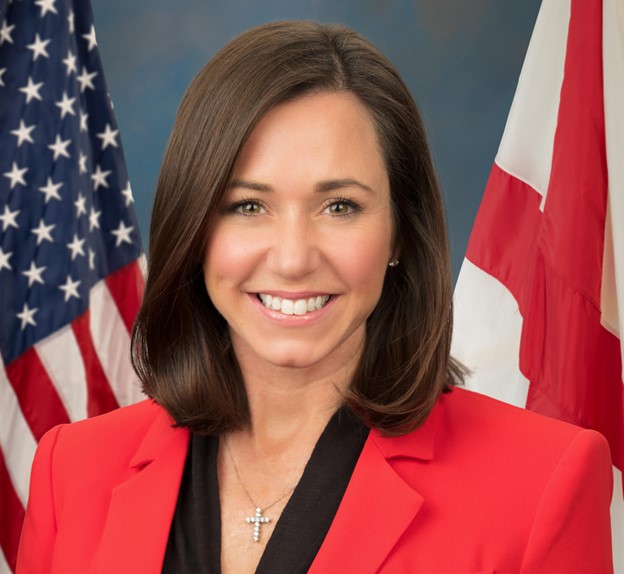

Katie Britt leads legislation to limit federal oversight into state-regulated insurance industry

On Tuesday, U.S. Senator Katie Britt (R-Alabama) led 16 of her Senate colleagues in introducing the Insurance Data Protection Act. This legislation would overrule a recent effort by the Federal Insurance Office (FIO) to step into the state-regulated insurance industry, including its proposed “Climate-Related Financial Risk Data Collection.” Britt said that the bill would eliminate the FIO Director’s subpoena authority. For over a century, the insurance industry was regulated by the states. That changed somewhat when the FIO was created in the Dodd-Frank Wall Street Reform and Consumer Protection Act. That Obama-era legislation does include an explicit provision stating that the Office does not have general supervisory or regulatory authority over the insurance business, which is supervised and regulated on a state-by-state basis across the United States. Senator Britt’s legislation clarifies that FIO does not need subpoena power since it is intended to function as an informational body. The bill would also require that the FIO coordinate any data collection efforts with state insurance regulators and assess all publicly available data and sources regarding the data being sought. These provisions would limit unnecessary data inquiries and prevent duplicative efforts across the state and federal landscapes. The bill would also set forth confidentiality procedures and requirements governing how data can be used by financial regulators if collected from insurers. This would ensure consumers’ information remains secure. “Our state insurance regulators have more than proven their ability to effectively and responsibly supervise the American insurance industry for over a century,” said Senator Britt. “FIO should work with, not around, state insurance officials. Not only is FIO overstepping its lawful authority and trampling on Congressional intent, but the office is also utilizing private insurance data to advance the Biden Administration’s leftwing Green New Deal agenda. This commonsense legislation would ensure the state-regulated insurance market remains strong, prevent redundant and unnecessary data reporting that would needlessly cost millions of dollars, and protect consumers’ sensitive information.” This legislation has been cosponsored by Senate Banking Committee Ranking Member Tim Scott (R-South Carolina). “As a former insurance agent, I know firsthand the importance of our state-based insurance regulation regime that has resulted in highly competitive and fair markets across the country – addressing local issues with local solutions,” said Sen. Scott. “That’s why I’ve been alarmed by the Federal Insurance Office’s (FIO) efforts to overstep its authority and push the Biden administration’s radical climate agenda. This important bill will reign in the administration’s climate activists, ensure greater coordination between FIO and state insurance regulators, and protect both consumers’ and insurers’ data.” Senators Marsha Blackburn (R-Tennessee), John Boozman (R-Arkansas), Ted Budd (R-North Carolina), Tom Cotton (R-Arkansas), Kevin Cramer (R-North Dakota), Mike Crapo (R-Idaho), Steve Daines (R-Montana), Bill Hagerty (R-Tennessee), John Kennedy (R-Louisiana), Cynthia Lummis (R-Wyoming), Pete Ricketts (R-Nebraska), Mike Rounds (R-South Dakota), John Thune (R-South Dakota), Thom Tillis (R-North Carolina), and J.D. Vance (R-Ohio) have all signed on to cosponsor the legislation. The National Association of Mutual Insurance Companies (NAMIC), American Property Casualty Insurance Association (APCIA), Association for Independent Agents (Big I), and Professional Insurance Agents (PIA) have endorsed this legislation. FIO is an office within the Treasury Department created by Dodd-Frank to monitor the insurance sector and help provide information to policymakers and state regulators, as needed, without regulatory authority. The climate risk assessments the FIO is collecting were requested in the President’s climate executive order and would require over 200 private insurance companies (over 70% of the homeowners’ insurance market) to provide to FIO highly-detailed data (broken down by zip code) regarding the effect of climate-related catastrophes on insurance availability and affordability for Americans. On November 1st, the Treasury announced its intention to move ahead with this data call. “Americans are facing growing challenges from extreme weather events caused by climate change,” Treasury Secretary Janet Yellen said in a statement about the FIO collection project. “The resulting data and analyses will help policymakers inform potential approaches to improving insurance availability and affordability for consumers.” While federal officials continue pushing for more detailed climate data from insurers, the National Association of Insurance Commissioners (NAIC) emphasizes climate concerns during its annual fall meeting. The Climate and Resiliency Task Force is expected to adopt a National Climate Resilience Strategy for Insurance to stabilize the insurance market. “It’s part of our overarching mission to manage risks, ensure the availability and reliability of insurance products, promote insurer solvency, and close protection gaps,” the strategy reads. “Our work to identify, assess, and communicate risk and risk reduction solutions, as well as to improve oversight of the insurance sector, has positioned state insurance regulators to implement a climate resilience strategy.” Katie Britt is a member of the Senate Committee on Banking, Housing, and Urban Affairs. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

