Alabama commission looks at further grocery tax cuts, potential revenue replacement

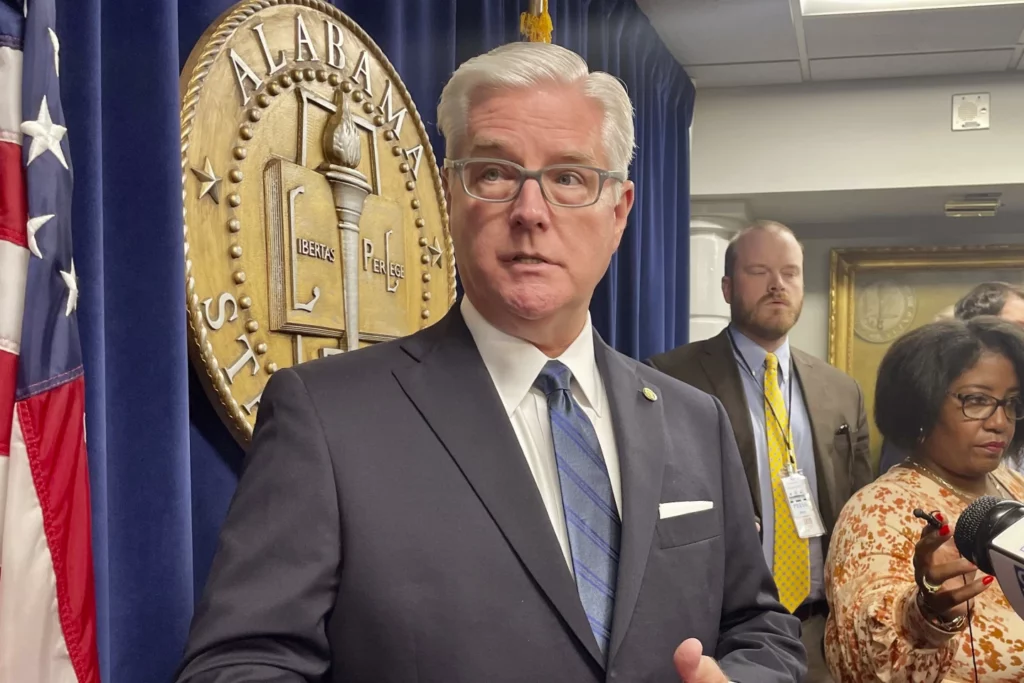

Alabama commission looks at further grocery tax cuts, potential revenue replacement by Jemma Stephenson, Alabama Reflector November 15, 2023 Members of a state commission looking at the impact of grocery tax repeal looked at the recent cut to the tax, the potential for slower education budget growth, and alternate revenues. Alabama in September cut the state’s 4% tax on groceries to 3%, the first reduction in the tax since it was first implemented in 1939. Prior to the cut, Alabama was one of only three states that fully taxed groceries, driving some local levies as high as 10%. Cuts to the tax have been a long-term goal of anti-poverty groups, which said the tax affected food security and the ability of low-income Alabamians to feed children, as well as conservatives in favor of cutting taxes. “It impacts lower income Alabamians more harshly than it impacts higher income Alabamians,” said commission member Akiesha Anderson, policy and advocacy director of Alabama Arise. The bill froze but did not reduce local taxes on groceries. If the Education Trust Fund (ETF) budget, where proceeds from the tax go, grows by 3.5% next year, the state tax will be cut to 2%. “We’re all excited about that possibility coming sooner rather than later,” said Sen. Andrew Jones, R-Centre. Kirk Fulford, deputy director of the fiscal division of the legislative services agency, said Tuesday that “later” seemed more likely. The director told the committee that he was not predicting growth in the ETF for Fiscal Year 2024. “Just based on the first month, I mean, we’re in negative growth,” said Fulford after the meeting. Publicly available information on the Education Trust Fund shows that income tax returns were lower in October than they were last October, the biggest drop in the Education Trust Fund. The Education Trust Fund is around $74.4 million lower than it was this time last year. About $54.7 million of that decrease is from income tax. Fulford said to reporters after the meeting that there are four parts to the income tax. He said withholding, or taxes withheld from a paycheck, has kept up with Alabama’s low unemployment. “The other components are what, first of all, jumped way up and then last year came right back down,” he said to reporters after the meeting. Fulford said over email before the meeting that October 2022 receipts last year were up by $65 million, so this year could be a return to normalcy after several years of drastic increases. Fulford said cutting local grocery taxes could affect local governments, who sometimes levy higher taxes on groceries than the state. “So there would be a bigger dollar figure impact at the local level if you eliminated all the groceries,” he said. House Ways and Means Education Committee chair Danny Garrett, R-Trussville, said in October that he did not expect to cut the tax further in the next legislative session, which begins in February. Commissioners brought up a number of different ways that revenues could be potentially restored to the Education Trust Fund. Anderson said she thinks that more tax dollars for education means better education. Alabama spends less on average than the national average on per pupil spending. According to the U.S. Census data released in May, Alabama spent $10,683 per student in fiscal year 2021, compared to a national average of $14,347. One idea was taxing services after first being brought up by Anderson. “I will point out that you are absolutely right; the economy and the world that we’re living in as a service economy, the state of Alabama, local governments don’t generally tax services on a broad scale, that may very well be something to look at to consider to investigate,” said Fulford. Fulford and Rosemary Elebash, state director for the National Federation of Independent Businesses, said that it had been discussed in the 1990s and later under former Gov. Bob Riley, who was in office from 2003 to 2011. Elebash said there were concerns about that also being a regressive tax. “They went so far as to tax haircuts, vet services, and people are unhappy when you start taxing their dogs and cats,” said Elebash about a previous attempt. Anderson asked if there had been any thought about taxing professional services, such as attorneys, that might avoid the regressive structure. Fulford said that there had been an occupational tax issue in Jefferson County that led to multiple lawsuits. “But there certainly has been an issue,” he said. The Joint Study Commission was formed to study the grocery tax and will file a report in 2026 after annual meetings. “Not to procrastinate, of course, but we got some time to get our homework done,” said Jones. Alabama Reflector is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Alabama Reflector maintains editorial independence. Follow Alabama Reflector on Facebook and Twitter.

