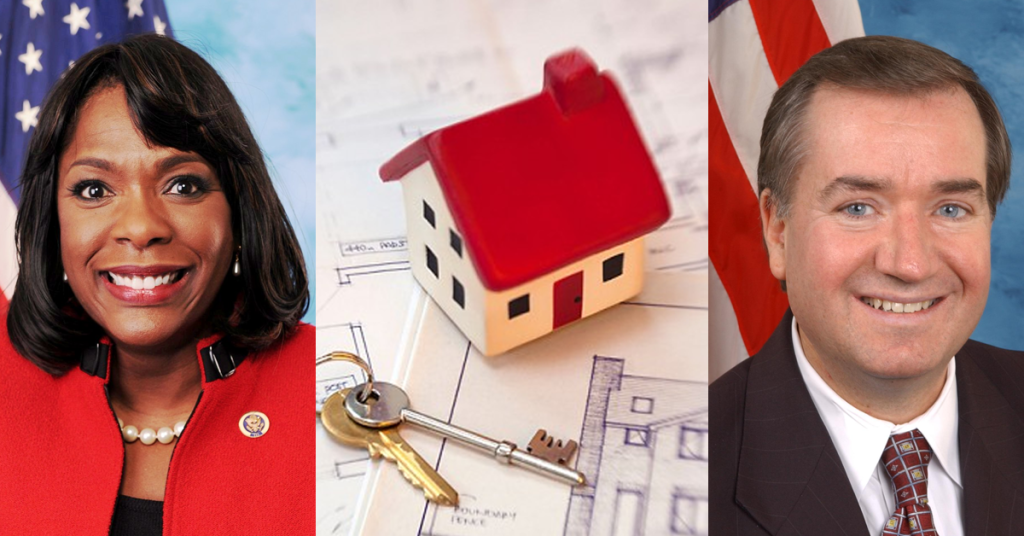

U.S. Reps. Terri Sewell, Ed Royce push to remove barriers to homeownership

Alabama U.S. Rep. Terri Sewell (AL-07) reached across the aisle Thursday to California U.S. Rep. Ed Royce (CA-40) in efforts to remove barriers to homeownership. The two – both members of the House Financial Services Committee – introduced, H.R. 4211, the Credit Score Competition Act of 2015, which allows the Government-Sponsored Enterprises (GSE) Fannie Mae and Freddie Mac to consider alternate credit scoring models when making mortgage lending decisions. “Fannie Mae and Freddie Mac are the largest mortgage purchasers in the nation, but they rely on credit score models that don’t necessarily take into account something as simple as whether borrowers have paid their rent on time,” Sewell said. “Home ownership is an integral part of the American Dream that shouldn’t be out of the reach for low-income, rural, and minority borrowers who lack access to traditional forms of credit. This legislation takes an important step towards addressing this issue and helps make homeownership a reality for more Americans across the country.” Fannie Mae and Freddie Mac currently evaluate their ability to purchase a mortgage based exclusively on a consumer’s FICO credit score. FICO scores are based on models and data from 1995 to 2000 that unnecessarily excludes millions of qualified borrowers. “The Credit Score Competition Act of 2015 allows Fannie Mae and Freddie Mac to consider modern and updated credit scoring models that give more creditworthy buyers access to affordable, home mortgages,” Sewell said. “It is my hope that this critically important legislation will help make homeownership a reality for many of the hard-working men and women living in Alabama’s 7th Congressional District.” The legislation will act to establish and preserve a competitive credit scoring marketplace by eliminating the Fannie and Freddie FICO monopoly and will foster innovation in the field and more affordable credit score products for consumers. “Breaking up the credit score monopoly at Fannie and Freddie will assist them in managing their credit risk and avoiding the need for another taxpayer bailout,” Royce said. “The GSEs’ use of a single credit score stifles innovation and affordability in the credit scoring field and bars millions of qualified homebuyers from purchasing a home.”

Zillow economist says homeownership not always best way

“Policies aimed at decreasing inequality by increasing homeownership often achieve the opposite,” said Zillow chief economist Stan Humphries in a column that appeared this past weekend on USAToday.com. “Overall, homeownership is a tremendous boost to millions. But in some specific cases, it simply does not deliver as advertised,” Humphries wrote. “[…] And our steadfast belief that homeownership is always the better option has led us to worry less about the one-third of Americans that rent, leading to a crisis in affordable rental housing.” In no state can a full-time minimum wage worker afford fair market rent for a one-bedroom or a two-bedroom apartment. In Alabama, a minimum wage employee would have to put in 72 hours per week for 52 weeks each year to afford rent and utilities on the average two-bedroom apartment. The answer, some say, lies in a dedicated stream of funding to build or rehab affordable rental housing. In 2008, the Bush Administration established a national pool of funds dedicated to housing low- and extremely low income Americans displaced by the economic crash. Most states supplement federal money with their own dedicated funding to provide more options for affordable rental housing. In 2012, Gov. Robert Bentley signed the Alabama Housing Trust Fund into law. However, Alabama is one of six states whose housing trust is authorized but unfunded in the state budget. This session, lawmakers will again consider whether to provide state funding for rental housing. House Bill 141 is with the House Financial Services Committee. The bill would increase mortgage recording fees from 15 cents per $100 to 30 cents, placing nearly $20 million into the Alabama Housing Trust Fund. An economic impact study conducted by Auburn University economics professor Dr. Keivan Deravi showed that Alabama needs about 90,000 rental housing units in order to meet the current need. That study also projected that investing $20 million annually into a housing trust fund would generate $1.1 billion in the state economy over 10 years, support 6,500 full time jobs, and produce more than 7,100 homes.