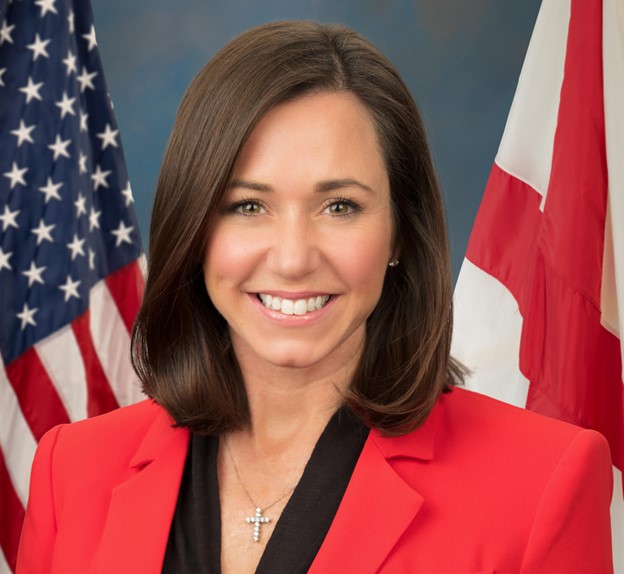

Senators Katie Britt, Marco Rubio, and colleagues demand answers on Iran’s nuclear program violations following attacks on Israel

On Wednesday, U.S. Senator Katie Britt (R-Alabama) joined Senator Marco Rubio (R-Florida) and 13 colleagues in sending a letter to Secretary of State Antony Blinken requesting an update on U.S. action to hold Iran accountable for multiple violations of nuclear program restrictions. The letter comes after this weekend’s multi-pronged attacks on the people of Israel by Hamas fighters that killed over 1300 Israelis and wounded 3,200 more. According to Secretary Blinken, at least 25 Americans are among the dead. Hamas has taken well over 100 hostages, and the White House believes that Americans are among the hostages. Republicans believe that the government of Iran financed and likely helped plan those attacks. “We respectfully request that the U.S. Department of State provide information regarding the status of the International Atomic Energy Agency’s (IAEA) investigation into Iran following the recent IAEA’s Board of Governors meeting,” the Senators wrote. “The Iranian regime is intent on fomenting terror across the region, as evidenced by its proxies, Hamas and Hezbollah’s, brutal attacks this weekend on our ally, Israel. Now more than ever, you must ensure that you hold the regime accountable for its failure to comply with obligations under the Nuclear Non-Proliferation Treaty (NPT). Further, we were disappointed that the administration did not call for a formal censure of Tehran given its continued non-compliance with the IAEA.” “The Biden Administration has failed to press for concrete action against Iran in Vienna,” the Senators continued. “We are especially disturbed by reports that the United States led efforts to oppose a censure of Iran. As Iran violates its commitments and refuses to comply with the IAEA, your business-as-usual approach to resolving the situation is tantamount to an endorsement of the Iranian regime’s activities.” “It is regrettable that the September 11-15, 2023, IAEA Board of Governors meeting achieved no progress in resolving key questions related to the Iranian regime’s nuclear program,” the Senators wrote. “Once again, Iran was able to escape any shred of accountability. As you know, since 2018, the IAEA has been investigating Iran’s undeclared nuclear material and activities related to a secret 2003 effort to produce atomic weapons called the Amad Plan. Despite the IAEA’s repeated requests to access several Iranian sites, it has not been able to determine whether Tehran retains covert nuclear weapons activities, nor has it investigated all sites, personnel, and documentation related to the Amad Plan and its successor entities, such as Organization of Defensive Innovation and Research (SPND).” Joining Senators Britt and Rubio in signing the letter were Senators Bill Cassidy (R-Louisiana), Rick Scott (R-Florida), Marsha Blackburn (R-Tennessee), Joni Ernst (R-Iowa), Kevin Cramer (R-North Dakota), Bill Hagerty (R-Tennessee), Jerry Moran (R-Kansas), Pete Ricketts (R-Nebraska), Thom Tillis (R-North Carolina), Roger Wicker (R-Mississippi), Tim Scott (R-South Carolina), Mike Braun (R-Indiana), and Susan Collins (R-Maine). In 2015, the Joint Comprehensive Plan of Action (JCPOA) was signed by the Obama Administration. Iran and other countries agreed to place restrictions on Iran’s nuclear program in exchange for sanctions relief. One condition included the JCPOA tasking the International Atomic Energy Agency (IAEA) to ensure the regime in Tehran adheres to nuclear restrictions. The Senators claim that even with the signed agreement, Iran has remained non-compliant and continues its nuclear programs. Senator Britt has been an outspoken critic of the Biden Administration’s controversial decision to free up $6 billion of seized illicit oil sales revenue to Iran to facilitate a prisoner exchange with Iran. The five Iranian-Americans appear to have been wrongfully jailed solely because they were American citizens. Britt warned at the time that the ransom payments would only result in more Americans being taken hostage. When the Administration formally notified Congress of the deal on September 11th, Britt warned, “This irresponsible, weak appeasement sends a terrible message across the globe and only incentivizes further hostage taking in the future.” Today, countless Israeli hostages have been taken into Gaza by Hamas. Senator Britt this week joined a letter led by Senator Blackburn (R-Tennessee) calling on the Biden Administration to re-freeze the $6 billion. Sen. Britt was elected to the Senate in 2022. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

