Alabama legislation has ambitious calendar for Tuesday

Time is running out on the 2023 Alabama regular legislative session. Tuesday will be day 24 of the session. The session is limited to a maximum of thirty legislative days in a session. It takes five legislative days at minimum to pass a bill. With just seven days left and both budgets yet to be addressed in the second house, time is becoming precious for lawmakers who hope to get their bills passed by the house of origin in order for it to go to the second house. The House of Representatives Rules Committee has prepared an ambitious special order calendar for Tuesday. The calendar includes: Senate Bill 39 (SB39) would add additional judges to the state’s most overcrowded court dockets. Senate Bill 159 (SB159) creates a rebuttable presumption of the nonliability of the awarding authority and its contractors in roadbuilding contracts. House Bill 430 (HB430) would provide further for the duties of the Alabama Literacy Task Force and would revise the membership of the task force. House Bill 168 (HB168) would increase the threshold dollar amount for which competitive bidding is required from $15,000 to $30,000. House Bill 435 (HB435) would increase the compensation paid for poll workers in elections to $50 a day. Senate Bill 189 (SB189) would increase the ceiling for reimbursement of nursing facilities’ allowable costs during a fiscal year, as determined by the Medicaid Commissioner and provided by this bill, due to any of the following: (1) a public health emergency; (2) a new federal or state law or regulation; or (3) a statewide uncontrollable catastrophic event. Senate Bill 300 (SB300) creates $10,000 to $15,000 stipends for principals who complete additional training. House Bill 432 (HB432) would reduce the minimum time period for which Alabama driver’s licenses may be issued to a foreign national for a period of time from 160 days to 30 days. House Bill 429 (HB429) would: (1) amend the Entertainment Industry Incentive Act of 2009 by renaming it the Film and Music Incentive Act of 2023; (2) provide a floor of $20,000 in production expenditures for music albums, to receive a rebate, as well as a cap on rebated expenditures of $200,000; and (3) limit the amount of rebates issued each year for music album and music video productions to 5% of the $20 million annual total cap on rebates, which would equal $1 million under the current cap. House Bill 450 (HB450), the Troy Act, would amend existing Alabama code to include the Public Health Service Commissioned Corps and the National Oceanic and Atmospheric Administration within all references to the United States Uniformed Services along with the United States Army, United States Navy, United States Marine Corps, United States Air Force, United States Coast Guard, and United States Space Force. House Bill 428 (HB428) would expand the definition of child abuse to include certain physical contact of a child five years of age or under and certain physical contact of children with certain mental or developmental disabilities who are 17 years of age or younger, provided the contact was committed with the intent to cause physical injury. Senate Bill 174 (SB174) would raise the caps on compensation for retired law enforcement officers working as school resources officers. Under existing law, a retiree receiving a pension from the Employees’ Retirement System or Teachers’ Retirement System pay is capped at $30,000 if they come out of retirement to work as a school resource officer. House Bill 436 (HB436) would allow criminals under 22 years of age to be treated as youthful offenders. Some courts in the state currently cap youthful offender status at 19 or less. House Bill 347 (HB347) would prohibit the installation of centralized mail delivery devices by residential real estate developers in certain new residential neighborhoods. Senate Bill 225 (SB225) would allow a Department of Corrections law enforcement officer who is certified by the Alabama Peace Officers’ Standards and Training Commission, including K-9 handlers, to assist any law enforcement agency with public safety. House Bill 337 (HB337) would provide for the payment of uncontested claims on an expedited basis for the Board of Adjustment. Senate Bill 60 (SB60) – Under existing law, the Board of Nursing is responsible for implementing the Alabama Loan-Repayment Program for Advanced Practice Nursing. This bill would remove the cap on the amount of loan that may be awarded annually, would provide further for the definition of a critical need area, and would remove certain penalties for defaulting. The Senate has not yet released a proposed special-order calendar for Tuesday. The House of Representatives will go into session at 1:00 p.m., while the Senate will not begin their workday at 3:00 p.m. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Vince Perez: Investment into industrial sites needed to spur economic growth

