Student loan help for millions coming from Joe Biden after delay

President Joe Biden on Wednesday is set to announce his long-delayed move to forgive up to $10,000 in federal student loans for many Americans and extend a pause on payments to January, according to three people familiar with the plan. Biden has faced pressure from liberals to provide broader relief to hard-hit borrowers and from moderates and Republicans questioning the fairness of any widespread forgiveness. The delay in Biden’s decision has only heightened the anticipation for what his own aides acknowledge represents a political no-win situation. The people spoke on the condition of anonymity to discuss Biden’s intended announcement ahead of time. The precise details of Biden’s plan, which will include an income cap limiting the forgiveness to only those earning less than $125,000 a year, were being kept to an unusually small circle within the Biden administration and were still not finalized on the eve of the announcement. Down-to-the-wire decision-making has been a hallmark of the Biden White House, but the particular delay on student loans reflects the vexing challenge confronting him in fulfilling a key campaign promise. The plan would likely eliminate student debt entirely for millions of Americans and wipe away at least half for millions more. The nation’s federal student debt now tops $1.6 trillion after ballooning for years. More than 43 million Americans have federal student debt, with almost a third owing less than $10,000 and more than half owing less than $20,000, according to the latest federal data. The continuation of the pandemic-era payment freeze comes just days before millions of Americans were set to find out when their next student loan bills will be due. This is the closest the administration has come to hitting the end of the payment freeze extension, with the current pause set to end on August 31. Wednesday’s announcement was set for the White House after Biden returns from vacation in Rehoboth Beach, Delaware. The administration had briefly considered higher education schools in the president’s home state for a larger reveal but scaled back their plans. Biden was initially skeptical of student loan debt cancellation as he faced off against more progressive Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., who had proposed cancellations of $50,000 or more during the 2020 primaries. As he tried to shore up support among younger voters and prepare for a general election battle against then-President Donald Trump, Biden unveiled his initial proposal for debt cancellation of $10,000 per borrower, with no mention of an income cap. Biden narrowed his campaign promise in recent months by embracing the income limit as soaring inflation took a political toll and as he aimed to head off political attacks that the cancellation would benefit those with higher take-home pay. But Democrats, from members of congressional leadership to those facing tough re-election bids this November, have pushed the administration to go as broad as possible on debt relief, seeing it in part as a galvanizing issue, particularly for Black and young voters this fall. The frenzied last-minute lobbying continued Tuesday even as Biden remained on his summer vacation. Senate Majority Leader Chuck Schumer, D-N.Y., one of the loudest advocates in recent years for canceling student loan debt, spoke privately on the phone with Biden, imploring the president to forgive as much debt as the administration can, according to a Democrat with knowledge of the call. In his pitch, Schumer argued to Biden that doing so was the right thing to do morally and economically, said the Democrat, who asked for anonymity to describe a private conversation. Inside the administration, officials have discussed since at least early summer forgiving more than $10,000 of student debt for certain categories of borrowers, such as Pell Grant recipients, according to three people with knowledge of the deliberations. That remained one of the final variables being considered by Biden heading into Wednesday’s announcement. Democrats are betting that Biden, who has seen his public approval rating tumble over the last year, can help motivate younger voters to the polls in November with the announcement. Although Biden’s plan is narrower than what he initially proposed during the campaign, “he’ll get a lot of credit for following through on something that he was committed to,” said Celinda Lake, a Democratic pollster who worked with Biden during the 2020 election. She described student debt as a “gateway issue” for younger voters, meaning it affects their views and decisions on housing affordability and career choices. A survey of 18- to 29-year-olds conducted by the Harvard Institute of Politics in March found that 59% of those polled favored debt cancellation of some sort — whether for all borrowers or those most in need — although student loans did not rank high among issues that most concerned people in that age group. Some advocates were already bracing for disappointment. “If the rumors are true, we’ve got a problem,” Derrick Johnson, the president of the NAACP, which has aggressively lobbied Biden to take bolder action, said Tuesday. He emphasized that Black students face higher debut burdens than white students. “President Biden’s decision on student debt cannot become the latest example of a policy that has left Black people — especially Black women — behind,” he said. “This is not how you treat Black voters who turned out in record numbers and provided 90% of their vote to once again save democracy in 2020.” John Della Volpe, who worked as a consultant on Biden’s campaign and is the director of polling at the Harvard Kennedy School Institute of Politics, said the particulars of Biden’s announcement were less important than the decision itself. “It’s about trust in politics, in government, in our system. It’s also about trust in the individual, which in this case is President Biden.” Combined with fears about expanding abortion restrictions and Trump’s reemergence on the political scene, Della Volpe said student debt forgiveness “adds an additional tailwind to an already improving position with young people.” Republicans, meanwhile, see only political upside if Biden pursues a large-scale cancellation of student debt ahead

