overturned on appeal in 1992. He was retried and convicted again in 1996. This time, the jury recommended a life sentence by a vote of 11-1, but a judge overrode the jury’s recommendation and sentenced Smith to death. Alabama no longer allows a judge to override a jury’s recommendation. Republished with the permission of The Associated Press.