Martha Roby: Momentum on tax reform

Congressional efforts to reform our nation’s broken tax code are picking up momentum. After a week of debate and deliberation, the House Ways and Means Committee approved H.R. 1, The Tax Cuts and Jobs Act. It will now go to the full House for consideration. When it comes to tax reform, my top priority is for the plan to benefit the people I represent in Central and Southeast Alabama. A study from the nonpartisan Tax Foundation found that House Republicans’ tax reform plan will offer the median household in Alabama an average of $2,078 in tax relief. Also, our bill expands the Child Tax Credit to $1,600 per child and lowers the income threshold so that more low-income families can take advantage of it. A few thousand extra dollars in the family budget can go a long way, and I believe individuals know how to spend their money better than the federal government does. And remember, these aren’t just one-time savings. This is annual tax relief that hardworking taxpayers can count on and budget for year after year. Another important priority is to boost the economy and create jobs. That’s why the Tax Cuts and Jobs Act lowers business tax rates from 35 percent to a globally-competitive 20 percent while also closing the labyrinth of loopholes that have been written into the tax code for three decades. This will help businesses to grow and hire more workers here in the United States. That same Tax Foundation study estimates that our plan could help create as many as 13,323 new full time jobs in Alabama. Tax reform is a complicated issue on its own, so it doesn’t help that some individuals and organizations are spreading misinformation and confusing the public. For example, Senate Democrats’ false claim that the bill somehow raises taxes on the middle class received “Four Pinocchios” from The Washington Post Fact Checker. Also, a Washington think tank was forced to retract its harsh analysis of the bill and admit they miscalculated how the expanded Child Tax Credit would help working families. Some have characterized our tax reform plan as a tax cut for the wealthiest Americans. That’s not true. The bill delivers relief at every level while maintaining the top 39.6 percent tax rate on high-income earners. Our plan actually lowers tax rates for low and middle-income earners and increases the standard deduction, which means that a lot of people will be able to immediately keep more of what they earn. Some feared that our tax reform plan will raise taxes on retirement. That’s not true either. Our bill retains the popular retirement savings options, such as 401(k)s and Individual Retirement Accounts (IRAs) just as Americans know them today. There is one important recent change to the bill I’m pleased to report: The adoption tax credit was successfully added back into the tax reform package. The tax code provides adoptive families a credit of up to $13,570 in qualified expenses for each child adopted, including through public foster care, domestic private adoption, and international adoption. For parents following the call to adopt children, this tax credit can make a big difference in removing financial barriers that often come with adoption. Restoring this tax credit was the right thing to do, and I appreciate Ways and Means Committee Chairman Kevin Brady for listening to the voices of adoptive families across the country. Simply put, I want you and your family to keep more of what you earn in your pocket. I believe hardworking Americans should have relief from our burdensome and frustrating tax code, and that’s what our plan delivers. The Tax Cuts and Jobs Act is just one step of the process. The Senate has released its own version of a tax reform plan, and we still have work to do. As we move forward, I encourage you to read the plan for yourself and stay informed on developments. You can find the text of the bill, frequently asked questions, and tools to help calculate how the plan would benefit you at FairandSimple.Gop. ••• Martha Roby represents Alabama’s Second Congressional District. She lives in Montgomery, Alabama with her husband Riley and their two children.

Alabama Arise opposes new GOP tax cut plan

A statewide nonprofit policy think tank that advocates for low-income families in Alabama has come out in opposition to the newly unveiled GOP tax cut plan. The Arise Citizens’ Policy Project on Friday said the new GOP tax plan would slash taxes for wealthy people while laying groundwork for cuts to education and Medicaid. “The House Republican tax plan is an expensive new giveaway to wealthy households and big corporations at the expense of working families. It would offer little or nothing to most Alabamians, and it actually would increase taxes for many low- and middle-income folks,” said Arise Executive Director Kimble Forrister. “The House Republican tax plan is an expensive new giveaway to wealthy households and big corporations at the expense of working families. It would offer little or nothing to most Alabamians, and it actually would increase taxes for many low- and middle-income folks. According to Forrister the plan would add at least $1.5 trillion to the national deficit, which he believe would lead to members of Congress cutting programs such as Medicaid and to food assistance to the poor. He continued, “Taking from those who have the least to give to those who have the most is no way to build a better economy, a better state or a better world. Congress should reject this tax bill and focus instead on closing corporate tax loopholes and investing in education, health care, transportation and other vital services that help struggling families get ahead across Alabama and across the country.”

