CFD Research launches growth project at Test Center in Jackson County, Alabama

CFD Research Corp. has formally kicked off a construction project to add a new facility at its Engineering Test Center in Jackson County that will allow it to expand activities at its growing site located in Hollywood. Huntsville-based CFD Research said the new 19,000-square-foot building will support work for ongoing contracts with the Army Space and Missile Defense Command, the Air Force Arnold Engineering Development Complex, and other customers. The building will provide more than 28 additional offices, a second-high bay, a larger conference room space, and closed areas for classified meetings. The facility will expand the team’s capability to provide services, perform technology development, and enable increased test capacity. “CFD Research specializes in delivering next-level technologies, services, and products that keep us all safe, and this expansion project at its Hollywood site will help the company achieve new milestones in that critical mission,” said Greg Canfield, secretary of the Alabama Department of Commerce. Alabama Commerce Secretary Greg Canfield speaks to CFD Research Chief Executive Sameer Singhal at an event to kick off a project to add a new facility at the company’s Engineering Test Center in Jackson County. (CFD Research) Joining Canfield at a groundbreaking were U.S. Rep. Dale Strong, state Sen. Steve Livingston, Scottsboro Mayor Jim McCamy, and Nathan Lee, president of the Jackson County Economic Development Authority. “Thank you to the town of Hollywood and Jackson County for welcoming us so graciously and celebrating this groundbreaking event, and thank you to the Alabama Department of Commerce for its support,” said Sameer Singhal, president and CEO of CFD Research. “The location and proximity to our other facilities have been an ideal solution and will enable us to work more efficiently and economically.” In August 2021, CFD Research opened its 13,125-square-foot test and evaluation facility on 10.4 acres in Jackson County Industrial Park in Hollywood. In November 2022, CFD Research added 63 acres and an additional test stand four times larger than the company’s previous capability to expand its manufacturing, system integration, and test and evaluation services. CFD Research had four employees at the Testing Center when it opened. It now has 22 employees there and expects to surpass 40 employees in the near future. This story originally appeared on the Alabama Department of Commerce’s Made in Alabama website. Republished with the permission of The Alabama NewsCenter.

Small businesses blast IRS over new tax credit announcement

Small businesses are crying foul after the Internal Revenue Service announced it would delay processing of a key tax credit, the latest in a series of delays for the agency. The IRS announced it will significantly slow its processing of Employee Retention Tax credits that have already been filed and not accept any new claims of this kind until next year. The agency says a flood of fraudulent attempts means it will have to take extra care to avoid fraud. The tax credit was meant to help businesses and nonprofits hold on to employees during the pandemic. Now, Small businesses say the IRS moving slowly means they will pay the price. “The IRS is increasingly alarmed about honest small business owners being scammed by unscrupulous actors, and we could no longer tolerate growing evidence of questionable claims pouring in,” IRS Commissioner Danny Werfel said in a statement. “The further we get from the pandemic, the further we see the good intentions of this important program abused. The continued aggressive marketing of these schemes is harming well-meaning businesses and delaying the payment of legitimate claims, which makes it harder to run the rest of the tax system. This harms all taxpayers, not just ERC applicants.” The National Federation of Independent Business, a leading small business group, blasted the IRS after the announcement, “While misleading marketing for the Employee Retention Tax Credit remains a problem, the IRS should not penalize the hundreds of thousands of small businesses that have followed the eligibility rules, correctly filed claims, and need help now,” Kevin Kuhlman, NFIB Vice President of Federal Government Relations, said in a statement. “NFIB has heard from many small business owners who are frustrated by the delays in processing claims and lack of communication from the IRS.” A recent NFIB survey found that small businesses are already hurting, in large part because of rising inflation. According to federal data, inflation spiked in August well beyond expectations. The NFIB poll of small business owners found that they cite inflation as their number one business concern, more than the labor shortage or anything else. Pandemic-era fraud led to hundreds of billions of dollars being taken from taxpayers across several government programs. Werfel, citing this kind of concern, seemed to suggest that processing could be delayed even further if needed to avoid fraud. “For those people being pressured by promoters to apply for the Employee Retention Credit, I urge them to immediately pause and review their situation while we look to add new protections and safeguards to stop bad claims from ever coming in,” Werfel said. “In the meantime, businesses should seek out a trusted tax professional who actually understands the complex ERC rules, not a promoter or marketer hustling to get a hefty contingency fee. Businesses that receive ERC payments improperly face the daunting prospect of paying those back, so we urge the utmost caution. The moratorium will help protect taxpayers by adding a new safety net onto this program to focus on fraudulent claims and scammers taking advantage of honest taxpayers.” Kuhlman said the IRS delay will only make things harder on small businesses. “By further delaying the processing of existing claims, the IRS is making it more difficult for small businesses to operate, keep employees, and create jobs,” Kuhlman said. Republished with the permission of The Center Square.