Akiesha Anderson: Alabama’s grocery tax reduction: A penny saved, a better future paved

The first stop on the road to untaxing groceries in Alabama is straight ahead. Lawmakers achieved a significant victory for the people this year by passing legislation to cut the state’s 4-cent grocery tax by half. That change will begin this Labor Day weekend, as the first 1-cent reduction takes effect September 1. Ultimately, this small change likely will result in large savings for Alabamians who are working hard to make ends meet. Once the new law is fully implemented, many families will have hundreds of dollars more available each year to spend on food or other expenses. For decades, Alabama Arise has focused on reducing and ultimately eliminating the state sales tax on groceries, which essentially taxes survival. At the beginning of the 2023 legislative session, Alabama stood as one of only three states with no tax break on groceries. Thanks to determined advocacy by Arise members and other advocates, our state is off that shameful list at last. The story behind the legislative triumph Arise collaborated this year with many partners and lawmakers to introduce and pass the grocery tax reduction. That list includes the Alabama Grocers Association, Lt. Gov. Will Ainsworth, Sens. Andrew Jones and Merika Coleman, and Reps. Danny Garrett and Penni McClammy. This year’s breakthrough also would not have happened without other legislative champions who laid the groundwork for this moment, including former Reps. John Knight and Thad McClammy, former Sen. Hank Sanders and Reps. Laura Hall, and Mary Moore. The grocery tax law’s passage is a testament to the importance of continuing to hold the line and fight for change for as long as it takes. It’s also a testament to the importance of seizing the moment when opportunity arrives. Something spectacular happened this year as the stars finally aligned after decades of advocacy. When this year’s session began, many Alabamians were struggling with inflation and higher costs for essentials like eggs and bread. Simultaneously, the state was witnessing strong revenue growth. As elected officials began talking about one-time tax rebates, advocates recognized an opportune moment to make permanent progress on reducing the state grocery tax. And the revenue growth ensured this reduction would not cause severe harm to funding for our children’s public schools. A positive step forward State leaders seized this window of opportunity and united across partisan lines to reduce the grocery tax. It was amazing to witness the culmination of decades of hard work. And it was inspiring to see nearly every legislator co-sponsoring this monumental legislation. Many lawmakers tout this as the state’s largest tax cut ever, and it is one that will provide the biggest everyday benefit to people with low incomes. Ultimately, Alabama Arise remains dedicated to transforming the state’s regressive tax system into a more progressive one. Progressive tax systems levy taxes based on one’s ability to pay, whereas regressive systems work in the reverse. The grocery tax has long exemplified regressive taxation, burdening those with fewer resources by requiring them to pay proportionally more than wealthier individuals. Reducing the state grocery tax is a step in the right direction for tax justice. This penny saved is symbolic of a better future being paved for Alabama. What lies ahead Arise will continue advocating to eliminate the state grocery tax while protecting Education Trust Fund revenues. We look forward to working with the new Joint Study Commission on Grocery Taxation to find a sustainable path forward. Rebalancing Alabama’s upside-down tax system will require both lower taxes for people with low incomes and higher taxes for wealthy households and highly profitable corporations that can afford to pay more. As this year’s grocery tax reduction takes effect, we celebrate its many champions – most notably the Alabamians who stayed vigilant to ensure their voices translated into tangible policy improvements. We also celebrate this policy change as a symbol of progress and unity, and as a testament to what state leaders can accomplish when they put partisanship aside to pass legislation with profound benefits for individuals and communities. Cheers to eliminating the first cent, and to the ongoing journey toward a more prosperous and equitable Alabama! Akiesha Anderson is policy and advocacy director of Alabama Arise, a statewide, member-led nonprofit organization advancing public policies to improve the lives of Alabamians who are marginalized by poverty. Arise’s membership includes faith-based, community, nonprofit and civic groups, grassroots leaders, and individuals from across Alabama.

Will Ainsworth: Alabama’s historic grocery tax goes into effect, but more work remains to finish the job

Alabamians are feeling a bit of relief at the grocery store checkout lines as a result of the tax cut on food that a coalition of conservative lawmakers and I pushed through the Legislature during the 2023 regular session. Beginning on September 1, the state’s four percent sales tax on grocery items was reduced to three percent, and if growth in the Education Trust Fund continues at the same pace as recent years, another $150 million tax cut will automatically go into effect as soon as 2024. My goal is to continue chipping away at the tax until it is eliminated altogether in the near future. Alabama was one of only three states that taxed groceries at the full rate – South Dakota and Mississippi are the others – and we are one of only 13 states in the nation that levy any tax on food. The newly-implemented tax cut applies to any food that falls under the definitions of the federal food stamp program, known as SNAP in D.C. circles, which means all groceries are covered except for pre-prepared, hot food from in-store delis. A clause in the law that is now in effect blocks cities and counties from raising their sales taxes on groceries so Alabamians can be assured of the intended savings, but mayors, council members, and commissions do have the option of following our lead and cutting the local sales taxes on groceries if they choose. For several decades, advocacy groups pushed to remove the grocery tax, but their plans always required new taxes to be shifted onto the backs of the middle class in order to offset revenue losses. As a conservative Republican who believes in cutting taxes, not simply moving them around like a rigged shell game, such proposals were considered non-starters in my eyes and those of my GOP colleagues. During my term in the Alabama House and now, as lieutenant governor, it became obvious that the commonsense budgeting practices put in place after Republicans gained control of the Legislature in 2010 were creating surpluses and comfortable fiscal cushions that did not previously exist. The pro-business measures we enacted were also creating an economic atmosphere that attracted both new and expanding industries and encouraged employers ranging from the largest companies to the smallest mom-and-pop storefronts to create new jobs and opportunities for Alabamians who were willing to work. Soon enough, the unprecedented revenues flowing into the state treasury meant we could afford to begin eliminating the grocery tax without burdening any Alabamians with new or offsetting levies. I worked closely with Sen. Andrew Jones (R – Centre), House Education Budget Chair Danny Garrett (R – Trussville), and Senate Education Budget Chair Arthur Orr (R – Decatur) to create a workable plan that also offered full protection to public education funding for K-12 schools, community colleges, and four-year universities. I personally met with countless experts, advisors, and associations, including the grocers who collect the tax at the point of sale, and rallied them to join us in taking action. Once the bill was drafted, my office recruited all 35 members of the Alabama Senate and 100 of the 105 House members to sign on as sponsors, which was considered by many pundits to be a political miracle in the highly partisan and philosophically contentious times in which we live. The legislation eventually passed both chambers with unanimous, bipartisan support. It is estimated that our dinner table tax cut will save the average Alabama family the cost of two weeks of groceries, which is essential when Bidenomics is causing inflation to skyrocket along with the price of gas and other everyday essentials. Between 2022 and 2023, the cost of food rose by an average of 7.7%, according to the U.S. Bureau of Labor Statistics. Eggs alone cost a third more than they did last year, bread and cereal are up by 25%, and meat, fish, and chicken are substantially higher. Our success in cutting the grocery tax demonstrates what can be accomplished if we stay true to our conservative beliefs, build consensus, and have the courage to attempt to accomplish what many say can’t be done. But the job is only half-complete. We must eliminate the second half of the grocery tax, and a legislative study group we empaneled is already running the numbers, making plans, and putting together a blueprint to accomplish that goal. In the meantime, Alabamians will find their wallets are just a bit fatter, and their bank accounts are just a bit fuller as savings at the checkout continue to accrue, but rest assured that my colleagues and I are working hard to finish our mission of providing you with full relief from taxes on the groceries you purchase. Will Ainsworth has served as lieutenant governor of Alabama since 2019.