Alabama delegations weighs in on GOP’s massive tax cut plan

As congressional Republicans unveiled a sweeping tax reform plan on Thursday, Alabama’s congressional delegation by and large came out in support of it. While 5th District U.S. Rep. Mo Brooks and 6th District U.S. Rep. Gary Palmer have yet to weigh in, the rest of the Republicans in the delegation came out in support of the $1.51 trillion plan to simplify the country’s tax code. The delegation’s lone Democrat 7th District U.S. Rep. Terri Sewell opposes the plan, which lowers the corporate tax rate from 35 percent to 20 percent, while reducing the number of tax brackets for individuals from seven to four — 12, 25, 35, and 39.6 percent. It also doubles the standard deduction for individuals and families, but caps deductions for both local and state taxes. Additionally it repeals the estate tax in six years. Congressional Republicans championed the measure at the plan’s unveiling. “This is it America,” said Texas-Republican, House Ways and Means Chair Kevin Brady at a press conference. “It is our opportunity to make tax reform a reality.” President Donald Trump applauded the release of the plan in a statement shortly after the bill was presented. There he took the opportunity to preemptively hit back at possible critics of the legislation. “I applaud the House Ways and Means Committee for introducing the Tax Cuts and Jobs Act, which is another important step toward providing massive tax relief for the American people,” said Trump. “The special interests will distort the facts, the lobbyists will try to save their special deals, and some in the media will unfairly report on our efforts.” Here’s what the Alabama delegation has to say about the tax cut proposal: Alabama 1st District U.S. Rep. Bradley Byrne: Tax reform has the potential to make America boom again, and it starts with putting more money in the pockets of hardworking Americans. The current tax code is too complicated and confusing, benefiting the elite while making things harder for American families. It is time for a fairer and simpler tax code that supports new jobs right here in the United States. We need to get this right, and I look forward to working with President Trump to do just that. We cannot pass up this historic opportunity to reform our outdated tax code and unlock our full economic potential. Alabama 2nd District U.S. Rep. Martha Roby: This is a unique and exciting opportunity to deliver on our promise and give the American people the results they deserve. Our tax reform plan will grow the economy, create jobs here in the United States, and allow hardworking taxpayers to keep more of their money in their pocket. An average family with about 60,000 dollars in household income would see their federal tax bill drop by about $1,200. For the people I represent, this can make a big difference. For that mom working a retail job or the dad driving the truck or that single parent working two or three jobs just to make ends meet, having an extra $1,000 in your pocket is a big deal. I promise you hardworking taxpayers know how to spend their money better than the government does. Alabama 3rd District U.S. Rep. Mike Rogers: Hard-working American families deserve to take home more of their hard-earned paychecks, and President Trump’s tax plan will help make that happen. Alabama 4th District U.S. Rep. Robert Aderholt: The tax bill released today is a good start, as it refocuses our tax code on today’s economy. Our current system was put in place when most Americans had never heard of the internet, the only phone they had was attached to the wall at home and Bill Curry and Pat Dye were coaching at Alabama and Auburn. It’s time for a tax code that puts working Americans first. More than 80% of the people in my district will see their tax burden drop, and to me, that is a good thing. Alabama 7th District U.S. Rep. Terri Sewell: After months of secret negotiations, it should come as no surprise that the tax plan revealed by Republican leaders today is a raw deal for Alabama and for working families across this nation. The Republican tax bill will raise costs on families who can least afford it while providing wealthy individuals and special interests a windfall in tax breaks. In order to pay for what would be the largest tax giveaway to special interests in American history, the Republican tax plan makes cuts to Medicare, Medicaid, and the programs that middle-class families rely on. We cannot afford poorly targeted tax cuts and we cannot afford to miss our chance for true bipartisan tax reform. While I disagree with a number of the points in today’s tax plan, I will work with my colleagues to try to reshape this bill so that it helps working families and encourages growth across the entire economy in a fiscally-responsible way.