Majority of Americans say they are ‘falling behind’ rising cost of living

The majority of Americans feel they cannot keep up with the cost of living as inflation and the price of goods continue to rise, according to new polling data. A poll from NBC News asked Americans, “Do you think that your family’s income is … going up faster than the cost of living, staying about even with the cost of living, or falling behind the cost of living?” In response, 65% said they are falling behind, and 28% said they are staying about even with the cost of living. Only 6% said their income is going up faster than the cost of living.” The poll comes amid soaring inflation and gas prices. U.S. gasoline prices hit another record high Monday, with Americans paying $4.48 per gallon average for a gallon of regular gasoline. Gas prices have risen about 40 cents in the past month alone. The average price per gallon was $3.04 a year ago, a $1.44 increase. The latest inflation data has also shown a significant rise in prices since President Joe Biden took office, with price increases outpacing wage gains. Consumer prices have risen at the fastest rate in decades. “The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis after rising 1.2 percent in March…” the Bureau of Labor Statistics says. “Over the last 12 months, the all items index increased 8.3 percent before seasonal adjustment.” Biden has defended his work on the economy, pointing to the jobs recovered since the pandemic. Republicans, though, point to inflation and problems with the labor market. “As Americans face record-high prices at the pump, President Biden is continuing his war on American energy by canceling oil and gas leases in Alaska and the Gulf of Mexico,” said Rep. Kevin Brady, R-Texas. “Working families are already suffering from Biden’s inflation crisis and harmful policies.” Republished with the permission of The Center Square.

House votes to further restrict Russian trade after invasion

The House voted Thursday overwhelmingly to suspend normal trade relations with Russia and Belarus, preparing for President Joe Biden to enact higher tariffs on more products and further weaken the Russian economy in response to its military assault on Ukraine. The U.S. has already taken steps to shut off the importation of Russian oil, liquefied natural gas, seafood, alcohol, and diamonds. The vote on Thursday sets the stage for making it more expensive to import certain steel, aluminum, and plywood items, among other goods. The House vote was 424-8. The Senate is expected to take up the measure soon for final passage. The broad trade action, which would revoke “most favored nation” status for Russia, is being taken in coordination with the European Union and Group of Seven countries. The House vote came one day after Ukrainian President Volodymyr Zelenskyy pleaded with Congress and U.S. allies to do more to deter Russia’. “I’m asking to make sure that the Russians do not receive a single penny that they use to destroy people in Ukraine,” Zelenskyy said in a video address to Congress. In a joint statement introducing the trade bill, Reps. Richard Neal, D-Mass., and Kevin Brady, R-Texas, said Zelenskyy’s remarks “only strengthened our resolve to further isolate and weaken” Russian President Vladimir Putin. “We must do all we can to hold Putin accountable for senselessly attacking the Ukrainian people and undermining global stability,” the two lawmakers said. “The suspension of normal trade relations is an essential part of our effort to restore peace, save lives and defend democracy.” World Trade Organization rules generally require each member to provide its lowest tariff rates to all WTO members. Russia joined the WTO in 2012, and Congress overwhelmingly approved legislation that year, providing the president with the authority to extend normal trade relations status with Russia. But countries can enact exceptions to protect security interests. Still, the revocation would carry mostly symbolic weight. The earlier sanctions on imports of Russian oil, gas, and coal already cut off about 60% of U.S. imports from the country, but certain sectors of the economy could feel an effect. Senate Majority Leader Chuck Schumer, D-N.Y., said, “To date, both parties, Democrat and Republican, remain united in sending Putin a clear message: His inhumane violence against the Ukrainian people will come at a crippling price.” Tariffs make imports less competitive by increasing their costs to U.S. companies. Timothy Brightbill, a partner at Wiley Rein LLP who focuses on international trade law, said the effects on American consumers should be modest in most sectors as companies can generally turn to other suppliers. He said it’s important for U.S. supply chains not to run through Russia anymore and that consumers understand that. “Most American consumers would be happy to pay a bit more to ensure that their products and raw materials don’t support Russia and the Russian government,” Brightbill said. He also said that revoking Russia’s trade status sends a strong signal to China that the United States would not tolerate hostile actions against Taiwan. Eight Republicans voted against the House measure, but speakers from both parties forcefully advocated for its passage during the debate. Democratic Reps. Lloyd Doggett, D-Texas, and Earl Blumenauer, D-Ore., introduced an earlier version. “What Putin is doing in Ukraine, bombing civilians, targeting children, … is outside the circle of civilized human behavior,” said House Speaker Nancy Pelosi. “He is committing war crimes, and he must be held accountable.” Rep. Victoria Spartz, R-Ind., who was born in Ukraine, said the bill sends a message to Putin and his allies that “the West is serious.” “They cannot just go kill a bunch of people, destroy cities, kill women and children and then go back and have business as usual,” Spartz said. Republished with the permission of the Associated Press.

