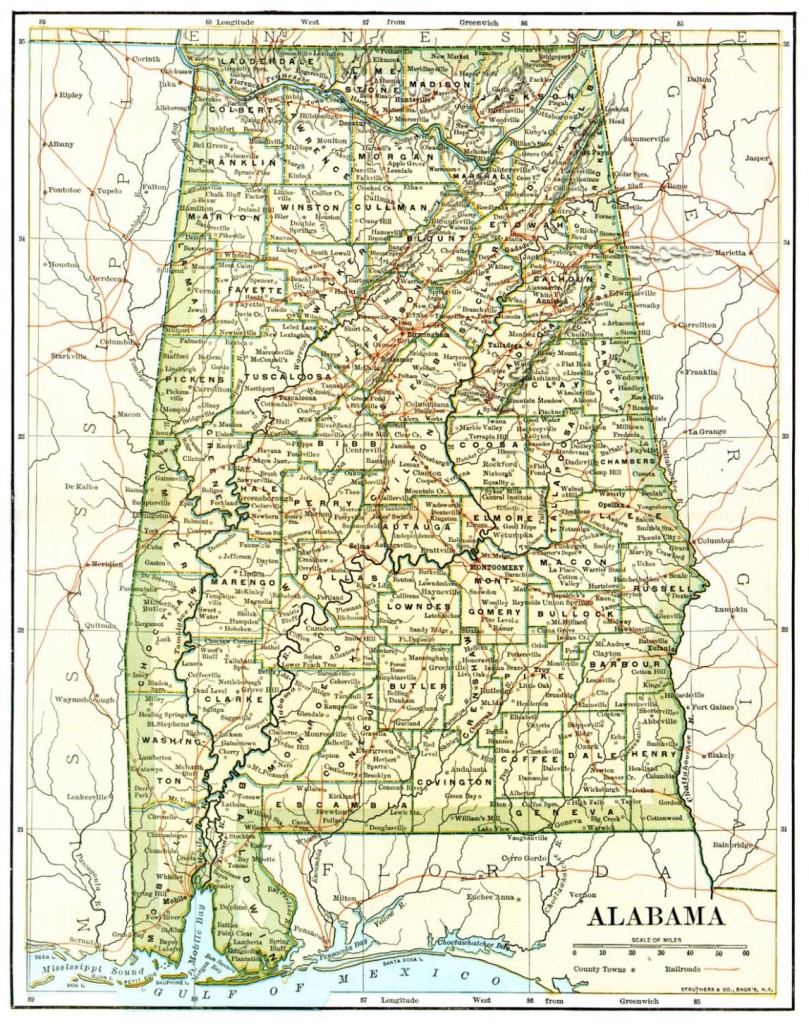

Report: Alabama has nation’s second-lowest property taxes

(The Center Square) — A recent report by the Tax Foundation found that Alabama has the second-lowest property taxes nationally as a percentage of a home’s value. Researchers from the non-partisan nonprofit that deals with tax policy found that the Yellowhammer State hits property owners with an effective rate of 0.4%. According to the report, property taxes amounted to 32.2% of state and local tax revenues in 2020, more than any other source. The Tax Foundation used the most recent data from 2021 in their calculations and found that the highest average property tax bills were in the Birmingham metro area, as suburban Shelby County (average of $1,167) and Jefferson County ($1,149). Only Hawaii had lower property taxes at 0.32%, with Colorado (0.55%), Wyoming (0.56 percent) and Louisiana (0.56%) rounding out the top five. According to the Alabama Department of Revenue, Greene County has the state’s highest property tax rates, but the average tax bill is $312 per year. On the opposite end of the spectrum, New Jersey had the nation’s highest property taxes with an average rate of 2.23%, followed by Illinois (2.08%), New Hampshire (1.93%), Vermont (1.83%) and Connecticut (1.79%). Alabama also outperformed its neighboring states, as Tennessee (0.67% rate) and Mississippi (0.67%) were at 37th and 36th lowest, respectively. Florida had the 26th-lowest rate at 0.91%, followed by Georgia at 25th with 0.92%. Alabama’s Choctaw County had one of the lowest average property bills nationally at $200, along with Allen, Avoyelles, East Carroll and West Carroll parishes in Louisiana and Northwest Arctic Borough and the Kusilvak Census Area in Alaska. A pair of Louisiana parishes — Madison ($215) and Bienville ($220) — were among the lowest average property taxes, along with Sioux County, North Dakota ($223), Alabama’s Lamar County ($234) and McDowell County, West Virginia ($237). Eleven counties had annual property taxes of more than $10,000, including Bergen, Essex, Hunterdon, Morris, Passaic, and Union counties in New Jersey; Nassau, New York, Rockland, and Westchester Counties in New York and Fall Church County in Virginia. Republished with the permission of The Center Square.