Mike Rogers: Making our broken tax code simpler and fairer for East Alabama

As most folks across East Alabama have seen in the news lately, President Donald Trump and Congress are working together to help make our broken tax code fairer and simpler. The House and Senate have both passed the Fiscal Year 2018 Budget Resolution which clears the path to start tax reform and it has been quite some time since this has happened. Guy Hunt was elected first Republican Governor of Alabama in over 100 years, Auburn’s Bo Jackson was first pick of the NFL Draft by the Tampa Bay Buccaneers, The Bangles were topping the charts, The Oprah Winfrey Show made its first national broadcast, Teddy Ruxpin was every child’s dream toy and the TV show “Dallas” brought Bobby Ewing back from the dead. That was the last time the tax code was reformed – the year was 1986. These are all great memories to look back on, but it’s amazing how much has changed since we’ve done anything on tax reform. Now Congress will begin the overhaul by simplifying our tax code. Hard-working American families deserve to take home more of their hard-earned paychecks, and President Trump’s tax plan will help make that happen. The plan will also give families more time together by making it easier to file. Instead of spending countless hours on filing taxes, the plan will make filing as easy as filling out a form the size of a postcard. The plan will give families back that time and money spent on preparing for Tax Day. The tax plan will also help our small businesses, which are the backbone of our local economies, by lowering tax rates and leveling the playing field. Closing special interest loopholes and rewarding hard work should help encourage investment back in America and help bring more good-paying jobs back home. I support President Trump’s efforts to reform our broken tax code to make things easier on the hard-working families across East Alabama. Learn more about the plan at fairandsimple.gop and sign up for SMS notifications on tax reform by texting “TAX REFORM” to 50589. I want to hear from you on this or any issue. ••• Mike Rogers is a member of U.S. Congress representing Alabama’s 3rd Congressional District. Sign-up for his e-Newsletter by visiting www.mikerogers.house.gov. To stay up to date, you can also like him on Facebook at Congressman Mike D. Rogers, follow him on Twitter, Pinterest and Instagram at RepMikeRogersAL, on Tumblr at www.repmikerogersal.tumblr.com.

Congress passes 2018 budget, moves one step closer to tax reform

The U.S. House of Representatives narrowly approved a Senate version of the 2018 federal budget on Thursday, which included language that would allow a tax reform bill to pass Congress without any Democratic votes. By a vote of 216-212, the entire Alabama delegation voted in favor of the resolution with the exception of lone Democrat Alabama 7th District U.S. Rep. Terri Sewell. Here’s what the delegation has to say about their votes: Alabama 1st District U.S. Rep. Bradley Byrne: With a budget now passed, we are one step closer to making tax reform a reality. We must follow through on our promise to make our tax code fairer and simpler for American families. Our ultimate goal is to put more money in the pockets of hardworking Americans. Alabama 2nd District U.S. Rep. Martha Roby: By passing this budget today, Congress is one step closer to enacting pro-growth tax reform that will offer much-needed relief to American families. Our tax reform plan will grow the economy, create jobs here in the United States, and allow hardworking taxpayers to keep more of their money in their pocket. This is a unique and exciting opportunity to deliver on our promise and give the American people the results they deserve. Alabama 3rd District U.S. Rep. Mike Rogers: Today’s vote is the beginning of the biggest tax overhaul in thirty years. I am hopeful both the House and Senate will take up and pass President Trump’s tax plan as soon as possible. Simplifying the tax code, lowering rates and making small businesses more competitive will improve take-home pay for hard-working American families. I agree with President Trump that our tax system should reward hard work and encourage investment in the private sector. Closing special interest loopholes and simplifying the tax code will save everyone billions of dollars spent on filling out IRS paperwork each year. Alabama 4th District U.S. Rep. Robert Aderholt: Did not release an official statement. Alabama 5th District U.S. Rep. Mo Brooks: Did not release an official statement. Alabama 6th District U.S. Rep. Gary Palmer: Did not release an official statement. Alabama 7th District U.S. Rep. Terri Sewell: I voted against today’s budget because it trades away critical investments in infrastructure, education, job-training, and health care programs in exchange for short-sighted tax cuts for special interests and the wealthy. As our country faces serious fiscal challenges, we need to make responsible budgeting decisions that build a foundation for job growth, better wages, and improved economic and health outcomes. Instead, today’s budget relies on gimmicks and irresponsible cuts to make way for a special interest tax plan that adds $1.5 trillion to the deficit.

