Stephen Stetson: ‘Ban the box’ to enhance the chance for Alabama workers, employers to succeed

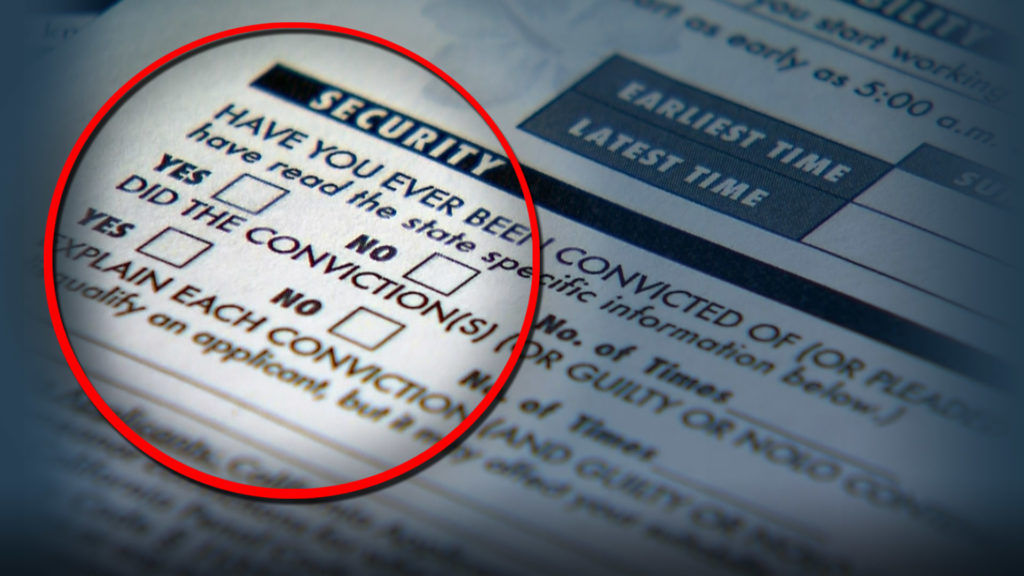

It’s rare to have a political revelation in the bread aisle. But two recent trips to the grocery store gave me a sense of a needed change in Alabama’s criminal justice system. Both Winn-Dixie and Publix carry Dave’s Killer Bread, which comes in bags with a logo of a guy with a mustache and a mullet holding an electric guitar. But the most interesting thing about this bread isn’t the branding — it’s the story behind it. Dave’s Killer Bread makes a conscious effort to employ people with criminal convictions. One in three of its employees has a criminal background. “We believe that everyone is capable of greatness, and we have seen firsthand the powerful transformation that is possible when someone is given a second chance,” the company’s website says. “Our goal is to serve as an example to other employers that hiring people with criminal backgrounds can strengthen not only their workforce and company culture, but their local communities as well.” This is powerful stuff — not to mention that I ended up buying a loaf and making some of the best toast I’ve ever had. It was a timely reminder that Alabama lawmakers are examining the state’s rules about job application processes in response to a nationwide nonpartisan movement to “ban the box” — that is, to remove the criminal history checkbox on job applications. Alabama would do well to move in this direction. Some of our neighbors already have this policy. Georgia Gov. Nathan Deal signed an executive order last year removing the criminal history question from applications for state jobs. Louisiana and Tennessee followed suit this year. In all, 24 states have some form of “ban the box” policy. Nine of them forbid private-sector employers from making the inquiry at the initial job application stage as well. Let’s be clear: These policies don’t mean employers can’t ask about applicants’ histories. It just means they get to build a first impression based on qualifications in the person’s resume. Study after study shows you get better candidates when you let them explain in person any previous mistakes they may have made. The “ban the box” movement isn’t just the product of criminal justice reform groups. It also has the support of some of our country’s largest employers, including Home Depot, Target, and Wal-Mart. All of them realize we’re better off when we don’t screen people out of the hiring process with a single question on an application. Nobody benefits from permanently locking people out of meaningful employment. Once people have served their time and paid their debt to society, they ought to be able to rejoin the economy and contribute in a meaningful way. When their job applications are rejected out of hand due to a previous run-in with the law, people can become alienated, frustrated, and hopeless. This same logic also applies to another change Alabama lawmakers need to make: updating the law to allow more people to regain voting rights. Certain crimes permanently disqualify people from voting, but amazingly, Alabama has no clear list of which offenses actually count as these “crimes of moral turpitude.” The Legislature should end that uncertainty in 2017. People with criminal convictions can, and must, re-enter society after fulfilling the terms of their punishments. They should be allowed to work and vote and make meaningful contributions to society. Some simple changes to our laws can help reduce recidivism and smooth the extremely difficult path facing people seeking to start a new life after prison. Getting re-entry policies right isn’t always easy. But “ban the box” and voting rights restoration are two policy changes that would make Alabama safer and more prosperous. Companies benefit when they hire from the fullest range of people in the applicant pool, and we all benefit when people are more invested in their community’s future. That’s why the legal barriers to re-entry in Alabama should become toast — and not the delicious kind. ••• Stephen Stetson is a policy analyst for Arise Citizens’ Policy Project, a nonprofit, nonpartisan coalition of congregations, organizations and individuals promoting public policies to improve the lives of low-income Alabamians. Email: stephen@alarise.org.