Legislature to finish redistricting today

On Friday, both Houses of the Alabama Legislature will meet on redistricting. The federal appeals court in Atlanta has set Friday, July 21, as the deadline for the state to submit a new congressional redistricting for the court to consider in the state’s ongoing Voting Rights Act case concerning congressional redistricting. There are a lot of disagreements in the Legislature on what plan the legislators should pass. Legislative Democrats, the plaintiffs in the lawsuit against the state, and civil rights groups believe that to comply with the Voting Rights Act of 1965, the state should pass a plan with two majority-minority districts. This would almost certainly mean a pickup of one House of Representatives seat for Democrats in the U.S. Congress as Alabamians overwhelmingly vote along racial lines, with over 90% of Black Alabamians preferring Democrats and over 80% of White Alabamians preferring Republicans in recent elections. Alabama’s Legislative Republicans have rejected calls by Democrats to turn Alabama’s Second Congressional District into a majority-minority district. Congressional District 2 is currently represented by Congressman Barry Moore (R-Enterprise) – who served two terms in the Alabama House of Representatives from 2010 to 2018. Moore is a Republican, a member of the conservative Freedom Caucus, and an ardent Donald Trump supporter. Currently, 30% of the voters of CD2 are Black. State Senator Rodger Smitherman (D-Birmingham) has introduced a plan that would turn Congressional District 2 into a majority-minority district with over 50% of the voters in the district being Black. Republicans rejected that map as well as others introduced by Sen. Bobby Singleton (D-Greensboro) and other Democrats. Republicans maintain that the court has not ruled on Milligan v. Allen that the state is in violation of the Voting Rights Act. Democrats look at the same U.S. Supreme Court ruling and the recent order by a three-judge panel of the Eleventh Circuit Court of Appeals and say that the court did not provide the state with enough guidance to know what an “opportunity district” means. “That could be 42% (Black voters), that could be 38%, we just don’t know,” Senate President Pro Tempore Greg Reed (R-Jasper) told reporters. House Republicans have passed a plan by State Representative Chris Pringle (R-Mobile) they title the community of interest plan where Congressional District 2 is over 42% Black. Pringle maintains that that is close enough racially so that it is winnable by either party. Senate Republicans have passed a competing plan by State Sen. Steve Livingston (R-Scottsboro). The Livingston plan would only raise the Black voting age population of CD2 from 30% Black to 38% Black. Livingston said his plan kept communities of interest together and is the most compact while still providing an opportunity district for Black voters in Congressional District 2. More radical elements in the Legislature had called for turning Alabama’s Seventh Congressional District into an opportunity district that would be potentially winnable by Republicans. Congressional District 7 is represented by Terri Sewell – the only Democrat and the only Black representative in the congressional delegation. Both Pringle and Livingston, while deeply divided on the merits of their respective plans, did not go that far, and Congressional District 7 remains majority Black. Livingston said that his plan kept the Wiregrass whole and in the Second Congressional District, and it keeps the Gulf Coast and Mobile County whole. The House passed Pringle’s plan on Wednesday, but when he brought his bill to the Senate, Livingston motioned to substitute the Pringle plan for the Livingston plan. The Committee passed that motion. Pringle then stormed out of the room without continuing to present his bill. His bill, now the Livingston Bill, was passed by the Committee along party lines, with Democrats voting against it and Republicans voting for it. The one exception was State Senator Andrew Jones (D-Centre). His primary disagreement with the Livingston plan is that a small portion of northwest Etowah County would be in Congressional District 4, while 90% of Etowah County would switch to Congressional District 3. Jones told reporters he did not care whether Congressman Mike Rogers (R-AL03) or Robert Aderholt (R-AL04) represented Etowah County. “My issue is that historically Etowah County has not been divided,” Jones, who represents Etowah and Cherokee Counties, said. Smitherman told reporters that he and Sen. Singleton had brought their own federal lawsuit and joined Milligan and the other plaintiffs. Smitherman said that it is his understanding that the plaintiffs will be given the opportunity to tell the court whether the plan passed by the Legislature satisfies their concerns or not. “Right now, I can’t support either (Republican) plan,” Smitherman said. Smitherman has demanded that the Apportionment Committee prepare a report on the plans showing the likelihood of a Democrat or a Republican winning each of these. “They can get that, or they already know it and don’t want to release it,” Smitherman said, Since the GOP is wildly divided on which plan they will advance to federal court, there is uncertainty about what the Legislature will pass on Friday. “Obviously, there will be negotiations,” Reed said. A compromise plan can be substituted on the floor of either House. Failing that, any difference between the House and Senate plans would be settled by a conference committee. If that happens, then under the circumstances, both Houses will recess until the conference committee returns with a conference committee plan to vote on. If the state and the plaintiffs cannot agree on a redistricting plan that is acceptable to both sides, a trial will likely be held in the eleventh circuit. Whatever is ultimately decided by the federal appeals court in Atlanta will likely be appealed by whichever party is dissatisfied with the outcome meaning that the Milligan case could go back to the Supreme Court, where Justice Brett Kavanaugh appears to be the swing vote. There is even a possibility that this case may not be resolved until after the 2024 elections. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Will Ainsworth: Alabama’s historic grocery tax cut shows me we must always attempt to accomplish what others say can’t be done