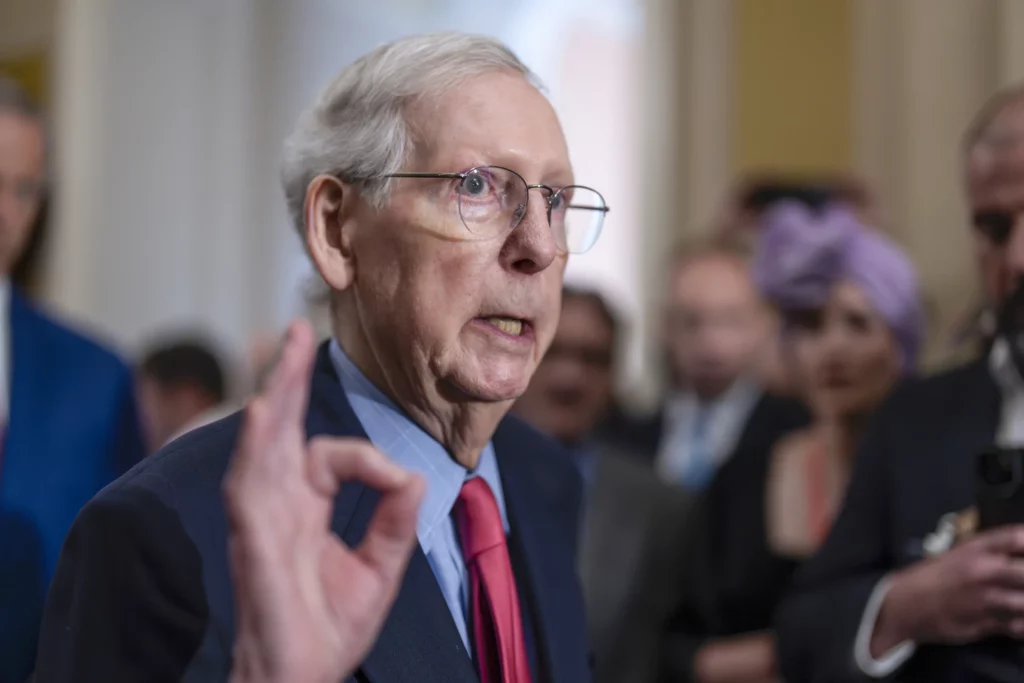

Mitch McConnell tries to reassure colleagues about his health, vows to serve out term as Senate GOP leader

Senate Republican Leader Mitch McConnell declared again Wednesday that he plans to finish his term as leader despite freezing up at two news conferences over the summer, brushing off questions about his health as he sought to reassure colleagues he’s still up to the job. At a weekly, closed-door lunch with fellow GOP senators on Wednesday, McConnell pointed to the statement released a day earlier by attending physician Brian P. Monahan about his health. He said he was ready to move forward with the Senate’s busy fall agenda. Monahan’s statement, released by McConnell’s office, said there was no evidence that the 81-year-old McConnell had a stroke or was suffering from a seizure disorder after he froze up and appeared unable to speak for 20-30 seconds at two different news conferences. The episodes came after the GOP leader fell and suffered from a concussion earlier this year. “I’m going to finish my term as leader, and I’m going to finish my Senate term,” McConnell told reporters, dismissing questions and requests for more detail about his medical condition. “I have nothing to add” to Monahan’s statement, he said. McConnell’s words to the press and his colleagues were his latest efforts to assuage growing concerns about his health and silence questions about whether he can continue to lead his party in the Senate. The famously private Kentucky senator has faced some criticism from colleagues for remaining quiet about the incidents and his health, which has visibly declined since the concussion. Behind closed doors, McConnell told other Republicans that his health issues are linked to his concussion. He believes that is a “plausible answer” to the questions, Texas Sen. John Cornyn said. Cornyn said McConnell “hasn’t missed a step” in terms of his cognitive abilities or ability to lead. But “physically, it’s been tougher.” “He was more transparent, which I’m glad he did,” Cornyn said of McConnell’s comments at the private lunch. “This is not his style. But I don’t think keeping things close to the vest serves his interests, and it created a lot of speculation. So I think this is a positive development.” Other Republican senators also said they were satisfied with McConnell’s explanation for the two incidents, the first in Washington in July just before the August recess and the second in Kentucky last week. “I feel really good; I’m behind Mitch, and let’s move forward,” said Sen. Lindsey Graham, R-S.C. North Carolina Sen. Thom Tillis said McConnell has ”broad support, and I think that’s known by the majority of the conference.” North Dakota Sen. Kevin Cramer, who had called for more transparency from McConnell, said the leader’s remarks were “a strong message. It was confident on his part. It was very direct.” Alabama Sen. Tommy Tuberville said that as part of his remarks to the GOP conference, McConnell touted that he’d raised $49 million for Republican Senate candidates in August. “He convinced me” of his ability to lead, Tuberville said. Still, Tuberville said the circumstances could change. “I don’t think there will be anything else said about it unless there’s another incident,” Tuberville said. “And that’s what we’re hoping.” The letter from Monahan that McConnell released Tuesday said there is “no evidence that you have a seizure disorder or that you experienced a stroke, TIA or movement disorder such as Parkinson’s disease.” TIA is an acronym for a transient ischemic attack, a brief stroke. But there was no elaboration as to what did cause McConnell’s episodes. The doctor said the assessments entailed several medical evaluations including a brain MRI scan and “consultations with several neurologists for a comprehensive neurology assessment.” “There are no changes recommended in treatment protocols as you continue recovery from your March 2023 fall,” Monahan said. Even though the majority of GOP senators have supported McConnell, some have raised questions. Republican Sen. Rand Paul, a doctor, and McConnell’s Kentucky colleague, has questioned whether the episodes were really caused by dehydration, as McConnell’s aides and the Capitol doctor have implied. After attending the lunch, Paul said he had no comment. Missouri Sen. Josh Hawley said he’s concerned about the leader’s health, adding that his health issues could undermine Republican arguments that President Joe Biden, 80, is too old for another term in office. “I mean, if you’re concerned about the president’s ability to do his job, and I am, and a lot of Republicans say they are, then you’ve got to be concerned when it’s somebody from your own party,” Hawley said. The top potential successors to McConnell as leader — Cornyn, South Dakota Sen. John Thune and Wyoming Sen. John Barrasso — have stood by him. “He was very strong, sharp in the lunch today,” said Thune, the No. 2 Republican leader. “He talked a lot about not just (his health) but the other issues we’re dealing with here in the Senate. I think everybody left feeling very good about where he’s at.” First elected to the Senate in 1984 and as leader in 2007, McConnell became the longest-serving Senate party leader in January. He would have to run again for leader after next year’s elections, and his next reelection to the Senate would be in 2026. McConnell will be a central figure as Congress returns from an extended summer break to a flurry of activity, most notably the need to approve funding to prevent any interruption in federal operations by Sept. 30, which is the end of the fiscal year. Some House Republicans are willing to shut down the government at the end of the month if they are unable to enact steep spending restrictions that go beyond the agreement Biden reached with Republican House Speaker Kevin McCarthy earlier this summer. Republished with the permission of The Associated Press.