Martha Roby joins Ivanka Trump, House and Senate leaders to push child tax credit expansion

Alabama 2nd District U.S. Rep. Martha Roby appeared alongside First Daughter Ivanka Trump as well Republican lawmakers on Capitol Hill Wednesday to promote the expansion of the child tax credit to help working families as part of a GOP tax-reform proposal. “Expanding the child tax credit is the right thing to do,” Roby said at a news conference promoting the proposal. “For the people I represent, this can make a big difference. For that mom working a retail job or the dad driving the truck or the parent working two or three jobs so the other one can stay home – having a couple thousand dollars in your pocket is a big deal.” She continued, “I promise you parents know how to spend that money better than the government does.” Ivanka Trump, who has championed policies to help working families in the Trump Administration, said the child tax credit expansion is key to the President’s commitment to ensuring tax reform benefits middle class Americans. “Today, the vast majority of American homes are dual income,” Ivanka said. “Our tax code has to recognize and support this reality and support our dual values of work and a family. Over the years, as wages have stagnated the costs of raising a family have grown exponentially,” she added. “It is a priority of this administration and it is a legislative priority to ensure that American families can thrive and that we deliver real and meaningful tax relief to middle-income Americans.” Under the tax reform framework from House and Senate Republicans and the White House, the child tax credit, which currently provides working families with $1,000 per child, would be significantly increased and made available to more middle and lower income Americans. Details of the tax reform proposal are still being crafted. Specifics about the current blueprint are available on the House Ways and Means website here. Watch the full news conference including comments from Rep. Roby and Ivanka Trump below:

In poll, people say Donald Trump tax plan benefits rich, companies

Most Americans say President Donald Trump‘s tax plan would benefit the wealthy and corporations, and less than half believe his message that “massive tax cuts” would help middle-class workers, according to an Associated Press-NORC poll. The survey could serve as a warning sign for Trump as he pushes Republicans to support his proposal. The president and GOP lawmakers are seeking a major legislative victory before the 2018 elections. For all the differences of opinion over the details of tax changes, the poll shows a large and bipartisan appetite for tax cuts for middle-class families. Majorities of both Republicans and Democrats think the middle class and small businesses pay too much and that the wealthy and large corporations pay too little. But doubts and partisan differences emerge when Americans size up whether the middle class will truly benefit from Trump’s plan, says the survey conducted by the AP-NORC Center for Public Affairs Research. Just 43 percent of those of adults who have heard at least a little bit about the plan think it would help the middle class. And on that, there’s a large partisan divide: 79 percent of Republicans and 19 percent of Democrats share that sentiment. “The more we give tax breaks to the wealthy, we’ve gone down that road before in the Bush regime,” said Democrat Benjamin Orris, a 36-year-old educator from Evanston, Illinois. “That brought us into the Great Recession – almost back to the Great Depression.” Darron Smith, a 49-year-old Trump voter from West Des Moines, Iowa, said the tax plan would help him as a single parent. He predicted lower taxes would lead to more consumer spending. As for the warnings from Democrats, Smith said he remembered hearing the same arguments during President Ronald Reagan’s tenure. “Any time Republicans want to do a tax cut, the first thing Democrats say is it’s going to help the rich. I don’t see it that way,” Smith said. Trump has held weekly events since late August on his tax overhaul, arguing the United States must slash the corporate rate to remain competitive and shrink the number of tax brackets. The Trump administration has suggested cutting corporate rates and overhauling the tax system could provide a $4,000 annual pay raise to the average family. Democrats and other critics question whether lower corporate rates and other changes would result in that kind of increase for families. Trump and congressional Republicans also want to repeal inheritance taxes on multimillion-dollar estates. “Our plan can be summarized in three simple words: jobs, jobs, jobs,” Trump said in the Oval Office on Tuesday. But the AP-NORC poll shows a negative undercurrent surrounding the plan, and majorities in both parties view the proposal as a boon for the rich and corporate interests. The poll found 69 percent of adults who have heard at least a little bit about the plan think it would help large corporations. The sentiment was bipartisan, including 70 percent of Democrats and 69 percent of Republicans. Also, 60 percent said the tax push would bolster the wealthy, with 67 percent of Democrats and 54 percent of Republicans viewing it that way. “I have no confidence in his tax plan,” said Democrat Nancy Bauhs, a 70-year-old retired sweater designer from New Holstein, Wisconsin. Fifty-four percent of those questioned, including 58 percent of Republicans and 52 percent of Democrats, think they personally pay too much in taxes. The survey found that 56 percent said they think middle-class households pay too much, while 56 percent say the same about small businesses. By contrast, 72 percent say the wealthy and large corporations pay too little in taxes. The administration has been actively trying to sell the plan. House Republicans are expected to consider a budget measure this week that would serve as a precursor to the tax overhaul, and administration officials have promoted the plan at events around the country. Vice President Mike Pence, in a Tuesday speech to the GOP-leaning American Enterprise Institute, noted that Trump “doesn’t like talking about tax reform, he likes talking about tax cuts because he wants the American people to know we are cutting taxes for every American.” “And when we cut taxes on businesses, it’s going to benefit working Americans. So I encourage you to go make that case,” Pence said. Large majorities of Americans think tax cuts for small businesses, middle-income people and lower income people would help the economy. But the poll shows people taking the opposite view for the wealthy and corporations. The poll found 51 percent think tax cuts for the wealthy would hurt the economy compared with 23 percent who thought it would help. Also, 48 percent said tax cuts for large corporations would hurt the economy compared with 31 percent who think they would help. Two-thirds of Democrats think tax cuts for the wealthy would hurt the economy. Among Republicans, about one-third said tax cuts benefiting the wealthy would help the economy, one-third said they would hurt and the final third think they would make no difference. There’s greater disagreement on the impact of cuts for large corporations: Democrats are more likely to think they would hurt rather than help the economy (59 percent to 20 percent) while Republicans are more likely to think they would help than hurt (49 percent to 30 percent). The AP-NORC poll of 1,054 adults was conducted Oct. 12-16 using a sample drawn from NORC’s probability-based AmeriSpeak panel, which is designed to be representative of the U.S. population. The margin of sampling error for all respondents is plus or minus 4.0 percentage points. Respondents were first selected randomly using address-based sampling methods, and later interviewed online or by phone. Republished with permission from the Associated Press.