Mo Brooks and Gary Palmer urge FBI director to call Congressional shooting an ‘act of domestic terrorism’

Mo Brooks and Gary Palmer joined other leaders, sending a letter to FBI Director Christopher Wray. The letter urges Wray to call the 2017 shooting on Congress during a baseball game an act of domestic terrorism. Four people were shot during the practice session for the Annual Congressional Baseball game, including Congressman Steve Scalise, Capitol police officer Crystal Griner, congressional aide Zack Barth, and lobbyist Matt Mika. The shooter, James Hodgkinson, was shot and died from his wounds. According to CNN, Hodgkinson was a small business owner in Illinois who was very public on social media about his support of Bernie Sanders and his hatred of conservatives and President Donald Trump. Brooks stated on Twitter, “I joined several GOP colleagues who were targeted in 2017 by a Socialist gunman in sending a letter to @FBI Dir Wray, urging him to call the shooting what it was: an act of domestic terrorism that sought to assassinate Republican members of Congress. It was not “suicide by cop.” I joined several GOP colleagues who were targeted in 2017 by a Socialist gunman in sending a letter to @FBI Dir Wray, urging him to call the shooting what it was: an act of domestic terrorism that sought to assassinate Republican members of Congress. It was not “suicide by cop.” pic.twitter.com/gYj9fwOtLI — Mo Brooks (@RepMoBrooks) May 12, 2021 Other leaders who signed the letter include H. Morgan Griffith, Rodney Davis, Jeff Duncan, Barry Loudermilk, John Moolenaar, Jack Bergman, Roger Williams, Scott DesJarlais, Bill Johnson, Chuck Fleischmann, Kevin Brady, Trent Kelly, and Jim Jordan.