We are living in a time where many companies across the globe are carefully in search of communities with the business-friendly environments and strong workforces needed to build out their manufacturing bases and invest in their organizations’ futures. This provides a great opportunity for state and community leaders to seize the moment and take the required steps needed to make the case that they are the best option for companies to establish their operations. I commend our state leaders for recognizing this opportunity and taking action to ensure that Alabama is serious about business recruitment, growing our economy, and preparing our citizens for the jobs of the future. Recently, the legislature passed, and Gov. Kay Ivey signed into law, a package of economic development incentive bills that will keep Alabama at the top of the list of locations companies will consider for making new investments and creating jobs. One bill in this package – the SEEDS Act – has the potential to allow Alabama to close the gap with our neighboring states through expanding the State Industrial Development Authority’s (SIDA) ability to give competitive grants to economic development organizations for site development and assessment. But for this bill to be effective, first, it needs to be fully funded. This is critically important. When looking at the toolbox communities need to have in order to win in competitions for business investment, there are few tools more important than access to high-quality industrial sites. Having a high-quality site, one with minimal risk to the prospective company you want to attract, is the best way to get your community into consideration for new investment and job creation. Without a quality industrial site that meets a prospective business’ size, logistics, utility, and workforce requirements, everything else falls apart. The most competitive communities plan for what type of job creator they want to attract, identify property that has the best chance to be developed, then invest in that site to make it as attractive as possible. Proactive investment in sites is critical because, outside of reducing risk for a business, it also shows that a community is committed to making whatever goes on that site successful. Many communities in Alabama are actively doing this, and doing it well, particularly in the region we serve at Southeast Gas. Over the years, cities across Southeast Alabama have invested in industrial parks, individual sites, and buildings. Those investments have resulted in new jobs, payroll, and capital investment that have been transformational to the communities and their citizens in the region. At the same time, those successes have now led to a lack of high-quality sites for the next round of opportunities. We have become victims of our own success, which is why now is the time to implement new strategies to continue capitalizing on our earned reputation as a state where great companies make high-quality products. Strategies vary by area, but most begin with communities and states taking a hard look in the mirror and understanding who they are and what they want. This includes understanding what incentives they are willing to use at the community level to attract the desired job creator. Once goals are agreed upon and established, communities typically start a process to acquire and improve their preferred site or industrial park. This is usually accomplished by leveraging a combination of public funds, state site development programs, and private funds. By fully funding the SEEDS Act, lawmakers will give the economic development teams across Alabama the ability to make those investments and make compelling arguments to companies looking to find a home. And with these business investments come high-quality jobs, a larger tax base that can fund education, infrastructure, and other important priorities that increase the quality of life for residents. The race to secure economic investment is a competitive one. Our neighboring states understand this, as do states across the country. Let’s put Alabama in a position to win those competitions. We are off to a great start, but we should finish strong and make the wise investments needed to win. Vince Perez is the Director of Economic Development for Southeast Gas. He directs the global and regional economic development initiatives of Southeast Gas and works with various organizations to promote economic growth across Southeast Alabama.

House to address legislation hiring more judges on Tuesday

On Tuesday, the Alabama House of Representatives will consider legislation adding new judges to reduce the dockets in Alabama’s fastest-growing judicial circuits. Senate Bill 39 (SB39)is sponsored by State Senator Sam Givhan (R-Huntsville). SB39 is the first item on the House’s proposed special order calendar for Tuesday. The version of the legislation that passed the Senate would add four additional circuit judgeships in the 23rd Circuit (Madison County), the 28th (Baldwin County), the 19th (Autauga, Chilton, and Elmore counties), and the 37th (Lee) as well as three additional district judgeships in Baldwin, Mobile, and DeKalb counties. SB39 would also put a moratorium on the reallocation of judges until 2027. The reallocation of judgeships from stagnant parts of the state like Birmingham, Montgomery, and the Black Belt to growing, prosperous areas of the state like Baldwin, Madison, Shelby, Lee, and Elmore counties is very controversial for the areas that would lose those judgeships. The legislature established a reallocation commission in 2015, but the courts have not reallocated judgeships as the legislature had intended. The new judgeships would be filled by elections in 2024, with the new judges going into office in the second week of January 2025. According to the fiscal note, passage of SB39 will cost the state $2.1 million in 2025 and at least $2.9 million a year beyond that. The effect on the SGF will be $1.9 million in FY2025 and $2.5 million in FY2026 and beyond. The new circuit judge in the 19th circuit may reside in any county within the Nineteenth Judicial Circuit (Chilton, Autauga, or Elmore counties) and shall be assigned to the domestic relations division of the circuit. SB39 also orders the Administrative Office of Courts to provide an annual report on the caseload statistics for each fiscal year by circuit. The legislation passed the Alabama Senate in a vote of 33 to 0. Speaker of the House Nathaniel Ledbetter (R-Rainsville) previously told Alabama Today that he and the House favored legislation addressing the state’s judge shortage. Overcrowded dockets mean that jury trials are often delayed for months denying victims justice, leaving business disputes unsettled for years, tying up estates, delaying final determinations in child custody cases, and making it difficult to live and do business in the state of Alabama. Tuesday will be day 24 of the 2023 Alabama Regular Legislative Session. The House convenes at 1:00 p.m., and the Senate convenes at 3:00 p.m. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Legislature to address budgets and grocery tax cut this week

