Danielle Zanzalari: Passage of the CHIPS Act is not economically smart

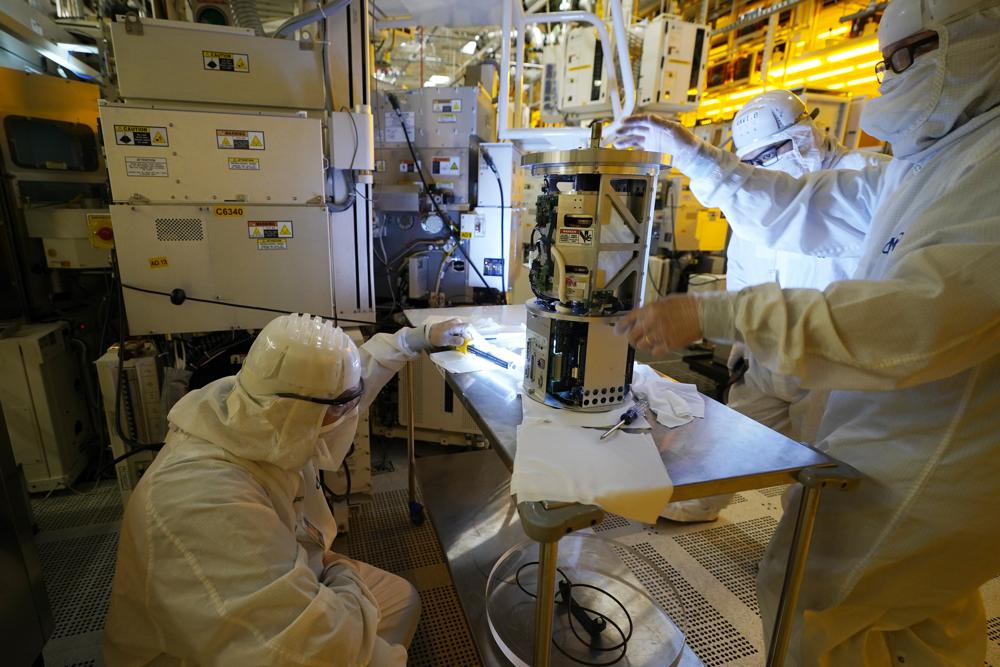

Even during high inflation, Congress chooses to waste money by giving it to large corporations who don’t need it. This week, semiconductor firms convinced Congress to provide free money and tax credits for expanding their U.S. manufacturing business – business expansion they already started in 2020 and 2021. The logic for these subsidies is not rooted in economics. Subsidies only make economic sense for infant industries and for industries critical to national security. In this case, neither condition applies. On Tuesday, the U.S. Senate voted for the CHIPS Act (Creating Helpful Incentives to Produce Semiconductors for America Act) to incentivize producers in chip manufacturing to compete with China. As part of the bill, there will be $52 billion in subsidies provided to chip makers as well as an investment tax credit for U.S. manufacturing. Both Intel and the Semiconductor Industry Association are major lobbiers for the bill – and that’s no surprise. After all, they have the most to gain from this legislation. Sensing a handout, they have declared that they need subsidies in order to compete with China. It’s a prime example of the “infant industry argument” commonly used in trade policy to justify government subsidies. Some companies need protection from international firms until they are mature enough to compete, or so the argument goes. However, there’s no conceivable way Intel and its competitors could be considered an infant industry in need of help from the U.S. government. Intel is the world’s biggest chipmaker with a market capitalization of $164 billion and a net income of about $20 billion per year since 2018 – greater than the GDP of the entire country of Jamaica. Their market share is 64% bigger than Semiconductor Manufacturing International Corp, China’s biggest semiconductor firm. As U.S. Senator Bernie Sanders asked about Intel, Micron Technology, and others: “Does it sound like these companies really need corporate welfare?” If the U.S. government truly wanted more competition and lower prices, they would actually support true “infant” firms in the semiconductor space to compete with Intel, Texas Instruments, and others. These already gigantic companies don’t need a handout; they need competition. Concentrating semiconductor production in only the largest firms will only lead to higher prices for chips. Some advocate providing these subsidies in the interest of national security – after all, what if China stops selling chips to the U.S.? Electronic goods production would stall, causing huge market disruptions, right? Wrong. U.S. firms already produce chips domestically, and Intel already has an incentive to manufacture in the U.S. due to increasing demand for U.S. made chips. In fact, they already started building a plant in Ohio and only shut it down as a political move to squeeze out money from Congress. Rather than subsidize large, existing semiconductor firms in the U.S., we ought to be inspiring domestic investment by private companies. There already exists incentives for firms that commonly use chips – like car companies – to enter into the semiconductor field or invest in these firms. Decreasing regulation to allow for more vertical integration can help create more chip producers. We can’t ignore the cost of these subsidies. For example, $52 billion is enough to give each state and D.C. $1 billion for schools – a 10% increase in New Jersey’s budget for K-12 education and a 5% increase for Texas. Another better use for the $52 billion could be immigration enforcement, which would be over a 15% increase for the Department of Homeland Security, or for state and local road repair, an increase of 28% in funding for most states. The government shouldn’t invest this money in companies that don’t need help – it ought to use it to help our public education system, overburdened immigration system, or neglected highways, among other viable options. Sanders is right to call out the CHIPS Act as crony capitalism. Danielle Zanzalari is an Assistant Professor of Economics at Seton Hall University and policy contributor for Garden State Initiative. She is a personal finance expert whose lesson plans are used in teaching financial literacy in high schools around the country. Republished with the permission of The Center Square.

Senate passes bill to boost computer chip production in U.S.