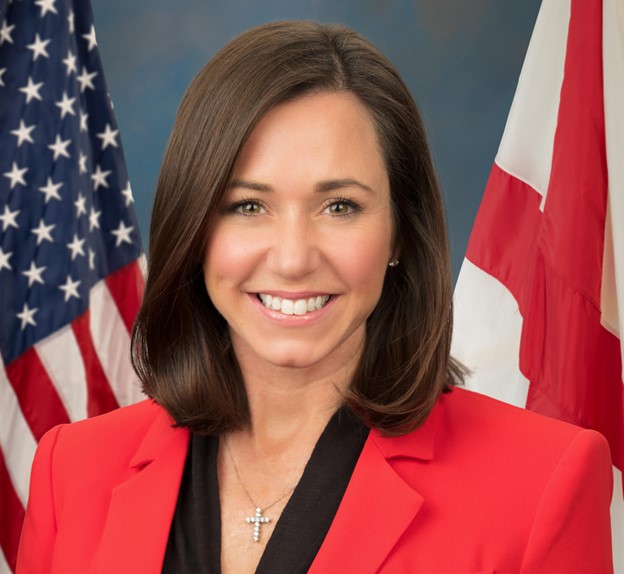

Katie Britt and colleagues demand answers after Biden Administration hands over $6 billion to Iran

On Monday, U.S. Senator Katie Britt (R-Alabama) joined a letter by Sen. Tim Scott (R-South Carolina), the ranking member of the Senate Committee on Banking, Housing, and Urban Affairs, and 24 of her Republican colleagues in demanding answers from the Biden Administration about the approximately $6 billion reportedly paid to Iran in exchange for Americans wrongfully being held as political hostages by the Iranian regime. “Handing $6 billion to the world’s largest state sponsor of terrorism is a reckless and disastrous decision that threatens the lives of Americans and our allies across the globe,” said Senator Britt. “Once again, the Biden Administration has chosen to appease our adversaries and set a dangerous precedent. President [Joe] Biden’s weakness will only embolden hostile actors to engage in further aggression around the world. We must achieve peace through strength, and I will always fight to hold this Administration accountable for putting American families at risk.” In a letter to Secretaries Antony Blinken and Janet Yellen, the senators wrote, “When the Obama administration released $400 million in liquidated assets to Iran in 2016, we warned that this dangerous precedent would put a price on American lives. Seven years later, the current administration is providing a ransom payment worth at least fifteen times that amount to the world’s largest state sponsor of terror, in yet another violation of the United States’ long-standing ‘no concessions’ policy. In the release of Executive Order 14078 on July 19, 2022, the White House admitted that ‘terrorist organizations, criminal groups, and other malicious actors who take hostages for financial, political, or other gain—as well as foreign states that engage in the practice of wrongful detention, including for political leverage or to seek concessions from the United States—threaten the integrity of the international political system and the safety of United States nationals and other persons abroad.’ The release of such a significant sum to the Iranian regime runs entirely counter to that claim and will only serve to encourage additional hostage-taking for financial or political gain.” Joining Senators Britt and Scott on the letter were Senators Jim Risch (R-Wisconsin), Roger Wicker (R-Mississippi), Tom Cotton (R-Arkansas), Bill Hagerty (R-Tennessee), Bill Cassidy (R-Louisiana), Chuck Grassley (R-Iowa), Lindsey Graham (R-South Carolina), Steve Daines (R-Montana), Marsha Blackburn (R-Tennessee), Kevin Cramer (R-North Dakota), Ted Budd (R-North Carolina), J.D. Vance (R-Ohio), John Cornyn (R-Texas), Joni Ernst (R-Iowa), Pete Ricketts (R-Nebraska), John Hoeven (R-North Dakota), Todd Young (R-Indiana), Mike Crapo (R-Idaho), Roger Marshall (R-Kansas), James Lankford (R-Oklahoma), Thom Tillis (R-North Carolina), John Kennedy (R-Louisiana), John Barrasso (R-Wyoming), and Shelley Moore Capito (R-West Virginia) After more than two years of quiet negotiations, Iran has released five Iranian American dual citizens into house arrest, according to original reporting by the New York Times – quoting officials at the State Department and the National Security Council. “This is just the beginning of a process that I hope and expect will lead to their return home to the United States,” Secretary of State Antony Blinken said on Thursday. “There’s more work to be done to actually bring them home. My belief is that this is the beginning of the end of their nightmare.” The prisoners are Siamak Namazi, Emad Sharghi, and Morad Tahbaz, who had all been jailed on unsubstantiated charges of spying, as well as two others whose families have withheld their names. One of the unnamed Americans is a scientist, and the other is a businessman, according to sources. In addition to releasing the $6 billion in seized oil funds, the U.S. has agreed to hand over imprisoned Iranians as part of the prisoner swap. Britt and her colleagues had objected to paying the ransom before the deal had been finalized. Britt was elected to the Senate in 2022. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Tommy Tuberville joins Republicans urging Defense Department to halt sales of border wall materials

