Alabama trying to revive lawsuit over Confederate monument

The Alabama attorney general’s office is trying to revive its lawsuit over the removal of a Confederate monument from outside the county courthouse in the city of Huntsville. The state claimed in court documents that a judge shouldn’t have dismissed the suit just because someone anonymously paid a $25,000 fine that was owed by Madison County for removing the statue nearly a year ago, WHNT-TV reported. Attorney General Steve Marshall’s office contends the county should be required to pay the penalty itself. A judge has scheduled a hearing for Friday afternoon on the state’s bid to reinstate the lawsuit. The state sued the county last year seeking a $25,000 penalty that’s mandated under a state law that makes it illegal to remove or alter monuments. Legislators passed the law in 2017 amid a national movement to take down memorials honoring the Confederacy. Madison County asked a judge to end the state’s suit after someone deposited $25,000 into a court account to pay the fine on Aug. 27. The county says the money isn’t from taxpayers or Madison County, but it hasn’t said where the funding came from. Circuit Judge Claude Hundley dismissed the suit, but the state argues it needs to know who paid the fine to end the case. It also says the judge still needs to rule on its claim that Madison County broke the law when it moved the monument. Erected in 1905 by the United Daughters of the Confederacy, the monument went up outside the Madison County Courthouse at a time when Confederate descendants were trying to portray the South’s cause in the Civil War as noble rather than linked to slavery. The statue was moved to a city-owned cemetery. Demonstrators sought the removal of the Huntsville statue and other numerous Confederate statues around the nation last year amid nationwide protests against racial injustice following the police killing of George Floyd in Minnesota. Those efforts to take down statues honoring Southern figures from the Civil War continued Wednesday as work crews hoisted an enormous statue of Confederate Gen. Robert E. Lee off its giant pedestal in Virginia’s capital city of Richmond, cheered on by a crowd. Republished with the permission of the Associated Press.

Bradley Byrne receives multiple endorsements this week for US Senate

Byrne received endorsements from two of Alabama’s State Senators.

Understanding Madison County local amendment 1: noise control

When Alabamians get to the polls on Tuesday, Nov. 6, voters in some counties will see local amendments on the ballot. Here’s a look at what residents of Madison County need to know about a local amendment they’ll see on the ballot: On the ballot: PROPOSED LOCAL AMENDMENT NUMBER ONE (1) Relating to Madison County and the areas outside the corporate limits of any municipality, proposing an amendment to the Constitution of Alabama of 1901, to authorize the county commission to adopt ordinances or resolutions to prohibit excess noise, to regulate, limit, and control excess noise levels, and to control public nuisance caused by excess noise levels in the unincorporated areas of Madison County and to authorize penalties not to exceed the penalties for a class C misdemeanor. (Proposed by Act 2018-167) Vote: Yes/No What it means: If passed, residents unincorporated areas, rural parts of the county would be subject to penalties if they make too much noise. Right now, they are able to be as loud as they want. Areas like Huntsville and Madison are not included in the amendment. Sample ballot Click out the Madison County sample ballot: Front side | Back side Don’t live in Madison County? Find your county’s sample ballot here.

Ceremony marks opening of Alabama computer forensics lab

A new lab specializing in digital forensics is operating in Huntsville, Alabama. The FBI and local leaders held a ceremony Wednesday to mark the opening of the Tennessee Valley Regional Computer Forensics Laboratory. The center is one of 17 such facilities in nationwide specializing in training and the analysis of digital evidence. The FBI will provide the facility, equipment and training for the lab. Local agencies will provide staffing for the center including the city of Huntsville police; sheriff’s departments in Etowah and Madison counties; and the Alabama National Guard Counterdrug program. The U.S. attorney’s office for north Alabama will help as a prosecuting agency. The lab is located at Redstone Arsenal. Republished with the permission of the Associated Press.