‘Tax Freedom Day’ was April 5 in Alabama

Taxes aren’t due until Tuesday, and according to a new report released by the Tax Foundation, Alabamians have already earned enough income this year to pay their total tax bill for 2018. Each year, Americans work together for several months to earn enough money to cover the federal, state, and local taxes they owe. Using that information, the Washington D.C.-based tax policy nonprofit sends out a report determining when the country as a whole, and each state has paid off its tax bill. This year Tax Freedom Day in Alabama was April 5, making it one of three states with the second lowest average tax burden in 2018. That’s also down four days from where it was last year. Tax Freedom Day for the nation as a whole is April 19 — 109 days into the year — and three days earlier than it was in 2017. “The three-day change from last year is largely due to the recently-enacted Tax Cuts and Jobs Act, which substantially lowered federal individual and corporate income taxes,” said Tax Foundation Analyst Erica York. The goal of Tax Freedom Day is to help Americans understand the cost of government, and according to the report, this year Americans will collectively pay $3.39 trillion in federal taxes and $1.8 trillion in state and local taxes, for a total bill of more than $5.19 trillion, or 30 percent of the nation’s income. Meaning Americans will collectively spend more on taxes in 2018 than they will on food, clothing, and housing combined. Here’s how Alabama compares to the rest of the nation:

“Tax Freedom Day” was April 9 in Alabama

Taxes are due Tuesday, and according to a new report from the Tax Foundation, Alabamians have already earned enough money this year to pay their total tax bill for 2017. In the Washington D.C.-based tax policy nonprofit’s new “Tax Freedom Day” report, the Tax Foundation determined the day when the average American hypothetically has worked enough to pay all federal, state and local taxes for the year. For the nation as a whole, that day falls on April 23 — this coming Sunday — 113 days into the year. For Alabamians, that day was April 9, making it the state with the fourth earliest Tax Freedom Day in the country. The goal of Tax Freedom Day is to help Americans understand the cost of government, and according to the report, this year Americans will collectively pay $3.5 trillion in federal taxes and $1.6 trillion in state and local taxes, for a total bill of more than $5.1 trillion, or 31 percent of the nation’s income. Meaning Americans will collectively spend more on taxes in 2017 than they will on food, clothing, and housing combined. Here’s how Alabama compares to the rest of the nation:

Analysis: Donald Trump proposals would add $5.3 trillion to debt

A new analysis from a nonpartisan group finds that Donald Trump‘s latest tax proposals would increase the federal debt by $5.3 trillion over the next decade, compared with $200 billion if Hillary Clinton‘s ideas were enacted. The Committee for a Responsible Federal Budget looked at Trump’s newly revised tax plan as well as other proposals. However, it says its analysis can’t be certain of the actual size of Trump’s tax plan because his campaign won’t spell out how it will treat certain businesses’ tax liabilities. The committee took a “mid-range guess” between two estimates provided by the nonpartisan Tax Foundation. When Trump introduced his economic plan last week, he vowed that his tax cuts would be paid for partly by triggering record economic growth. The committee was skeptical and presumed they would generate no new growth. Several economists have projected that Trump’s economic agenda — especially his restrictions on immigration and trade — would slow economic growth and possibly cause a recession. Trump has also proposed a sharp increase in spending on the military and veterans. He has proposed some spending cuts, but the committee calculated they wouldn’t come close to balancing the budget. The cost of Clinton’s plan comes largely from her proposals for free college, child care aid and universal pre-K for 4-year-olds. She proposes paying for them with tax hikes on the rich and businesses. Republished with permission of the Associated Press.