Budget deficit hits $666 billion, up $80 billion as tax debate kicks off

The federal budget deficit rose to $666 billion in the just-completed fiscal year, a spike that comes as Republicans are moving to draft a tax code rewrite that promises to add up to $1.5 trillion to the national debt over the coming decade. The sobering deficit numbers, released Friday by the Treasury Department and the White House budget office, followed Senate passage Thursday night of a 10-year budget plan that shelves GOP concerns on deficits and debt in favor of a tax overhaul. Still, House Speaker Paul Ryan of Wisconsin insisted Friday on “CBS This Morning”: “We’re Republicans. We’re sensitive to the deficit.” President Donald Trump and his GOP allies on Capitol Hill promise this year’s tax legislation will spark a burst of economic growth – and hope it will pay big political dividends for their party. Friday’s budget figures represent an $80 billion jump over last year’s $585 billion deficit, which itself was way up over the previous year’s $438 billion. The administration says the sour deficit report shows a need to pass the tax overhaul measure. “Through a combination of tax reform and regulatory relief, this country can return to higher levels of GDP growth, helping to erase our fiscal deficit,” said Treasury Secretary Steven Mnuchin. “These numbers should serve as a smoke alarm for Washington, a reminder that we need to grow our economy again and get our fiscal house in order. We can do that through smart spending restraint, tax reform and cutting red tape,” said White House budget director Mick Mulvaney. Democrats argue that the GOP should work with them on a bipartisan approach to revamping the tax code without adding to the deficit. “With the deficit as large and growing as quickly as it is, Republicans pursuing a reckless plan that would blow a huge hole in the deficit and put Medicare and Medicaid at risk is the height of irresponsibility,” said Senate Minority Leader Chuck Schumer, D-N.Y. Mulvaney drafted Trump’s May budget plan, which promised to balance the budget within a decade, but only through politically unrealistic cuts and rosy assumptions of economic growth. But Trump hasn’t promoted the effort, which was quickly shelved by the GOP in Congress. The White House in July revised its short-term deficit outlook significantly to warn of worsening deficits. Since then, a bad hurricane season has forced the government to spend billions in disaster relief. The deficit issue has largely fallen in prominence in Washington in recent years, and Trump doesn’t speak of the issue. He has ruled out cuts to Social Security and Medicare. Earlier, gridlock between former President Barack Obama and congressional Republicans took hold after failed attempts at budget deals. Most economists don’t believe the deficit is very worrisome in the short term, though it is creeping above 3 percent of the size of the economy, a threshold that bears watching. The picture over the long run is more problematic, at least under a conventional view that if deficits continue to rise and the national debt grows, government borrowing will “crowd out” private lending and force up interest rates. And if interest rates go up, the government would have to pay much more to finance the more than $14 trillion in Treasury debt held by investors. Republished with permission from the Associated Press.

