Kamala Harris positive for COVID-19, Joe Biden not a ‘close contact’

Vice President Kamala Harris tested positive for COVID-19 on Tuesday, the White House announced, underscoring the persistence of the highly contagious virus even as the U.S. eases restrictions in a bid to return to pre-pandemic normalcy. Neither President Joe Biden nor first lady Jill Biden was considered a “close contact” of Harris in recent days, said the vice president’s press secretary, Kirsten Allen. Harris had been scheduled to attend Biden’s Tuesday morning Presidential Daily Brief but was not present, the White House said. She had returned Monday from a weeklong trip to the West Coast. The last time she saw Biden was the previous Monday, April 18. “I have no symptoms, and I will continue to isolate and follow CDC guidelines,” Harris tweeted. “I’m grateful to be both vaccinated and boosted.” Biden phoned her Tuesday afternoon to make sure she “has everything she needs” while working from home, the White House said. Harris, 57, received her first dose of the Moderna COVID-19 vaccine weeks before taking office and a second dose just days after Inauguration Day in 2021. She received a booster shot in late October and an additional booster on April 1. Fully vaccinated and boosted people have a high degree of protection against serious illness and death from COVID-19, particularly from the most common and highly transmissible omicron variant. Harris’ diagnosis comes a month after her husband, Doug Emhoff, recovered from the virus, as a wave of cases of the highly transmissible omicron subvariant has spread through Washington’s political class, infecting Cabinet members, White House staffers, and lawmakers, including House Speaker Nancy Pelosi. Sens. Ron Wyden, D-Ore., and Chris Murphy, D-Conn., tested positive on Tuesday. Allen said Harris would follow Centers for Disease Control and Prevention guidelines “and the advice of her physicians.” It was not immediately clear whether she is being prescribed any antiviral treatments. The White House has put in place strict COVID-19 protocols around the president, vice president, and their spouses, including daily testing for those expected to be in close contact with them. Biden is tested regularly on the advice of his physician, the White House has said and last tested negative on Monday. “We have a very, very contagious variant out there,” said White House COVID-19 coordinator Dr. Aashish Jha on Tuesday. “It is going to be hard to ensure that no one gets COVID in America. That’s not even a policy goal.” He said the administration’s goal is to make sure people don’t get seriously ill. Jha added that despite the precautions, it is possible that Biden himself will come down with the virus at some point. “I wouldn’t say it’s just a matter of time, but of course, it is possible that the president, like any other American, could get COVID,” he said. “There is no 100% anything.” Psaki said she “would not expect” any changes to White House protocols. After more than two years and nearly a million deaths in the U.S., the virus is still killing more than 300 people a day in the U.S., according to the CDC. The unvaccinated are at far greater risk, more than twice as likely to test positive and nine times as likely to die from the virus as those who have received at least a primary dose of the vaccines, according to the public health agency. Harris’ diagnosis comes as the Biden administration is taking steps to expand availability of the life-saving COVID-19 antiviral treatment Paxlovid, reassuring doctors that there is ample supply for people at high risk of severe illness or death from the virus. Paxlovid, when administered within five days of symptoms appearing, has been proven to bring about a 90% reduction in hospitalizations and deaths among patients most likely to get severe disease. In addition to her husband’s diagnosis, Harris was identified as a “close contact” after her communications director tested positive on April 6. The Centers for Disease Control and Prevention defines “close contact” with an infected person as spending 15 minutes or more with them over a 24-hour period. The CDC says people with “close contact” do not need to quarantine if they are up to date on their vaccines but should wear well-fitting masks around other people for 10 days after the contact. Republished with the permission of the Associated Press.

Katie Britt now accepts Bitcoin and other cryptocurrency for campaign contributions

U.S. Senate candidate Katie Britt announced today that her campaign will now accept contributions via BitPay.Through the BitPay plug-in on Britt’s campaign website, eligible individuals can now contribute via various forms of cryptocurrency to her campaign. Any contributions made via BitPay must abide by all federal laws and regulations regarding political donations. The total market cap of these accepted cryptocurrencies exceeds $1.4 trillion, which accounts for nearly 70% of the global crypto market cap. “I’m excited to announce that our campaign now accepts cryptocurrency contributions, including Bitcoin, Ethereum, and Dogecoin,” said Britt. “This is merely a small token of my overall staunch support for the digital asset ecosystem, blockchain technology, proof of work, cryptocurrency, and Bitcoin in particular.” “We need fresh blood in the Senate to keep America at the forefront of innovation and technology, not the same-old ineffective career politicians who are stuck in the past,” she continued. “Supporting Bitcoin means supporting personal freedom, American competitiveness, and national security. I will be an advocate for commonsense policies that provide appropriate consumer protections while fostering innovation, entrepreneurship, and investment here at home rather than driving the digital asseteconomy overseas to places like China.” Britt supports the digital asset economy. She has advocated for Congress to fix a provision in the new infrastructure bill that uses an antiquated, anti-innovation definition of what it means to be a digital asset broker. U.S. Senators Pat Toomey, Ron Wyden, and Sen. Cynthia Lummis filed an amendment clarifying the definition of “broker” with respect to digital asset third-party reporting requirements. Britt also noted that when elected, she plans to work closely with longtime cryptocurrency advocate U.S. Sen. Cynthia Lummis of Wyoming. Britt believes Wyoming’s approach to regulating digital assets is a good roadmap for the nation to take. U.S. Senators Pat Toomey, Ron Wyden, and Cynthia Lummis filed an amendment clarifying the definition of “broker” with respect to digital asset third-party reporting requirements. “I support American innovation and entrepreneurship, including in the crypto space, and want to see the digital asset broker issue clarified in a way that ensures that the federal government is not putting their thumb on the scale,” Britt stated. “We should be encouraging competition here in America, not driving economic activity overseas.” Britt is currently endorsed by the Home Builders Association of Alabama, the Alabama Farmers Federation’s FarmPAC, and the Alabama Retail Association’s federal political action committee.