Grocery tax persists in Alabama, ‘punishes’ those on fixed incomes

Alabama is one of only thirteen states across the country who taxes the sale of groceries. According to the Tax Foundation, Alabama, Hawaii, Idaho, Kansas, Mississippi, Oklahoma and South Dakota tax groceries at the same rate as the sales tax on all purchases, which puts a disproportionate burden on the poor, which may affect the quality of food they can afford to put on the table. Stateline, an online site of The Pew Charitable Trusts, takes a deeper look at the states that continue to charge a grocery state, focusing on the Yellowhammer State: In Alabama, most of the sales tax goes toward education. And Nancy Dennis, spokeswoman for the Alabama Retail Association, noted that every time the sales tax goes up, retail sales go down. That worries both retailers and educators in the state. “The kicker here is where the replacement tax revenue is going to come from,” she said. “Alabama, like many states, is in budgetary crisis. So if legislators take away revenue, it’s not going to help solve their problems in continuing to help fund the state.” Alabama State Sen. Gerald Dial is one legislator who would like to see the tax eliminated. The tax, Dial told Stateline, is “the most regressive tax you can have and punishes those on fixed income.” Dial knows the facts — households across the country spend more money on food when incomes rise, but food represents a smaller portion of income as they allocate additional funds to other goods. For poorer household, the food budget represent a larger percentage of their income in order to feed their families. According to the U.S. Department of Agriculture, the lowest-income Americans spent an average of $3,667 on food in 2014, amounting to 34.1 percent of their income, . In contrast, middle-income families spent an average of $5,992 on food, or 13.4 percent of income. Despite the facts against the tax, and a handful of lawmakers like Dial fighting against it, it doesn’t look like the grocery tax is going away any time soon in Alabama. For a state with a perennial budget shortfall, the tax provides a steady and secure stream of revenue. Here’s a look at where groceries are taxed in America:

New report ranks Alabama No. 29 in nation for business climate

A new report released Tuesday from the Washington, D.C.-based Tax Foundation ranks Alabama at No. 29 in the nation in terms of business climate. The conservative-leaning group think-tank cited a high sales tax and middling rankings when it comes to the cost of unemployment insurance and the corporate tax rate when assigning the state its rating. Alabama’s relatively low property taxes and and personal income tax levels, on the other hand, were listed as better than average. The No. 29 slot was good for some ten spots better than neighboring Georgia, but considerably lower than its southern neighbors in Florida, which structures its revenue base primarily on tourism and real estate. Wyoming, South Dakota, Alaska and Nevada rounded out the top five along with the Sunshine State, which came in at No. 4. Alabama border states Tennessee (No. 16) and Mississippi (No. 20) also scored somewhat higher in the foundation’s ratings. Fiscally liberal bastions like Rhode Island, Vermont, Minnesota, California, New York were at the bottom of the list. New Jersey took home the dubious distinction of coming in very last among all states. “The states in the bottom 10 tend to have a number of afflictions in common: complex, non-neutral taxes with comparatively high rates,” the study explained. “New Jersey, for example, is hampered by some of the highest property tax burdens in the country, is one of just two states to levy both an inheritance tax and an estate tax, and maintains some of the worst-structured individual income taxes in the country.” The news isn’t all bad for Alabama – the Tax Foundation authors said taxes aren’t everything, and that quality of life and infrastructure play a significant role in luring businesses as well. “…[P]olicymakers routinely overestimate the degree to which tax policy affects business location decisions and that as a result of this misperception, they respond readily to public pressure for jobs and economic growth by proposing lower taxes. According to [Syracuse economist Michael] Wasylenko, other legislative actions are likely to accomplish more positive economic results because in reality, taxes do not drive economic growth.” They do, however, remain a major factor. “The taxes paid by businesses should be a concern to everyone because they are ultimately borne by individuals through lower wages, increased prices, and decreased shareholder value,” the authors wrote. “Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.”