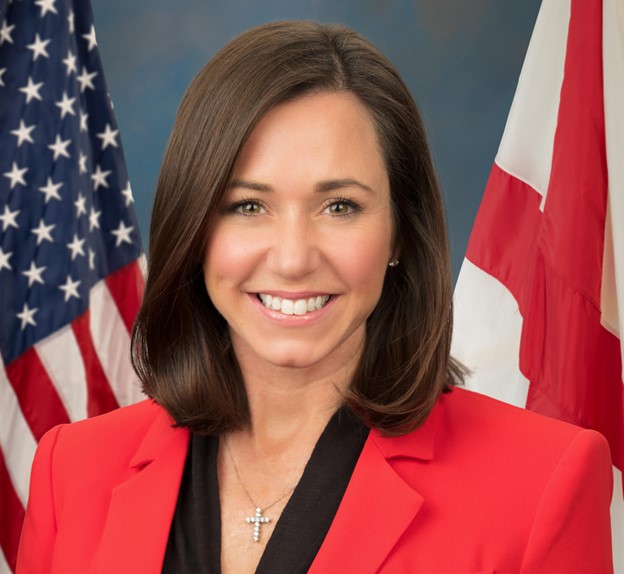

Katie Britt condemns Biden Administration decision to allow Iranian President to visit the U.S.

On Monday, the Biden Administration announced that it will allow Iranian President Ebrahim Raisa to enter the United States for the United Nations General Assembly meeting. U.S. Senator Katie Britt (R-Alabama) released a statement critical of the decision. “This disgraceful decision is the latest in a long line of dangerous appeasement by the Biden Administration,” Sen. Britt said. “Just two days ago, Iran reportedly expelled several senior International Atomic Energy Agency inspectors from the country. Now, President [Joe] Biden is sending a clear message to the world that the United States of America tolerates terrorism. On the very same day that the Biden Administration hands $6 billion to the largest state sponsor of terrorism in the world, the President chooses to allow the unapologetic leader of this ruthless regime into our country. This weakness endangers our national security, insults the Americans and allies struck by Iranian-backed terrorism across the globe, and abandons oppressed people in Iran who hunger for liberty, peace, and safety. We achieve peace through strength, not placation. The safety and security of all Americans is gravely imperiled by President Biden’s continued blunders on the global stage,” said Senator Britt. Five Americans who were freed by Iran as part of a prisoner exchange deal arrived in Qatar on Monday. The five American dual citizens were falsely convicted and imprisoned in Iran. They are now on their way home. The deal cost $6 billion in seized oil sales and the release of five Iranians convicted of nonviolent crimes. Sen. Britt opposed that deal on the grounds that paying out funds for hostages simply encourages bad actors to take more hostages. Britt said that the deals with Iran are appeasement. Last week, Senator Britt joined a group of four Republican colleagues in sending a letter reproaching President Raisi’s visit last month to the home of Asadollah Assadi. Assadi was sentenced to twenty years in prison by Belgium for his role in a bomb plot. The letter expressed concern over President Raisi’s record of publicly tolerating terrorism and continued threats against American officials and urged the Biden Administration to deny visas to President Raisi and his staff at UNGA. Joining Senator Britt in sending the letter were U.S. Senators Rick Scott (R-Florida), Tom Cotton (R-Arkansas), Chuck Grassley (R-Iowa), and Ted Budd (R-North Carolina). To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Report: Alabama has nation’s second-lowest property taxes