Joe Biden urges bill over ‘finish line’ as Dems eye new surtax

With his signature domestic initiative at stake, President Joe Biden is urging Democrats to wrap up talks and bring the social services and climate change bill “over the finish line” before he departs Thursday for global summits overseas. Top Democratic leaders are signaling a deal is within reach even though momentum fizzled and tempers flared late Wednesday after a billionaires’ tax and a paid family leave program fell out of the Democrats’ sweeping bill, mostly to satisfy a pivotal senator in the 50-50 Senate. But expanded health care programs, free pre-kindergarten, and some $500 billion to tackle climate change remain in the mix in what’s now at least a $1.75 trillion package. And Democrats are eyeing a new surcharge on the wealthy — 5% on incomes above $10 million and an additional 3% on those beyond $25 million — to help pay for it, according to a person who requested anonymity to discuss the private talks. “They’re all within our reach. Let’s bring these bills over the finish line.” Biden tweeted late Wednesday. Biden could yet visit Capitol Hill before traveling abroad, and House Democrats were set to meet in the morning. Besides pressing for important party priorities, the president was hoping to show foreign leaders the U.S. was getting things done under his administration. The administration is assessing the situation “hour by hour,” White House press secretary Jen Psaki said. It was a fast-moving day on Capitol Hill that started upbeat as House Speaker Nancy Pelosi declared that Democrats were in “pretty good shape.” But hopes quickly faded as Biden’s big proposal ran into stubborn new setbacks, chief among them how to pay for it all. A just-proposed tax on billionaires could be scrapped after Democratic Sen. Joe Manchin of West Virginia objected, according to a senior party aide, who requested anonymity to discuss the private talks. The billionaires’ tax proposal had been designed to win over another Democratic holdout, Sen. Kyrsten Sinema of Arizona, but Manchin panned it as unfairly targeting the wealthy, leaving Democrats at odds. “People in the stratosphere, rather than trying to penalize, we ought to be pleased that this country is able to produce the wealth,” Manchin told reporters. Manchin said he prefers a minimum 15% flat “patriotic tax” to ensure the wealthiest Americans don’t skip out on paying any taxes. Nevertheless, he said: “We need to move forward.” Next to fall was a proposed paid family leave program that was already being chiseled back from 12 to four weeks to satisfy Manchin. But with his objections, it was unlikely to be included in the bill, the person said. Sen. Kirsten Gillibrand, D-N.Y., had devised several new options for Manchin’s review and told reporters late in the evening, “It’s not over until it’s over.” Together, Manchin’s and Sinema’s objections packed a one-two punch, throwing Biden’s overall plan into flux, halving what had been a $3.5 trillion package, and infuriating colleagues along the way. In the evenly divided Senate, Biden needs all Democrats’ support with no votes to spare. White House officials met at the Capitol with Manchin and Sinema, two senators who now hold enormous power, essentially deciding whether or not Biden will be able to deliver on the Democrats’ major campaign promises. “Making progress,” Sinema said as she dashed into an elevator. A Sunday deadline loomed for approving a smaller, bipartisan roads-and-bridges infrastructure bill or risk allowing funds for routine transportation programs to expire. But that $1 trillion bill has been held up by progressive lawmakers who are refusing to give their support without the bigger Biden deal. Despite a series of deadlines, Democrats have been unable to close the deal among themselves, and Republicans overwhelmingly oppose the package. At best, Democrats could potentially reach a framework Thursday that could send Biden overseas with a deal in hand and unlock the process while the final details were sewn up. Applying pressure, Pelosi announced a Thursday committee hearing to spur the Biden package along toward a full House vote, though the timing remained uncertain. Democrats had hoped the unveiling of the billionaires tax Wednesday could help resolve the revenue side of the equation after Sinema rejected the party’s earlier idea of reversing Donald Trump-era tax breaks on corporations and the wealthy, those earning more than $400,000. The new billionaires’ proposal would tax the gains of those with more than $1 billion in assets or incomes of more than $100 million over three consecutive years — fewer than 800 people — requiring them to pay taxes on the gains of stocks and other tradeable assets, rather than waiting until holdings are sold. The billionaires’ tax rate would align with the capital gains rate, now 23.8%. Democrats have said it could raise $200 billion in revenue that could help fund Biden’s package over ten years. Republicans have derided the billionaires’ tax as “harebrained,” and some have suggested it would face a legal challenge. But Democratic Sen. Ron Wyden of Oregon, chairman of the Senate Finance Committee, insisted the billionaires tax remains on the table. “I’ve not heard a single United States senator — not one — get up and say, ‘Gee, I think it’s just fun that billionaires pay little or nothing for years on end,’” Wyden said. More likely in the mix was the companion proposal, a new 15% corporate minimum tax, as well as the new surtax being proposed on higher incomes above $10 million. Together they are designed to fulfill Biden’s desire for the wealthy and big business to pay their “fair share.” They also fit his promise that no new taxes hit those earning less than $400,000 a year, or $450,000 for couples. Biden wants his package fully paid for without piling on debt. Resolving the revenue side has been crucial, as lawmakers figure out how much money will be available to spend on the new health, child care, and climate change programs in Biden’s big plan. Among Democrats, Rep. Richard Neal of Massachusetts, the chairman of the Ways and Means Committee, said he told Wyden

