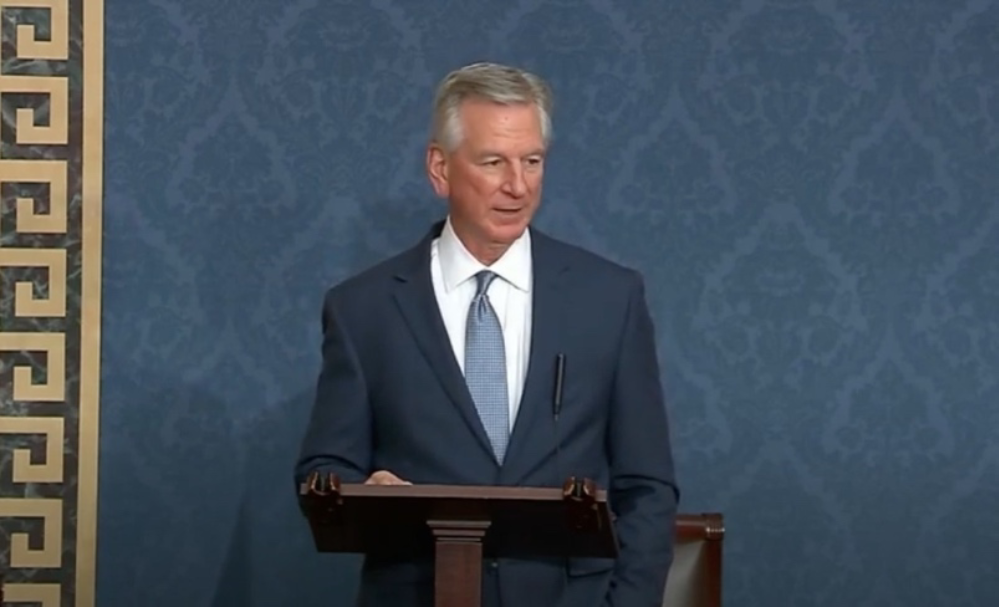

Sen. Tommy Tuberville asks for DOJ, SEC investigation into crypto firm with ties to China

U.S. Senator Tommy Tuberville (R-Alabama) is asking for an investigation of a Chinese-linked crypto-currency exchange company firm Prometheum, Inc. Senator Tuberville recently discussed Prometheum’s alleged China ties on Fox Business Channel’s Larry Kudlow. “Crypto is here to stay,” Tuberville told Kudlow. “We have got to have regulations, but the thing that we are running into now is we have got what we call crypto exchanges that are coming around all over the country. They have to be approved by the SEC and FINRA, the two regulators.” Tuberville continued, “We all know that they (China) are our number one adversary – the Republicans, the Democrats, people across the country, but somebody needs to tell our financial regulators because what has happened recently. There is a company, Promethium, that has been given the rights to a crypto exchange. Their biggest investor is Wanxiang which is a Communist China Party company. It is their biggest investor. What’s going on with our regulators? There was several dozen companies and people who applied for this, but they went with the Chinese Communist Party company.” Tuberville and five congressional colleagues sent a letter to U.S. Attorney General Merrick Garland and Securities and Exchange Commission (SEC) Chair Gary Gensler requesting a review of inconsistencies in congressional testimony given by digital asset firm Prometheum, Inc.’s Co-CEO Aaron Kaplan and the company’s SEC filings. Senator Tuberville announced the letter in an op-ed published by 1819 News. “Lying to Congress is a crime. Providing misleading information to investors in SEC filings constitutes securities fraud,” said Sen. Tuberville. “…If Prometheum ended its tech buildout with its China-based partners in December 2019 as Mr. Kaplan led Congress to believe, that development should have been reflected in the company’s SEC filings. Instead, Prometheum continued to tout its China-tainted tech partnership to regulators and potential investors for nearly two more years.” Prometheum’s largest outside investor is a China-based company – Shanghai Wanxiang Blockchain, Inc. (Wanxiang) and its subsidiary HashKey Digital Asset Group, Ltd. (HashKey)- with deep ties to the Chinese Communist Party (CCP) that were documented in a Wall Street Journal op-ed written by Senator Tuberville last month. HashKey holds a seat on Prometheum’s board, and until October 2021, Prometheum benefitted from a formal technology development agreement with its Chinese partners. In written testimony submitted to Congress for a June 13 House Financial Services Committee hearing on the future of digital assets, Mr. Kaplan indicated Prometheum began developing its technology platform without influence from Wanxiang or HashKey in December 2019. Tuberville claims that SEC filings submitted by Prometheum throughout 2020 and for most of 2021 indicate the technology development partnership was still in force until October 2021. The letter sent to the Attorney General and the SEC Chair by Sen. Tuberville and his congressional colleagues requests a review of these inconsistencies. Last month, Senator Tuberville sent an oversight letter to the SEC and the Financial Industry Regulatory Authority (FINRA), objecting to those agencies’ approval of Prometheum Ember Capital, LLC – a subsidiary of Prometheum, Inc. – as a special purpose broker-dealer to custody digital asset securities. Tuberville has requested an investigation. Tuberville said that he and Senator Kirsten Gillibrand introduced legislation last week that will keep companies partly owned by the Chinese Communist Party from being able to invest in financial exchanges. “That will keep out Chinese Communist Party investors out of crypto, out of our exchanges, but these regulators are asleep at the wheel,” Tuberville said. “It is just another thing that the Biden Administration has let the Chinese do and get by with, and we need to put a stop to it.” Tuberville was elected to the Senate in 2020. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