A bill designed to encourage more semiconductor companies to build chip plants in the United States passed the Senate on Wednesday as lawmakers raced to finish work on a key priority of the Biden administration. The $280 billion measure, which awaits a House vote, includes federal grants and tax breaks for companies that construct their chip facilities in the U.S. The legislation also directs Congress to significantly increase spending on high-tech research programs that lawmakers say will help the country stay economically competitive in the decades ahead. Senate passage came by a 64-33 vote. The House vote is expected later this week as lawmakers try to wrap up business before returning to their home states and districts in August. House Speaker Nancy Pelosi, D-Calif., has said she is confident there is enough GOP support to overcome potential defections from Democrats who view the subsidy effort to boost semiconductor companies as a misplaced priority. Seventeen Republicans voted for the measure. Sen. Bernie Sanders, I-Vt., broke ranks with Democrats in voting against the bill. Proponents of the legislation say other countries are spending billions of dollars to lure chipmakers. Backers say the U.S. must do the same or risk losing a secure supply of the semiconductors that power automobiles, computers, appliances, and some of the military’s most advanced weapons systems. Senate Majority Leader Chuck Schumer, D-N.Y., said the bill represented one of the nation’s largest investments in science and manufacturing in decades and that with the Senate’s approval, “we say that America’s best years are yet to come.” Opponents have been critical of the bill’s price tag. It is projected to increase federal deficits by about $79 billion over ten years. President Joe Biden said the bill would create jobs and lower costs on a wide range of products from cars to dishwashers. “For decades, some ‘experts’ said we needed to give up on manufacturing in America. I never believed that. Manufacturing jobs are back,” Biden said. “Thanks to this bill, we are going to have even more of them. The House should promptly pass it and send this bill to my desk.” The bill has been in the works for years, starting with efforts by Schumer and Sen. Todd Young, R-Ind., to increase the government’s investment in high-tech research and development. While the bill has taken several twists and turns, one constant theme that lawmakers repeatedly emphasized during Wednesday’s debate was the need to keep up with China’s massive investments in cutting-edge technology. China’s government is planning on “winning the (artificial intelligence) race, winning future wars and winning the future,” Young said. “And the truth is, if we’re being honest with ourselves, Beijing is well on its way to accomplishing these goals.” Sen. Roger Wicker, R-Miss., said: “Regrettably, we are not in the driver’s seat on a range of important technologies. China is.” Congress, he said, now has “a chance to move us back in the right direction and put America back into a place to win the game.” The bill provides more than $52 billion in grants and other incentives for the semiconductor industry, as well as a 25% tax credit for those companies that invest in chip plants in the U.S. It calls for increased spending on various research programs that would total about $200 billion over ten years, though Congress will have to follow through by approving that money in future spending bills. Despite years of work, the bill’s future did not look so promising about a month ago. That’s when Senate Republican leader Mitch McConnell tweeted that there would be no chips legislation as long as Democrats pursued a party-line package of energy and economic initiatives. GOP support is critical in the Senate to get the 60 votes needed to overcome a filibuster. But when Sen. Joe Manchin of West Virginia quashed the idea of imposing higher taxes on the rich and corporations, key Republicans said that was an opening to go forward on semiconductors. Meanwhile, the Biden administration pushed to get a bill passed before the August recess, even if meant considerably narrowing the focus to just the $52 billion in semiconductor incentives. Commerce Secretary Gina Raimondo told lawmakers behind the scenes and publicly that semiconductor companies were making plans on how to meet the increased demand for chips. She said the growth in the industry would move forward with or without the United States and if lawmakers didn’t act quite soon, those companies would simply choose to build in other countries offering significant financial incentives. Schumer said that after McConnell’s statement, he called the CEOs of chipmakers and companies such as General Motors and Ford and reached out to “unlikely allies” like the U.S. Chamber of Commerce and the Business Roundtable. He urged them to reach out to Republican senators about the importance of the bill. “And they changed things,” Schumer told The Associated Press. “They really, for the first time, industry really helped a good government program.” The House could take up the bill as soon as Thursday. While most Republicans are expected to oppose it, some of the ranking Republicans on committees dealing with national security — Reps. Michael McCaul of Texas, Michael Turner of Ohio, and John Katko of New York — support the measure. So do many of the Republicans on a bipartisan group called the Problem Solvers Caucus, which is made up of moderates from both parties. Republished with the permission of The Associated Press.