White House, Dems hurriedly reworking $2 trillion Joe Biden plan

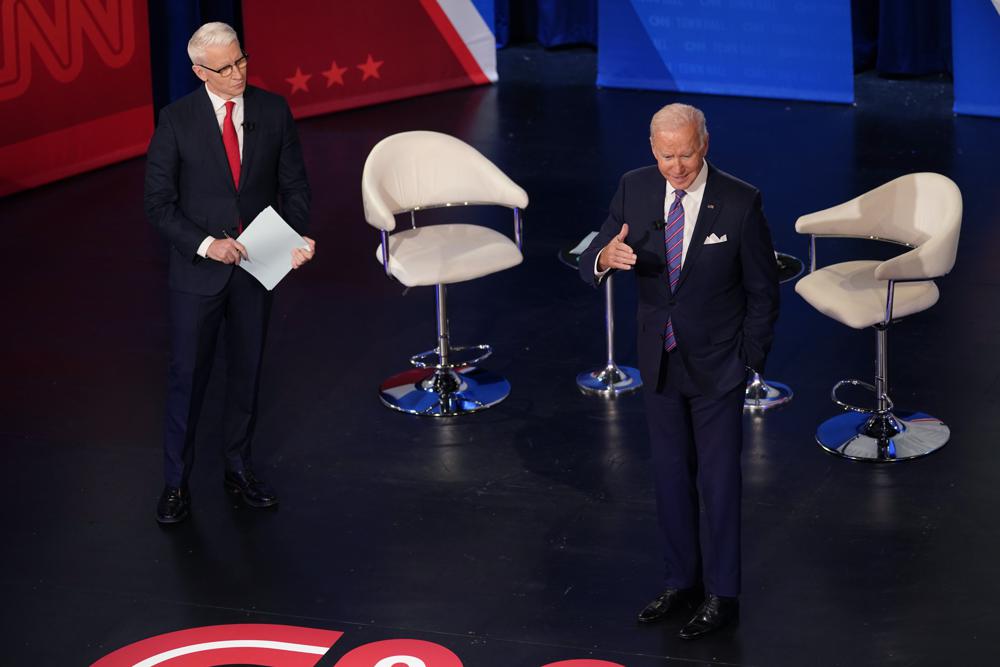

The White House and Democrats are hurriedly reworking key aspects of President Joe Biden’s $2 trillion domestic policy plan, trimming the social services and climate change programs and rethinking new taxes on corporations and the wealthy to pay for a scaled-back package. The changes come as Biden more forcefully appeals to the American public, including in a televised town hall Thursday, for what he says are the middle-class values at the heart of his proposal. Biden mentioned during the evening event the challenge he faces in wrangling the sharply divergent factions in the Democratic party to agree to the final contours of the bill. With an evenly divided Senate, he can’t afford to lose a single vote, and he is navigating the competing demands of progressives, who want major investments in social services, and centrists, who want to see the price tag on the package come down. “When you’re president of the United States, you have 50 Democrats — every one is a president. Every single one. So you gotta work things out,” he said during a CNN town hall. Still, he expressed optimism about the process, saying “I think so” when asked if Democrats were close to a deal. “It’s all about compromise. Compromise has become a dirty word, but bipartisanship and compromise still has to be possible,” he said. Biden later said the discussions are “down to four or five issues.” On one issue — the taxes to pay for the package — the White House idea seemed to be making headway with a new strategy of abandoning plans for reversing Trump-era tax cuts in favor of an approach that would involve taxing the investment incomes of billionaires to help finance the deal. Biden has faced resistance from key holdouts, in particular Sen. Kyrsten Sinema, D-Ariz., who has not been on board with her party’s plan to undo President Donald Trump’s tax breaks for big corporations or individuals earning more than $400,000 a year. The president was unusually forthcoming Thursday night about the sticking points in the negotiations with Sinema and another key Democrat, conservative Sen. Joe Manchin of West Virginia. While the president said Sinema “will not raise a single penny in taxes” on the wealthy or corporations, a White House official later clarified that the president was referring to raising the top tax rates, not the range of tax proposals, “which Senator Sinema supports.” Biden said Manchin doesn’t want to “rush” the transition to clean energy so quickly it will result in major job losses in his coal-producing state. Even as he seemed encouraged by progress, Biden acknowledged major reductions to his original vision. He signaled the final plan would no longer provide free community college but said he hoped to increase Pell Grants to compensate for the loss of the policy. “It’s not going to get us the whole thing, but it is a start,” he said. He also said that what had been envisioned as a federally paid, months-long family leave program would be just four weeks. As long-sought programs are adjusted or eliminated, Democratic leaders are working to swiftly wrap up talks, possibly in the days ahead. Talks between the White House and Democratic lawmakers are focused on reducing what had been a $3.5 trillion package to about $2 trillion in what would be an unprecedented federal effort to expand social services for millions and address the rising threat of climate change. “We have a goal. We have a timetable. We have milestones, and we’ve met them all,” said House Speaker Nancy Pelosi, D-Calif., who predicted Thursday, “It will pass soon.” An abrupt change, of course, came late Wednesday when the White House floated new ways to pay for parts of the proposal. Biden himself signaled flexibility on the tax provisions of the bill, as long as it’s paid for and it doesn’t increase taxes on those earning $400,000 or less. “I’m willing to make sure that we pay for everything,” he said when pressed on what tax proposal he’d support. The newly proposed tax provisions, though, are likely to sour progressives and even some moderate Democrats who have long campaigned on scrapping the Republican-backed 2017 tax cuts that many believe unduly reward the wealthy and cost the government untold sums in lost revenue at a time of gaping income inequality. Many are furious that perhaps a lone senator could stymie that goal. The chairman of the tax-writing Ways & Means Committee, Rep. Richard Neal, D-Mass., said he spoke for more than 30 minutes with the centrist Arizona senator, whose closely held views are a mystery to her colleagues. “I said, Kyrsten, you and I both know this has got to pass. She said: ‘I couldn’t agree more,’” Neal told reporters at the Capitol. Sinema’s office did not respond to a request for comment. Under existing law passed in 2017, the corporate tax rate is 21%. Democrats had proposed raising it to 26.5% for companies earning more than $5 million a year. The top individual income tax rate would go from 37% to 39.6% for those earning more than $400,000, or $450,000 for married couples. Under the changes being floated, the corporate rate would not change. But the revisions would not be all positive for big companies and the wealthy. The White House is reviving the idea of a minimum corporate tax rate, similar to the 15% rate Biden had proposed this year. That’s even for companies that say they had no taxable income — a frequent target of Biden, who complains they pay “zero” in taxes. The new tax on the wealthiest individuals would be modeled on legislation from Sen. Ron Wyden, D-Ore., chairman of the Senate Finance Committee. He has proposed taxing stock gains of people with more than $1 billion in assets — fewer than 1,000 Americans. Other tax options are also being considered, and Democrats are almost certain to include a provision to beef up the Internal Revenue Service to go after tax dodgers. Biden and his party are trying to shore up middle-class households, tackle climate