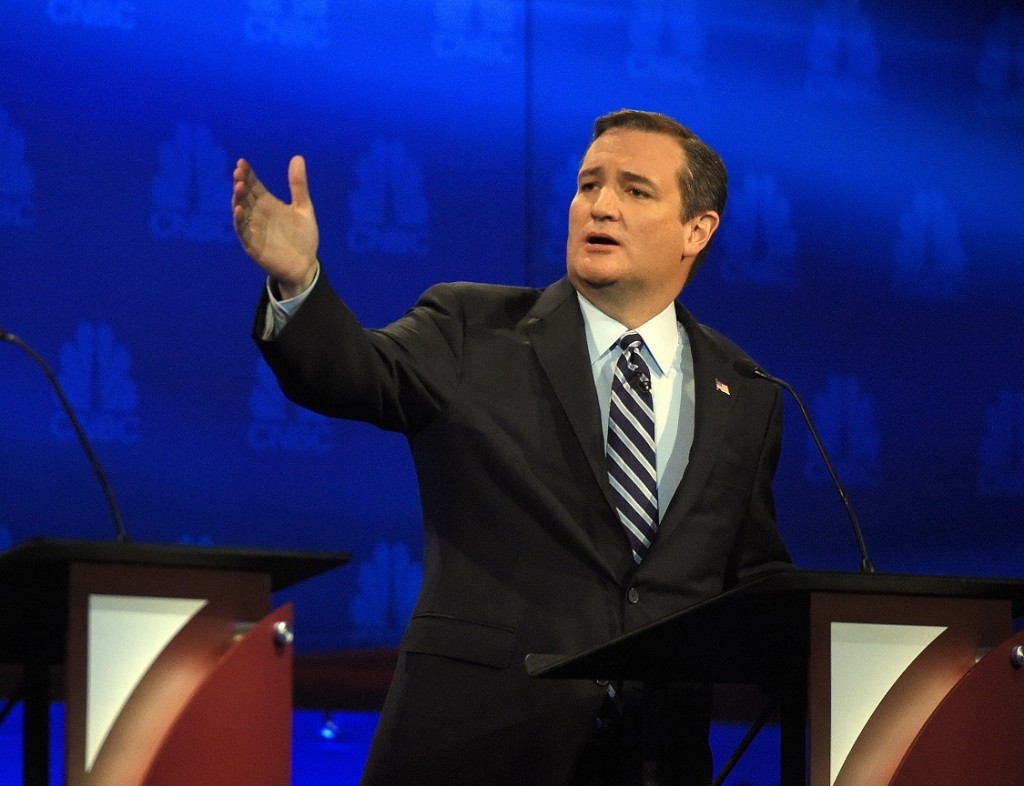

Ted Cruz adds to GOP divide on how best to overhaul tax system

In proposing the U.S. adopt a flat tax coupled with a levy similar to a European-style value added tax, Texas Sen. Ted Cruz is contributing to a division in the Republican presidential field. Some simply want to cut existing rates. But others — Cruz among them — suggest scrapping the nation’s tax code entirely and starting over from scratch. All the tax plans released by the Republican candidates to date would starkly reduce the amount of money Americans and U.S. businesses pay in taxes, with experts — including those who support them — predicting they would balloon the nation’s debt by trillions of dollars over the next decade. While all people of all incomes would generally pay less in federal taxes in every plan, the benefits skew largely toward the wealthy. But the candidates, who say the proposals would jump-start economic growth, get there in very different ways. Donald Trump, Marco Rubio and Jeb Bush have all proposed cuts and consolidation of existing tax rates, maintaining a tax code that collects a larger share of income from taxpayers as it rises. Cruz has joined Kentucky Sen. Rand Paul in combining a flat tax, or a single rate paid by all regardless of their income, along with a tax on business activity that would take the place of the current payroll and corporate income tax. That business activity tax is essentially what’s known as a value-added tax. It’s akin to a sales tax, since it’s assumed that businesses will pass the cost of paying it onto consumers. Many tax experts like the value-added tax since it is simpler and less likely to include loopholes for special interest groups. “Nearly every economist would tell you it’s a more efficient tax,” said Howard Gleckman of the Tax Policy Center, a joint project of the nonpartisan Brookings Institute and Urban Institute. Cruz’s plan, released shortly before Wednesday’s Republican presidential debate, calls for a flat income tax rate of 10 percent, as well as a tax of 16 percent on all aspects of business — from sales to expenses to salaries paid. “You pay 10 percent of the flat tax going up,” Cruz said during Wednesday night’s debate. “The billionaire and the working man. No hedge fund manager pays less than his secretary.” An analysis by the Tax Foundation, a group that supports lower tax rates, found that about half the benefits