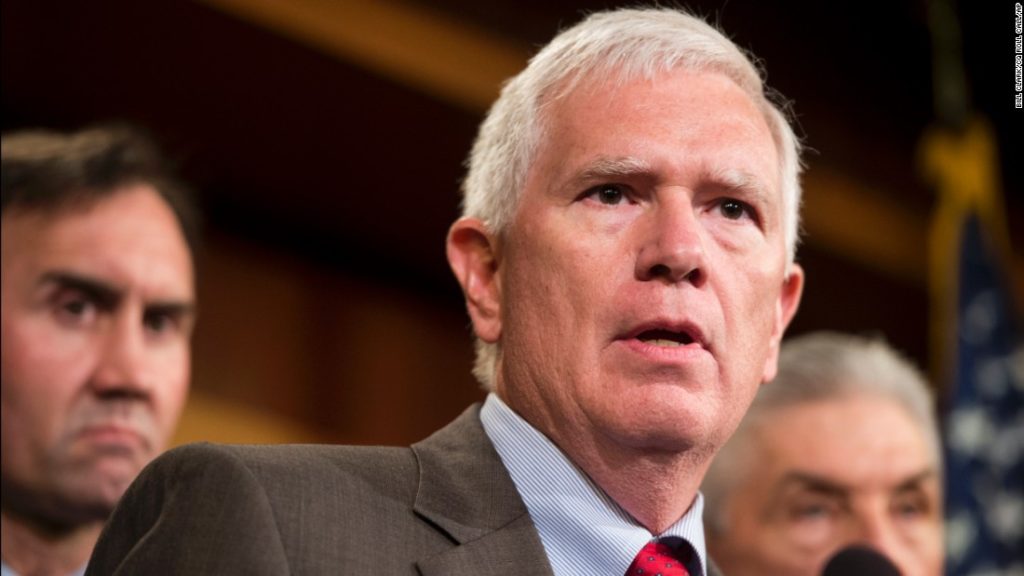

Mo Brooks’ long career of slamming Alabama taxpayers with increases, fees

Senate candidate Mo Brooks wants to be seen as a “proven conservative,” especially on fiscal matters. But actual proof suggests the opposite. On his 2010 congressional campaign website, the Huntsville Republican makes an audacious claim: to have “vigorously fought tax increases as an Alabama legislator, a Madison County Commissioner, and a citizen.” Brooks even goes as far as to link to a pair of signed pledges: Taxpayers Protection Pledge — Americans for Tax Reform and the No Climate Tax Pledge — Americans for Prosperity, both promoting strict anti-tax promises. In his Senate campaign, Brooks continues to carry the fiscal responsibility banner, railing against Congress’ attempts to change the Affordable Care Act by calling it a “Republican Welfare Program.” And Brooks tells Alabama Today he is running “because America needs an ethical, principled conservative who has the intellect and backbone to face and defeat America’s challenges.” As he faces an uphill climb in Alabama’s Aug. 15 GOP primary — solidly third in most recent polling — Brooks’ boasts recall the old saying: “”The best predictor of future behavior is … Past behavior.” With that in mind, a closer examination of his Alabama voting record — particularly on the county and state levels — shows his anti-tax rhetoric does not tell the complete story. For more than a decade, Brooks represented District 5 of the Madison County Commission, from 2000 to 2011, before winning the first of four terms in the U.S. House. During that time, the Huntsville Republican amassed a considerable history of supporting tax and fee increases on local constituents, a record that seems to contradict later campaign promises and his membership in the House Freedom Caucus, a group that emerged from the 2008-2010 Tea Party wave. Tea Party, for those who may have forgotten, stands for “Taxed Enough Already,” a grassroots movement set up under the principle of fiscal responsibility and actively resisting government taxation in most forms. In his time in public service — in the Madison County Commission, and before that, an earlier stint in the Alabama House — Brooks “represented” Alabama taxpayers by way of several (successful and attempted) tax and fee raises. Prominent examples include September 1997, when, as Madison County Commission water department liaison, Brooks supported a $6.50 monthly per-household increase in the county’s water rate, something Huntsville Times business reporter Mike Salinero questioned in “Who Will Pay for Soaring Water Use in Thirsty County?” Later, as a Madison County commissioner, Brooks approved a 2006 Tax Increment Financing (TIF) measure that would borrow money to fund construction projects, which, the Huntsville Times reported at the time, would have to be paid with “anticipated increased property taxes.” Also in 2006, Commissioner Brooks voted to raise property taxes, followed by another proposal to raise property taxes and other tax increases just one year later. He did the same thing in 2008, again calling for increased property taxes. The following year, the Huntsville Times strongly criticized a Brooks’ proposal — one that would blanch a present-day fiscal conservative. This time, Brooks again argued that the “only way” to pay for needed school construction was through higher property taxes. As an alternative, Brooks offered several possibilities for raising revenue in Madison County — all of them distasteful to anti-tax proponents: increases in property and sales taxes, as well as a state measure to lift caps on the amount of property tax levied for Madison County schools. Madison County Board Member John Ehinger panned Brooks’ tax-and-spend pitch, writing in a March 2007 Huntsville Times op-ed that while they “are real enough … none of them is workable.” “If local schools need more money to build and renovate facilities, is there an alternative to the proposed half-cent countywide sales tax?” Ehinger wrote. “Well, it depends. Solutions to problems generally fall into two categories: the theoretical and the practical. Theoretical solutions might do a better job in some instances, provided you can put them in place. The theoretical solutions to the financial needs of the three local school systems, some of which were outlined last week by County Commissioner Mo Brooks, are real enough, but none of them is workable.” Finally, in 2009, Brooks wanted folks to pay more in garbage fees, voting for a $13.50-a-month garbage fee increase in Madison County. Nevertheless, this laundry list of Brooks’ tax-happiness goes even further back, including his days in the Alabama House, where he served from 1982-92 — often landing on the same side as Democrat George Wallace, who served his final term as Alabama Governor from 1983-87. Most notably, Brooks tried to seek voter approval for increasing income taxes on Alabama families and businesses (by as much as 20 percent) during the House Regular Sessions in 1983, 1984, 1987 and 1988. In those days, Brooks championed a wide range of tax and fee increases, everything from annual fees on natural gas meters, a liquor tax hike, a “tax crackdown” bill, privilege taxes on dog racing, allowing city and county school boards to levy sales taxes, a gasohol tax hike, raising hunting and fishing fees, and raising cigarette taxes. In 1983, the Alabama House passed a bill that to levy a “50-cent annual fee on every natural gas meter in the state,” as reported by The Associated Press’ Phillip Rawls in “House OKs Gas Meter Fees.” That same Session, lawmakers passed a bill sending “additional mark ups’” (taxing, just by another name) on liquor to Alabama’s General Fund — something that observers at the time believed would raise liquor prices across the board. Alabama’s “Journal of The House” shows Brooks voting “Yea.” Brooks also voted for a Gov. Wallace’s “Tax Crackdown” measure, aggressively going after delinquent Alabama Taxpayers. H 13, considered during the state’s Fourth Extraordinary Session that year, was titled: “Increase Revenue and Promote Compliance with The Tax Laws by Providing the Means for A More Effective And Efficient Enforcement Of Said Tax Laws.” Records show that Brooks voted for both the House and conference versions of the crackdown bill. In 1984,