The Alabama Legislature will meet on Tuesday, Wednesday, and Thursday this week for days 24, 25, and 26 of the 2023 Alabama regular legislative session. The 1901 Constitution of Alabama limits the regular session to no more than thirty legislative days, and the primary constitutional purpose of the session is to pass the state’s budgets. Alabama has two budgets: the state general fund (SGF) for non-education spending and the education trust fund (ETF) for education spending. Speaker of the House Nathaniel Ledbetter told reporters that he anticipates the House Ways and Means Education Committee will advance the 2024 education budget bills, including a large one-time supplemental appropriation for the current budget year, on Wednesday. If that happens, the Speaker intends to have the education budget bills on the floor of the House of Representatives on Thursday. Ledbetter said that he expects the House to address cutting the state’s four percent tax on groceries at that time. “I think we will see that come out next Thursday,” Ledbetter said of the bill cutting grocery taxes. House Bill 479 (HB479), sponsored by State Rep. Danny Garrett, is the bill cutting the sales tax on food. HB479, as introduced, would use the definition of food used by the Federal Supplemental Nutritional Assistance Program (SNAP). The legislation would cut the state groceries tax from 4.0 percent to 3.5% on September 1, 2023. The legislation also provides for conditional future tax cuts on food. On November 1, 2024, the rate would drop again to 3.0%, but only if net receipts to the ETF increase by 2.0% or more during the FY2024 fiscal year. In years where net receipts to the education budget increase by 2.0% or more, the tax on foodstuffs will drop .5% until it reaches a floor of 2.0%. If we have a robust economy, that could be reached as soon as November 1, 2026. If the economy stagnates and growth fails to reach 2.0% or more, there will be no tax cut that year. HB479 does not affect county or local governments’ existing sales taxes on food sales. It would be left up to the local governments whether or not they would follow the state’s example and reduce their own sales taxes – which in many jurisdictions are much higher than the state’s tax. Some The state brings in over $600 million from the sales taxes on food. HB479 could cut state revenues by over $300 million, with $75 million being felt in FY2024. “We will address the budgets on Thursday,” Ledbetter said. The FY2024 education budget that passed the Senate, Senate Bill 88, was $8,798,591,041. That is an increase from $8,261,590,649 in FY2023 2023 – a $537,000,392 ( 6.5% increase). The budget package that passed the Senate included a $2,787,667,309 supplemental appropriation, Senate Bill 87, in one-time money. “There will be some changes in the House side,” Ledbetter said. Senate President Pro Tempore Greg Reed told reporters that the general fund budget should be voted on by the Senate Finance and Taxation Committee on Wednesday and that budget will be addressed by the full Senate on Thursday. He also anticipates movement on cutting the grocery tax this year. The SGF budget that passed the House, House Bill 124, was $3,024,167,948, an increase of $169,030,561 – 5.92% – over FY2023. There is also a supplemental appropriation to the 2023 general fund of $201,738,865 – House Bill 125. Both budgets have already passed in their respective House of origin, but it is highly unlikely that the second house will pass both budgets without making changes. Both budgets will then have to go back to the House of origin for their consideration. It is likely that they will then vote to non-concur – in which case the differences will be resolved in conference committees before returning to both houses. Alabama is 49th in per capita taxation. High poverty and low labor force participation rates adversely affect total state revenues. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Jim Zeigler: Bills would add 98 cents to three dollars a month on each cell phone and landline