from a switch to Cruz’s plan would go to the top 10 percent of all income earners. In part, that’s because wealthy people paying higher rates benefit more from the drop to 10 percent. It’s also because they spend a smaller percentage of their money on daily necessities and would therefore pay less via the value-added tax. The Tax Foundation’s analysis of Cruz’s plan says that it would increase the deficit by as much as $3.6 trillion over the next decade. When factoring in the possible economic growth triggered by the tax cuts, that number drops to $768 billion. Daniel Mitchell, an economist at the libertarian Cato Institute, said combining a flat tax and value-added tax has the benefits of low rates and a simpler tax code. But there’s a political risk in a Republican primary, too. “A Republican could score some very serious punches if he says, well, my opponent wants a European-style value-added tax,” Mitchell said. Cruz spokesman Rick Tyler argued the tax is not really European-style since it replaces existing taxes rather than adding onto them. “The result should be the opposite of Euro-stagnation: A re-ignition of the U.S. economy.” Value-added taxes are also criticized by some for placing a heavier burden on low-income taypayers. Higher standard deductions can mitigate that issue, Gleckman said, but he said Cruz’s deduction of $36,000 for a family of four is too low. To encourage savings, Cruz would also allow taypayers to save $25,000 a year in an IRA-style account in which no tax would be paid until the money is spent. But poorer households, Gleckman said, don’t tend to make enough money to take advantage of such a benefit. Cruz’s plan would also lower the tax on capital gains to 10 percent, a windfall for those who make most of their money from investments. Still, by eliminating the payroll tax he gets rid of an existing regressive levy on salaried workers, especially middle-class ones. Mitchell said the Cruz proposal is sound and could help boost economic growth, but he has reservations about how a future president could try to raise the flat income tax from Cruz’s low levels while enjoying the large revenues supplied by the value-added tax. “I worry that if you are putting in a VAT without getting rid of all income taxation, then you’re just setting the stage for President Chelsea Clinton to make America into France,” Mitchell said. Republished with permission of the Associated Press.