Alabamians may have felt their wallets bulge a bit last month when the Legislature approved our bill that slices the sales tax on groceries in half and implements the single largest tax cut in state history. Alabama was one of only three states that taxed groceries at the full rate – South Dakota and Mississippi are the others – and we were one of only 13 states in the nation that levied any tax on food. But beginning on September 1, 2023, Alabama’s 4% state sales tax on groceries will be cut to 3%, and another percent will be automatically deducted when revenues in the Education Trust Fund reach a trigger point that is set in the bill, which is expected to occur as soon as the next fiscal year. Safety provisions have been put in place to ensure that education dollars are protected as the $300 million tax cut goes into effect, and we remain dedicated to fully funding our K-12 public schools, community colleges, and public universities at all times. The bill uses the same definition of groceries as the federal food stamp program, known in D.C. nomenclature as SNAP, which means all groceries will be covered except for pre-prepared, hot food from grocery store delis. A close in the legislation blocks cities and counties from raising their sales taxes on groceries so Alabamians can be assured of the intended savings, but it does allow officials in city halls and county complexes to follow the Legislature’s lead and cut the local food tax, if they choose. For several decades, elected officials and advocacy groups across Alabama have attempted to reduce or remove the grocery tax, but their plans always required other taxes to be raised in order to offset the revenue losses. Many of those suggested tax increases targeted middle-class families, which always doomed the efforts from the start, especially among hardcore Republicans like me. As lieutenant governor, though, I noticed that the conservative budgeting practices implemented since Republicans gained control of the Legislature in 2010 have provided Alabama’s coffers with a sizable financial cushion that did not exist before. Our state’s business sector – ranging from the largest employers to the smallest, mom-and-pop operations – remains healthy, and our continuing success in attracting both new and expanding industries is resulting in unprecedented revenues flowing to the treasury. Putting pencil to paper and running the numbers soon revealed to me that Alabama could afford to cut the grocery tax without needing to penalize any groups or individuals by raising their existing levies. I met with countless experts, advisors, and associations, including the grocers who collect the tax at the point of sale, to rally them to take immediate action and worked with Sen. Andrew Jones (R – Centre), House Education Budget Chair Danny Garrett (R – Trussville), and Senate Education Budget Chair Arthur Orr (R – Decatur) to create a workable plan. Once lawmakers were briefed on our proposal, support for it spread like wildfire. All 35 members of the Alabama Senate agreed to serve as sponsors, along with 100 of the 105 members of the House. I am told by many longtime State House observers that no major bill of such significance has ever achieved the same unanimous and bipartisan support. Our dinner table tax cut will save the average Alabama family the cost of two weeks of groceries, and that financial relief is much needed in the current economic environment because the liberal fiscal policies being pushed and promoted by Joe Biden and congressional Democrats have caused inflation to skyrocket. Between 2022 and 2023, the cost of food rose by an average of 7.7%, according to the U.S. Bureau of Labor Statistics. Eggs alone cost a third more than they did last year, bread and cereal are up by 25%, and meat, fish, and chicken are substantially higher. Our success in cutting the grocery tax demonstrates what can be accomplished if we stay true to our conservative beliefs, build consensus among lawmakers, and have the courage to attempt to accomplish what many say can’t be done. But the job is only half-complete, and work still lies ahead as I am determined and fully committed to abolishing the grocery tax altogether. I ask all of you to join me in thanking each member of the legislature for supporting this historic tax cut. It was a true bipartisan effort. Together, we will continue making an already great state even better. Will Ainsworth has served as lieutenant governor of Alabama since 2019.

Alabama lawmakers approve cut in state’s 4% grocery tax

Alabama families could soon pay less at the grocery store after lawmakers Thursday voted to remove half of the 4% state sales tax on food. Lawmakers unanimously gave final approval to the long-sought legislation. It would gradually remove half of the state’s 4% sales tax on food by September 1, 2024, provided there is enough revenue growth to offset the loss. The bill now goes to Alabama Gov. Kay Ivey Alabama is one of only three states that tax groceries at the same rate as other purchases. “This is going be great for working Alabamians. Folks who are struggling to put food on the table,” Republican Sen. Andrew Jones, sponsor of the Senate version of the bill, said after Senate passage. The measure had been proposed unsuccessfully in Montgomery for decades. But it gained bipartisan support as the state sees a record budget surplus — partly driven by rising prices leading to higher sales tax collections — and consumer frustration over the cost of food. The bill would reduce the 4% tax on food to 3% on September 1. It would drop to 2% on September 1, 2024, provided that tax collections to the Education Trust Fund are projected to rise more than enough to offset the loss. Robyn Hyden, executive director of Alabama Arise, an advocacy group for low-income families, said, reducing the state sales tax on groceries “will provide meaningful help for Alabamians who struggle to make ends meet.” “This grocery tax reduction will benefit every Alabamian. And it is an important step toward righting the wrongs of our state’s upside-down tax system, which forces Alabamians with low and moderate incomes to pay a higher share of their incomes in state and local taxes than the wealthiest households,” Hyden said. The Senate on Thursday quickened the pace of the tax removal but also increased the required revenue growth from 2% to 3.5% to safeguard against a loss in education funding. The House accepted the change on Thursday afternoon. The current 4% tax provides more than $600 million annually to the state for education funding. Cutting it in half would cost the education budget an estimated $318 million annually. “I think there’s some concern among members we’re heading into potentially perilous economic times… so we wanted to make sure that we have enough growth in the ETF (Education Trust Fund) to sustain the drawdown in the grocery tax,” Jones said. If the growth requirement isn’t met to drop the tax to 2% in 2024, it would be reduced in the next year that the growth requirement is satisfied. Alabama lawmakers proposed multiple tax cuts this year. But the food tax proposal drew widespread support, with nearly all 140 legislators signing on as sponsors. The legislation also would prevent local governments from raising taxes on groceries after the bill is signed into law. Jones said lawmakers are creating a study commission to explore the possibility of eventually removing all of the tax. Republished with the permission of The Associated Press.