Consumers get online tool to check nursing home vaccine data

Families and patients have a new online tool to compare COVID-19 vaccination rates among nursing homes, Medicare announced Tuesday, addressing complaints from consumer groups and lawmakers that the critical data had been too difficult to find. The information is now being made available through the “Care Compare” feature at Medicare.gov, the online tool for basic research on quality and safety issues at nursing homes. Consumers will be able to compare up to three nursing homes at the same time, and the webpage shows vaccination rates for residents and staff, as well as national and state averages. “We want to give people a new tool to visualize this data to help them make informed decisions,” Chiquita Brooks-LaSure, head of the Centers for Medicare and Medicaid Services, said in a statement. Nursing home residents are a tiny proportion of the U.S. population, but they have borne a crushing burden from the COVID-19 pandemic, accounting for more than 150,000 deaths, or roughly 1 in 5. Nationally, about 84% of residents are now vaccinated, which has slowed — but not totally prevented — the spread of the delta variant among frail patients. Nursing home staffers are the bigger concern since only about 64% are vaccinated, roughly the same share as the adult population. The virus commonly gets into facilities via staffers who have been exposed in nearby communities and unwittingly pass the infection on to residents. Medicare has been posting vaccination information online for months, but it was on a site designed for researchers and industry. One way to navigate it involved accessing a huge spreadsheet. Another approach called for hunting around on a map for little red dots that represented nursing homes. The statistics reveal big disparities in vaccination rates among states and sometimes wide differences within states and communities. Among the organizations complaining were Consumer Voice, which advocates for quality improvement in long-term care, and the Center for Medicare Advocacy, a watchdog group. Their concerns were echoed by two senior Democratic lawmakers, Sens. Ron Wyden of Oregon and Bob Casey of Pennsylvania. Citing an Associated Press report on breakthrough infections among nursing home residents, the two lawmakers urged Medicare to move quickly. Wyden chairs the Finance Committee, which oversees Medicare and Medicaid, and Casey heads the Aging Committee. The new online tool reminds consumers comparing facilities that higher percentages of vaccinated residents and staff “are better.” Information on COVID-19 vaccination rates is available just below each nursing home’s ratings. The data reflect the latest reported by nursing homes to the Centers for Disease Control and Prevention. Medicare officials say they are encouraged that even as the delta variant has swept across the country, outbreaks in nursing homes have not raced out of control as happened last year. They attribute that to the high rate of residents who have gotten their shots. Nursing home residents are expected to be top on the priority for booster shots as they become available. The nursing home industry says it fully supports vaccination of staffers and residents but that Medicare should also publish vaccine levels for hospitals and other medical care settings. Republished with the permission of the Associated Press.

White House taps populist message as Joe Biden pushes $3.5T plan

The White House is preparing an urgent and populist message for selling President Joe Biden’s $3.5 trillion “build back better” agenda, even as House committee leaders begin churning out pieces of the forthcoming measure. In a memo being sent Tuesday to Capitol Hill and obtained by The Associated Press, the administration warns there is no time to waste in passing the package of corporate tax hikes and domestic initiatives by the end of the month. “We face a fundamental choice in America right now as we rebuild our economy: this time, will everyone get in on the deal?” the memo says. “The time is now. We have to meet the needs in front of us. Not tomorrow, not months from now, not next year. Right now.” The urgent appeal comes at a crucial time, with House and Senate Democrats hoping to assemble the package by a self-imposed Sept. 15 deadline. It also comes as Biden seeks to refocus on his core campaign promises after a brutal summer, punctuated by spiking COVID-19 cases and the deadly evacuations and withdrawal from Afghanistan. Illustrating Democrats’ ambition as well as the challenges they face, House Ways and Means Chairman Richard Neal released part of his panel’s portion of the bill Tuesday. The Massachusetts Democrat proposed creating a new paid family and medical leave program for workers that is more generous than Biden’s own plan and expanding Medicare to provide dental, vision, and hearing benefits. But Neal also did not immediately unveil tax boosts on the rich and corporations that Democrats say will pay for much of the measure’s cost, saving that for coming days. The tax increases are likely to be among the most contentious items in the package, with some moderate Democrats facing tough reelection fights wary of them. But they are crucial if the party wants to support its claim that those tax boosts and other savings will pay for the entire measure, which they say will cost $3.5 trillion over 10 years. Neal and Senate Finance Committee Chairman Ron Wyden, D-Ore., are trying to resolve differences over some items in hopes the measure the House ultimately approves will largely face smooth sailing in the Senate, said Democrats who spoke on condition of anonymity to describe the legislation’s status. The bill will need the support of virtually every Democrat to clear the closely divided Congress. The Ways and Means panel has jurisdiction over the biggest chunk of the overall bill, and its members plan to begin voting on their piece of the plan on Thursday and Friday. “This is our historic opportunity to support working families and ensure our economy is stronger, more inclusive, and more resilient for generations to come,” Neal said in a statement. Republicans say Neal’s measure will end up raising taxes on people earning under $400,000, which Biden and Democrats have said will not happen. “They’re hiding the ball,” said J.P. Freire, the panel’s GOP spokesman. The committee’s proposal will pay for up to 12 weeks of paid family and medical leave for workers, beginning in 2023, including for higher earners. Biden’s plan would be phased in over the decade. Neal’s proposal would also phase in Medicare coverage for vision benefits starting in 2022, hearing in 2023, and dental in 2028. Missing in the details, he released Tuesday was a proposal to lower the Medicare eligibility age to 60, which has been considered unlikely to be included because it is expensive. It includes increased spending for child care, long-term care facilities, better benefits for workers laid off due to imports, and training health care workers. It would also require many employers to automatically enroll workers in savings arrangements like IRAs or 401(k) plans. Inside the White House, September is seen as a crucial month to make gains on Biden’s agenda. In speeches and travel, the president is expected to take a more aggressively populist tone as he rallies support for the plan. Congressional approval is not guaranteed as Democrats work to fundamentally reorder aspects of the U.S. economy and its governmental support systems. Democrats are already preparing for an onslaught of attacks over what Republicans call Biden’s big tax and spending plans, as the GOP tries to wrest control of Congress by winning House and Senate seats in next year’s midterm elections. In framing the arguments ahead as a choice, the White House is showing congressional Democrats one way the administration plans to counter those Republican attacks. “Republicans who oppose the Build Back Better agenda have chosen whose side they are on, too,” said the memo from White House Communications Director Kate Bedingfield to House Democratic communicators. “The Build Back Better agenda is about tackling those challenges and leveling the playing field to ensure the wealthiest and corporations pay their fair share and working families get a fighting chance to succeed and prosper in this country,” the memo said. Republished with the permission of the Associated Press.