Republican field pushes tax cuts bound to drive up debt

Republicans came into this presidential campaign with painful memories of how, in the last one, Democrats blasted Mitt Romney’s tax plan as a giveaway to the rich. Yet Donald Trump‘s tax plan adds to the number of major GOP presidential candidates who propose to cut all taxes — but especially those for the wealthy — as deeply, or deeper, than Romney proposed. The lesson Republicans seem to have drawn is to simply stop worrying about balancing the budget. The plans would blow open deficits over the next decade that economists estimate ranging from $3.6 trillion to $12 trillion. Oren Cass, who was Romney’s domestic policy adviser, noted the former Massachusetts governor had pledged to make his tax cuts deficit-neutral by cutting tax loopholes, though he never fully detailed how his plan would do so. Yet he was still savaged by Democrats who accused him of planning to stiff middle-class ratepayers for the benefit of the rich. “You look at what Gov. Romney did and you say, ‘There’s nothing to be gained from being responsible that way,’ ” Cass said. “You may as well do the plan that your base is going to love.” Trump initially hinted he might buck conservative economic orthodoxy and raise taxes on the wealthy. But he ended up releasing the most aggressive tax cut of all candidates to date. The Tax Foundation, which favors lower taxes, estimated that his plan would increase the deficit by $12 trillion. The foundation found more than one-fifth of the plan’s benefit would accrue to the top 1 percent of income earners. Trump’s plan pointed to the enduring power of traditional conservative thinking — that lower taxes are the best way to spark growth, and any skew toward the wealthy is mainly a reflection of the outsized amount of taxes the rich already pay. “Even for Trump, it’s hard to be different,” said Martin Sullivan, chief economist for the nonpartisan research group Tax Analysts. “The new flavor is a lot of tax benefits at the low end and then much more on the high end.” With his trademark showmanship, Trump vowed to remove families making less than $50,000 from the tax rolls and allow them to send the IRS a single-page form declaring “I win!” Former Florida Gov. Jeb Bush‘s plan is less flamboyant but reduces rates and raises standard deductions enough to remove those families making $40,000 and under from the rolls. Florida Sen. Marco Rubio, meanwhile, would increase the child tax credit and lower the rate for families making less than $150,000 to 15 percent. Still, Rubio would eliminate taxes on investment gains, which is how most of the affluent make most of their money, and Bush would lower top rates dramatically as well. Both of their plans are skewed to the wealthy, like Trump’s, but less so. Criticism of tax proposals that benefit the wealthy grates on conservative economists. They note that the top 1 percent already pays more than a third of federal income taxes, so any large reduction would inevitably benefit them anyhow. They also argue that, by goosing the economy, the benefits from well-designed tax cuts would spread out more equitably through the economy. Still, Democrats are poised to exploit the issue. “Each one of these candidates has a tax plan that would rip a multi-trillion-dollar hole in the federal deficit, which would likely have to be offset by cuts to programs important to the middle class, including Social Security, Medicare, infrastructure and education,” said Eric Walker, a spokesman for the Democratic National Committee. “We need a tax system that rewards work instead of just wealth.” That sort of sound bite gnawed at Romney in 2012. This time, the Republican tactic is to shrug off the slam on the deficit, said Kyle Pomerleau, an economist at the Tax Foundation. “Republican candidates aren’t looking to be revenue-neutral” anymore, he said. “They’re saying ‘let’s cut taxes for everyone so we’re not accused of raising taxes for everyone.’ “ Republished with permission of The Associated Press.