Alabama House to consider ambitious special-order calendar on Wednesday

The Alabama House of Representatives will meet on Wednesday at 1:00 p.m. to consider a very ambitious proposed special-order calendar. Senate Bill 206 (SB206) is sponsored by State Senator Clyde Chambliss (R-Prattville). It is being carried on the floor by State Representative Allen Treadaway (R-Morris). SB206 creates the crime of organized retail theft and turns what used to be misdemeanor shoplifting into a felony. Senate Bill 261 (SB261) is sponsored by Sen. Dan Roberts (R-Mountain Brook). It is carried in the House by Rep. Chip Brown (R-Hollinger’s Island). The anti-ESG legislation would prohibit state and local governments from entering into certain contracts that boycott businesses in certain sectors or based on certain environmental or corporate governance criteria. Senate Bill 279 (SB279) is sponsored by Sen. Randy Price (R-Opelika) and carried in the House by Rep. Matt Woods (R-Jasper). SB279 deals with elected county superintendents of education. Under existing law, the salary for an elected county superintendent of education is required to be set by the county board of education before the beginning of the term of office. This bill would remove that requirement retroactive to July 1, 2021. Senate Bill 94 (SB94) is sponsored by Sen. April Weaver (R-Briarfield) and is carried in the House by Rep. Corley Ellis (R-Columbiana). SB94 would move the Shelby County juvenile probation services and probation officers into the state court system. Senate Bill 99 (SB99) is sponsored by Sen. Sam Givhan (R-Huntsville) and carried in the House by Rep. Prince Chestnut (D-Selma). SB99 would increase the mileage reimbursement rate received by jurors Senate Bill 56 (SB56) is sponsored by Sen. Arthur Orr (R-Decatur) and carried in the House by Rep. Allen Baker (R-Brewton). SB56 would require the use of video cameras in certain special education classrooms. Allen is bringing a substitute version of the bill. Senate Bill 292 (SB292) is sponsored by Sen. Roberts and carried by Rep. Joe Lovvorn (R-Auburn). SB292 would provide for the Department of Revenue to grant certificates of exemption from sales and use taxes to contractors and subcontractors licensed by the State Licensing Board for General Contractors for the purchase of building materials and construction materials to be used in the construction of a project for an entity that is exempt by law from paying sales and use taxes. Senate Bill 223 (SB223) is sponsored by Sen. Vivian Figures (D-Mobile) and carried in the House by Rep. Matt Simpson (R-Daphne) would include a child witness in the definition of “a physical offense, sexual offense, or violent offense” for the purpose of the Child Physical and Sexual Abuse Victim Protection Act. Senate Bill 309 (SB309) is sponsored by Sen. Chambliss and carried by Rep. Wood in the House. SB309 is related to contracts for professional services to provide for the procurement of certain professional service contracts based on competitive, qualification-based policies and procedures, as well as to provide for the advertisement of such contracts; and to subject such contracts to a fee schedule established by the Division of Construction Management of the Department of Finance. Senate Bill 198 (SB198) is sponsored by Sen. Orr and carried in the House by Rep. Cynthia Almond (R-Tuscaloosa). It would add additional offenses that would be subject to the presumptive sentencing guidelines; to modify the criminal penalties for criminal solicitation, attempt, and criminal conspiracy; to give a judge discretion when sentencing a person convicted of a Class C or Class D felony offense. Senate Bill 184 (SB184) is sponsored by Sen. Greg Albritton (R-Atmore) and carried in the House by Rep. Kyle South (R-Fayette). SB184 would authorize the Department of Corrections to expend funds for the recruitment and training of law enforcement officers and to further the mission of the department. South will introduce a substitute version of the bill. Senate Bill 224 (SB224) is sponsored by Sen. Figures and carried in the House by Rep. Simpson. It provides for the age of a child for the crime of transmitting obscene material to a child by computer, to establish jurisdiction for a violation of distributing a private image, and further provides for the crime of incest. Senate Bill 281 (SB281) is sponsored by Sen. Albritton and carried by Rep. Margie Wilcox (R-Mobile). SB281 creates a new distinctive license plate to benefit the USS Alabama Battleship Commission. Senate Bill 285 (SB285) is sponsored by Sen. Jones and carried in the House by Rep. Terri Collins (R-Decatur).SB285 will allow nonprofit organizations to host wine festivals. Senate Bill 176 (SB176) is sponsored by Sen Orr and carried by Rep. Collins. SB176 is the Student Right to Know Act of 2023. It requires the Alabama Commission on Higher Education to collect and make available online data for students to plan for their educational and professional futures; and for the Workforce Division of the Department of Commerce to share data and information with ACHE. Senate Bill 192 (SB192) is sponsored by Sen. Albritton and is carried in the House by Rep. Donna Givens (R-Loxley). SB192 would allow private corporations to limit access to industrial facilities and that industrial access roads to continue to be maintained as a public corporation. Senate Bill 263 (SB263) is sponsored by Sen. Donnie Chesteen (R-Dothan) and carried in the House by Rep. Terri Collins (R-Decatur). SB263 makes changes to the Alabama Accountability Act of 2013. It revises the law to change the term failing school to priority school and nonfailing to qualifying school to make other changes. Senate Bill 258 (SB258) is sponsored by Sen. Andrew Jones (R-Centre). It deals with nonprofit corporations that provide water services to the public authorizing a one-time audit by the Department of Examiners of Public Accounts. There is a substitute version of this bill. Senate Bill 103 (SB103) is sponsored by Sen. Orr: and carried by Rep. Almond. It would require the Alabama Ethics Commission to provide exonerating evidence to persons accused of ethics wrongdoing. Almond will introduce a substitute. Senate Bill 76 (SB76) is sponsored by Sen. Will Barfoot (R-Pike Road). It is carried in the House by Rep. Lovvorn. SB76 establishes the Rural Logging Support Act, funding supporting rural economic Development. Wednesday will be Day 28 of the 2023 Alabama Regular Legislative Session. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Governor will host a ceremonial bill signing for legislation passed during 2023 Regular Session