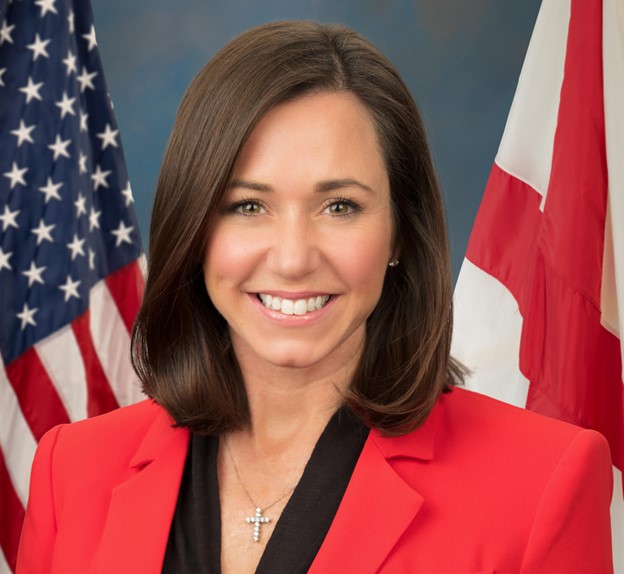

Sen. Katie Britt joins colleagues in introducing bicameral bill to protect American businesses from SEC overreach

U.S. Senator Katie Britt (R-Alabama) joined Sen. Mike Rounds (R-South Dakota) and eight of their Senate colleagues in reintroducing legislation to only allow the U.S. Securities and Exchange Commission (SEC) to impose future disclosure requirements on publicly traded companies if the information is important for investors’ decisions. “If this Administration continues to try and enforce its radical Green New Deal policies on every corner of America, this reckless, partisan overreach is going to result in fewer American jobs, higher inflation, and more competitive advantages for foreign competitors in the marketplace,” said Sen. Britt. “American companies should not be held hostage by unelected bureaucrats. I’m proud to support this commonsense legislation that would uphold fiscal sanity and free-market values in our economy.” “The heavy hand of government is hampering the growth of our businesses and economy,” said Sen. Rounds. “This legislation would seek to depoliticize the SEC by preventing the agency from requiring reporting of unnecessary information and instead focus on protecting investors, maintaining fair and efficient markets and facilitating capital formation.” In March 2022, the SEC issued a rule requiring any public company to disclose its direct and indirect greenhouse gas emissions, including reporting by downstream suppliers like farmers and ranchers, even if that information is not relevant to investors. This rule would potentially limit access to capital, discourage new companies from going public and result in onerous reporting requirements that will be borne by farmers and small businesses. The Mandatory Materiality Requirement Act would refocus future SEC disclosure requirements on what is important: the information investors need to make smart investment decisions. Specifically, it would amend both the Securities Act of 1933 and the Securities Exchange Act of 1934 by inserting statutory language directly into both acts saying an “issuer is only required to disclose information in response to disclosure obligation adopted by the Commission to the extent the issuer has determined that such information is important with respect to a voting or investment decision regarding such issuer.” Sens. Britt and Rounds were joined by Sens. Thom Tillis (R-North Carolina), Bill Hagerty (R-Tennessee), Cynthia Lummis (R-Wyoming), Steve Daines (R-Montana), Chuck Grassley (R-Iowa), John Boozman (R-Arkansas), Kevin Cramer (R-North Dakota), and Dan Sullivan (R-Alaska) in introducing this legislation. SEC chair Gary Gensler advanced the SEC rule. Gensler has advocated for the SEC to consider climate-related and social issues in its regulatory policy since he took office in 2021. Gensler said climate reporting rules are a concern for investors and fit in with a tradition of disclosure requirements dating back to the Great Depression. Katie Britt was elected to the Senate in 2022. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Tommy Tuberville announces bipartisan bill to block Chinese owned companies from owning crypto-currency exchanges