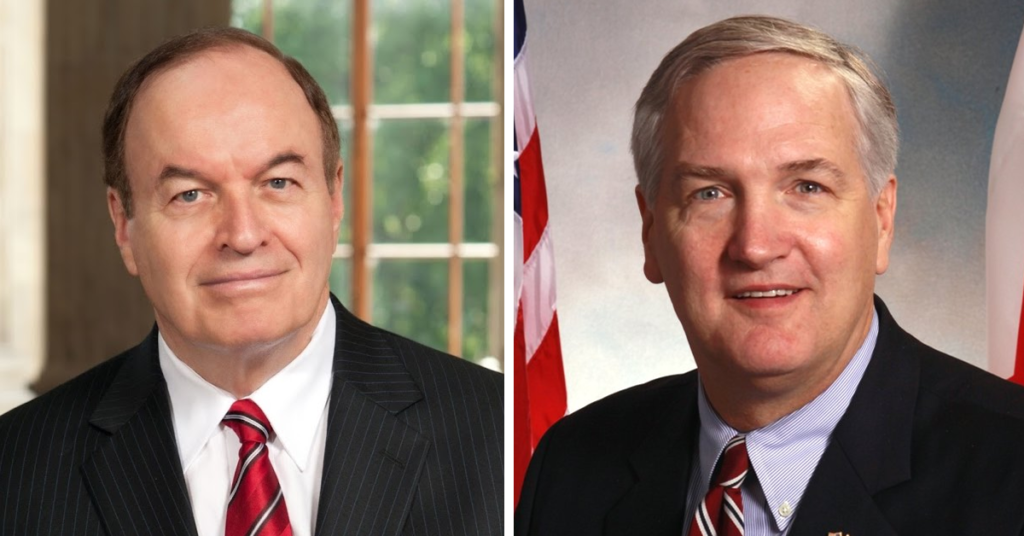

Luther Strange, Richard Shelby vote in favor of FY18 budget

With the support of Alabama U.S. Sens. Luther Strange and Richard Shelby, the U.S. Senate approved the FY18 budget Thursday night, 51-49. The passage of the budget will allow work to begin, in earnest, on tax relief through the use of a procedural maneuver to pass tax reform legislation through the Senate with 50 or more votes, removing the need for support from Democratic senators. The budget allows for the possibility of expanding the federal deficit by $1.5 trillion over 10 years via President Donald Trump’s proposed tax cuts. “Passing a budget resolution is in our job description as Senators – it is not the finish line,”said Strange. “We owe the American people concrete action on several major issues, the first being the outdated tax code that stands in the way of their hard-earned take-home pay.” Strange also joined ten Republican colleagues in sending a letter to Senate Majority Leader Mitch McConnell pledging to “be available for voting day and night” to help accomplish Trump’s fall legislative agenda. “As I joined my colleagues in writing to Leader McConnell, I am ready to make good on our promises, starting with comprehensive tax relief, this year,” added Strange.