Dems propose $1,400 payments as part of Joe Biden virus relief plan

House Democrats on Monday proposed an additional $1,400 in direct payments to individuals as Congress began piecing together a $1.9 trillion COVID-19 relief package that tracks President Joe Biden’s plan for battling the pandemic and reviving a still staggering economy. Democrats on the Ways and Means Committee would expand tax credits for families with children, for lower-earning people, and those buying health insurance on marketplaces created by the 2010 Affordable Care Act. The panel, which plans to approve the measure by week’s end, would also provide health care subsidies for some unemployed workers. Less than three weeks into his presidency, Biden has declared that vanquishing the virus and resuscitating the economy are his top priorities. The coronavirus pandemic has killed over 460,000 Americans while the economy has lost 10 million jobs since the crisis began last year. Monday’s Ways and Means unveiling of its piece of the package — at over $900 billion, nearly half of Biden’s entire plan — came with Congress’ Democratic leaders hoping to rush the legislation to the president for his signature by mid-March, when existing emergency unemployment benefits expire. Their schedule reflects a desire by Biden and congressional Democrats to show they can respond swiftly and decisively to the crisis, even if, as seems likely, they must muscle past solid Republican opposition. “While it is still our hope that Republicans will join us in doing right by the American people, the urgency of the moment demands that we act without further delay,” said Ways and Means Chairman Richard Neal, D-Mass. Texas Rep. Kevin Brady, top Republican on that committee, criticized Democrats for driving ahead on the massive measure “without bipartisan compromise.” He said the GOP wants to focus on vaccine distribution and more targeted relief for workers, families, and small businesses — essentially previewing amendments Republicans are expected to propose during committee votes this week, some of which might win Democratic backing. House Education and Labor Committee Democrats also previewed their plans Monday. Their $350 billion package includes $130 billion to help schools reopen safely, $40 billion for colleges battered by the pandemic, and a plan to gradually raise the federal minimum wage to $15 an hour. The minimum wage increase faces an uphill climb, and even Biden has conceded it likely won’t survive. The Financial Services Committee proposal includes $50 billion to help the Federal Emergency Management Agency handle pandemic costs, plus $25 billion for struggling rental property owners and people at risk of homelessness. Transportation and Infrastructure Committee spending would include grants of $30 billion for struggling public transit agencies with starkly reduced ridership. Democrats have only narrow House and Senate majorities. Besides Republican opposition that could be unanimous, Democrats will have to balance party moderates who worry about a package going too far and progressives eager to push Biden as far leftward as they can. In one potential battleground within the party, the Ways and Means Democrats proposed limiting the full $1,400 relief payments to individuals making $75,000 or less, and phasing them out until they end completely at $100,000. Couples who make up to $150,000 would be entitled to $2,800 relief payments, which would gradually diminish and fully disappear for those earning $200,000. The income levels at which people qualify for the direct payments has caused rifts among Democrats, with moderates arguing that relief should be more narrowly targeted to people most in need. Biden has said he will not allow the per-person payments to fall below $1,400 but has indicated flexibility on the income thresholds. “There is a discussion right now about what that threshold will look like. A conclusion has not been finalized,” said White House press secretary Jen Psaki. Congress approved $600 per person direct payments in December. The additional $1,400 would bring the total to $2,000. Democrats have sought that amount for months, and it won support from then-President Donald Trump during his unsuccessful reelection campaign, even as it was opposed by many congressional Republicans. The Ways and Means proposal would increase emergency jobless aid to $400 weekly from its current $300. Benefits would last until Aug. 29, instead of March 14 as now scheduled. The new amount is still below the original $600 extra weekly benefit that was enacted last March but expired July 31. The plan would fight child poverty by increasing the child tax credit for families for one year. Now a maximum $2,000 annually, it would grow to up to $3,600 per child under 6 and as much as $3,000 for those up to age 17. Payments of the credit would be made monthly, even to families that owe no federal income taxes — a change from current policy. The bill also provides several pathways for people to get and keep health insurance, including an early test of Biden’s pledge to build on Obama’s health care law. One section would sweeten the subsidies provided under former President Barack Obama’s health law. The Biden administration has already announced a three-month special sign-up period for ACA coverage starting next Monday. The more generous financial assistance in the House bill would be available for this year and next. The bill would also cover 85% of the cost of premiums for workers trying to preserve their job-based health insurance after getting laid off. A federal law known as COBRA already allows them to temporarily keep their old employer’s health plan, but they typically have to pay prohibitively high premiums. The assistance would be available through Sept. 30. For workers without children, the plan proposes a significant expansion of the earned-income tax credit — a refundable credit currently claimed by taxpayers who earn an average of $20,000 a year. The EITC is viewed by its proponents as a major anti-poverty tool for working people. The legislation calls for the maximum credit for workers without children to be nearly tripled and for wider eligibility. It also contains tax breaks for some restaurants that have received pandemic aid. The bills’ details were announced as a report by the nonpartisan Congressional