A lot of attention has been focused this session on the Alabama Legislature’s efforts to cut taxes. Bills have been introduced to lower or eliminate a large portion of the state’s grocery tax. Also, there are bills to lower the state’s top income tax rate and eliminate the lowest rate. I had hopes that the 2023 session would become known as “The Tax-Cutting Session.” I hoped that tax-raising days were over. But some tax raisers just can’t seem to help themselves. Two bills moving through the Alabama Legislature would add a new tier of taxes on Alabama consumers. House Bill 389 (HB389) and Senate Bill 328 (SB328) would also create yet another bureaucracy to duplicate existing emergency call services now handled by 9-1-1 and 9-8-8. We all want to help prevent suicides and help emergency mental health services. But when the state has more money than ever, why is the answer a new tax? The phone tax bills would add a new tax of from 98 cents to three dollars a month to all phone bills. At the low figure, the tax increase would amount to about 12 dollars a year for each line and each cell number. At this point, the proposed income tax rebate had been dropped to just $105 one time, and it will be subject to federal income tax. Add this phone tax increase, and it’s getting to the point where the rebate won’t be enough to buy a sack full of Jack’s Hamburgers. While the $3 a month phone tax rate in the original bill has been amended out, there’s nothing to stop it from being put back into the bill – with merely a voice vote or a stroke of the pen. Furthermore, we’re already taxed heavily for emergency call services. For 9-1-1, Alabama residents are already charged $1.86 per line per month for a total annual revenue of nearly $130 million. The proposed new phone taxes would add an additional $69 million on top of the 9-1-1 tax. The 98 cents a month new phone tax would be one of the highest in the country, and the $3 tax would make us No. 1 in the nation. Friends, we don’t want to be No. 1 on that phone tax list. The bill would also create the “988 Commission” to oversee the project. It would consist of 11 politically appointed officials. There’s a lot that can be done to help with mental health issues without new taxes and a new bureaucracy. For starters, there is no proposal for better training of current dispatchers in fielding mental health calls and suicide threats. Nor is there a program to better and more quickly connect callers to emergency mental health services. Why have two mediocre emergency call services? Just make the one we already have work better. As a state government, we have more money than we’ve ever had. When there is money available to augment mental health services, a new tax is a bad idea and merely feeds the tax-and-spend habit Montgomery has had. We’re taxed enough. We’ve got enough money. Do the right thing. Fund the mental health and suicide prevention programs through existing dollars. Jim Zeigler, former Public Service Commissioner

Appeals court says Alabama can’t execute intellectually disabled inmate

A federal appeals court on Friday said Alabama cannot execute a man with an IQ in the 70s, agreeing with a lower court’s ruling that he is intellectually disabled and that his death sentence is unconstitutional. The Atlanta-based 11th U.S. Circuit Court of Appeals upheld a federal judge’s 2021 decision vacating the death sentence of Joseph Clifton Smith, 52. Smith was convicted and sentenced to death for the 1997 beating death of Durk Van Dam. Van Dam, whose body was found in his pickup truck in Mobile County, died as a result of 35 blunt-force injuries to his body, according to testimony from a forensic pathologist. The appellate court wrote Friday that it found no error in the federal judge’s review of the case that determined that Smith is “intellectually disabled and, as a result, that his (death) sentence violates the Eighth Amendment.” The U.S. Supreme Court in 2002 barred the execution of intellectually disabled people. The court has since ruled that in borderline cases, states should look at other evidence of disability because of the margin of error in IQ tests. Alabama law defines intellectual disability as an IQ of 70 or below, “significant or substantial deficits in adaptive behavior,” and the onset of those issues before the age of 18. Smith scored as low as 72 and as high as 78 on IQ tests over the years and showed evidence of poor intellectual and adaptive functioning since a young age, the court ruling noted. He was placed in school programs for students with learning or intellectual disabilities and ”went on to fail the seventh and eighth grades before dropping out of school for good.” Senior U.S. District Judge Callie V. S. Granade wrote in 2021 that Smith’s IQ score of 72 could mean his IQ is actually as low as 69 “if you take into account the standard error of measurement.” “This is a close case, but the evidence indicates that Smith’s intelligence and adaptive functioning has been deficient throughout his life,” Granade wrote. The ruling is a victory for Smith’s attorneys, who have been fighting for years to overturn his death sentence. A spokeswoman for Alabama Attorney General Steve Marshall said the state will appeal the ruling to the U.S. Supreme Court. “Joseph Smith brutally murdered Durk Van Dam in 1997, and for that, he was sentenced to death. Smith’s IQ scores have consistently placed his IQ above that of someone who is intellectually disabled. The Attorney General thinks his death sentence was both just and constitutional,” Amanda Priest, a spokeswoman for Marshall, wrote in an email. Republished with the permission of The Associated Press.