On Tuesday, U.S. Senator Tommy Tuberville (R-Alabama) joined U.S. Sen. Roger Wicker (R-Mississippi), the ranking member of the Senate Armed Services Committee, and all the Republican members of the Senate Armed Services Committee, in a letter to the Department of Defense to halt the sale of border wall construction materials. The letter, addressed to Secretary of Defense Lloyd Austin, was in response to reports that the Defense Department was moving quickly to dispose of the unused border wall materials before the provisions of Wicker’s FINISH It Act could be implemented. “We are deeply disappointed to learn that rather than using construction materials that were purchased to secure the southwest border for that purpose, the Department of Defense has begun auctioning these materials off for other purposes,” the senators wrote. “These auctions represent a brazen attempt to circumvent the FINISH IT Act, which was included in both the House and Senate FY2024 National Defense Authorization Act.” As ranking member of the Armed Services Committee, Wicker worked with Republicans to insert the legislation, which would force the administration to allow the materials to be used to complete sections of the southern border wall, in this year’s National Defense Authorization Act (NDAA). The NDAA passed the Senate with a broad bipartisan majority and the provisions of the FINISH It Act were also included in the House-passed version of the NDAA. However, Congress has not passed the final conference committee version of the NDAA. The Senators believe Austin and the Defense Department are taking the opportunity to auction all the unused border wall materials for scrap metal while Congress is still on its August recess. The Senators are calling to halt further auctions of border wall materials and requesting detailed information on the current sales. The letter calls for the administration to direct the Department of Defense Inspector General to investigate Assistant Secretary of Defense for Homeland Defense and Hemispheric Affairs Melissa Dalton for her failure to provide Congress with accurate and timely information about the use of these border wall construction materials. The Senate Armed Services Committee Republicans have pledged to never consent to a confirmation hearing for the nominee for Under Secretary of Defense for Policy until the senators’ concerns are addressed. The DOD’s combat support branch, the Defense Logistics Agency (DLA), confirmed to reporters with Power Corridor last week that the Pentagon is now moving ahead with the sale of the leftover materials, many of which have been sitting for years in piles on government and private land out West. The items up for auction this week are “excess border wall materials that the U.S. Army Corps of Engineers turned over to the DLA for disposition and are now for sale,” a DLA spokesperson said. Leading the liquidation is Gov Planet, an online auction marketplace run by publicly traded Canadian company Ritchie Bros. Auctioneers. This week, Gov Planet began posting photos on its website and social media of large sections of the unbuilt wall, understood to be worth hundreds of millions of dollars. Sens. Tuberville and Wicker were joined by Sens. Deb Fischer (R-Nebraska), Tom Cotton (R-Arkansas), Mike Rounds (R-South Dakota), Joni Ernst (R-Iowa), Dan Sullivan (R-Alaska), Kevin Cramer (R-North Dakota), Rick Scott (R-Florida), Markwayne Mullin (R-Oklahoma), Ted Budd (R-North Carolina), and Eric Schmitt (R-Missouri). Tuberville stated that he supports common-sense policies that strengthen our border and national security, like building the wall and reinstating the Migrant Protection Protocols, also known as the Remain in Mexico policy. Senator Tuberville has spoken about his concerns on the floor of the U.S. Senate and called on the Biden administration to act. Tuberville has made multiple visits to the southern border to bring attention to the border situation. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Sen. Katie Britt and colleagues urge CMS to adjust proposed payment update in final rule

U.S. Senator Katie Britt (R-Alabama) recently joined a bipartisan coalition of 33 Senators in a letter led by Bob Menendez (D-New Jersey) and Kevin Cramer (R-North Dakota) requesting that the Centers for Medicare and Medicaid Services (CMS) Administrator, Chiquita Brooks-LaSure, use the agency’s special exceptions and adjustments authority to update the proposed payment update in the final inpatient prospective payment system rule. “I’m glad to join this bipartisan letter urging CMS to adjust its Medicare fee-for-service payment rate to more accurately reflect costs incurred by hospitals in our current inflationary economy,” said Sen. Britt. “It is vital to our hospitals and healthcare system that the most up-to-date information is used to support the important care they provide to Medicare patients. I’ll continue to fight to ensure that every American and Alabamian has the opportunity to receive quality health care, regardless of their zip code.” Sen. Tommy Tuberville also joined the letter. “We write today to express our concern regarding the proposed payment updates included in the Centers for Medicare & Medicaid Services’ (CMS) inpatient prospective payment system (IPPS) proposed rule for fiscal year (FY) 2024,” wrote the senators to Administrator Brooks-LaSure. “We are concerned that the proposed payment updates do not fully account for the current cost of care and will result in an overall payment reduction for hospitals in FY2024.” The senators highlighted their view that during the FY2024 proposed rule, CMS relies on historical data that does not predict the impact of the current elevated cost of providing care and the increased growth in expenses due to labor and supply chain costs. They also pointed out that the productivity update included in the proposed rule assumes hospitals can replicate the general economy’s productivity gains when in fact, hospitals and health systems continue to face productivity declines. “Conditions like the ones currently facing hospitals require a heightened review of payment policy. We respectfully request that CMS consider using its special exceptions and adjustments authority to make a retrospective adjustment to account for the difference between the market basket update that was implemented for FY 2022 and what the market basket actually is for FY 2022,” added the senators. “These important changes will ensure Medicare payments for acute care services more accurately reflect the cost of providing hospital care today and for the coming year. On behalf of our hospitals and health systems nationwide, we appreciate your attention to these concerns.” This effort is supported by the American Hospital Association and the Alabama Hospital Association. “The American Hospital Association (AHA) thanks Senators Menendez and Cramer for leading this important bipartisan effort urging CMS to ensure hospitals and health systems have the resources they need to continue delivering high-quality care to their patients and communities,” said Lisa Kidder Hrobsky, AHA Senior Vice President, Advocacy and Political Affairs. “This support is more needed than ever as the hospital field continues to confront rising inflation, workforce shortages, and surging costs for supplies and drugs.” Katie Britt was elected to her first term in the Senate in 2022. To connect with the author of this story or to comment, email brandonmreporter@gmail.com

Sen. Katie Britt joins colleagues in introducing bicameral bill to protect American businesses from SEC overreach