Joe Biden tells oil refiners: Produce more gas, fewer profits

President Joe Biden on Wednesday called on U.S. oil refiners to produce more gasoline and diesel, saying their profits have tripled during a time of war between Russia and Ukraine as Americans struggle with record-high prices at the pump. “The crunch that families are facing deserves immediate action,” Biden wrote in a letter to seven oil refiners. “Your companies need to work with my Administration to bring forward concrete, near-term solutions that address the crisis.” Gas prices nationwide are averaging roughly $5 a gallon, an economic burden for many Americans and a political threat for the president’s fellow Democrats going into the midterm elections. Broader inflation began to rise last year as the U.S. economy recovered from the coronavirus pandemic, but it accelerated in recent months as energy and food prices climbed after Russia invaded Ukraine in February and disrupted global commodity markets. The government reported on Friday that consumer prices had jumped 8.6% from a year ago, the worst increase in more than 40 years. The letter notes that gas prices were averaging $4.25 a gallon when oil was last near the current price of $120 a barrel in March. That 75-cent difference in average gas prices in a matter of just a few months reflects both a shortage of refinery capacity and profits that “are currently at their highest levels ever recorded,” the letter states. The American Petroleum Institute, which represents the industry, said in a statement that capacity has been diminished as the Biden administration has sought to move away from fossil fuels as part of its climate change agenda. “While we appreciate the opportunity to open increased dialogue with the White House, the administration’s misguided policy agenda shifting away from domestic oil and natural gas has compounded inflationary pressures and added headwinds to companies’ daily efforts to meet growing energy needs while reducing emissions,” API CEO Mike Sommers said in a statement. Sommers added, “I reinforced in a letter to President Biden and his Cabinet yesterday ten meaningful policy actions to ultimately alleviate pain at the pump and strengthen national security, including approving critical energy infrastructure, increasing access to capital, holding energy lease sales, among other urgent priorities.” The letter is unlikely to start a chain of events that would boost supplies. Refineries have gone through unprecedented, unplanned maintenance globally in the last three months and there is an extreme shortage being felt across the globe, said Claudio Galimberti, senior vice president at Rystad Energy. China’s decision to limit its exports of oil products also contributed to the problem, he said. “U.S. refiners cannot increase capacity beyond current levels,” Galimberti said. “If they could, they would have done it already.” As Biden sees it, refineries are capitalizing on the uncertainties caused by “a time of war.” His message that corporate greed is contributing to higher prices has been controversial among many economists, yet the claim may have some resonance with voters. Some liberal lawmakers have proposed cracking down on corporate profits amid the higher inflation. Sen. Bernie Sanders, a Vermont independent, in March proposed a 95% tax on profits in excess of companies’ pre-pandemic averages. The president has harshly criticized what he views as profiteering amid a global crisis that could potentially push Europe and other parts of the world into a recession, saying after a speech Friday that ExxonMobil “made more money than God this year.” ExxonMobil responded by saying it has already informed the administration of its planned investments to increase oil production and refining capacity. “There is no question that (Russian President) Vladimir Putin is principally responsible for the intense financial pain the American people and their families are bearing,” Biden’s letter says. “But amid a war that has raised gasoline prices more than $1.70 per gallon, historically high refinery profit margins are worsening that pain.” The letter says the administration is ready to “use all reasonable and appropriate Federal Government tools and emergency authorities to increase refinery capacity and output in the near term, and to ensure that every region of this country is appropriately supplied.” It notes that Biden has already released oil from the U.S. strategic reserve and increased ethanol blending standards, though neither action put a lasting downward pressure on prices. There’s little the government can do to lower prices, other than release oil from the strategic reserve, and that’s already been done, said Jim Burkhard, vice president at IHS Markit. If Biden had not done that, prices would be even higher today, he added. “No government can simply conjure up new supply,” Burkhard said. “One thing that may help would be to have a more constructive relationship with the U.S. oil industry, because it’s been somewhat antagonistic so far.” The president sent the letter to Marathon Petroleum, Valero Energy, ExxonMobil, Phillips 66, Chevron, BP, and Shell. He also has directed Energy Secretary Jennifer Granholm to convene an emergency meeting and consult with the National Petroleum Council, a federal advisory group that is drawn from the energy sector. Biden is asking each company to explain to Granholm any drop in refining capacity since 2020, when the pandemic began. He also wants the companies to provide “any concrete ideas that would address the immediate inventory, price, and refining capacity issues in the coming months — including transportation measures to get refined product to market.” There may be limits on how much more capacity can be added. The U.S. Energy Information Administration on Friday released estimates that “refinery utilization will reach a monthly average level of 96% twice this summer, near the upper limits of what refiners can consistently maintain.” The letter says that roughly 3 million barrels a day of refining capacity around the world have gone offline since the pandemic began. In the U.S., refining capacity fell by more than 800,000 barrels a day in 2020. Republished with the permission of The Associated Press.

Katie Britt declines to debate Mo Brooks before primary runoff election

The campaign for Katie Britt has declined a request to debate U.S. Rep. Mo Brooks. The debate would have been syndicated across the state and hosted by Gray TV and Alabama Daily News on June 14. Alabama Daily News’ Todd Stacy stated on Twitter, “RE our now-nixed #ALSEN debate w/ @WBRCnews, see a statement from the Katie Britt campaign why she’s not interested in a face-off w/ Mo Brooks. Again, we thought we had a solid date for a runoff debate on June 14, but that fell apart after a week of talks.” The Britt campaign argued that the debate would only be a “circus.” “Mo Brooks doesn’t want a debate: he wants a circus. That’s the only thing he’s capable of. He doesn’t want to talk about his do-nothing record, because he hasn’t accomplished anything for Alabamians throughout his 40 years living off the taxpayer dime,” the release stated. “Instead, Mo Brooks will undoubtedly resort to embarrassing our state with false, desperate personal attacks. We are seeing his lies get more blatant by the day, and there is no way that a constructive or substantive debate can occur with his continually devolving behavior. Katie won’t participate in the final circus act of Mo’s career.” Brooks released a statement describing Britt as “weak” and “shrill.” “Katie Britt’s flip-flops are too numerous to count. In the primary she said a candidate who won’t debate should not get any citizen’s vote. Now, yet again, she flip-flops as she gets more shrill, more negative and more vitriolic, Brooks stated. “While I disagree with ‘June’ Katie Britt, I agree with ‘April’ Katie Britt. If she is too weak to stand on a stage and take Mo Brooks on, how can anyone expect her to take on Chuck Schumer, Bernie Sanders, or any of the other Socialist Democrats that are destroying America. Katie Britt’s debate refusal is an admission of profound weakness at a time America needs fighters in the U.S. Senate, not pushovers. As my record reflects, I am exactly the fighter America needs at this critical juncture in history.” Stacy posted another Tweet regarding the debate. “FWIW, I definitely understand the Britt campaign’s rationale. Given the results of election night (45-29), Britt has little to gain and lots to lose in a debate. And Brooks does have every incentive to make it a circus. Just disappointed we won’t get a debate,” Stacy stated. The Republican primary runoff election is June 21, 2022.

