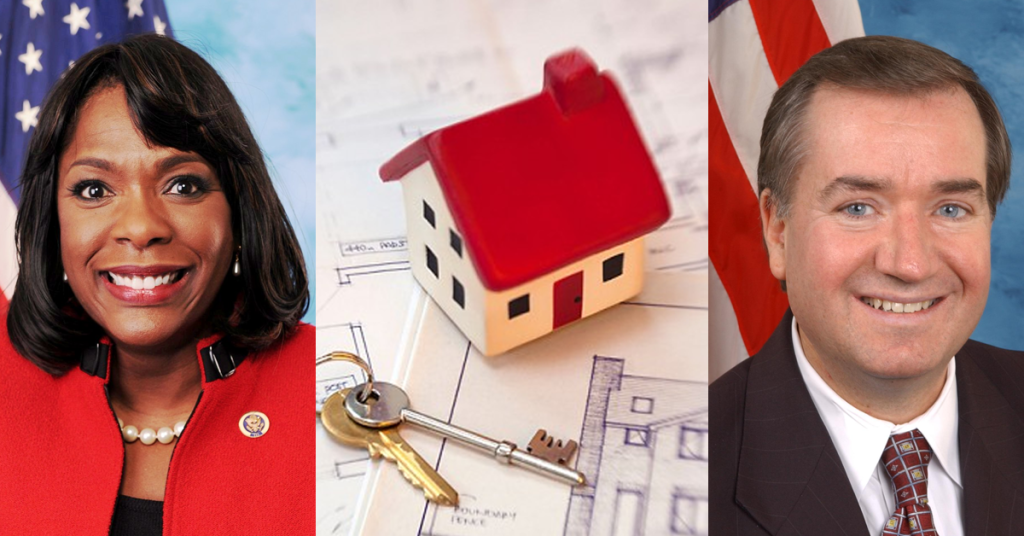

Terri Sewell urges alternative credit score consideration by GSEs

Home ownership is an integral part of the American Dream, but buying a home is a stressful process. Perhaps one of the most stressful components — securing a good, home loan. For millions of Americans the task of being approved for a home loan is daunting, as they know the fate of their future home hinges on one main factor: their FICO credit scores. Which is why, last December, Alabama 7th District U.S. Rep. Terri Sewell and her colleague Ed Royce from California’s 39th District introduced a bill urging the government-sponsored enterprise (GSEs) Fannie Mae and Freddie Mac — which control 90% of the mortgage market and set the underwriting standards for the entire mortgage industry — to consider alternative credit-scoring models beyond the FICO credit score. The bill, H.R. 4211: the Credit Score Competition Act of 2015 aims to abandon FICO for a softer standard in evaluating credit risk making home ownership a greater possibility for more Americans. Last week, the Federal Housing Finance Agency (FHFA) released their 2017 Scorecard and seemed to take heed of Sewell’s and Royce’s bill including stating that the FHFA expects the GSEs to: “Conclude assessment of updated credit score models for underwriting, pricing, and investor disclosures, and, as appropriate, plan for implementation.” Sewell and Royce say the change of policy is a win-win. “Alternative credit score consideration by the GSEs is a win-win: it opens up the market to those looking to buy a home in a responsible manner and fosters healthy competition in the credit scoring field,” said both Reps in a joint press release. “That’s why there is strong bipartisan support in Congress for such a move. We encourage the FHFA to move forward without further delay.” In Royce and Sewell’s view, lower-to-middle income Americans who are qualified to buy a home, but are unable to do so because of their current FICO score or often lack thereof will “specifically benefit from the GSEs using other credit scoring models.”

U.S. Reps. Terri Sewell, Ed Royce push to remove barriers to homeownership

Alabama U.S. Rep. Terri Sewell (AL-07) reached across the aisle Thursday to California U.S. Rep. Ed Royce (CA-40) in efforts to remove barriers to homeownership. The two – both members of the House Financial Services Committee – introduced, H.R. 4211, the Credit Score Competition Act of 2015, which allows the Government-Sponsored Enterprises (GSE) Fannie Mae and Freddie Mac to consider alternate credit scoring models when making mortgage lending decisions. “Fannie Mae and Freddie Mac are the largest mortgage purchasers in the nation, but they rely on credit score models that don’t necessarily take into account something as simple as whether borrowers have paid their rent on time,” Sewell said. “Home ownership is an integral part of the American Dream that shouldn’t be out of the reach for low-income, rural, and minority borrowers who lack access to traditional forms of credit. This legislation takes an important step towards addressing this issue and helps make homeownership a reality for more Americans across the country.” Fannie Mae and Freddie Mac currently evaluate their ability to purchase a mortgage based exclusively on a consumer’s FICO credit score. FICO scores are based on models and data from 1995 to 2000 that unnecessarily excludes millions of qualified borrowers. “The Credit Score Competition Act of 2015 allows Fannie Mae and Freddie Mac to consider modern and updated credit scoring models that give more creditworthy buyers access to affordable, home mortgages,” Sewell said. “It is my hope that this critically important legislation will help make homeownership a reality for many of the hard-working men and women living in Alabama’s 7th Congressional District.” The legislation will act to establish and preserve a competitive credit scoring marketplace by eliminating the Fannie and Freddie FICO monopoly and will foster innovation in the field and more affordable credit score products for consumers. “Breaking up the credit score monopoly at Fannie and Freddie will assist them in managing their credit risk and avoiding the need for another taxpayer bailout,” Royce said. “The GSEs’ use of a single credit score stifles innovation and affordability in the credit scoring field and bars millions of qualified homebuyers from purchasing a home.”