Bradley Byrne: Tax reform will grow the American economy

Last week, the House took a big step toward long overdue tax reform when we passed our budget for Fiscal Year 2018. The budget is important because it opens up the process by which we can bypass a Democrat filibuster and pass tax reform with 51 votes in the Senate. If you read last week’s column, you know that the unified Republican tax plan will benefit working families by lowering tax rates, increasing the standard deduction, expanding the child tax credit, and simplifying the entire tax code. Under our plan, most Americans would be able to do their taxes on a single, small postcard. For me, the top priority of tax reform is to make things easier for working families who deserve to keep more of their hard-earned money in their pockets instead of sending it to the federal government. That will remain my main goal throughout the process. At the same time, tax reform also allows us to level the playing field for small businesses and promote economic growth. When the American economy is stronger, American families are stronger. Many things have changed since we last had tax reform in 1986. Unfortunately, for the most part, the way we tax businesses has not. With this in mind, our tax reform plan strives to help small businesses, which are the backbone of the American economy. Most small business owners and job creators say that the current confusing and burdensome tax code is one of the biggest challenges they face. Under our plan, the top tax rate applied to the business income of small and family-owned businesses conducted as sole proprietorships, partnerships, and S corporations would be 25%. This is significantly lower than the top rate these businesses pay today. Most Americans work for these Main Street businesses, and lowering the small business rate will produce a boom of economic activity and more American jobs. Our plan also calls for a reduction in the corporate tax rate to 20%. Our current corporate tax rate is the highest in the industrialized world and has resulted in businesses shipping jobs and revenues overseas. This is why lowering the corporate rate is a key part of President Trump’s economic agenda. As another way to help spur economic growth, our plan would allow businesses to deduct 100% of the money they spend on capital investments for at least the next five years. This will incentivize businesses to buy heavy machinery and equipment that is necessary to really jumpstart our economy. Importantly, our plan also focuses on leveling the playing field and closing loopholes that only benefit the well-off and well-connected. Another key piece of our plan centers around bringing jobs and businesses back to America. We want to move from the current “offshoring model” that has been a disaster for American workers toward an “American model” that encourages more companies to do business in our country. We do this by ending the current tax code’s disincentive for companies that want to bring wealth they have earned overseas back to the United States. Foreign profits already accumulated offshore will be subject to a low, one-time tax. This will bring money flowing back into America. By creating a more business-friendly tax code, more jobs will be created and greater opportunities will exist for the American people. Again, a stronger economy leads to a stronger America where everyone benefits. Of course, our tax reform plan must still go through the legislative process and changes will likely occur. I also want your feedback to hear what concerns or ideas you have regarding our tax reform plan. You can find the plan online at FairAndSimple.gop. • • • Bradley Byrne is a member of U.S. Congress representing Alabama’s 1st Congressional District.

New report says more than half of GOP plan’s tax cuts in Alabama would go to top 1 percent

Congressional Republicans’ new tax plan would deliver a major boost to the top 1 percent of Alabamians — the middle class, however, not so much. According to a new study released Wednesday by the Institute on Taxation and Economic Policy (ITEP), a nonprofit research organization based in Washington, D.C., Alabamians with incomes of more than $1 million would get an average tax cut of nearly $116,000 a year. Meanwhile, one in seven Alabamians would pay higher taxes under the plan. Key Alabama findings from the ITEP report include: The top 1 percent of Alabama earners – those who make $501,800 or more – would receive 56.2 percent of the tax cuts going to the state. Nearly half, 49.2 percent, of the overall tax cuts that Alabama residents would get under the plan would flow to people with incomes of more than $1 million a year. They would receive an average annual tax cut of $115,900. 12.5 percent of the state’s total tax cuts would go to the three in five Alabamians with incomes of less than $57,900 a year. They would see an average tax cut of $190 a year. One in seven Alabamians, 14.5 percent, would pay higher taxes under the plan. “These tax cuts would be a windfall for the wealthy at the expense of everyone else,” Arise Citizens’ Policy Project executive director Kimble Forrister said. “This plan likely would force massive cuts to future federal funding for Medicaid, education, housing, transportation and other vital services that help everyday families make ends meet. Congress should reject these reckless tax cuts for the rich and focus on investing in education, health care and other services that help all Alabamians and all Americans get ahead.” A U.S. Senate Budget Committee is scheduled to vote soon on a federal spending plan that will lay the groundwork for tax cuts.