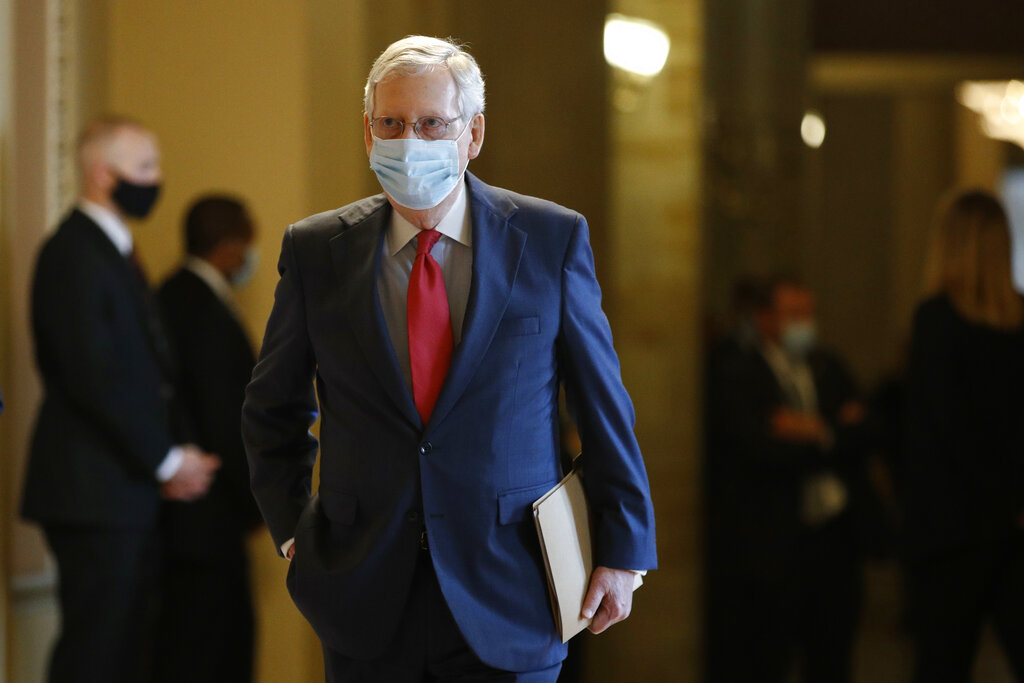

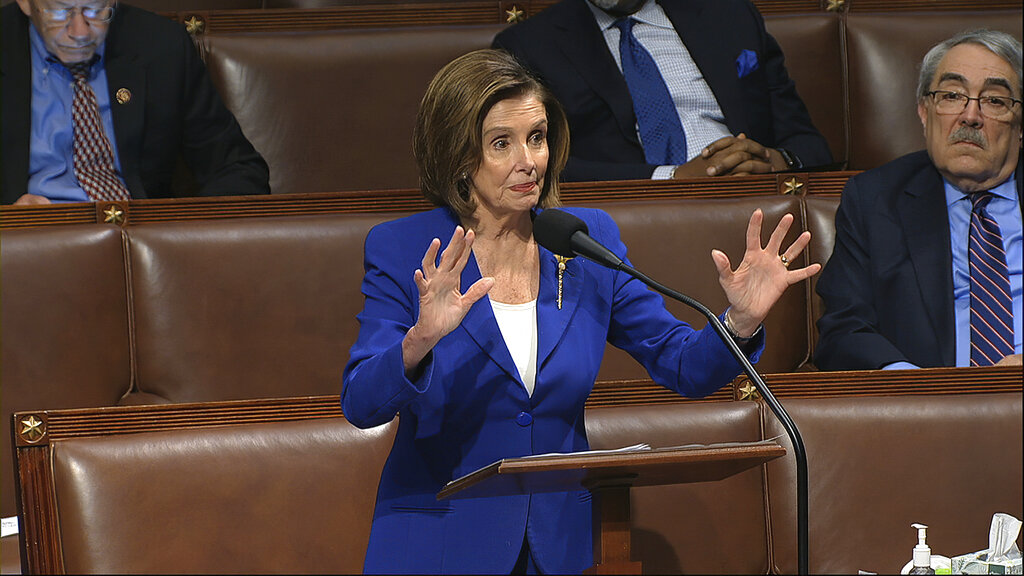

House approves Donald Trump’s $2K checks, sending to GOP-led Senate

The House voted overwhelmingly Monday to increase COVID-19 relief checks to $2,000, meeting President Donald Trump’s demand for bigger payments and sending the bill to the GOP-controlled Senate, where the outcome is uncertain. Democrats led passage, 275-134, their majority favoring additional assistance, but dozens of Republicans joined in approval. Congress had settled on smaller $600 payments in a compromise over the big year-end relief bill Trump reluctantly signed into law. Democrats favored higher payments, but Trump’s push put his GOP allies in a difficult spot. The vote deeply divided Republicans who mostly resist more spending. But many House Republicans joined in support, preferring to link with Democrats rather than buck the outgoing president. Senators were set to return to session Tuesday, forced to consider the measure. House Speaker Nancy Pelosi declared, “Republicans have a choice: Vote for this legislation or vote to deny the American people” the assistance she said they need during the pandemic. The showdown could end up as more symbol than substance. Senate Majority Leader Mitch McConnell, R-Ky., has declined to say publicly how the Senate will handle the bill when Democrats there try to push it forward for a vote on Tuesday. The legislative action during the rare holiday week session may do little to change the $2 trillion-plus COVID-19 relief and federal spending package that Trump signed into law Sunday, one of the biggest bills of its kind providing relief for millions of Americans. Rep. Kevin Brady of Texas, the chairman of the Ways and Means Committee, acknowledged the division and said Congress had already approved ample funds during the COVID-19 crisis. “Nothing in this bill helps anybody get back to work,” he said. The package the president signed into law includes two parts — $900 billion in COVID-19 aid and $1.4 trillion to fund government agencies. It will deliver long-sought cash to businesses and individuals and avert a federal government shutdown that otherwise would have started Tuesday, in the midst of the public health crisis. Aside from the direct $600 checks to most Americans, the COVID-19 portion of the bill revives a weekly pandemic jobless benefit boost — this time $300, through March 14 — as well as a popular Paycheck Protection Program of grants to businesses to keep workers on payrolls. It extends eviction protections, adding a new rental assistance fund. The COVID-19 package draws and expands on an earlier effort from Washington. It offers billions of dollars for vaccine purchases and distribution, for virus contact tracing, public health departments, schools, universities, farmers, food pantry programs, and other institutions and groups facing hardship in the pandemic. Americans earning up to $75,000 will qualify for the direct $600 payments, which are phased out at higher income levels, and there’s an additional $600 payment per dependent child. Meantime the government funding portion of the bill keeps federal agencies nationwide running without dramatic changes until Sept. 30. Together with votes Monday and Tuesday to override Trump’s veto of a sweeping defense bill, the attempt to send