Will Ainsworth announces Public Service Commissioners endorsements for Chip Beeker and Jeremy Oden

Lt. Gov. Will Ainsworth announced his endorsement of Chip Beeker and Jeremy Oden for their reelection bids to the Alabama Public Service Commission (PSC). Ainsworth believes that conservative leaders should hold these seats because the two incumbents have already successfully shielded Alabama from the far left climate agenda. According to Alabama Secretary of State campaign finance records, radical “environmental justice” activists are once again pushing their agenda in Alabama. They have selected their preferred “Republican” primary candidates Robin Litaker and Brent Woodall for the Public Service Commission, Alabama Today reported in May. As first reported by Dylan Smith of Yellowhammer News, both candidates have taken large sums of money from Nelson Brooke, of Black Warrior Riverkeeper. Brooke has made a total of $73,000 in contributions to Alabama candidates all of the money going to democrats except three contributions: $20,000 to Litaker this cycle, $10,000 to her in her last race, and $10,000 to Woodall. Ainsworth asserted that the left’s “Green New Deal” would have consequences for Alabama. “Chip Beeker and Jeremy Oden have shown they have the grit, tenacity, and leadership to fight Joe Biden, Nancy Pelosi, Bernie Sanders, AOC, and the rest of the Washington liberals who are pushing radical energy policies and the snake oil promises of the Green New Deal,” Ainsworth stated. “If the liberal Democrat extremists are allowed to win, energy prices will skyrocket, jobs will disappear, and Alabama’s economy, which is currently the best in our history, will go into freefall.” “Commissioners Beeker and Oden will preserve our jobs and protect our Alabama way of life from the left-wing radicals and their dangerous agenda. They have my full confidence and strong endorsement for a new term on the Public Service Commission,” concluded Ainsworth. The runoff election will take place on June 21.

Progressive environmental activists pick ‘Republican’ favorites in Alabama Public Service Commission primary races

According to Alabama Secretary of State campaign finance records, radical “environmental justice” activists are once again pushing their agenda in Alabama. They have selected their preferred “Republican” primary candidates Robin Litaker and Brent Woodall for the Public Service Commission. As first reported by Dylan Smith of Yellowhammer News, both candidates have taken large sums of money from Nelson Brooke, of Black Warrior Riverkeeper. Brooke has made a total of $73,000 in contributions to Alabama candidates all of the money going to democrats except three contributions: $20,000 to Litaker this cycle, $10,000 to her in her last race, and $10,000 to Woodall. Alabama Today reported on Brooke’s contribution history in an opinion piece last cycle when Litaker, who is attempting her third run to the Public Service Commission. She ran against Twinkle Andress Cavanaugh in 2020. Cavanaugh handily won that election with 73.8% of the vote. In 2018, Litaker ran against Beeker with him getting 68.7% of the vote. In that race, she was her own biggest contributor and the next closest gave her $250.00. According to the Yellow Hammer report, the Federal Election Commission (FEC) campaign finance records show that Margaret Wade Johnston, from the advocacy group Sierra Club, loaned Litaker’s campaign $45,000. Johnston has a history of backing progressive candidates in an attempt to defeat incumbent conservatives in Alabama. Johnston donated to the Democratic challengers of U.S. Reps. Robert Aderholt and Mo Brooks in the 2018 general election and also donated to former U.S. Sen. Doug Jones in 2020. Like Johnston, Brooke also has a history of financially supporting far-left candidates in federal races, including former President Barack Obama’s 2012 reelection campaign and socialist U.S. Sen. Bernie Sanders’ 2016 presidential bid. It is unknown if the ALGOP will take action to decertify their elections based on these contributions. Earlier this year, Trip Powell was removed from the ballot for giving a $500 contribution to Walt Maddox. Litaker and Woodall supporter Brooke gave Maddox a total of $6,000. In 2018, the party voted to not certify a candidate who made social media posts that were described as “anti-Semitic, racist or otherwise offensive.” The primary election is on May 24, 2022. You can find your polling place or get more voting information at AlabamaVotes.gov.

William Haupt III: Nancy Pelosi’s home district is a progressive nightmare

“Nancy Pelosi’s district in California has rapidly become one of the worst anywhere in the U.S. when it comes to the homeless and crime. It has gotten so bad, so fast.” – Donald Trump In the 1960s, America’s boomers rebelled against authority and the Vietnam War. They pursued sexual liberation, experimental drugs, communal living, and civil rights. This counterculture lived by the motto “sex, drugs, rock and roll.” In 1967, thousands of hippies and flower children made their way to Haight-Ashbury in San Francisco for what was billed as the “Summer of Love” – and many never left. Haight-Ashbury soon eroded into an enclave for dropouts, addicts, and the homeless. In the late 1970s, the area was targeted for gentrification, and investors began cleaning it up. By 1990, Haight-Ashbury was among San Francisco’s most affluent and expensive neighborhoods. But today, it is home to tent cities with trash-ridden streets ravaged with violent crime, and it is a Mecca for drug users and sellers. Conditions are worse than slums in almost every other U.S. city. How can the most expensive place to live in America also be one of the worst places to live in the U.S.A.? While San Francisco has been the most progressive city in America for years, this liberal utopia has not always been a harbor for addicts, the homeless, criminals, and social derelicts. “It’s an odd thing, but anyone who disappears is said to be seen in San Francisco.” – Oscar Wilde In the 1960s, liberal strategist Phillip Burton saw the potential of growing the Democratic Party by pandering to the hippies, minorities, and gays. With their support, he was elected to the U.S. House in 1964, where he served until his death in 1983. His wife Sala Burton held this seat until 1987. In a special election, Nancy Pelosi seized this coveted progressive prize in 1987 and won’t give it up. With the election of far-left liberal Gov. Jerry Brown in 2010, San Francisco became a progressive paradise. In 2014, Brown financed Prop 57, which helped free thousands of California inmates from prison. Voters also approved Prop 47, which reduced most nonviolent crimes, including theft under $950 to misdemeanors. Both were pushed by Lt Governor Gavin Newsom, San Francisco district attorney George Gascón, the San Francisco Democratic Party, and the Harvey Milk LGBT Club. In 2016, voters approved Prop 64, giving municipalities the power to ban or sell weed. But many cities and counties did not react. A 2011 federal court had ruled that local governments trying to regulate the sale of weed would violate federal law. But it was welcomed by all San Franciscans. By 2019, the deregulation of crime, release of thousands of inmates, legalization of cannabis, and declaring California a sanctuary state enabled new Gov Gavin Newsom, the former mayor of San Francisco, to clone the entire state of California into a progressive twin sister of San Francisco. San Francisco has declared the NRA a “domestic terrorist organization,” banned fast-food joints that include toys in children’s meals, outlawed plastic bags and straws, raised the minimum wage from $9.79 to $15.59 an hour, and refuses to prosecute anyone for nonviolent crimes. While these policies appeal to the far left, they also encourage the homeless and derelicts to venture up north. How bad are things in San Francisco? According to a KGO news report, in 2011, the Bay City spent $157 million on the homeless. By 2016, it was up to $242 million. In the 2021 budget proposal, it is now over $364 million. The consensus estimates the homeless population is at least 17,500. “As mayor of San Francisco, I witnessed its greatest cultural and social transition.” – Gavin Newsom Progressives insist the stark contrast in wealth and poverty is the result of the failure of capitalism to provide for the needy. But while politicians preach “compassion,” their policies have resulted in record-high levels of homelessness, drug addiction, and a rapid increase in violent felonious crime. According to the San Francisco Chronicle, the city’s policies have created an “influx of about 450 homeless people a year who migrate to places like the Tenderloin District. This is a sanctuary for people hiding out from the law who do not want the government to know where they are living. In reaction to the George Floyd and Black Lives Matter protests and riots, along with outrage by activists against police, San Francisco elected progressive Chesa Boudin as district attorney of San Francisco in 2020. He was endorsed by Angela Davis, Bernie Sanders, and Ibram X. Kendi. Boudin, the adopted son of radicals Bill Ayers and Bernardine Dohrn, quickly reduced the use of cash bail and restrained the power of the police. He quit prosecuting misdemeanors. He then did the unthinkable and started charging police officers with felonies who used force during arrests. “I will move away from the draconian, tough-on-crime, three-strike super-rhetoric hype.” – Chesa Boudin According to Stop Crime, the Bay City is experiencing a dramatic increase in serious crime under Boudin. Burglaries are up 42%, and homicides have increased 30% compared to the previous year. Motor vehicle thefts have risen by 71%, and arsons have jumped over 35% since he became DA. Recently, a local ABC News reporter witnessed a shoplifter sweeping entire shelves of products into garbage bags inside a Walgreens. He mounted a bike and rode past a security guard out the door. Other retail stores are reporting the same problems in every neighborhood in San Francisco. “This rise in crime is a result of Chesa Boudin’s soft-crime policies.” – Frank Noto, Victim’s Rights It’s been said that “The road to hell is paved with good intentions.” All good intentions of Prop 47 and Prop 57 have been undone by Chesa Boudin’s leftist extremism, pandering to criminals, and punishing the police for doing their job. What’s happening in San Francisco is proof of how quickly perjured progressive idealism can turn an economically prosperous city into a living hell on earth. It is hard