Stephen Stetson: Keep the faith, Alabama’s lending reform movement will win

It’s no secret that tremendous wealth can open doors, and you don’t have to look far to see the colossal power of money in the political process. Here in Alabama, the high-cost lending industries are throwing hefty sums of money around, merging affluence with influence and hoping to keep lawmakers and regulators from getting swept up in the rising sea of public outrage about how many Alabamians are caught in debt traps. A July 12 report by AL.com’s Kyle Whitmire exposed a luxurious trip for Alabama legislators to a North Carolina spa, paid for by the Alabama Lenders Association. The state Ethics Commission cleared the event, but it’s still worth noting that the lawmakers who attended the installment lenders’ conference in lush surroundings are among those who would consider legislation affecting consumer loans in our state. Alabama Arise has teamed with faith-based groups and consumer advocates across the state in a multi-year, grassroots push for reasonable protections for Alabama borrowers across a wide spectrum of loan types. Our movement’s main focus in recent years has been on reining in annual interest rates of 456 percent on payday loans in Alabama – not to mention rates of 300 percent a year on auto title loans. (Yes, you read those numbers right.) The need for change is real, and Alabama’s lending reform movement has real momentum. A payday loan reform bill sponsored by Sen. Arthur Orr, R-Decatur, nearly passed the Legislature this spring, receiving overwhelming Senate approval before dying in the House on the session’s last day. Many passionate advocates across Alabama believe 2017 could be the year for true and substantive lending reform. Payday and title lending practices don’t involve ensuring the borrower’s ability to repay the loans, and they have sent thousands of borrowers spiraling into cycles of deep debt while draining money from other areas of the state’s economy. Georgia, Arkansas, North Carolina and many other states have placed reasonable restrictions on these and other types of consumer loans, and they offer plenty of examples of profitable businesses lending money to struggling borrowers without resorting to exorbitant interest rates. There’s no reason that couldn’t happen in Alabama as well. Unfortunately, reports about a lender-funded junket to a North Carolina spa can leave everyday citizens feeling dispirited. How can an email or phone call from a constituent compete with a luxurious vacation hosted by lenders? It’s like we’re playing checkers, and they’re playing Monopoly. That kind of pessimism is debilitating to civic engagement and democracy. When ordinary folks feel like politics is a one-sided game, it’s no wonder that many would stop caring entirely. It’s a lot easier just to shrug and play Pokemon Go or talk about college football. But Alabamians shouldn’t give in to the temptation to give up. Lending reform is still on the move, and there’s real hope for change at both the national and state levels. Nationally, proposed new federal rules would require important consumer protections for payday and title borrowers. Alabamians can urge the Consumer Financial Protection Bureau to strengthen those proposals further by submitting a comment at stoppaydaypredators.org/ARLA. Every comment helps. At the state level, a new task force considering consumer lending issues in Alabama is heavy with industry representatives, but Arise and other consumer advocates on the task force will push hard for consumer-friendly changes. We’ll also oppose efforts to transform short-term payday loans into new longer-term loans that would keep borrowers in debt year-round. Such loans may not be called “payday loans,” but they could be equally usurious. The lending reform movement has broad support across Alabama and across the political spectrum, and the outcry for change is getting louder every year. The coalition against high-cost lending practices in Alabama won’t give legislators the spa treatment. We’re determined to get results through the power of the people. Our message to everyday Alabamians who support change is this: Let’s keep the faith, redouble our advocacy and remind our elected officials of the constituents they really represent. There are some things money can’t buy. ••• Stephen Stetson is a policy analyst for Arise Citizens’ Policy Project, a nonprofit, nonpartisan coalition of 150 congregations and organizations promoting public policies to improve the lives of low-income Alabamians.