GOP tax proposals tilt to rich despite populist rhetoric

Jeb Bush went to Detroit and talked about leveling the playing field. Marco Rubio wrote a book about helping the working class. Rand Paul is promising to expand the Republican Party beyond its traditional base. Yet all three Republican presidential candidates have offered tax proposals that would, for reasons such as nomination politics and tax rate realities, benefit overwhelmingly the wealthiest. In doing so, they have drawn criticism from Democrats who call it proof that the GOP’s eventual nominee will mainly try to help the rich. Even some conservatives expressed concerns after Bush released his proposed tax cut this past week. Then there was the analysis Thursday from the Washington-based Tax Foundation that concluded his plan would initially help the top 1 percent of earners 10 times as much as it would those in the bottom 10 percent. “Republicans should be countering the caricature of themselves as slavishly devoted to the interests of rich people and corporations, not playing into it,” according to an editorial in the conservative National Review. The magazine nonetheless praised Bush’s effort to reduce income and business tax rates. The trio’s tax plans do contain elements aimed directly at middle- and working-class voters. Rubio proposes to expand the child tax credit and Bush wants to double the Earned Income Tax Credit, which is designed to help the working poor. But experts note that any broad income tax cut inevitably will benefit the rich more than anyone else, because they pay much more in federal income taxes than the middle class or poor. About 40 percent of the country does not pay federal income tax. The top 1 percent of earners pays about 35 percent of the income tax. “It is a mechanical problem,” said Howard Gleckman of the Tax Policy Center, a joint project of the centrist Brookings Institute and left-leaning Urban Institute. “If you start from the place where any tax plan has got to cut tax rates, you start with a plan that is already regressive and it becomes challenging and complicated to ameliorate that.” Michael Strain of the conservative American Enterprise Institute said Republicans have good reason to push for across-the-board cuts, despite the inevitable benefit to the wealthy. “There’s a genuine concern on the part of conservatives about economic growth and having tax code that fosters economic growth because of a belief that you need a growing economy to help everyone in the country,” Strain said. John Cogan, a Stanford economist who served in the Reagan administration and consulted on the Bush plan, argued that the tax reductions can help cure the inequality that critics contend they exacerbate. “Economic growth is absolutely essential to reducing the degree of inequality,” Cogan said. That’s how Bush, a former, Florida governor, has tried to sell his plan. On Thursday, he brushed aside Democratic criticisms that the proposal was a giveaway to his wealthy donors and could increase the deficit, under his own supporters’ estimates, by more than $3 trillion. The U.S. must get back to “high, sustained economic growth,” Bush said during a CNN interview. “We need to boost people’s spirits by giving them more money to be able to make decisions for themselves.” Bush’s plan condenses seven different brackets to three — 28 percent for top earners (who are now taxed at as high as a 39.6 percent rate), 25 percent and 10 percent for families making up to $87,000. He would drop the corporate rate from 35 percent to 20 percent. To help middle- and working-class families, he would double the standard deduction and raise the Earned Income tax Credit. Bush surprised observers by pledging to eliminate a tax break that benefits investment managers — a small but symbolically potent change to a Wall Street benefit that comes weeks after rival Donald Trump called for such a move. Florida Sen. Rubio wrote a book in December outlining proposals to help low-income and middle-class families. In February he signed on to a sweeping tax proposal that does not cut top rates as much as Bush’s plan but does eliminate taxes on investment income. That would slash federal tax bills for many of the wealthiest in the country. Paul, a Kentucky senator, followed with a proposal to drop the tax rate to 14.5 percent across the board, which analysts argue may be an even bigger windfall for the rich. Conservative commentator Ramesh Ponnuru wrote in a column Thursday that the GOP should look to cutting other levies, like the payroll tax, which fall the heaviest on lower- and middle-income laborers. He said the GOP tax cut plans might end up being compared to Mitt Romney‘s in 2012, which a majority of voters thought helped the rich, according to exit polls. Republished with permission from The Associated Press.

Tax Foundation: Alabama boasts nation’s 7th-earliest “Tax Freedom Day”

The Tax Foundation, a conservative nonpartisan research think tank, based in Washington, D.C., says that Alabama gives its residents the seventh-most relief from high taxes among all states in the union. By its calculations, Alabamians celebrated what it calls “Tax Freedom Day” — the day by when the average worker’s tax bill is paid in full — on April 7 in 2015. The puts Alabama just ahead of Kentucky, New Mexico and South Carolina on the group’s annual list, and just behind Tennessee, South Dakota and Mississippi. Louisiana earned the No. 1 spot according to the nonprofit, celebrating its final tribute to the tax man on April 2. The think tank describes its methodology on its page promoting Tax Freedom Day, a registered trademark of the Tax Foundation: “Taxes at all levels of government — federal, state, and local — are included in the calculation. In calculating Tax Freedom Day for each state, we look at taxes borne by residents of that state, whether paid to the federal government, their own state or local governments, or governments of other states. Where possible, we allocate tax burdens to the taxpayer’s state of residence.”