Daniel Sutter: The debt ceiling and the national debt

The United States faces potential default in June as we run up against the debt ceiling, currently at $31.4 trillion. Whether the debt ceiling is good policy depends largely on one’s attitude toward Federal spending. Is our national debt sustainable? I will defer to the judgment of financial markets. Interest rates compensate savers for being patient and for bearing default risk, the risk that borrowers may not repay the loan or interest payments. The “risk-free” interest rate is what investors would charge a borrower with no default risk. When default risk increases, investors will first demand a higher interest rate and then stop lending altogether. U.S. Treasury securities have long been viewed as the risk-free investment. The inflation-adjusted (or real) interest rate on 10-year U.S. Treasury securities, courtesy of the St. Louis Fed, stands at 1.3 percent, over two percentage points higher than at the start of 2022. But this interest rate hike is widely attributed to the Fed’s tightening of monetary policy to combat inflation. The debt to GDP ratio stands at historically high levels. But economists Jason Furman and Larry Summers argue that real interest payments as a percentage of GDP better measures indebtedness. This measure is not at record levels, suggesting that Washington has untapped credit. Nonetheless, our current budget situation is troubling. The Congressional Budget Office (CBO) estimates this year’s deficit at $1.5 trillion, the third largest ever and 7th largest since 1962 as a percentage of GDP. Yet the economy is not in recession. We are at peace, and the COVID-19 pandemic is over. This represents a structural and not cyclical deficit. Deficit projections depend on future policy choices, so let’s consider entitlement spending. The CBO projects that Social Security and Medicare spending will increase from $2.3 trillion this year to $4.2 trillion in 2033. The deficit will increase significantly unless we cut spending or increase taxes. Credit markets are voluntary; nobody must purchase Treasury bonds. At some point, credit markets will say no more Federal borrowing. We would be wise to keep some credit for emergencies. Imagine financing World War II without any borrowing! Now let’s turn to the debt ceiling, beginning with its history. Congress enacted the ceiling in 1917 to keep from having to approve each issuance of Treasury debt. The ceiling has been raised over 100 times since World War II and suspended on several occasions. Fiscal conservatives use the ceiling as leverage to push spending cuts, like the 1985 Gramm-Rudman-Hollings Debt Reduction Act and the 2011 budget deal. The ceiling creates policy uncertainty for our economy. Uncertainty is unavoidable in life and especially business but hurts investment. Government affects business in many ways, so uncertainty about government policy increases overall uncertainty. Failure to raise the debt ceiling will delay the repayment of bonds, drive up the Federal government’s interest rate, and potentially also other interest rates. A long-term budget agreement would be better than a fight over the ceiling every other year. Evaluation of the ceiling depends mostly on how one views current Federal spending, not creditworthiness. If avoiding default were paramount, a deal could be done easily. Republicans could agree to big tax hikes, or Democrats could agree to freeze discretionary spending. These are not solutions due to their impact on spending. The Biden Administration is considering challenging that the debt ceiling violates the 14th Amendment. I am not a constitutional lawyer, so I will not weigh in here. Fiscal conservatives have voiced opposition to this tactic, but we are a constitutional republic; the constitutionality of any law can be questioned. The inability to reach a compromise reflects our increasingly divided nation. Legitimate government reflects the consent of the governed, meaning all Americans, because we recognize the equal moral worth of all citizens. Today both sides want to force their preferred policy on the other by any means necessary. This is a tell that many now view their fellow Americans as subjects, not fellow citizens. Daniel Sutter is the Charles G. Koch Professor of Economics with the Manuel H. Johnson Center for Political Economy at Troy University and host of Econversations on TrojanVision. The opinions expressed in this column are the author’s and do not necessarily reflect the views of Troy University.