much higher pandemic-era checks to people is perhaps the last standoff of the president’s final days in office as he imposes fresh demands and disputes the results of the presidential election. The new Congress is set to be sworn in Sunday. Trump’s sudden decision to sign the bill in Florida, where he is spending the holidays, came as he faced escalating criticism from lawmakers on all sides over his eleventh-hour demands. The bipartisan bill negotiated by Treasury Secretary Steven Mnuchin had already passed the House and Senate by wide margins. Lawmakers had thought they had Trump’s blessing after months of negotiations with his administration. The president’s defiant refusal to act, publicized with a heated video he tweeted just before the Christmas holiday, sparked chaos, a lapse in unemployment benefits for millions, and the threat of a government shutdown in the pandemic. It was another crisis of his own making, resolved when he ultimately signed the bill into law. In his statement about the signing, Trump repeated his frustrations with the COVID-19 relief bill for providing only $600 checks to most Americans and complained about what he considered unnecessary spending, particularly on foreign aid — much of it proposed by his own budget. While the president insisted he would send Congress “a redlined version” with spending items he wants removed, those are merely suggestions to Congress. Democrats said they would resist such cuts. For now, the administration can only begin work sending out the $600 payments. A day after the signing, Trump was back at the golf course in Florida, the state where he is expected to move after President-elect Joe Biden is sworn in on Jan. 20. Republican Rep. Mo Brooks of Alabama, a conservative who supported Trump’s extraordinary and futile challenge of the election results, counted himself Monday among the opponents of a more generous relief package and Trump’s call for higher payments. “It’s money we don’t have, we have to borrow to get and we can’t afford to pay back,” he said on “Fox and Friends.” But Republican Rep. Elise Stefanik of New York said she was open to the idea of $2,000 checks. “Many Americans are in dire need of relief,” she said on the show. Altogether, Republicans and Democrats alike swiftly welcomed Trump’s decision to sign the bill into law. “The compromise bill is not perfect, but it will do an enormous amount of good for struggling Kentuckians and Americans across the country who need help now,” said Senate Majority Leader Mitch McConnell, R-Ky. “I thank the President for signing this relief into law.” Senate Democratic leader Chuck Schumer, D-N.Y., said he would offer Trump’s proposal for $2,000 checks for a vote in Senate — putting Republicans on the spot. “The House will pass a bill to give Americans $2,000 checks,” Schumer tweeted. “Then I will move to pass it in the Senate.” He said no Democrats will object. “Will Senate Republicans?” Democrats are promising more aid to come once Biden takes office, but Republicans are signaling a wait-and-see approach.

GOP weighs jobless aid cuts to urge Americans back to work

Revamping jobless aid is fast becoming the focus of debate over the next virus aid package.

House passes $2.2T rescue package, rushes it to Donald Trump

Donald Trump said he would sign the measure immediately.