Joe Biden urges bill over ‘finish line’ as Dems eye new surtax

With his signature domestic initiative at stake, President Joe Biden is urging Democrats to wrap up talks and bring the social services and climate change bill “over the finish line” before he departs Thursday for global summits overseas. Top Democratic leaders are signaling a deal is within reach even though momentum fizzled and tempers flared late Wednesday after a billionaires’ tax and a paid family leave program fell out of the Democrats’ sweeping bill, mostly to satisfy a pivotal senator in the 50-50 Senate. But expanded health care programs, free pre-kindergarten, and some $500 billion to tackle climate change remain in the mix in what’s now at least a $1.75 trillion package. And Democrats are eyeing a new surcharge on the wealthy — 5% on incomes above $10 million and an additional 3% on those beyond $25 million — to help pay for it, according to a person who requested anonymity to discuss the private talks. “They’re all within our reach. Let’s bring these bills over the finish line.” Biden tweeted late Wednesday. Biden could yet visit Capitol Hill before traveling abroad, and House Democrats were set to meet in the morning. Besides pressing for important party priorities, the president was hoping to show foreign leaders the U.S. was getting things done under his administration. The administration is assessing the situation “hour by hour,” White House press secretary Jen Psaki said. It was a fast-moving day on Capitol Hill that started upbeat as House Speaker Nancy Pelosi declared that Democrats were in “pretty good shape.” But hopes quickly faded as Biden’s big proposal ran into stubborn new setbacks, chief among them how to pay for it all. A just-proposed tax on billionaires could be scrapped after Democratic Sen. Joe Manchin of West Virginia objected, according to a senior party aide, who requested anonymity to discuss the private talks. The billionaires’ tax proposal had been designed to win over another Democratic holdout, Sen. Kyrsten Sinema of Arizona, but Manchin panned it as unfairly targeting the wealthy, leaving Democrats at odds. “People in the stratosphere, rather than trying to penalize, we ought to be pleased that this country is able to produce the wealth,” Manchin told reporters. Manchin said he prefers a minimum 15% flat “patriotic tax” to ensure the wealthiest Americans don’t skip out on paying any taxes. Nevertheless, he said: “We need to move forward.” Next to fall was a proposed paid family leave program that was already being chiseled back from 12 to four weeks to satisfy Manchin. But with his objections, it was unlikely to be included in the bill, the person said. Sen. Kirsten Gillibrand, D-N.Y., had devised several new options for Manchin’s review and told reporters late in the evening, “It’s not over until it’s over.” Together, Manchin’s and Sinema’s objections packed a one-two punch, throwing Biden’s overall plan into flux, halving what had been a $3.5 trillion package, and infuriating colleagues along the way. In the evenly divided Senate, Biden needs all Democrats’ support with no votes to spare. White House officials met at the Capitol with Manchin and Sinema, two senators who now hold enormous power, essentially deciding whether or not Biden will be able to deliver on the Democrats’ major campaign promises. “Making progress,” Sinema said as she dashed into an elevator. A Sunday deadline loomed for approving a smaller, bipartisan roads-and-bridges infrastructure bill or risk allowing funds for routine transportation programs to expire. But that $1 trillion bill has been held up by progressive lawmakers who are refusing to give their support without the bigger Biden deal. Despite a series of deadlines, Democrats have been unable to close the deal among themselves, and Republicans overwhelmingly oppose the package. At best, Democrats could potentially reach a framework Thursday that could send Biden overseas with a deal in hand and unlock the process while the final details were sewn up. Applying pressure, Pelosi announced a Thursday committee hearing to spur the Biden package along toward a full House vote, though the timing remained uncertain. Democrats had hoped the unveiling of the billionaires tax Wednesday could help resolve the revenue side of the equation after Sinema rejected the party’s earlier idea of reversing Donald Trump-era tax breaks on corporations and the wealthy, those earning more than $400,000. The new billionaires’ proposal would tax the gains of those with more than $1 billion in assets or incomes of more than $100 million over three consecutive years — fewer than 800 people — requiring them to pay taxes on the gains of stocks and other tradeable assets, rather than waiting until holdings are sold. The billionaires’ tax rate would align with the capital gains rate, now 23.8%. Democrats have said it could raise $200 billion in revenue that could help fund Biden’s package over ten years. Republicans have derided the billionaires’ tax as “harebrained,” and some have suggested it would face a legal challenge. But Democratic Sen. Ron Wyden of Oregon, chairman of the Senate Finance Committee, insisted the billionaires tax remains on the table. “I’ve not heard a single United States senator — not one — get up and say, ‘Gee, I think it’s just fun that billionaires pay little or nothing for years on end,’” Wyden said. More likely in the mix was the companion proposal, a new 15% corporate minimum tax, as well as the new surtax being proposed on higher incomes above $10 million. Together they are designed to fulfill Biden’s desire for the wealthy and big business to pay their “fair share.” They also fit his promise that no new taxes hit those earning less than $400,000 a year, or $450,000 for couples. Biden wants his package fully paid for without piling on debt. Resolving the revenue side has been crucial, as lawmakers figure out how much money will be available to spend on the new health, child care, and climate change programs in Biden’s big plan. Among Democrats, Rep. Richard Neal of Massachusetts, the chairman of the Ways and Means Committee, said he told Wyden