Legislature awards Law Enforcement Medal of Honor

On Thursday, two Bibb County deputies were awarded the Alabama Law Enforcement Medal of Honor for their successful pursuit of a dangerous career criminal. Deputies Brad Johnson and Chris Poole engaged in a high-speed pursuit of Austin Hall. After crashing the stolen car, Hall engaged the officers in a deadly gun battle. Both officers were shot in the gun battle with Hall. Officer Johnson was declared dead the next day. House Resolution 181 reads: “COMMENDING DEPUTY BRAD JOHNSON AS A RECIPIENT FOR THE 2023 ALABAMA LEGISLATIVE MEDAL OF HONOR FOR LAW ENFORCEMENT. WHEREAS, it is with highest commendation that we recognize Deputy Brad Johnson as a recipient of the 2023 Alabama Legislative Medal of Honor for Law Enforcement, Alabama’s highest law enforcement award for extraordinary courage in the line of duty; and WHEREAS, on June 29, 2022, Deputy Chris Poole initiated the pursuit of a vehicle that was reported stolen in Calera and driven by a 26-year-old felon, who had been arrested on 46 criminal charges since the age of 17; at periods during the pursuit, speeds exceeded 100 miles per hour; and WHEREAS, the driver lost control of the vehicle and began firing gunshots towards Deputy Poole, who reported on his radio that he had been shot and urged Deputy Johnson, who had joined the pursuit, to back off because of the continuing gunfire; and WHEREAS, Deputy Johnson, who was determined to provide support for Deputy Poole, arrived at the scene, began firing, and placed two shots through the windshield; as Deputy Johnson stepped onto the side rail of his Sheriff’s Department vehicle, he successfully fired two additional rounds before sustaining a gunshot wound as well; both deputies were transported by police escort to UAB Hospital in Birmingham, where Poole was treated and released, and Johnson was placed on life support, which was removed the following day; and WHEREAS, Deputy Brad Johnson was pronounced dead shortly after 3:15 P.M. on June 30, 2022; andWHEREAS, for his bravery on June 29, 2022, and for the events that followed, Deputy Brad Johnson, is highly honored and deserving of the 2023 Legislative Medal of Honor; now therefore, BE IT RESOLVED BY THE HOUSE OF REPRESENTATIVES OF THE LEGISLATURE OF ALABAMA, That we hereby recognize and honor the late Deputy Brad Johnson as recipient of the 2023 Legislative Medal of Honor for Law Enforcement and by copy of this resolution prepared in honor and tribute, we commend his memory to the citizens of Alabama.” House Resolution 179 is the resolution honoring Deputy Poole. Poole was present with his family, as was the family of the late Deputy Johnson and members of the Bibb County Sheriff’s Department. The Law Enforcement Medal of Honor is awarded annually by the Legislature. Lieutenant Governor Will Ainsworth told the members of law enforcement present for the joint session: “On behalf of the people of Alabama, we appreciate what you do to keep Alabama safety.” Senate President Pro Tempore Greg Reed said, “When we are at our worse, they are at their best.” Speaker of the House Nathaniel Ledbetter said, “What an honor it is to be here today in the presence of greatness.” “We pray for you, and we pray that God puts his protection around you,” Ledbetter added. “Thank you for your service and what you do for our state.” Alabama Law Enforcement Agency Secretary Hal Taylor thanked the Legislature for giving this annual award and credited former State Rep. Howard Sanderford for starting this, “and thank you for keeping it going.” “What yall do every day is absolutely incredible for the people of Alabama,” Taylor told the officers. “We appreciate you more than you now.” Rep. Rex Reynolds said, “In Alabama, we stand with law enforcement.” Reynolds warned, “The law enforcement profession is under attack.” Reynolds said that since he was 17, Hall had been charged with 49 prior offenses prior to his violent encounters with Deputies Poole and Johnson. Hall had been released from prison just days prior on good time, even though he had other charges pending in the courts. Alabama Today asked if Hall should have been out of prison last June. “That was the basis for Senator [April] Weaver’s bill,” Reynolds said. That bill significantly curtailed good time sentence reductions awarded by prison wardens. Reynolds said that a similar situation occurred with the Huntsville police officer who was killed earlier this year. Reynolds is the former Huntsville Chief of Police. The awards ceremony occurred during a special joint session of both Houses of the Alabama Legislature. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