Congress seen as not likely to pass tax overhaul quickly

After their humiliating loss on health care, Republicans in Congress could use a quick victory on a big issue. It won’t be an overhaul of the tax code. Overhauling the tax code could prove harder to accomplish than repealing and replacing Barack Obama‘s health law. Congressional Republicans are divided on significant issues, especially a new tax on imports embraced by House Speaker Paul Ryan. And the White House is sending contradicting signals on the new tax, adding to the uncertainty. House Republicans also can’t decide whether to move on from health care. Ryan canceled a scheduled vote on a House GOP plan after it became obvious that Republicans didn’t have the votes. He said he will continue to work on the issue but one of his top lieutenants on health care, Rep. Kevin Brady, R-Texas, says he is now “100 percent” focused on a tax overhaul. Ryan says Congress can work on both at the same time. It won’t be easy. Here’s why: ___ REPUBLICAN DIVIDE House and Senate Republicans largely agree on the broad outlines of a tax overhaul. They want to lower tax rates for individuals and corporations, and make up the lost revenue by scaling back tax breaks. But they are sharply divided on a key tenet of the House Republican plan. The new “border adjustment tax” would be applied to profits from goods and services consumed in the U.S., whether they are domestically produced or imported. Exports would be exempt. House GOP leaders say the tax is key to lowering the top corporate income tax rate from 35 percent to 20 percent. But good luck finding a single Republican senator who will publicly support the tax. Sen. Rob Portman, R-Ohio, is the latest in a long line of Republican senators to come out against the tax. ___ ABSENT DEMOCRATS Senate Finance Committee Chairman Orrin Hatch, R-Utah, says he wants to work with Democrats to overhaul the tax code. “A bipartisan bill would allow us to put in place more lasting reforms and give the overall effort additional credibility,” Hatch said. Majority Leader Mitch McConnell, R-Ky., has said it is bad policy to pass major legislation without bipartisan support. “Without some meaningful buy-in, you guarantee a food fight,” McConnell wrote in his memoir last year. “You guarantee instability and strife.” But in the House, Republicans haven’t reached out to Democrats in any meaningful way. ___ WHERE’S THE WHITE HOUSE? “Obviously we’re driving the train on this,” White House press secretary Sean Spicer said. But President Donald Trump‘s administration has been all over the map on tax reform. Trump at one point said the House border tax is too complicated, then said it’s in the mix. Treasury Secretary Steven Mnuchin told a Senate panel that “there would be no absolute tax cut for the upper class” in Trump’s tax plan. However, the plan Trump unveiled during his presidential campaign would provide big tax breaks to high-income households. Since taking office, Trump has promised “massive” tax cuts for the middle class. A former Treasury official under President Barack Obama says the White House needs to stake out clear goals on tax overhaul to guide the debate in Congress. “I think it’s important for the administration to signal early the general shape” of what they would like to accomplish so that there are fewer proposals vying for attention, said Michael Mundaca, a former assistant Treasury secretary now at Ernst & Young. ___ TAX CHANGE IS DIFFICULT There is a reason it’s been 31 years since the last time Congress rewrote the tax code. Since then, the number of exemptions, deductions and credits has mushroomed. Taxpayers enjoyed $1.6 trillion in tax breaks in 2016 — more than the federal government collected in individual income taxes. That huge number could provide plenty of tax breaks that lawmakers can scale back so they can lower tax rates significantly. There is just one problem — all of the biggest tax breaks are very popular and have powerful constituencies. Nearly 34 million families claimed the mortgage interest deduction in 2016. That same year more than 43 million families took advantage of a deduction of state and local taxes. The House Republicans’ tax plan would retain the mortgage deduction and eliminate the deduction for state and local taxes. ___ HEALTH CARE Both Trump and Republicans in Congress made big campaign promises to repeal and replace Obama’s health law, so the issue won’t go away. However, several players say negotiations on a way forward are non-existent. In the meantime, Trump is stoking animosity among a key voting bloc by criticizing them on Twitter. Two factions in the House GOP had members oppose the health plan: the hard-right Freedom Caucus and the moderate Tuesday Group. Ryan has suggested that they get together to sort out their differences, but it’s not happening, according to one key lawmaker. “We are not currently negotiating with the Freedom Caucus. There was never a meeting scheduled with the Freedom Caucus. We will never meet with the Freedom Caucus,” said Rep. Chris Collins, R-N.Y., a member of the Tuesday Group. Trump tweeted: “The Freedom Caucus will hurt the entire Republican agenda if they don’t get on the team, & fast. We must fight them, & Dems, in 2018!” To quote a favorite saying of the president, Not nice. Republished with permission of The Associated Press.