On Tuesday, Alabama Governor Kay Ivey will host a series of bill-signing ceremonies to celebrate the passage of several pieces of legislation that addressed concerns facing the state of Alabama. Ivey will sign several bills, including reform of the state’s adoption laws. House Bill 101 (HB 101) is sponsored by State Representative Ginny Shaver and State Senator Arthur Orr. This bill streamlines the state’s adoption process and updates the current adoption law language. (Act 2023-092). “Alabama has consistently set state records for adoptions and placed thousands of children in loving, forever homes,” said Gov. Ivey. “Currently, we have more than 5,000 children in the foster care system, and with this modernized and streamlined process now in place, we have positioned Alabama on even firmer footing and will be able to provide more of our children with the life they deserve.” House Bill 66 (HB66) by Rep. Joe Lovvorn and Sen. Andrew Jones allows certain firefighters, law enforcement officers, and correctional officers, covered under the ERS or TRS, to purchase hazardous duty time for prior service. (Act 2023-101). HB66 removes the time limitations for Tier I firefighters, law enforcement officers, and correctional officers covered under the Employees’ Retirement System or the Teachers’ Retirement System to purchase eligible service credit prior to January 1, 2003. House Bill 164 (HB164) by Rep. Andy Whitt and Sen. Jay Hovey requires high school students to complete a personal financial literacy and money management course before graduation. (Act 2023-179). “I have got story after story from thirty years of banking experience of young people who did not have a checking account,” said Whitt. “They go to convenience stores and check cashing places to get their paychecks cashed. One young fellow was working two hours a week just to be able to get his check cashed each week.” Senate Bill 131 (SB 131) by Sen. Vivian Figures and Rep. Steve Clouse. This bill transfers the regulation of preneed funeral contracts from the Department of Insurance to the Alabama Board of Funeral Services. (Act 2023-094). The Alabama Preneed Funeral and Cemetery Act of 2023 transfers the existing Preneed Funeral and Cemetery Act and the regulation of preneed contracts from the Commissioner and Department of Insurance to the Alabama Board of Funeral Service. It authorizes the Department of Insurance to temporarily transfer certain funds to the board to defray costs associated with the administration and operation of the Alabama Preneed Funeral and Cemetery Act of 2023; Senate Bill 28 (SB28) by Sen. Tim Melson and Rep. Randy Wood would expand the scope of practice of podiatry to include treatment of the foot and ankle. (Act 2023-106). Podiatrists in most states are already allowed to treat disorders of the ankle. This expansion of the scope of practice to come in line with national standards was long overdue. Senate Bill 104 (SB 104) by Sen. Chris Elliott and Rep. David Faulkner revises the current Dram Shop Act by addressing liability for providers of alcohol if a recipient injures a third party. (Act 2023-025) . Before this, only three insurance carriers would insure restaurants and bars from lawsuits due to the liability. This will make it harder for plaintiffs’ attorneys to prove a case against the establishment that sold the alcohol. House Bill 56 (HB56) by Rep. Frances Holk-Jones and Sen. Linda Coleman-Madison will expand the scope of practice for licensees of the Alabama Board of Social Work Examiners. (Act 2023-100). This will allow specially trained social workers with master’s degrees to diagnose mental illnesses. House Bill 62 (HB 62) by Rep. Ben Robbins and Sen. Keith Kelley will extend the amount of time that nonprofit veterans’ organizations have to comply with state and local building codes when acquiring a former armory building. (Act 2023-175). This bill primarily deals with an armory in Sylacauga owned by the American Legion and used by the Alabama National Guard. When the National Guard shut down its presence, it transferred back to the American Legion. The NG never updated the building during its tenure, so it lacks the sprinkler system needed to comply with state building code requirements. Tuesday will be day 24 of the 2023 Alabama Regular Legislative session. Kay Ivey has been governor since 2017. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Alabama senators back bill to cut state sales tax on food

Every member of the Alabama Senate on Thursday backed legislation to cut the state sales tax on groceries by half, as food bill relief emerges as a bipartisan issue for lawmakers in the face of rising prices. The bill introduced by Republican Sen. Andrew Jones of Centre would gradually reduce the sales tax on food from 4% to 2% — taking off .5% each year — provided there is more than enough state revenue to offset the loss to the education budget, which relies on sales and income taxes. All 35 state senators have signed on as a sponsor, or cosponsor. The broad support boosts the legislation’s chances of winning approval after similar bills have stalled in Montgomery for decades. “This is going to help people afford groceries, put food on the table,” Jones said. The legislation, which next heads to a Senate committee for debate, is less sweeping than other proposals that would eliminate the groceries sales tax. Jones said he is seeking a reduction in a way that won’t hurt funding for public schools. Alabama Arise, an organization that lobbies for policies that would benefit low-income families, said the average Alabama family spends $600 a year on the state grocery tax. Various lawmakers, mostly Democrats, have proposed removing the grocery tax since the early 1990s, but the proposals failed partly because of their impact on the education budget. But the idea has gained traction among lawmakers in both parties as the state sees both an unusual budget surplus and families experience rising food costs. Removing the 4% tax on groceries would cost $608 million, according to the Legislative Services Agency. Jones’ bill would eliminate half that amount when fully implemented. Competing proposals vary on if the tax would be removed entirely, what foods would be included, and if the lost revenue would be replaced. Sen. Merika Coleman, D-Pleasant Grove, said she supports Jones’ bill but prefers a version that offers more immediate relief to families and also replaces funding for public schools. Coleman has sponsored legislation that would let voters decide whether to replace the money by ending a tax deduction that allows Alabamians to deduct federal income tax payments from their income before calculating their state income taxes. She said the tax break disproportionately lowers taxes for the wealthiest people. “But again, any type of relief that folks from the state of Alabama can get, I’m going to support,” Coleman said. Republished with the permission of The Associated Press.