State sets new record low unemployment rate of 2.2%

On Friday, Alabama Governor Kay Ivey announced today that Alabama’s preliminary, seasonally adjusted April unemployment rate is 2.2%. This is down from the previous record low rate of 2.3% in March and below April 2022’s rate of 2.5%. 51,462 people were unemployed in April – down from 53,017 in March and 57,712 in April 2022. “Yet again, we see the resiliency of our state’s workforce,” said Gov. Ivey. “When Alabama works, Alabama families thrive, and records are broken time and time again,” said Governor Ivey. “We have a quick growing economy, and we are leading the game when it comes to economic success. Boasting the lowest unemployment rate in the Southeast, Alabama is well on its way to having the lowest unemployment rate in the nation.” 3,367 Alabamians joined the workforce in April, raising the total to 2,293,022. The number of people counted as employed reached a new record high, grew 4,922 to 2,241,560. “Continuing this positive trend, Alabama’s employers added more than 40,000 jobs over the last year, reaching the third highest jobs count in history,” said Alabama Department of Labor Secretary Fitzgerald Washington. “Wages have yet again set a new record high, rising by more than $30 a week since last month alone. More money in the pockets of Alabamians is always a good thing.” During the last year, wage and salary employment increased by 40,800 to 2,143,700, with gains in the private education and health services sector (+8,000), the government sector (+6,300), and the professional and business services sector (+6,100), among others. Over the month, wage and salary employment increased in April by 7,900. Monthly gains were seen in the leisure and hospitality sector (+3,800), the financial activities sector (+1,700), and the private education and health services sector (+1,300), among others. “Comparatively, Alabama had the lowest jobless rate in the southeast for all 12 months in 2022, further evidence that our state is a wonderful place to live, to work, and to succeed,” Washington wrote. “And nationally, we ranked an impressive 7th lowest unemployment rate with a 2.6 percent annual average, compared to the 3.6 percent for the nation. That’s really quite a feat and definitely something to be proud of.” Wages continued to climb. Total private average weekly wages reached a new record high in April of $1,023.12. This is up $31.02 over the month and up $27.68 over the year. The trade, transportation, and utilities sector and the financial activities sectors both hit new record-high weekly wages, rising to $835.56 and $1,305.68, respectively. The Alabama counties with the lowest unemployment rates are Shelby County at 1.3%, Morgan, Marshall, Madison, and Cullman Counties at 1.4%, and St. Clair, Limestone, Lawrence, Elmore, and Blount Counties at 1.5%. The counties with the highest unemployment rates are Wilcox County at 6.0%, Greene County at 4.0%, and Clarke County at 3.7%. The major cities with the lowest unemployment rates are Alabaster, Madison, Trussville, and Vestavia Hills at 1.2%, Homewood, Hoover, and Northport at 1.3%, and Athens at 1.4%. The major cities with the highest unemployment rates are Selma at 4.5%, Prichard at 3.2%, and Bessemer and Gadsden at 2.5%. Nationally, the U.S. unemployment rate dropped from 3.5% in March to 3.4% in April and down from 3.6% a year ago. The Alabama labor participation rate improved slightly to 56.8% from 56.7% in March. However, it is still below the 57.2% rate a year ago and well below the national labor force participation rate of 62.6%. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

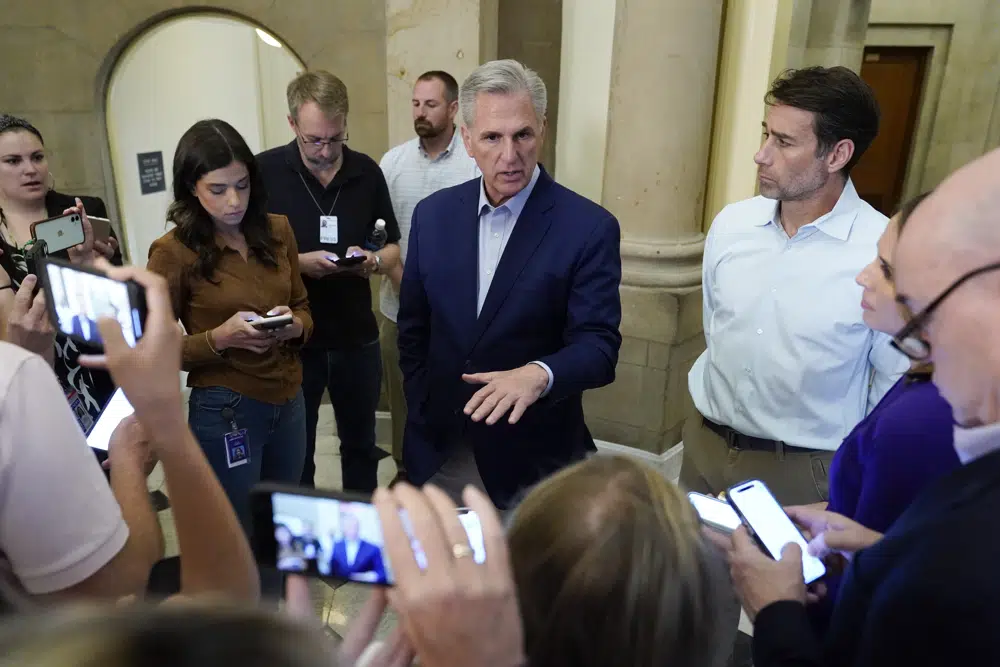

Debt ceiling: Joe Biden, Kevin McCarthy to meet Monday as negotiators ‘keep working’ to resolve standoff