U.S. Senator Katie Britt (R-Alabama) joined Sen. Mike Rounds (R-South Dakota) and eight of their Senate colleagues in reintroducing legislation to only allow the U.S. Securities and Exchange Commission (SEC) to impose future disclosure requirements on publicly traded companies if the information is important for investors’ decisions. “If this Administration continues to try and enforce its radical Green New Deal policies on every corner of America, this reckless, partisan overreach is going to result in fewer American jobs, higher inflation, and more competitive advantages for foreign competitors in the marketplace,” said Sen. Britt. “American companies should not be held hostage by unelected bureaucrats. I’m proud to support this commonsense legislation that would uphold fiscal sanity and free-market values in our economy.” “The heavy hand of government is hampering the growth of our businesses and economy,” said Sen. Rounds. “This legislation would seek to depoliticize the SEC by preventing the agency from requiring reporting of unnecessary information and instead focus on protecting investors, maintaining fair and efficient markets and facilitating capital formation.” In March 2022, the SEC issued a rule requiring any public company to disclose its direct and indirect greenhouse gas emissions, including reporting by downstream suppliers like farmers and ranchers, even if that information is not relevant to investors. This rule would potentially limit access to capital, discourage new companies from going public and result in onerous reporting requirements that will be borne by farmers and small businesses. The Mandatory Materiality Requirement Act would refocus future SEC disclosure requirements on what is important: the information investors need to make smart investment decisions. Specifically, it would amend both the Securities Act of 1933 and the Securities Exchange Act of 1934 by inserting statutory language directly into both acts saying an “issuer is only required to disclose information in response to disclosure obligation adopted by the Commission to the extent the issuer has determined that such information is important with respect to a voting or investment decision regarding such issuer.” Sens. Britt and Rounds were joined by Sens. Thom Tillis (R-North Carolina), Bill Hagerty (R-Tennessee), Cynthia Lummis (R-Wyoming), Steve Daines (R-Montana), Chuck Grassley (R-Iowa), John Boozman (R-Arkansas), Kevin Cramer (R-North Dakota), and Dan Sullivan (R-Alaska) in introducing this legislation. SEC chair Gary Gensler advanced the SEC rule. Gensler has advocated for the SEC to consider climate-related and social issues in its regulatory policy since he took office in 2021. Gensler said climate reporting rules are a concern for investors and fit in with a tradition of disclosure requirements dating back to the Great Depression. Katie Britt was elected to the Senate in 2022. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Katie Britt and Senate colleagues introduce a bipartisan bill to cut compensations from failed bank executives

U.S. Senator Katie Britt on Friday joined Senator J.D. Vance (R-Ohio), Senator Elizabeth Warren (D-Massachusetts), and a bipartisan group of colleagues in introducing the Failed Bank Executives Clawback Act. This legislation would enable federal regulators to claw back compensation from bank executives who are responsible for the reckless decisions that resulted in their institution’s failures. “When executives drive financial institutions into failure with reckless business practices, they shouldn’t be allowed to use their golden parachutes to escape responsibility while their customers, their employees, and hardworking American families are left footing the bill for the failure of their bank,” said Sen. Britt. “This commonsense legislation will dissuade risky bank mismanagement and ensure that bad actors are held accountable.” “The executives responsible for running their banks into the ground are sitting on millions of dollars in compensation and bonuses. Meanwhile, the American people are bearing the financial burden for their excessive risk-taking and gross mismanagement,” said Sen. Vance. “This legislation would right that wrong and ensure that failed bank executives are held accountable for the collapse of their institutions – not the American taxpayer.” “Nearly three months after the collapse of Silicon Valley Bank, a bipartisan group of Senators is demonstrating a serious commitment to pass legislation requiring financial regulators to claw back pay from executives when they implode their bank,” said Sen. Warren. “Congress must answer the President’s call for stronger laws to hold failed bank executives accountable, and I’m determined to work with lawmakers on both sides of the aisle in the Senate Banking, Housing, and Urban Affairs Committee to deliver change.” The bill would expand the existing authority of the Federal Deposit Insurance Corporation (FDIC) to claw back the compensation of bank executives when they are found to have substantially contributed to the collapse of a financial institution by engaging in reckless business practices. Any funding that is clawed back will be directed to the FDIC’s Deposit Insurance Fund. This legislation was introduced in light of the recent collapses of Silicon Valley Bank (SVB) in California and Signature Bank in New York. Sponsors claim that considering the cost of the institutions’ collapse to the FDIC’s Deposit Insurance Fund and impact to the broader banking sector, this legislation is needed to deter future bad actors. Sen. Britt questioned former SVB CEO Greg Becker at a recent Banking Committee hearing, demanding answers about his responsibility in the bank’s collapse and his plans to give back the $1.5 million bonus he received. “If the team would have known it was going to be the fastest rate in history, I believe they would have considered different decisions,” Becker testified. “Senator, I was the CEO of Silicon Valley Bank. I take responsibility for what ultimately happened.” Co-sponsors of the bill also include U.S. Senators Bob Menendez (D-New Jersey), Mark Warner (D-Virginia), Kevin Cramer (R-North Dakota), Chris Van Hollen (D-Maryland), Tina Smith (D-Minnesota), Raphael Warnock (D-Georgia), John Fetterman (D-Pennsylvania.), Catherine Cortez Masto (D-Nevada), Josh Hawley (R-Missouri.), and Mike Braun (R-Indiana). To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Katie Britt and colleagues introduce the Back the Blue Act