Steve Flowers: Alabama has a host of outstanding political leaders under 45

It may appear to you and most casual observers of Alabama politics that our Alabama elected officials are old. That observation is accurate when you observe our current leaders in the highest offices. The governor’s office has been held by mature folks in recent years. Our current Governor, Kay Ivey, is 78 and has been the object of national media humor for appearing to be a pistol-toting great-grandmother. Dr. Robert Bentley, her predecessor, was in his 70’s, but he may have been sprier than he appeared. Bob Riley was no spring chicken while governor at age 65, although he looked younger. Our iconic senator, Richard Shelby, retired in January at 88 after a record-breaking 36 years in the U.S. Senate. Our new Senior Senator, Tommy Tuberville, is 68. This was not always the case in the Heart of Dixie. In the period from 1930 through 1970, we elected the youngest political leaders in the nation, beginning with our legendary tandem of United States Senators Lister Hill and John Sparkman, who served together close to 30 years. Lister Hill was elected to Congress from Montgomery in 1923 at age 29 and was elected to the U.S. Senate at age 44. John Sparkman was elected to the U.S. Senate in 1946 at 46 after serving as the Congressman for the Tennessee Valley. If you think Hill and Sparkman were young when they went to Washington, you have not seen anything like the governors we elected from 1946 -1966. James E. “Big Jim” Folsom was 38 when he was elected in 1946. John Patterson was 37 when he was elected in 1958. Patterson was referred to as the “Boy Governor.” When George Wallace was elected to his first term in 1962, he was only 43. When his wife Lurleen Wallace was elected in 1966, she was 40. She died in office of cancer less than two years later at 41. Lurleen Wallace was succeeded by Lt. Governor Albert Brewer, who had been Speaker of the Alabama House at 34, Lt. Governor at 38, and was 39 when he became governor. Bill Baxley was the youngest Attorney General in America when he was elected Attorney General of Alabama at 29 years old in 1970. He had been a 25-year-old District Attorney in Houston and Henry Counties. Baxley still practices law in Birmingham at 81. Well, folks, a cursory look at our current top elected officials may appear old. However, we have a generation of young political leaders arriving on the scene in Alabama. We already have superstars on the horizon and already on the scene who are under 45. Our new United States Senator, Katie Britt, is only 40 years old. She has the ability and youthfulness to be one of Alabama’s greatest senators. She has gotten to the Senate at a younger age than Hill, Sparkman, or Shelby. Marshall County has become the hotbed and breeding ground for the next generations of Alabama political leaders. This beautiful pristine lake area of North Alabama lays claim to Lt. Governor Will Ainsworth, age 41, State Senate Majority leader Clay Scofield, age 42, and State Representative Wes Kitchens, who is 35 and is Vice Chairman of the House Republican Caucus. Andrew Sorrell, the newly elected State Auditor, is only 37. He has a bright future. The brightest star in the Democratic ranks is Huntsville State Representative Anthony Daniels. At age 40, Daniels is a superstar. He is in his third term in the House from Huntsville. He is the Minority Leader in the House. This gentleman is also a successful high-tech businessman in Rocket City. There are several other stars under 45 in the Alabama House of Representatives besides Daniels and Kitchens, including Kyle South of Fayette, Matt Simpson of Daphne, Joe Lovvorn of Auburn, Ben Robbins of Sylacauga, Scott Stadthagen of Madison, Corey Harbison of Cullman, and very young newcomers James Lomax of Huntsville and Brock Colvin of Albertville. Joining the affable and accomplished 42-year-old Senate Majority Leader, Clay Scofield in the powerful State Senate in the under 45 superstar group are Senator Chris Elliott, 42, of Baldwin, Senator Andrew Jones, 38, of Cherokee, and newly elected Senator Josh Carnley from Coffee County who is 44. Alabama has a host of under 45 political leaders. See you next week. Steve Flowers is Alabama’s leading political columnist. His weekly column is seen in over 60 Alabama newspapers. Steve served 16 years in the legislature. He may be reached at: www.steveflowers.us.