White House, Dems hurriedly reworking $2 trillion Joe Biden plan

The White House and Democrats are hurriedly reworking key aspects of President Joe Biden’s $2 trillion domestic policy plan, trimming the social services and climate change programs and rethinking new taxes on corporations and the wealthy to pay for a scaled-back package. The changes come as Biden more forcefully appeals to the American public, including in a televised town hall Thursday, for what he says are the middle-class values at the heart of his proposal. Biden mentioned during the evening event the challenge he faces in wrangling the sharply divergent factions in the Democratic party to agree to the final contours of the bill. With an evenly divided Senate, he can’t afford to lose a single vote, and he is navigating the competing demands of progressives, who want major investments in social services, and centrists, who want to see the price tag on the package come down. “When you’re president of the United States, you have 50 Democrats — every one is a president. Every single one. So you gotta work things out,” he said during a CNN town hall. Still, he expressed optimism about the process, saying “I think so” when asked if Democrats were close to a deal. “It’s all about compromise. Compromise has become a dirty word, but bipartisanship and compromise still has to be possible,” he said. Biden later said the discussions are “down to four or five issues.” On one issue — the taxes to pay for the package — the White House idea seemed to be making headway with a new strategy of abandoning plans for reversing Trump-era tax cuts in favor of an approach that would involve taxing the investment incomes of billionaires to help finance the deal. Biden has faced resistance from key holdouts, in particular Sen. Kyrsten Sinema, D-Ariz., who has not been on board with her party’s plan to undo President Donald Trump’s tax breaks for big corporations or individuals earning more than $400,000 a year. The president was unusually forthcoming Thursday night about the sticking points in the negotiations with Sinema and another key Democrat, conservative Sen. Joe Manchin of West Virginia. While the president said Sinema “will not raise a single penny in taxes” on the wealthy or corporations, a White House official later clarified that the president was referring to raising the top tax rates, not the range of tax proposals, “which Senator Sinema supports.” Biden said Manchin doesn’t want to “rush” the transition to clean energy so quickly it will result in major job losses in his coal-producing state. Even as he seemed encouraged by progress, Biden acknowledged major reductions to his original vision. He signaled the final plan would no longer provide free community college but said he hoped to increase Pell Grants to compensate for the loss of the policy. “It’s not going to get us the whole thing, but it is a start,” he said. He also said that what had been envisioned as a federally paid, months-long family leave program would be just four weeks. As long-sought programs are adjusted or eliminated, Democratic leaders are working to swiftly wrap up talks, possibly in the days ahead. Talks between the White House and Democratic lawmakers are focused on reducing what had been a $3.5 trillion package to about $2 trillion in what would be an unprecedented federal effort to expand social services for millions and address the rising threat of climate change. “We have a goal. We have a timetable. We have milestones, and we’ve met them all,” said House Speaker Nancy Pelosi, D-Calif., who predicted Thursday, “It will pass soon.” An abrupt change, of course, came late Wednesday when the White House floated new ways to pay for parts of the proposal. Biden himself signaled flexibility on the tax provisions of the bill, as long as it’s paid for and it doesn’t increase taxes on those earning $400,000 or less. “I’m willing to make sure that we pay for everything,” he said when pressed on what tax proposal he’d support. The newly proposed tax provisions, though, are likely to sour progressives and even some moderate Democrats who have long campaigned on scrapping the Republican-backed 2017 tax cuts that many believe unduly reward the wealthy and cost the government untold sums in lost revenue at a time of gaping income inequality. Many are furious that perhaps a lone senator could stymie that goal. The chairman of the tax-writing Ways & Means Committee, Rep. Richard Neal, D-Mass., said he spoke for more than 30 minutes with the centrist Arizona senator, whose closely held views are a mystery to her colleagues. “I said, Kyrsten, you and I both know this has got to pass. She said: ‘I couldn’t agree more,’” Neal told reporters at the Capitol. Sinema’s office did not respond to a request for comment. Under existing law passed in 2017, the corporate tax rate is 21%. Democrats had proposed raising it to 26.5% for companies earning more than $5 million a year. The top individual income tax rate would go from 37% to 39.6% for those earning more than $400,000, or $450,000 for married couples. Under the changes being floated, the corporate rate would not change. But the revisions would not be all positive for big companies and the wealthy. The White House is reviving the idea of a minimum corporate tax rate, similar to the 15% rate Biden had proposed this year. That’s even for companies that say they had no taxable income — a frequent target of Biden, who complains they pay “zero” in taxes. The new tax on the wealthiest individuals would be modeled on legislation from Sen. Ron Wyden, D-Ore., chairman of the Senate Finance Committee. He has proposed taxing stock gains of people with more than $1 billion in assets — fewer than 1,000 Americans. Other tax options are also being considered, and Democrats are almost certain to include a provision to beef up the Internal Revenue Service to go after tax dodgers. Biden and his party are trying to shore up middle-class households, tackle climate