On Monday. U.S. Senator Katie Britt joined U.S. Senator John Cornyn, U.S. Senator Tommy Tuberville, and 37 Republican colleagues to introduce the Back the Blue Act. The announcement coincided with the annual observance of Peace Officers Memorial Day and National Police Week. This legislation will strengthen existing laws that protect police officers, increase the criminal penalties for individuals who target law enforcement, and expand the tools that police can use to protect themselves. “Today, we honor the courageous law enforcement officers who have valiantly made the ultimate sacrifice,” Sen. Britt said. “Every single day, the brave men and women of law enforcement go above and beyond to serve and protect our communities. It is essential that we not only support our police, but we respect the rule of law in our country. I’m proud to join Senator Cornyn and my colleagues in introducing the Back the Blue Act, and I will always stand with our police officers in Alabama and across the country.” “The Back the Blue Act adds stiff, mandatory penalties and makes it a federal crime to kill – or attempt to kill – a law enforcement officer, a federal judge, or a federally funded public safety officer,” Sen. Cornyn said. “We must make it absolutely clear that violence against them will not be tolerated. In honor of National Police Week, we honor the brave men and women who protect us, we pay tribute to those who made the ultimate sacrifice, and we commit to doing everything in our power to ensure that they have all the resources they need to keep our people safe.” “Today marks the start of National Police Week,” Sen. Tuberville said on Twitter. “America’s brave men and women in blue wake up every day prepared to sacrifice their own safety in service to their fellow Americans. It is more important than ever that we show our support. To all who protect and serve, thank you.” In addition to Senators Britt, Tuberville, and Cornyn, this legislation is cosponsored by Senate Minority Leader Mitch McConnell (R-Kentucky), Senate Judiciary Committee Ranking Member Lindsey Graham (R-South Carolina), and Senators Ted Cruz, Thom Tillis, Rick Scott, Jerry Moran, Mike Braun, Kevin Cramer, Marsha Blackburn, John Boozman, Deb Fischer, Shelley Moore Capito, Mike Crapo, Marco Rubio, Jim Risch, Pete Ricketts, Steve Daines, John Barrasso, James Lankford, Cindy Hyde-Smith, John Kennedy, Tom Cotton, John Thune, John Hoeven, Ted Budd, Josh Hawley, Tim Scott, Bill Hagerty, Roger Marshall, Bill Cassidy, Joni Ernst, Chuck Grassley, Todd Young, Eric Schmitt, Cynthia Lummis, and Roger Wicker. The Back the Blue Act has been introduced in Congress multiple times since 2017. Senator Britt is also a cosponsor of Senator Braun’s Thin Blue Line Act, which expands the list of statutory aggravating factors in capital punishment determinations to also include killing or targeting a law enforcement officer, firefighter, or other first responders. To connect with the author of this story or to comment, email brandonmreporter@gmail.com

Tommy Tuberville and GOP Colleagues urge Joe Biden to negotiate on debt limit

U.S. Senators Tommy Tuberville and Katie Britt joined U.S. Senator Mike Lee and dozens of Republican colleagues in calling for fiscal responsibility and spending control measures in debt ceiling negotiations. Tuberville joined a GOP letter to Majority Leader Chuck Schumer declaring broad Republican opposition to any debt ceiling legislation that lacks significant spending control measures. “It is now clear that Senate Republicans aren’t going to bail out Biden and Schumer. They have to negotiate,” said Sen. Lee. “I thank my colleagues for joining my effort to emphasize this point in the clearest possible terms.” “The Senate Republican conference is united behind the House Republican conference in support of spending cuts and structural budget reform as a starting point for negotiations on the debt ceiling,” wrote the senators. “This trajectory must be addressed with fiscal reforms.” The letter emphasizes the GOP senators’ united front with the House Republican conference, advocating for spending cuts and structural budget reforms as prerequisites for any negotiation on raising the debt ceiling. “Dear Leader Schumer, The Senate Republican Conference is united behind the House Republican Conference in support of spending cuts and structural budget reform as a starting point for negotiations on the debt ceiling. Our economy is in free fall due to unsustainable fiscal policies. This trajectory must be addressed with fiscal reforms. Moreover, recent Treasury projections have reinforced the urgency of addressing the debt ceiling. The House has taken a responsible first step in coming to the table with their proposals. It is imperative that the president now do the same. As such, we will not be voting for cloture on any bill that raises the debt ceiling without substantive spending and budget reforms,” the Senators wrote. Senators Tuberville, Britt, and Lee, current signatories include U.S. Senators Marsha Blackburn, Ted Cruz, Mike Crapo, Ted Budd, Mike Braun, James Lankford, Cynthia Lummis, Roger Marshall, M.D., Ron Johnson, James Risch, Eric Schmitt, Rick Scott, John Cornyn, Kevin Cramer, Markwayne Mullin, Roger Wicker, Steve Daines, Lindsey Graham, John Barrasso, Deb Fischer, Tim Scott, John Hoeven, Thom Tillis, and J.D. Vance. The debt limit — commonly called the ‘debt ceiling’ — is the highest amount the government can borrow under federal law. The federal government hit the debt limit in January 2023. Since then, the U.S. Treasury has employed ‘extraordinary measures’ to continue making payments on debt and new expenses. According to the U.S. Treasury, the United States is on track to exhaust those measures and run out of financial liquidity in a matter of weeks, meaning the federal government would no longer be able to make all of its payments. The debt is continuing to rise. The debt ceiling will have to be increased in the coming weeks. Democrats have advocated for an increase in the amount of money the federal government is allowed to borrow without any reduction in federal spending. Republicans say they will not support any debt ceiling increase without significant reductions in spending. President Biden has repeatedly refused to negotiate a debt ceiling deal with Republicans even though the GOP controls the U.S. House of Representatives. The House Republicans passed the Limit, Save, Grow Act of 2023 — a debt ceiling increase paired with spending cuts — on April 26, 2023. In Fiscal Year 2022, federal tax revenue hit a record high of $4.9 trillion. However, in the same year, the federal government had a deficit of more than $1.38 trillion even though the country is not at war and the economy is at full employment. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Katies Britt joins bipartisan group of colleagues questioning Federal Reserve’s actions in Silicon Valley Bank crisis