Federal payday lending reforms find support in Alabama

An ongoing effort by the federal Consumer Financial Protection Bureau to rein in the excesses of high-interest “payday loan” lenders has so far been generally been well-received in Alabama. “The proposed CFPB rules have bipartisan support and empower consumers to make better financial decisions for themselves,” said Rep. Terri Sewell, a Democrat. “I strongly support the adoption of these proposed regulations and will continue to fight for greater consumer protections in my role as a member of the House Committee on Financial Services.” Sewell repeated an oft-cited figure that there are “four times as many payday lenders in Alabama as there are McDonalds” in supporting the regulatory action. “Borrowers should not be at the mercy of predatory lenders and CFPB’s proposed rules would strengthen consumer protections and make it harder to prey on vulnerable communities,” said Sewell, who also noted minority communities are disproportionately affected by payday lenders’ usurious behavior. Arise Citizens’ Policy Project, a nonpartisan public interest advocacy group, also endorsed the moves by and large, though they said state-level reforms are still needed. A related bill which would have limited interest rates among other reforms circulated in the state Legislature earlier this year, though it ultimately failed to reach the desk of Gov. Robert Bentley. “Today’s CFPB announcement is an important step in the right direction for payday and title loan borrowers in Alabama, but it’s not enough. The new federal rules would strengthen consumer protections by requiring lenders to verify borrowers’ ability to repay for many loans. But the rules contain many exceptions, and they may not go into effect for quite some time,” said policy analyst Stephen Stetson. “The new rules also would not change the extremely high annual interest rates that Alabama allows those loans to carry: up to 456 percent a year for payday loans, and up to 300 percent a year for title loans. Alabama needs to build on these rules at the state level by closing loopholes and encouraging more affordable short-term loans for borrowers,” said Stetson.

Alabama House committee passes weakened payday lending reform

The House Financial Services Committee voted Wednesday to approve a version of the payday lending reform bill already passed by the Alabama Senate, but neither side of the debate is particularly happy with the outcome. Weaker than the original legislation, the substitute bill offered during the committee meeting Wednesday restricts payday lenders to making loans at 15 percent for minimum terms of 28 days, which cuts the APR of such loans significantly, but not as much as reformers had hoped. The move is seen as a compromise, and the original bill’s sponsor Danny Garrett, a Republican of Trussville, said it means “[w]e’re moving to the point where we’ll have reform this year.” Besides the increase in the amount of interest allowed, one of the biggest issues reformers have with the new bill is the maintenance of the inability to pay off the loans in installments, one of the features they say keep low-income borrowers trapped in a cycle of debt. In a public hearing on the previous Wednesday, a member of the payday lending industry said the original bill would be an “extinction event” for the entire sector. Blake calls payday loan bill a “global extinction event” for payday lenders. #alpolitics — Tim Lockette (@TLockette_Star) April 20, 2016 A database created by the Alabama Department of Banking found Alabamians took out 462,209 loans over a 10-week period. A total of $146 million was borrowed, or an average of about $14 million each week. A coalition of activists from across the state have fought for years to bring reform to the table. The Alliance for Responsible Lending in Alabama (ARLA) has members from the Arise Citizens’ Policy Project, Alabama Appleseed, the Alabama State Conference of the NAACP, the Alabama Citizens’ Action Program, the Southern Poverty Law Center, and the Federation of Republican Women. While opponents of reform say such loans are sometimes necessary to help low-income families through tough times, ARLA policy analyst Stephen Stetson wrote in an op-ed last month that what can appear to be a helping hand for those in need can be an “anchor” holding them in a cycle of poverty. “We all want a world where people can get the kinds of credit they need. But that requires putting some brakes on a system that all too often acts as an engine for poverty, handing out extremely high-cost loans to desperate folks who may treat them as a lifeline. Too often, those ‘lifelines’ instead end up as anchors, dragging people into financial quicksand.” But regardless of the compromise, the changes made to the bill may mean reform is dead in the water this year, as it will have to be re-passed by the Senate, and this time under the body’s unanimous consent rules, with just a few days left in the Regular Session.