Lynda Blanchard: Democrats singing that same old debt-limit song

When Johnny and I first married, times were tough. He was in school, and I was working a minimum-wage job. We had to watch every penny. We did without, and we made do, and we lived on what money we had at the time. Why can’t the federal government do the same? Now, we’re seeing yet another verse of the same old debt-limit song from Washington. The Democrats are pushing Bernie Sanders’ $3.5 trillion dollar budget while Treasury Secretary Janet Yellen is saying that unless the debt ceiling is raised, the United States will default on our debt payments for the first time in history. On Monday, Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer announced that they would combine bills to suspend the debt limit once again with an emergency spending bill to avoid a government shutdown and default. Thankfully, Congressional Republicans are going to make the Democrats do this all on their own, so there will be no question about who owns it. Republicans know that the Democrats will use suspending the debt limit to fuel their wasteful spending on their progressive wish list. We’re lucky that on Monday, the Senate Parliamentarian blocked an attempt by the Democrats to put amnesty for millions of illegals in the budget. This would have basically created a new immigration policy without any input from Republicans and would have cost us an estimated $109 billion dollars, and included green cards, education, and other benefits for roughly 10 million illegals. Pelosi, Schumer, Sanders, and company want to keep turning illegals into Democrat voters, and they want you to pay for it on the nation’s credit card. The Democrats want to import voters so they can stay in power forever, and they expect us to foot the bill. They want to ram through a $3.5 trillion budget using the reconciliation process without Republicans having any say in the process, never mind that it would cause trillion-dollar deficits for the next ten years. They want to borrow and spend on every kind of perk for themselves, like a $200 million park near Pelosi’s home, when the country isn’t able to pay its credit card bill now. This nonsense has to stop. I support our Congressional Republicans in blocking the Democrats’ out-of-control spending. We also have to stop allowing immigrants to pour across our southern border, spreading themselves and the COVID they carry across the country and draining federal, state, and local resources where they settle. Until we get a handle on the Biden border crisis, we’ll continue to run up bills paying for it. We can’t fix one without fixing the other, as the Democrats’ amnesty end-run in the budget just proved. It’s time that Congress started living within the country’s means. We need to kill this budget bill, then focus on fixing our hard infrastructure that’s been ignored for decades, meeting our country’s real needs, and cutting the waste, so we only spend what we take in. Ordinary families and most states do this all the time. What will it take for the federal government to start doing this? I strongly urge the Republicans in Congress to save this bill because it’s a necessary first step toward saving America. Lynda Blanchard served as President Donald Trump’s United States Ambassador to Slovenia, the First Lady’s birth country. Ambassador Blanchard is also a successful business woman from Montgomery, where she is involved in many philanthropic activities. She is a mom to 8 wonderful kids. Ambassador Blanchard is one of only 3 Presidential appointed Ambassadors in history from the state of Alabama. She is currently running for U.S. Senate.

Joe Manchin favors trimming Joe Biden budget plan by more than half

A Democratic senator vital to the fate of President Joe Biden’s $3.5 trillion plan for social and environmental spending said Sunday he won’t support even half that amount or the ambitious timetable envisioned for passing it. The stand by Sen. Joe Manchin, D-W.Va., was described as unacceptable by the chairman of the Senate Budget Committee, who is helping craft the measure. But Democrats have no votes to spare if they want to enact Biden’s massive “Build Back Better” agenda, with the Senate split 50-50 and Vice President Kamala Harris the tiebreaker if there is no Republican support. With congressional committees working toward the target of Wednesday set by party leaders to have the bill drafted, Manchin made clear his view, in a series of television interviews, that there was “no way” Congress would meet the late September goal from House Speaker Nancy Pelosi, D-Calif., for passage. “I cannot support $3.5 trillion,” Manchin said, citing, in particular, his opposition to a proposed increase in the corporate tax rate from 21% to 28% and vast new social spending. “We should be looking at everything, and we’re not. We don’t have the need to rush into this and get it done within one week because there’s some deadline we’re meeting, or someone’s going to fall through the cracks,” he said. Pressed repeatedly about a total he could support, Manchin said, “It’s going to be $1, $1.5 (trillion).” He later suggested the range was based on a modest rise in the corporate tax rate to 25%, a figure he believes will keep the U.S. globally competitive. “The numbers that they’re wanting to pay for and the tax changes they want to make, is that competitive?” Manchin asked. “I believe there’s some changes made that does not keep us competitive.” But Vermont Sen. Bernie Sanders, who is developing the budget bill, noted that he and other members of the liberal flank in Congress had initially urged an even more robust package of $6 trillion. “I don’t think it’s acceptable to the president, to the American people, or to the overwhelming majority of the people in the Democratic caucus,” Sanders said. He added: “I believe we’re going to all sit down and work together and come up with a $3.5 trillion reconciliation bill which deals with the enormously unmet needs of working families.” The current blueprint proposes billions for rebuilding infrastructure, tackling climate change, and expanding or introducing a range of services, from free prekindergarten to dental, vision, and hearing aid care for seniors. Manchin voted last month to approve a budget resolution that set the figure, though he and Sen. Kyrsten Sinema, D-Ariz., have expressed reservations about the topline amount. All of it would be paid for with taxes on corporations and the wealthy. Congressional committees have been working hard this month on slices of the 10-year proposal in a bid to meet this week’s timeline from Pelosi and Senate Majority Leader Chuck Schumer, D-N.Y., to have the bill drafted. Pelosi is seeking a House vote by Oct. 1, near the Sept. 27 target for voting on a slimmer infrastructure plan favored by moderates. Manchin, who in an op-ed earlier this month urged a “strategic pause” on the legislation to reconsider the cost, described the timing as unrealistic. He has urged Congress to act first on a nearly $1 trillion bipartisan infrastructure bill already passed by the Senate. But liberal Democrats have threatened to withhold their support until the $3.5 trillion spending bill is passed alongside it. Neither side on Sunday revealed how they hoped to quickly bridge the divide among Democrats. “There’s no way we can get this done by the 27th if we do our job,” Manchin said. “There’s so much differences that we have here and so much — there’s so much apart from us where we are. … I’m working with people. I’m willing to talk to people. It makes no sense at all.” Manchin spoke on CNN’s “State of the Union,” NBC’s “Meet the Press,” and ABC’s “This Week.” Sanders was on CNN and ABC. Republished with the permission of the Associated Press.