U.S. Senator Tommy Tuberville last week announced a bipartisan plan to block Chinese companies from owning American cryptocurrency companies. In an op-ed in The Wall Street Journal, Tuberville announced a bipartisan bill, with U.S. Senator Kirsten Gillibrand (D-New York), to amend the Commodity Exchange Act to prohibit entities organized or established in the People’s Republic of China (PRC) or a subsidiary of such an entity from acquiring a U.S. digital asset broker, dealer, custodian, or exchange. “This bipartisan bill will help to wall off the burgeoning American digital commodity industry from CCP interference and preserve our data privacy and investor protection rights,” wrote Senator Tuberville. “It will also help ensure that America continues to lead in financial innovation, which is essential to maintaining America’s position in the world.” The bill would prohibit the Commodity Futures Trading Commission (CFTC) from registering a digital commodity platform owned in whole or in part by an entity organized or established in the PRC. It also requires the CFTC to revoke the registration of any digital commodity platform if an entity with ties to the Chinese Communist Party (CCP) acquires all or any part of the ownership of the entity. Tuberville and Gillibrand say they are concerned because digital commodity platforms collect and store their users’ personally identifiable information — including Social Security numbers, mailing addresses, and sensitive financial account data. They claim that allowing entities based in the PRC to access this information raises serious concerns about investor protection, data privacy, national security, sanctions compliance, and anti-money laundering efforts. They also expressed concerns that companies based in the PRC all ultimately answer to the CCP. On Monday, Senator Tuberville sent an oversight letter to both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), objecting to those agencies’ approval of a Chinese-connected crypto securities broker-dealer, Prometheum Ember Capital, LLC. In May, Senator Tuberville sent a similar letter to financial regulators asking for details surrounding Chinese-linked stock trading platforms operating in the U.S. Under current law, U.S. regulators have limited tools to block the purchase of a U.S. digital commodity platform by a CCP-tied entity. Tuberville and Gillibrand say that their bipartisan bill will help to shield the burgeoning U.S. digital asset industry from Chinese interference and help to ensure continued American leadership in financial innovation. Investors in crypto-currencies lost over $2 trillion last year, highlighting how speculative and risky those alternative investments actually are. Sen. Tuberville is also leading the call for an investigation into Webull Financial, LLC and Moomoo, Inc. — two Chinese-owned stock trading apps operating in the United States that are registered with the SEC and FINRA. Both apps are widely used by American investors and freely collect and store sensitive information about users, including Social Security numbers, mailing addresses, and financial account data. In May 2023, Senator Tuberville sent a letter to SEC Chair Gary Gensler and FINRA President and CEO Robert Cook calling for oversight of the trading platforms due to the potential CCP access of American user data. In the letter, Senator Tuberville expressed concerns about the ability of the SEC and FINRA to examine the Chinese companies’ compliance with U.S. law. Tuberville’s concerns about China are not limited to just financial markets. In March, Senator Tuberville led a congressional delegation to Panama to discuss countering China’s growing influence in the region. On the trip, Senator Tuberville met with American and Panamanian officials to strategize ways to combat Chinese attempts to control the Panama Canal, which would give China enormous influence over global supply chains. The United States built the Panama Canal in the early part of the 20th century. In the 1970s then-President Jimmy Carter transferred it back to Panama. The Panamanians, with Chinese technical assistance and capital, have since widened and modernized the canal. Tuberville has also introduced legislation to ban members of the CCP from receiving B-1 and B-2 visas to the United States for vacation and non-official government business, citing the CCP’s responsibility for trillions of dollars of intellectual property theft each year. The bill cosponsored by Senator Tuberville would bar all 93 million CCP members from entering the United States using nonimmigrant B-1 and B-2 visas. Tuberville has expressed concerns about the retirement savings of our military and federal government employees, known as the Thrift Savings Plan (TSP) being invested in the economies of our adversaries like China. Tuberville previously wrote about this issue in the Wall Street Journal in a column entitled, “I’ll Keep Veterans’ Pensions Safe From Communism.” To that end, Tuberville has pushed for accountability from the Federal Retirement Thrift Investment Board (FRTIB) surrounding the board’s policy on foreign investments. Tuberville has even placed a hold on nominees to the FRTIB until the nominees provided clarification regarding foreign investment policies, which forced the nominees to commit to opposing TSP investment in China. Tommy Tuberville was elected to the U.S. Senate in 2020 following decades as an educator, football coach, and sports broadcaster. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