Bill to regulate payday lenders inches closer to final passage

As the clock winds down on the Alabama Legislature’s 2016 Regular Session, a bill to regulate payday lenders which started with a great deal of momentum is now inching itself toward the finish line, despite broad support from both sides of the aisle in Montgomery. SB91, sponsored in the Alabama Senate by powerful senator and committee chairman Arthur Orr (R-Decatur), and carried in the House by Sophomore member David Faulkner (R-Mountain Brook) would cap maximum annual interest on payday loans at 180 percent, down from current interest rates of 456 percent per year. The bill passed the Alabama Senate nearly unanimously, garnering merely a single No vote. While supporters of the bill believe they have the votes in the House, the bill is meeting some resistance on its way to final passage. At a roundtable discussion held on April 18th by the Junior League of Birmingham, Rep. Faulkner said his primary goal is to get the bill, which he admits isn’t perfect but is a step in the right direction, out of committee and out of the House without any changes. The bill did not receive a vote after a lengthy public hearing during last week’s Financial Services Committee meeting, during which members heard from advocates on both sides of the issue. The reform being championed by two Republicans is somewhat of an anomaly, as such changes have frequently been carried by Democrats in other states. But Faulkner told Alabama Today it was a no brainer for him as soon as the lenders’ tactics were explained to him. “When the issue was explained to me by a member of my church I just knew it was the right thing to do,” said Faulkner. “I see these places all over the place, I’ve heard the stories, once I learned more about it, I felt like this was usury, and that the State of Alabama is wrong for having a system in place that really allowed people to be preyed upon. I’m a less government, small government conservative, but I don’t believe when the government put in place a system that allows people to be preyed upon, I felt like that was wrong.” A database created by the Alabama Department of Banking found Alabamians took out 462,209 loans over a 10-week period. A total of $146 million was borrowed, or an average of about $14 million each week. A coalition of activists from across the state have fought for years to bring this reform to the table. The Alliance for Responsible Lending in Alabama (ARLA) has members from the Arise Citizens’ Policy Project, Alabama Appleseed, the Alabama State Conference of the NAACP, the Alabama Citizens’ Action Program, the Southern Poverty Law Center, and the Federation of Republican Women. The group argues it has the deck stacked against them, with a well-funded special interest bolstering the bill’s opposition. A report by AL.com’s Kyle Whitmire found during the 2014 election cycle lenders gave more than $475,000, including $37.835 to House Speaker Mike Hubbard (R-Auburn) and thousands more to other influential members of the House and Senate. While opponents of reform say such loans are sometimes necessary to help low-income families through tough times, ARLA policy analyst Stephen Stetson wrote in an op-ed last month that what can appear to be a helping hand for those in need can be an “anchor” holding them in a cycle of poverty. “We all want a world where people can get the kinds of credit they need. But that requires putting some brakes on a system that all too often acts as an engine for poverty, handing out extremely high-cost loans to desperate folks who may treat them as a lifeline. Too often, those ‘lifelines’ instead end up as anchors, dragging people into financial quicksand.” With only two weeks left in the session, the bill’s advocates have precious few days to shepherd it through the rest of the legislative process and onto the governor’s desk.