(The Center Square) — A recent report by the Tax Foundation found that Alabama has the second-lowest property taxes nationally as a percentage of a home’s value. Researchers from the non-partisan nonprofit that deals with tax policy found that the Yellowhammer State hits property owners with an effective rate of 0.4%. According to the report, property taxes amounted to 32.2% of state and local tax revenues in 2020, more than any other source. The Tax Foundation used the most recent data from 2021 in their calculations and found that the highest average property tax bills were in the Birmingham metro area, as suburban Shelby County (average of $1,167) and Jefferson County ($1,149). Only Hawaii had lower property taxes at 0.32%, with Colorado (0.55%), Wyoming (0.56 percent) and Louisiana (0.56%) rounding out the top five. According to the Alabama Department of Revenue, Greene County has the state’s highest property tax rates, but the average tax bill is $312 per year. On the opposite end of the spectrum, New Jersey had the nation’s highest property taxes with an average rate of 2.23%, followed by Illinois (2.08%), New Hampshire (1.93%), Vermont (1.83%) and Connecticut (1.79%). Alabama also outperformed its neighboring states, as Tennessee (0.67% rate) and Mississippi (0.67%) were at 37th and 36th lowest, respectively. Florida had the 26th-lowest rate at 0.91%, followed by Georgia at 25th with 0.92%. Alabama’s Choctaw County had one of the lowest average property bills nationally at $200, along with Allen, Avoyelles, East Carroll and West Carroll parishes in Louisiana and Northwest Arctic Borough and the Kusilvak Census Area in Alaska. A pair of Louisiana parishes — Madison ($215) and Bienville ($220) — were among the lowest average property taxes, along with Sioux County, North Dakota ($223), Alabama’s Lamar County ($234) and McDowell County, West Virginia ($237). Eleven counties had annual property taxes of more than $10,000, including Bergen, Essex, Hunterdon, Morris, Passaic, and Union counties in New Jersey; Nassau, New York, Rockland, and Westchester Counties in New York and Fall Church County in Virginia. Republished with the permission of The Center Square.