Katie Britt emphasizes support for small businesses

On Monday U.S. Senate candidate Katie Britt released a statement outlining her support for small businesses and opposing new governmental lockdowns or mandates related to COVID-19 in Alabama. “Small businesses are the backbone of our state and the lifeblood of our local communities,” said Britt. “The SBA classifies 99.4% of Alabama businesses as small businesses. Growing up as the daughter of two small business owners from the Wiregrass, I know firsthand that the actions at all levels of government impact the bottom-line for job creators, entrepreneurs, and innovators across our great state. As Alabama’s next U.S. Senator, I will fight tirelessly to slash red tape and roll back burdensome regulations, allowing small businesses and hardworking Alabama families to thrive in safe, strong communities.” Britt has spoken out against Sen. Ron Wyden’s plan to substantially curtail the Small Business Deduction, which allows many small businesses to deduct 20% of their income. This measure, created in the Tax Cuts and Jobs Act of 2017, is set to expire in 2025. According to the NFIB, more than 80% of small business owners say the Small Business Deduction is important to their operations. “Curtailing the Small Business Deduction would represent an effective tax hike at a time when small businesses can least afford it,” stated Britt. “Not only would I proudly oppose any vote to raise taxes in the Senate, but I firmly believe we must make the Small Business Deduction permanent and eliminate restrictions that limit which industries qualify. Alabama has a diverse economy, and all of our tremendous small businesses should be on a level playing field when it comes to treatment by the federal government. This means continuing to simplify our tax code so that small businesses have certainty and clarity, which in turn will give them greater confidence to reinvest in the growth of their businesses and communities.” Britt also commended Governor Kay Ivey for rejecting suggestions that Alabama could be headed towards shutting back down. This comes after a report published last week stoked concerns that “new lockdowns in Alabama” could soon be called for. Britt commented, “I’m 100% against a new lockdown of any form or fashion. Vaccines are readily available to all Americans, and I encourage my fellow Alabamians to get vaccinated. Just as the case has been throughout the pandemic – but especially now – personal responsibility is the solution, not governmental mandates. We need to use freedom to combat COVID-19, not combat freedom because of COVID-19. I am confident that the state of Alabama will not shut back down or bring back a mask mandate. Our great state is open for business, and I’ll fight to not only keep it that way but also to grow jobs and opportunity for all hardworking Alabamians, no matter their zip code.”

Tommy Tuberville joins other leaders to change sexual assault investigations in the military