Stephen Stetson: A good first step toward payday lending reform in Alabama

We’re calling for payday lending reform in Alabama, and we’re not alone. For years, reform of high-cost lending has been the goal of the Alliance for Responsible Lending in Alabama (ARLA), an incredibly wide-ranging coalition of activists and advocates. The groups pushing for reform span the spectrum, including Arise Citizens’ Policy Project, Alabama Appleseed, the Alabama State Conference of the NAACP, the Alabama Citizens’ Action Program, the Southern Poverty Law Center and the Federation of Republican Women. ARLA is a coalition staggering in its breadth and ideological diversity – and its members are excited to see the Alabama Legislature considering reforms that would lower costs for hundreds of thousands of payday borrowers now coping with interest rates of up to 456 percent a year. Let’s be clear: SB91, sponsored by Sen. Arthur Orr (R-Decatur) doesn’t give reform advocates everything they want. In an ideal world, lawmakers would cap interest rates on payday loans at 36 percent a year and allow more borrowers to be served by banks and credit unions (and family and friends), while making good plans and decisions about monthly budgeting. Sadly, that approach simply doesn’t seem politically possible right now in Alabama. Orr’s approach would do a whole lot of good for a whole lot of people, though. The bill, which the Senate is expected to consider in April, would enable the payday loan industry to stay in Alabama, while putting some common-sense rules in place to govern the loans. SB91 models reforms made in Colorado in 2010. The bill would cut interest rates, give payday borrowers at least six months to repay, and allow them to pay down the loan principal in installments. These would be meaningful changes. Under current Alabama law, payday loans are usually for two weeks and must be repaid in full, with no requirement for lenders to allow installment payments. In Colorado, extending the loans’ length and allowing installment payments has given borrowers a shot to reduce their debt without it eating up huge chunks of every paycheck. Fewer people are pulled into a ceaseless churn of short-term loan after short-term loan. Again, SB91 wouldn’t solve every problem related to consumer debt, and it wouldn’t eliminate the payday loan industry in Alabama. It’s a compromise proposal that would curb some of the worst excesses of an industry built on loans that leave far too many people trapped in debt. It would help keep some folks out of bankruptcy court, and it would allow more reasonable lending approaches to flourish. We all want a world where people can get the kinds of credit they need. But that requires putting some brakes on a system that all too often acts as an engine for poverty, handing out extremely high-cost loans to desperate folks who may treat them as a lifeline. Too often, those “lifelines” instead end up as anchors, dragging people into financial quicksand. A growing number of Alabamians now agree: The time has come to give payday borrowers some relief. SB91 would be a real and substantial step in the right direction for Alabama consumers. • • • Stephen Stetson is a policy analyst for Arise Citizens’ Policy Project, a nonprofit, nonpartisan coalition of 150 congregations and organizations promoting public policies to improve the lives of low-income Alabamians. Email: stephen@alarise.org.

Alabama House panel debates cap on title loan interest rates

Alabama title loan companies could see a 36 percent cap on the interest rates they’re allowed to charge consumers under legislation under consideration in the House. The House financial services committee heard public arguments Wednesday about tightening regulations of subprime loans that use cars and other assets as collateral. House Bill 400 requires title lending companies to be licensed by the state and adhere to state-level restrictions on the charges, interest, and fees associated with title loans. The Federal Deposit Insurance Corporation estimates that 1.1 million households used auto title loans in 2013. Alabama lenders are allowed to charge 25 percent per month for an auto title loan, translating to as much as 300 percent on a yearly basis. “We’re talking about an industry that doubles its money three times on an annual basis,” bill sponsor Rep. Rod Scott said. “We know that’s not appropriate. From the consumer’s perspective, that’s usury.” Scott said he brought the bill because of concern over what he describs as unfair practices and predatory lending to Alabama’s poorest households. The result, he said, is that people have to ask family, churches or nonprofit groups for help to pay off the loans. “You can’t borrow your way out of debt, especially when the interest rates are so onerous,” Scott said. Osjha Domenicone, head of government affairs for title loan company Select Management Resources, said her company has had only two complaints in five years. “Other states that have passed price restrictions like the ones in this bill have seen an increase in complaints because their citizens are left with nothing but unregulated, unaccountable online lenders,” she said. “I assure you, a 36 percent cap does eliminate the industry and this access to credit … I have a difficult time understanding why my customers and employees should suffer over two complaints in five years.” Stephen Stetson from Alabama ARISE argued that in the 25 states without a title loan presence, consumers can still access credit through traditional banking. Several members expressed concern over imposing regulation at the state level, when the federal Consumer Financial Protection Bureau is expected to take action on payday and title lending this year. “Anything we do is just going to get overturned at the federal level,” Rep. Mike Hill said. The panel declined to vote on House Bill 400 Wednesday. Stetson said that with just seven days left in the regular session, that decision would mean another year of predatory lending for Alabama consumers. “We’re looking at a long off-season where more people are going to get their cars repossessed or get trapped in more loans,” Stetson said. “It’s a shame that 67 bill co-sponsors – which is enough (votes) to get it passed on the House floor – wasn’t enough to get this bill through committee.”