Paid in full? Biden, GOP struggle over infrastructure costs

Congressional negotiators and the White House appear open to striking a roughly $1 trillion deal on infrastructure. But they are struggling with the hard part — how to pay for it. As President Joe Biden jumps back into the talks this week, the question of where the money will come from looms large. And time is running short to solve it. Biden wants to increase taxes for corporations and those households making more than $400,000 a year. Republicans have ruled that out, putting forward alternatives that Democrats find unacceptable. Both sides have said the infrastructure spending should be paid for and not add to the national debt. It’s a long-standing challenge with no easy solution, one that puts the bipartisan agreement around infrastructure in tension with the nettlesome realities of governing. It’s a problem that has thwarted previous attempts at an infrastructure bill, including during the Trump administration, and their ability to solve it now is likely to determine whether a bipartisan accord is possible. Senate Republican leader Mitch McConnell has said user fees are the way to go. But the White House and key Democratic lawmakers oppose increasing the user fee that has traditionally funded road and bridge construction, the federal gas tax, even if the increase is just allowing it to rise at the rate of inflation from its current level of 18.4 cents per gallon. The federal gas tax has not increased since 1993. “The president’s pledge was not to raise taxes on Americans making less than $400,000 a year, and the proposed gas tax or vehicle mileage tax would do exactly that,” said White House press secretary Jen Psaki. “So that is a nonstarter for him. I’d also note for the mathematicians in the room that only raises $40 billion, which is a fraction of what this proposal would cost.” Biden hosted two key Democratic senators, Joe Manchin of West Virginia and Kyrsten Sinema of Arizona, at the White House on Monday. He told them he was encouraged by the plans that were taking shape but still had questions about the policy and the financing for the proposal, a White House official said. Biden also said he was focused on budget resolution discussions. The two senators were among a group huddling late Monday at the Capitol, some emerging upbeat that a bipartisan deal was within reach. “Significant progress,” said Sen. Susan Collins, R-Maine. Sen. Jon Tester, D-Mont., said they were “very close” to having a full proposal from the bipartisan group as soon as Tuesday. One idea under consideration is reallocating money already approved as part of COVID-19 relief measures. Sen. Rob Portman, R-Ohio, said Sunday that they’re looking at repurposing more than $100 billion from COVID-19 relief to help pay for infrastructure. He put the onus on the White House to put forward other ideas since Democrats are balking at indexing the gas tax to inflation or creating a user fee for electric vehicles. “The administration, therefore, will need to come forward with some other ideas without raising taxes,” Portman said on NBC’s “Meet the Press.” “What we don’t want to do is hurt the economy right now as we’re coming out of this pandemic by raising taxes on working families.” With the gas tax likely out, other ideas include raising revenue from communication spectrum leases, and both parties are eyeing funds that could be raised by going after tax dodgers. The Republicans estimate about $63 billion could be raised by beefing up enforcement by the Internal Revenue Service. Democrats say the amount could be even higher. Another complication in the negotiations is that many Democrats question whether the size and scope of the infrastructure package being discussed by the White House and senators is adequate. Within the $1 trillion package, about $579 billion would be new spending, and the remainder would be a continuation of existing programs. Many Democrats are wary of a repeat of 2009 when Barack Obama was president, and they spent months negotiating the details of the Affordable Care Act with Republicans. Eventually, Democrats passed the package that became known as “Obamacare” on their own. “The amount of money that they are proposing is about one-quarter of what the president talked about in terms of new money. That’s not adequate,” said Sen. Bernie Sanders, I-Vt., on CNN’s “State of the Union.” Lawmakers are also hoping to influence more than the price tag of the infrastructure bill. One senator key to the talks, Manchin, unveiled his own draft proposal Monday for green energy infrastructure investments. The 423-page bill contains a wish list of energy-related proposals, and he’ll hold a hearing on the plan Thursday in the Senate Energy and Natural Resources Committee. Senate Majority Leader Chuck Schumer, D-N.Y., has described the infrastructure bill being negotiated as a good start. But he says most Democrats don’t believe it does enough on climate and also want it to address priorities like paid family leave. He is pushing a “two-track” approach that leaves open the possibility of a far larger bill without Republican votes. Using a special budget, the second infrastructure bill would only take a simple majority of 51 votes to pass. Such a measure could include more of the priorities laid out by Biden as part of his $1.8 trillion American Families Plan, such as paid family leave and universal pre-K for 3- and 4-year-olds. Sen. Lindsey Graham, R-S.C., warned the administration not to go that route. “I would just say to President Biden, you’ve got a party that’s divided. You’ve got a Republican Party that’s willing to meet you in the middle for a trillion dollars of infrastructure that could fundamentally change the way America does business in roads, ports, and bridges and accelerate electrical vehicles,” Graham said on “Fox News Sunday.” “You’ve got to decide what kind of president you are and what kind of presidency you want.” Republished with the permission of the Associated Press.