U.S. Senator Tommy Tuberville has joined a bipartisan group of senators to support a bill that will change the way the military conducts sexual assault investigations and prosecutions. Tuberville, a member of the Senate Armed Services Committee Subcommittee on Personnel, joined U.S. Senators Kirsten Gillibrand (D-NY), Chuck Grassley (R-IA), Joni Ernst (R-IA), Richard Blumenthal (D-CT), Ted Cruz (R-TX), Jeanne Shaheen (D-NH), Mark Kelly (D-AZ), and 28 other Senators to introduce the Military Justice Improvement and Increasing Prevention Act. According to the press release, the legislation “keeps the prosecution of sexual assault crimes within the military but moves the decision to prosecute to independent, trained, professional military prosecutors, and provides for several new prevention provisions such as better training for commanders and increased physical security measures, while ensuring that commanders still have the ability to provide strong leadership and ensure a successful command climate.” Tuberville stated, “Our men and women in uniform sacrifice every day to keep us safe, often working in some pretty unsafe places around the world. The last thing they should be worrying about is whether they’re unsafe within their ranks, and they certainly shouldn’t have to fear retaliation if they report a sexual assault. This bill is what happens when a bipartisan group of senators come together to get something done. I’m thankful that Senator Gillibrand and Senator Ernst have led the charge, and I’m glad to join my colleagues in support of this bill that will help improve the way the military handles sexual assaults so survivors can get the justice they deserve.” The bill was introduced in 2019, but did not receive a vote. Specifically, the legislation would: Move the decision on whether to prosecute serious crimes to independent, trained, and professional military prosecutors, while leaving misdemeanors and uniquely military crimes within the chain of command. Ensure the Department of Defense supports criminal investigators and military prosecutors through the development of unique skills needed to properly handle investigations and cases related to sexual assault and domestic violence. Require the Secretary of Defense to survey and improve the physical security of military installations– including locks, security cameras, and other passive security measures – to increase safety in lodging and living spaces for service members. Increase, and improve training and education on military sexual assault throughout our armed services. Kirsten Gillibrand stated on Twitter, “Here’s a bipartisan mission we can all support: Survivors of military sexual assault deserve justice. I’m proud to have @JoniErnst join me this week to introduce our new, improved bill to reform the military justice system and invest in prevention.” Here’s a bipartisan mission we can all support: Survivors of military sexual assault deserve justice. I’m proud to have @joniernst join me this week to introduce our new, improved bill to reform the military justice system and invest in prevention. https://t.co/pYYUL6IRyA — Kirsten Gillibrand (@SenGillibrand) April 27, 2021 The legislation is cosponsored by U.S. Senators Kirsten Gillibrand (D-NY), Chuck Grassley (R-IA), Joni Ernst (R-IA), Richard Blumenthal (D-CT), Ted Cruz (R-TX), Jeanne Shaheen (D-NH), Tammy Baldwin (D-WI), Chris Van Hollen (D-MD), Angus King (I-ME), Michael Braun (R-IN), Dick Durbin (D-IL), Tammy Duckworth (D-IL), Michael Bennet (D-CO), Rand Paul (R-KY), Chris Coons (D-DE), Mark Kelly (D-AZ), Sherrod Brown (D-OH), Bob Casey Jr. (D-PA), Maggie Hassan (D-NH), Mazie K. Hirono (D-HI), Amy Klobuchar (D-MN), Patrick Leahy (D-VT),Elizabeth Warren (D-MA), Ron Wyden (D-OR), Cynthia Lummis (R-WY), Dianne Feinstein (D-CA), Catherine Cortez Masto (D-NV), Raphael Warnock (D-GA), Alex Padilla (D-CA), Shelley Moore Capito (R-WV), Gary C. Peters (D-MI), Tim Kaine (D-VA), Tina Smith (D-MN), Bob Menendez (D-NJ), and Martin Heinrich (D-NM).

Donald Trump escalates war on Twitter, social media protections

Announced with fanfare, the president’s action yet appeared to be more about politics than substance.

James Comey in middle of political fray over Donald Trump and Russians