Senate Committee advances legislation to bar protests at individual residences

On Thursday, the Alabama Senate Veterans and Military Affairs Committee voted to advance legislation prohibiting protests and picketing outside individual residences. Senate Bill 199 is sponsored by State Senator Arthur Orr (R-Decatur). Orr said that this legislation was inspired by the protests outside of Justice Brett Kavanaugh’s house following the release of a draft opinion overturning the Roe v. Wade decision. Orr said, “Protesters come out to the house and protested on the sidewalk with bullhorns and created a nuisance.” Orr said that he felt that the state of Alabama did not want that, so he drafted legislation to ban such tactics. “I showed it to Judiciary Chairman [Will] Barfoot, and he had some ideas,” Orr said. Sen. Will Barfoot said, “No person at or near a person’s residence. I think that is pretty vague. I think we need to tighten that up.” Sen. Andrew Jones is the Chairman of the Senate Veterans and Military Affairs Committee. The synopsis states, “This bill would prohibit a person from picketing or protesting at or near the residence of any individual intending to harass or intimidate. This bill would require law enforcement officers to ask a person who is protesting to peacefully leave the premises before placing that person under arrest.” This offense would be a class C misdemeanor. If local law enforcement can’t or won’t enforce this statute, it authorizes the Alabama Law Enforcement Agency to do so. This legislation would allow municipalities or counties to adopt ordinances or resolutions to regulate the time and noise level of any picketing or protesting in a residential area and provide criminal penalties for violations.” The committee voted to give SB199 a favorable report. It could be considered by the full Senate as early as Tuesday. While the protests outside of Supreme Court Justices’ homes made national news, there have been instances of protests outside of individual residences in Alabama. Protesters protested outside the home of Hoover Mayor Frank Brocato following the shooting of Emantic “E.J.” Bradford Jr. in the Galleria Mall by a Hoover police officer. In the case of the Supreme Court Justices, legal experts generally agree that targeted, stationary protests outside of a justice’s home are already prohibited under federal law — an effort to protect judges from undue pressures or influence. U.S. Sen. Katie Britt and other Republicans maintain that the Biden administration ordered the federal marshals to protect the judges but not to remove the protestors. Tuesday will be day 11 of the 2023 Alabama Regular Legislative Session. The Alabama Constitution limits the Legislature to no more than thirty legislative days during a regular session. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

League of Municipalities disappointed with passage of legislation further limiting towns from collecting occupational taxes

On Tuesday, the Alabama Senate County and Municipal Government Committee advanced legislation that would place further limits on cities that currently have occupational taxes. The committee gave a favorable report to a substitute version of the legislation – Senate Bill 65 (SG65). The Alabama League of Municipalities are staunchly opposed to this legislation. They released a statement following its receiving committee approval. “While the League is disappointed with today’s passage of SB65 by the Senate Committee on County and Municipal Government, our advocacy efforts will not stop here,” the League said in a statement on social media. “It is our organization’s mission to protect measures that are in place which allow for local decisions to be made at the local level, one of those being the ability to maintain or implement an occupational tax.” “We appreciate the mayors and first responders that attended and shared examples of the negative impacts this legislation could cause, including: laying off first responders and other essential personnel; making cuts to infrastructure, education, and public works; and restricting economic development growth,” the League added. Senate Bill 65 (SB65) is sponsored by State Sen. Andrew Jones. Jones represents Etowah County, where several municipalities including Gadsden, have occupation taxes. An occupation tax is a tax on payrolls that goes to municipalities. Workers already owe income taxes and FICA/social security taxes to the federal government, plus the state income tax. They also pay a percentage (usually one or two percent) to the town they work in. The tax burden of working in a town with an occupation tax is onerous. An occupation tax is not a true income tax because they do not tax rental income, investment income, business profits, farm income, etc., but anyone who is a wage earner must pay the tax to hold a job in that city or town. The tax is despised by many workers Jones represents, particularly those who work in but do not live in a town with an occupation tax as they pay the tax, but receive little, if any, of the tax benefits. Workers who live in a town with an occupation tax but work in another town do not pay the tax in the town where they live, even if the town where they work does not have an occupation tax – unlike a true income tax which is already forbidden in towns and cities under Alabama law. Jones has led efforts to repeal the remaining occupation taxes across the state. The Legislature blocked Jefferson County from imposing an occupation tax ten years ago, with the state’s largest county filing for bankruptcy protection. Cities like Montgomery that don’t have an occupation tax are already blocked from imposing one without coming to the Legislature. Jones first tried to abolish the remaining occupation taxes in the state. Failing that, he has tried to phase them out or prevent cities with occupation taxes from extending that occupation tax outside the city limits to the police jurisdiction or the town annexing new property to capture more workers into Tuesday’s tax scheme. Jones said, “There is a lot of things we should be able to agree on. It is unfair that workers who have lost their jobs when a plant closes, like Goodyear, have to pay a 2% tax on their unemployment severance pay.” “We should be able to agree that is unfair that a business like a tow truck operator has to keep records on how much time their operators spend working in each town in order to calculate the occupation taxes,” Jones said. Opponents bitterly opposed this bill in the public hearing. Opelika Mayor Gary Fuller said, “The citizens have the option of addressing that every four years.” “We think this is a local issue,” Mayor Fuller said. Guin Mayor Phil Segraves said that Guin has had an occupation tax since 1984. “We need to retain this tax,” Segraves said. “It has been a valuable tool for economic development.” Rainbow City Mayor Joe Taylor said, “I stand in opposition to HB65, but not to my Senator.” Taylor explained that Rainbow City wants to annex 1,100 acres of farmland on I-59 for industrial development, and they need the occupation tax to develop that site. “This is about economic development,” Taylor said. “We have a memorandum of understanding with our county on a water and sewer project. We have dedicated $2 million of our ARPA money to this project. The county has dedicated $20 million.” The ban on allowing cities with an occupation tax to extend that to newly annexed land would prevent Rainbow City from extending the occupation tax to new jobs created on the Etowah County mega site they are trying to annex. Jones agreed to amend his bill so that cities annexing a thousand acres or more parcels would be an exemption from the legislation. Gadsden Fire Chief Will Reed said that ending the occupation tax would mean he would have to cut his paramedics. “This is a horrible thing for our fire department and for the people of our community,” Reed said. State Sen. Linda Coleman Madison said, “As I listen to the people that came before us, these taxes are tied to schools, police and fire services, economic development, recreational opportunities.” Jones said, “Median household income in Alabama is about $53000, so 2% is about a thousand dollars, which is a considerable amount.” “There are only about 24 cities that have this,” Jones said. Sen. Kirk Hatcher said that for the state to prevent cities from imposing occupation taxes is excessive. “This is the definition of big government,” Hatcher said. HB65 was amended and substituted by the committee. The committee voted to give the newest version of HB65 a favorable report in a 5 to 4 vote. HB65 could be voted on by the full Senate as early as Wednesday. If passed, it would still have to go to the Alabama House of Representatives for their consideration. The Senate will go into session at 3:00 p.m. for the third legislative day of the 2023 Alabama Regular Legislative Session. As of Monday, 243 bills have