The White House and House Republicans wrapped up another round of debt ceiling talks Sunday as Washington races to strike a budget compromise along with a deal to raise the nation’s borrowing limit and avert an economy-wrecking federal default. President Joe Biden and House Speaker Kevin McCarthy spoke by phone Sunday while the president was returning home on Air Force One after the Group of Seven summit in Japan. Upbeat, McCarthy, R-Calif., told reporters at the Capitol that the call was “productive” and that the on-again, off-again negotiations between his staff and White House representatives are focused on spending cuts. Biden and McCarthy are set to meet for a pivotal meeting Monday at the White House. Negotiators for the Democratic president and Republican speaker met for 2 1/2 hours at the Capitol as talks appear to be narrowing on a 2024 budget year cap that would be key to resolving the standoff. “We’ll keep working,” said Steve Ricchetti, counselor to the president, as the White House team exited. The Republicans were not seen leaving the speaker’s office and offered no immediate comment after the talks. They all face a deadline, as soon as June 1, when the government could run out of cash to pay its bills. Treasury Secretary Janet Yellen said Sunday that June 1 is a “hard deadline.” McCarthy said after his call with Biden that “I think we can solve some of these problems if he understands what we’re looking at.” The speaker added, “But I’ve been very clear to him from the very beginning. We have to spend less money than we spent last year.” McCarthy emerged from that conversation sounding optimistic and was careful not to criticize Biden’s trip, as he had before. He did caution, “There’s no agreement on anything.” “We’re looking at, how do we have a victory for this country?” McCarthy said. He said he did not think the final legislation would remake the federal budget and the country’s debt, but at least “put us on a path to change the behavior of this runaway spending.” The White House confirmed the Monday meeting and late Sunday talks but did not elaborate on the leaders’ call. Earlier, Biden used his concluding news conference in Hiroshima, Japan, to warn House Republicans that they must move off their “extreme positions” over raising the debt limit and that there would be no agreement to avoid a catastrophic default only on their terms. Biden said “it’s time for Republicans to accept that there is no deal to be made solely, solely, on their partisan terms.” He said he had done his part in attempting to raise the borrowing limit so the government can keep paying its bills, by agreeing to significant cuts in spending. “Now it’s time for the other side to move from their extreme position.” Biden had been scheduled to travel from Hiroshima to Papua New Guinea and Australia but cut short his trip in light of the strained negotiations with Capitol Hill. Even with a new wave of tax revenue expected soon, perhaps giving both sides more time to negotiate, Yellen said on NBC’s “Meet the Press” that “the odds of reaching June 15, while being able to pay all of our bills, is quite low.” GOP lawmakers are holding tight to demands for sharp spending cuts with caps on future spending, rejecting the alternatives proposed by the White House for reducing deficits in part with revenue from taxes. Republicans want to roll back next year’s spending to 2022 levels, but the White House has proposed keeping 2024 the same as it is now, in the 2023 budget year. Republicans initially sought to impose spending caps for 10 years, though the latest proposal narrowed that to about six. The White House wants a two-year budget deal. A compromise on those topline spending levels would enable McCarthy to deliver for conservatives, while not being so severe that it would chase off the Democratic votes that would be needed in the divided Congress to pass any bill. Top Republican negotiator Rep. Garret Graves of Louisiana, speaking alongside McCarthy at the Capitol, said the numbers “are the foundation” of any agreement. Republicans also want work requirements on the Medicaid health care program, though the Biden administration has countered that millions of people could lose coverage. The GOP additionally introduced new cuts to food aid by restricting states’ ability to waive work requirements in places with high joblessness. That idea, when floated under President Donald Trump, was estimated to cause 700,000 people to lose their food benefits. GOP lawmakers are also seeking cuts in IRS money and, by sparing Defense and Veterans accounts from reductions, would shift the bulk of spending reductions to other federal programs. The White House has countered by keeping defense and nondefense spending flat next year, which would save $90 billion in the 2024 budget year and $1 trillion over 10 years. All sides have been eyeing the potential for the package to include a framework that would speed energy project developments. And despite a push by Republicans for the White House to accept parts of their proposed immigration overhaul, McCarthy indicated the focus was on the House’s previously approved debt and budget package. “I think that we can reach an agreement,” Biden said, though he added this about Republicans: “I can’t guarantee that they wouldn’t force a default by doing something outrageous.” Republicans had also rejected various White House revenue proposals. Among the proposals the GOP objects to are policies that would enable Medicare to pay less for prescription drugs. Republicans also have refused to roll back Trump-era tax breaks on corporations and wealthy households as Biden’s own budget has proposed. For months, Biden had refused to engage in talks over the debt limit, contending that Republicans in Congress were trying to use the borrowing limit vote as leverage to extract administration concessions on other policy priorities. But with the June 1 potential deadline looming and Republicans putting their own legislation on the table, the White House launched talks on