FBI Director James Comey is again in a familiar spot these days – the middle of political tumult. As a high-ranking Justice Department official in the George W. Bush administration, he clashed with the White House over a secret surveillance program. Years later as head of the FBI, he incurred the ire of Hillary Clinton supporters for public statements on an investigation into her emails. Now, Comey is facing new political pressure as White House officials are encouraging him to follow their lead by publicly recounting private FBI conversations in an attempt to dispute reports about connections between the Trump administration and Russia. It’s an unusual position for a crime-fighting organization with a vaunted reputation for independence and political neutrality. Yet Comey, the former top federal prosecutor in Manhattan who later became deputy attorney general of the United States, is known for an unshaking faith in his own moral compass. “I’m not detecting a loss of confidence in him, a loss of confidence in him by him,” said retired FBI assistant director Ron Hosko, noting the broad recognition that “these are very tumultuous, polarized, angry, angry times.” The latest flare-up occurred Friday, when White House officials told reporters that chief of staff Reince Priebus had asked top FBI officials to dispute media reports that Donald Trump‘s campaign advisers were frequently in touch with Russian intelligence agents during the election. The officials said the FBI first raised concerns about New York Times reporting but told Priebus the bureau could not weigh in publicly on the matter. The officials said Deputy Director Andrew McCabe and Comey instead gave Priebus the go-ahead to discredit the story publicly, something the FBI has not confirmed. As the FBI declined to discuss the matter, pressure mounted on Comey to either counter or affirm the White House’s account. Even the Trump administration urged him to come forward, which as of Friday was not happening. “Politicized assertions by White House chief of staff Priebus about what may or may not be the findings of an FBI investigation are exactly the wrong way for the public to hear about an issue that is of grave consequence to our democracy,” Sen. Ron Wyden, an Oregon Democrat and member of the Senate Intelligence Committee, said in a statement. “The American people deserve real transparency, which means Director Comey needs to come forward, in an open hearing, and answer questions.” The push on Comey to publicly discuss the bureau’s investigation of Russian interference in the 2016 presidential election is especially acute given his statements in the run-up to Nov. 8 that many Democrats believe cost Clinton the election. He detailed the results of the FBI’s investigation at an unusual July news conference, testified on it for hours on Capitol Hill and alerted Congress less than two weeks before Election Day that the FBI would be reviewing new emails potentially connected to the case. But it’s not clear that Comey, now in the fourth year of a 10-year term, will be swayed by any public hand-wringing. People who have worked with the FBI director describe him as holding strong personal convictions. As deputy attorney general, he confronted White House officials in the hospital room of then-Attorney General John Ashcroft in an effort to quash the reauthorization of a counterterrorism surveillance program. When nominating Comey for FBI director in 2013, President Barack Obama praised him for his “fierce independence and deep integrity.” Comey stood apart from the administration on a few occasions after that, including when he floated the possibility that police concerns over being recorded on video were causing officers to pull back and contributing to an uptick in homicides, a viewpoint the White House refused to endorse. His decision to announce the FBI’s recommendation against criminal charges in the Clinton email case was made without any notice to the Justice Department, and his notification to Congress about the new emails was not supported by department leaders, including Attorney General Loretta Lynch. Decisions that reach the desk of the top leadership of the FBI are generally not easy, said Robert Anderson, a retired FBI executive assistant director. “The director of the FBI is a hard job, even when it’s an easy day or nothing’s in the newspaper,” Anderson said. “By the time it makes it up to Jim, it’s all hard at that point.” Republished with permission of The Associated Press.