State AGs want more time to comment on bank ESG regulations

Eighteen attorneys general are asking the Securities and Exchange Commission for more time to ponder climate change rules affecting financial firms. The comment period for the two rules expired in the spring. The SEC announced last month that comments on the rules and 10 others might not have been received or documented due to technical errors. The problems seemed to be limited to ones received in August, but the problem could go back to June 2021, the agency said. The SEC proposed an additional 14-day comment period to give people time to re-submit comments. The first rule, “Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices,” would require certain investment fund advisors to disclose greenhouse gas emissions in their portfolio. The rule was released by the SEC in May, and the public had 60 days to comment. The “Enhancement and Standardization of Climate-Related Disclosures for Investors” would require financial firms to add climate-related information in their annual reports. The comment deadline expired on May 20. Arkansas Attorney General Leslie Rutledge and 17 other attorneys general sent a letter to the SEC asking them to extend the comment period. “The liberal agenda pushing ESG regulations on banks is creating huge problems for businesses attempting to invest in American economic growth,” Rutledge said in a news release. “Public input shouldn’t be wrongly discarded due to a computer error. Giving the public more time to comment is just common sense.”Attorneys general from Alabama, Alaska, Arizona, Georgia, Indiana, Kansas, Kentucky, Louisiana, Mississippi, Montana, Ohio, Oklahoma, South Carolina, South Dakota, Texas, Utah, and West Virginia also signed the letter. Republished with the permission of The Center Square.

Governors pan SEC climate disclosure proposal as unprecedented federal overreach

Sixteen Republican governors are asking the Biden administration to withdraw a proposed rule by the U.S. Securities and Exchange Commission that would require companies to disclose some climate-related investment information in annual reports and registration. The governors called the move an “unprecedented level of federal overreach” in a letter sent Tuesday to President Joe Biden and SEC Commissioner Gary Gensler. “The proposed rule will harm businesses and investors in our states by increasing compliance costs and by larding disclosure statements with uncertain and immaterial information that the federal government – let alone the SEC – is not equipped to judge,” the governors said in their letter. The governors said it’s OK for companies to disclose the information voluntarily. “However, since climate change models vary dramatically, the notion of evaluating investment risk based on such uncertain variables is inherently subjective and unreliable,” they wrote. “Moreover, such disclosures would serve to confuse investors as to how to judge true financial risk, significantly reducing market efficiency. It is precisely the type of question where government should not impose its own judgments of what constitutes material risk in place of managers.” The rule “appears part of an ongoing effort across the federal government to penalize companies involved in traditional energy development,” the governors said. “Until recently, the Biden administration explicitly refused to issue new oil and gas leases on federal lands and is now considering only a fraction of the lands that should be available,” they wrote. “In addition, the Council on Environmental Quality is rolling back reforms to the environmental review process, the President has denied key pipeline and other permitting applications, and officials throughout the Biden Administration are rhetorically discouraging investment in oil and gas development.” SEC officials said companies are interested in climate-related information. “The results of multiple recent surveys indicate that climate risks are among the most important priorities for a broad set of large asset managers,” the SEC said in its 140-page report. “PWC reported in their Annual Global CEO Survey that in 2016, only 39% of asset and wealth management CEOs reported that they were concerned about the threats posed by physical risks brought about by climate change, whereas this figure increased to 70% in 2021.” The SEC extended the comment period on the proposed rule from May 20 to June 17. The commission is accepting electronic comments. The letter is signed by Kay Ivey of Alabama, Mike Dunleavy of Alaska, Doug Ducey of Arizona, Asa Hutchinson of Arkansas, Brad Little of Idaho, Kim Reynolds of Iowa, Tate Reeves of Mississippi, Mike Parson of Missouri, Greg Gianforte of Montana, Pete Ricketts of Nebraska, Doug Burgum of North Dakota, Kevin Stitt of Oklahoma, Kristi Noem of South Dakota, Greg Abbott of Texas, Spencer Cox of Utah and Mark Gordon of Wyoming. Republished with the permission of The Center Square.