Meet the candidates running in the House District 16 special election

by Alander Rocha, Alabama Reflector With about a week left before the special primary election for House District 16, candidates in the crowded field are preparing to go head-to-head when voters cast their ballots on September 26. Five Republicans will compete for the party nomination, and if none of the candidates win at least 50% of the vote, a runoff for the two top candidates will be held on October 24. The district takes in Fayette County in north central Alabama, as well as northern Tuscaloosa County and western Jefferson County. The candidate who wins — either with 50% in the primary or in the runoff — will face Democratic candidate John Underwood in the General Election for the seat in January. Former Rep. Kyle South, R-Fayette, who assumed office in 2014, stepped down June 30 to become the CEO of the West Alabama Chamber of Commerce as CEO. During his time in the Alabama House of Representatives, he served as vice chair for the Ways and Means General Fund and was a member of several other committees. South won House District 16 with 75% of the vote in 2014. He ran unopposed in 2018 and 2022. A special runoff, if necessary, is scheduled for October 24. The special general election will be held on January 9, 2024. The special primary election for House District 55, which Rep. Fred Plump, D-Fairfield, resigned in May after pleading guilty to charges of conspiracy and obstruction of justice, will be held on the same day. The Candidates Brad Cox Brad Cox, Republican candidate for House District 16. Age: 33 Residence: Fayette Occupation: Banker at Alabama ONE Credit Union. Before, Cox was a high school teacher. Education: B.S., Agricultural Education, Auburn University, 2012; M.A., Agricultural Education, Auburn University, 2013. Party: Republican Previous political experience/campaign: Fayette County Commissioner, District 1, 2021-present. Fundraising: Cox has raised $47,544 and spent $38,185 as of September 15. Cox is the candidate with the most contributions from PACs, totaling $33,000 from 13 PACs. His largest contributors are Alabama Voice of Teachers for Education (AVOTE), a PAC affiliated with the Alabama Education Association, and the Alabama Credit Union Legislative Action Council. Each donated $5,000. Cox said that it’s time for young, conservative Republicans to “step up to the plate and throw their hat in the ring.” He said that he’s passionate about public service, and he feels that his set of personal and professional experience will complement the position. Citing his prior experience as a high school teacher, Cox said he wants to expand tech training for young Alabamians. By training young folks for high-paying, tech jobs, he hopes to keep young talent in his district and in Fayette County, which reported population losses in the 2010 and 2020 censuses. “As I’ve knocked on doors, met with stakeholders in the communities, it’s a lot of gray hair, and in a lot of ways, that’s good, but I think we’ve got to expand and grow our industry and job opportunities for people in this district,” Cox said. He also said that infrastructure has been at the forefront as a county commissioner, which he said feeds into another priority for his campaign: business development. “A lot of the time, rural Alabama kind of gets left out of the equation with funding and infrastructure projects. In my eyes, if we want to recruit business and industry to this area, we’ve got to have infrastructure,” he said. Greg Fanin Greg Fanin, Republican candidate for House District 16. Age: 54 Residence: Berry Occupation: Retired munitions and ordnance specialist with the U.S. Army and U.S. Air Force. Education: B.S., Public Administration, Samford University, 1994; Associate’s degree in munitions and ordnance from the Community College of the Air Force, 1998. Party: Republican Previous political experience/campaign: First-time candidate for political office. Fundraising: Fanin has raised $27,371, with $23,000 coming from Fanin. As of September 8, he spent $24,938. As a retired veteran, Fanin said he has the capacity to put his focus entirely on serving the district. He wants to see an industrial park, an area meant to attract investment and create employment, and for continued infrastructure projects on U.S. Highway 43 and State Route 13, two of the major roads running through Fayette. “We’ve got to have folks. We’ve got to have those roads widened. We got to, or it’s going to be unsafe,” he said. Besides infrastructure, Fanin sees workforce development as his district’s greatest need. He said there is a coal mine coming to Fayette County that has the potential to bring in a significant amount of jobs, and building infrastructure will support workforce development. “We’ve got the jobs opening up every day,” he said. “We need infrastructure because our little towns and our communities are going to be booming.” He said that to get these things done; the district needs someone who can dedicate their full time to working in Montgomery, which he said he is able to do. He said that other candidates have at least one job and asked, “When do you have time to do anything?” Floyd Rodgers, Jr. Floyd Rogers Jr., Republican candidate for House District 16. Age: 40 Residence: Fayette Occupations: Coordinator, Alabama Communities of Excellence for the City of Fayette, a program from the Alabama League of Municipalities, an association of cities and towns; minister; business owner. Education: Technical certificate in quality assurance supervision from Southwest Tennessee Community College, 2010; Church leadership certificate in biblical ministry from the New Orleans Baptist Theological Seminary, 2021. Party: Republican Previous political experience/campaigns: Candidate, Fayette City Council Ward 2, 2020. Fundraising: As of September 15, Rodgers had not submitted campaign finance reports. Rodgers said that he often feels like the elephant in the room. People often tell him they don’t see many Black Republicans, and among his peers, he’s often the only conservative in the room. But he sees that as an opportunity to “connect with everyone, on every level.” He said from conversations he’s had with voters, people are tired of