On Monday, U.S. Senator Katie Britt joined Senators Kyrsten Sinema, Thom Tillis, and a bipartisan group of Senators questioning the Federal Reserve its’ oversight of troubled Silicon Valley Bank before the bank’s failure. The Sens. claim that the Federal Reserve missed clear warning signs – including bank leadership’s failure to appropriately manage customer deposits. That it missed as part of its responsibilities to conduct oversight and examinations ahead of Silicon Valley Bank’s collapse. “SVB is a clear case of regulators refusing to do their job despite the fact that all of the red flags were there,” said Sen. Britt. “The Fed failed to use the tools in their toolbox to prevent what we saw in recent weeks, and I want to know why. Alabamians don’t just want answers, they deserve answers. And I, for one, will not stop until we get them.” “It is gravely concerning that retail participants, utilizing only publicly available information, were able to identify clear and compelling examples of financial mismanagement and asset over-concentration at SVB, while the Fed, which can draw even deeper from non-public supervisory information, was unable to ascertain a similar conclusion,” the Sens. wrote in their letter. “The fact that the San Francisco Fed, among other regulatory agencies, found no reason to take appropriate regulatory action or even investigate SVB further in the months, weeks, and days prior to the bank’s collapse must be addressed in a manner that restores public confidence in Fed supervision.” “Safety and soundness is the cornerstone regulatory principle of the U.S. banking system, and it is important we assess what went wrong at SVB to ensure future stability in the U.S. financial services sector. Specifically, we support any efforts that will provide further information on all relevant risks, actions, and inactions – taken by SVB and by regulators, supervisors, and examiners – that contributed to this failure,” the Sens. wrote. “It is gravely concerning that retail participants, utilizing only publicly available information, were able to identify clear and compelling examples of financial mismanagement and asset over-concentration at SVB, while the Fed, which can draw even deeper from non-public supervisory information, was unable to ascertain a similar conclusion. The fact that the San Francisco Fed, among other regulatory agencies, found no reason to take appropriate regulatory action or even investigate SVB further in the months, weeks, and days prior to the bank’s collapse must be addressed in a manner that restores public confidence in Fed supervision. We look forward to evaluating the results of your review, particularly with respect to the robustness of Fed supervision and examination of SVB.” Britt joined Sinema and Tillis in cosigning the letter. Also cosigning were Sens. John Hickenlooper (D-Colorado), Kevin Cramer (R-North Dakota), Chris Murphy (D-Connecticut), Mike Rounds (R-South Dakota), Cynthia Lummis (R-Wyoming), Bill Hagerty (R-Tennessee), Catherine Cortez Masto (D-Nevada), J.D. Vance (R-Ohio), and Michael Bennet (D-Colorado). There are media reports that federal regulators knew about the problems at SVB for more than a year, and yet they hesitated to act. The Wall Street Journal reported that federal bank regulators knew Silicon Valley Bank was a troubled bank as early as 2019. In 2021, the Federal Reserve cautioned the bank about significant vulnerabilities in the bank’s containment of risk. SVB had a uniquely concentrated customer base of venture capital funds, venture investors, and start-ups, many of whom have or have had financial relationships or business partnerships with one another. That customer base includes a significant level of financial interdependency that potentially increased risk. The Fed identified the risks to the bank, yet SVB did nothing to mitigate any of the risks. The Federal Reserve has already announced an internal investigation into its regulatory oversight, supervision, and examination of Silicon Valley Bank. The Senators urged that as part of this investigation, the Fed should focus on the role of concentration risk in the bank examination process and review the financial arrangements between Silicon Valley Bank and its customers to determine their impact on the bank’s collapse. Katie Britt is a member of the Financial Institutions and Consumer Protection Subcommittee of the Senate Committee on Banking, Housing, and Urban Affairs. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.

Katie Britt and colleagues introduce legislation to require federal agencies to publish their regulatory guidance on the internet

U.S. Senators Katie Britt and Ron Johnson and 14 of their colleagues reintroduced the Guidance Out of Darkness (GOOD) Act, which requires federal agencies to publish their regulatory guidance on the internet in an easily accessible location. Sponsors claim that the GOOD Act will enhance the transparency of guidance documents issued by government agencies, helping all entities — including small businesses, workers, and households — to comply with regulations. The bill was advanced by the Senate Homeland Security and Governmental Affairs Committee by voice vote twice and passed the House in 2018. “Sunlight is often the best disinfectant, and that’s exactly what the Biden Administration’s runaway red tape regime needs,” said Sen. Britt. “Unelected federal bureaucrats should not be taking actions that affect hardworking Americans’ lives without robust transparency and the opportunity to hold them publicly accountable. This is a commonsense measure that my colleagues on both sides of the aisle should support.” “As an advocate for transparency and accountability in government, I am proud to reintroduce the Guidance Out of Darkness Act. This bill reduces the regulatory burden placed on small businesses, workers, and households by holding federal agencies accountable,” stated Sen. Johnson. “Increasing transparency and simplifying the regulatory process will further economic growth for all Americans. I look forward to working with my colleagues to advance this bill and provide the American people with the transparency they deserve.” Senators Britt and Johnson were joined on the legislation by Sens. Mike Braun (R-Indiana), Kevin Cramer (R-North Dakota), Ted Cruz (R-Texas), Joni Ernst (R-Iowa), Lindsey Graham (R-South Carolina), James Lankford (R-Oklahoma), Mike Lee (R-Utah), Cynthia Lummis (R-Wyoming), Rand Paul (R-Kentucky), Rick Scott (R-Florida), Thom Tillis (R-North Carolina), Bill Hagerty (R-Tennessee), Marsha Blackburn (R-Tennessee), and Mitt Romney (R-Utah). “Transparency in government is crucial. That is why I am proud to join Senator Ron Johnson in sponsoring the GOOD Act. People deserve to know just what government agencies are up to, especially when it comes to their hard-earned tax dollars,” said Sen. Scott. “This bill will bring commonsense reform and shed light on how the government operates—which is something we should all support.” “People in Wyoming deserve transparency from the federal government, which is why I’m joining my colleague Senator Ron Johnson in introducing the Guidance Out of Darkness Act,” said Sen. Lummis. “This bill would require federal agencies to post regulations and guidance to the agency website, making it easy for small businesses, workers, and the people of Wyoming to know about the federal regulations that impact their daily lives.” “Unlike other regulatory actions, agency guidance documents are not required to undergo the public notice and comment process. James Madison warned that our laws would be of little use if they can ‘be repealed or revised before they are promulgated, or undergo such incessant changes, that no man who knows what the law is today, can guess what it will be tomorrow,’” said Sen. Lee. “I’m proud to cosponsor Sen. Johnson’s legislation to reduce the regulatory burden placed on small businesses, workers, and American households and increase transparency for all the entities needed to comply.” Navigating through all of the regulations promulgated by federal agencies and keeping up to date with all of the periodic changes to guidance as well as administrative reinterpretations and changes of previous rules can be very difficult for businesses operating in those regulated agencies. Katie Britt is serving in her first term in the U.S. Senate after her election in November. To connect with the author of this story or to comment, email brandonmreporter@gmail.com.