Dems force delays in votes on Jeff Sessions, Steve Mnuchin, Tom Price

Democrats forced delays Tuesday in planned Senate committee votes on President Donald Trump‘s picks for Health and Treasury secretaries and attorney general, amid growing Democratic surliness over the administration’s aggressive early moves against refugees and an expected bitter battle over filling the Supreme Court vacancy. Democrats abruptly boycotted a Senate Finance Committee meeting called to vote on Rep. Tom Price, R-Ga., the Health nominee and Steve Mnuchin, Trump’s Treasury selection, saying both had misled Congress about their financial backgrounds. The Democrats’ action prevented the Finance panel from acting because under committee rules, 13 of its members — including at least one Democrat — must be present for votes. It was unclear when the panel would reschedule to votes. At the Senate Judiciary Committee, a meeting considering Sen. Jeff Sessions, R-Ala., to be attorney general lasted so long — chiefly because of lengthy Democratic speeches — that Chairman Charles Grassley, R-Iowa, said the panel would meet again Wednesday. The meeting on Sessions’ nomination was coming with Democrats and demonstrators around the country in an uproar over Trump’s executive order temporarily blocking refugees. Even some Republicans were warning it could hinder anti-terrorism efforts. Not everything ground to a halt. The Senate education committee voted 12-11 to send Trump’s pick to head the Education Department, Betsy DeVos, to the full Senate for a confirmation vote. The Senate Energy and Natural Resources Committee quickly approved former Texas Gov. Rick Perry as Energy secretary by 16-7, and Rep. Ryan Zinke, R-Mont., to head Interior by 16-6. And the full Senate easily confirmed Elaine Chao to become transportation secretary by a 93-6 vote. Chao was labor secretary under President George W. Bush, and is wife of Senate Majority Leader Mitch McConnell, R-Ky. Just before the Finance committee was scheduled to vote on Price and Mnuchin, Democrats called a briefing for reporters and announced their plan to force a delay. Sen. Debbie Stabenow, D-Mich., said Price and Mnuchin would hold positions “that directly affect peoples’ lives every day. The truth matters.” Finance Committee Chairman Orrin Hatch, R-Utah, accused Democrats of “a lack of desire to fulfill their constitutional responsibilities.” “They ought to stop posturing and acting like idiots,” he said. In 2013 when Democrats controlled the Senate, Republicans boycotted a committee vote on Gina McCarthy to head the Environmental Protection Agency, temporarily stalling it. Democrats cited one report in The Wall Street Journal that Price received a special, discounted offer to buy stock in a biomedical company, which contradicted his testimony to Congress. They said another report in The Columbus Dispatch showed documents revealing that Mnuchin had not been truthful with the Senate in the confirmation process in comments about how his bank OneWest had handled home foreclosures. Republicans have supported both men, and both have strongly defended their actions. Democrats have opposed Price, a seven-term congressional veteran, for his staunch backing of his party’s drive to scuttle Obama’s health care law and to reshape Medicare and Medicaid, which help older and low-income people afford medical care. They’ve also assailed Price for buying stocks of health care firms, accusing him of using insider information and conflicts of interest for backing legislation that could help his investments. Price says his trades were largely managed by brokers and that he’s followed congressional ethics rules. Democrats have criticized Mnuchin for not initially revealing nearly $100 million in assets, and were expected to vote against both nominees. They’ve also accused him of failing to protect homeowners from foreclosures and criticized him for not initially disclosing all his assets. DeVos, a wealthy GOP donor and conservative activist, has long supported charter schools and allowing school choice. That’s prompted opposition from Democrats and teachers’ unions who view her stance as a threat to federal dollars that support public education. Critics have also mocked her for suggesting that guns could be justified in schools to protect students from grizzly bears. Two prominent Republicans on the education committee, Sens. Susan Collins of Maine and Lisa Murkowski of Alaska, said they remained uncertain if they will vote for her on the Senate floor. Murkowski said DeVos has yet to prove that she deeply cares about America’s struggling schools and its children. Republished with permission of the Associated Press.