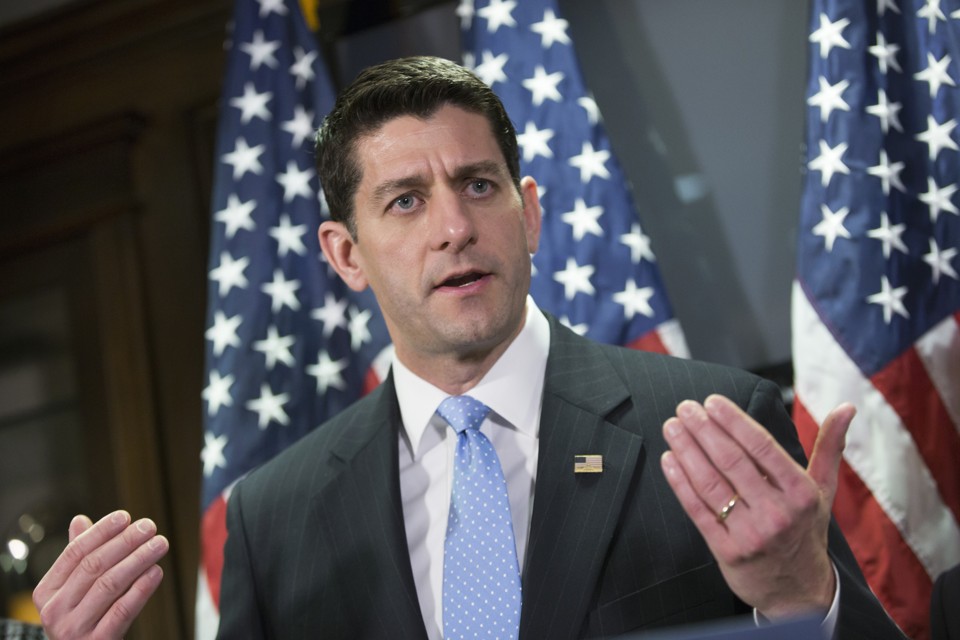

House GOP eyes budget passage that is key to tax debate

Republicans are focused on cutting taxes instead of deficits as they look to power a $4.1 billion budget plan through the House on Thursday. The 2018 House GOP budget promises deep cuts to social programs and Cabinet agency budgets but its chief purpose is to set the stage for action later this year on a comprehensive Republican overhaul of the U.S. tax code. The tax overhaul is the party’s top political priority as well as a longtime policy dream of key leaders like Speaker Paul Ryan. The plan calls for more than $5 trillion in spending cuts over the coming decade, including a plan to turn Medicare into a voucher-like program for future retirees, slash Medicaid by about $1 trillion over the coming decade, and repeal the “Obamacare” health law. But Republicans are not actually planning to impose any of those cuts with follow-up legislation that would be required under Washington’s byzantine budget rules. Instead, those GOP proposals for spending cuts are limited to nonbinding promises, and even a token 10-year, $200 billion spending cut package demanded by tea party House Republicans appears likely to be scrapped in upcoming talks with the Senate. Instead, the motivating force behind the budget measures is the Republicans’ party-defining drive to cut corporate and individual tax rates and rid the tax code of loopholes. They promise this tax “reform” measure will put the economy in overdrive, driving economic growth to the 3 percent range, and adding a surge of new tax revenues that would help bring the budget toward balance. Passing the measure through the House and Senate would provide key procedural help for the tax measure because it sets the stage for follow-on legislation that can’t be filibustered by Senate Democrats. Republicans used this so-called reconciliation procedure in their failed attempt to kill “Obamacare,” including its tax surcharges on wealthy people. “Through reconciliation, our budget specifically paves the way for pro-growth tax reform that will reduce taxes for middle class Americans and free up American businesses to grow and hire,” said House Budget Committee Chairman Diane Black, R-Tenn. The House vote comes as the Senate Budget Committee is considering a companion plan that differs in key details and is set for a vote Thursday afternoon. Both the House and Senate plans rely on rosy estimates of economic growth and illusory spending cuts to promise to wrestle the federal budget back into surplus within a decade. The House measure also assumes that the upcoming tax bill won’t add to the deficit; the Senate version, however, would permit the measure to add $1.5 trillion to the $20 trillion-plus national debt over the coming 10 years. The final version is likely to stick closely to the Senate measure. The real-world trajectory of Washington, however, is for higher deficits as Republicans focus on tax cuts, a huge hike in the defense budget, and a growing disaster aid tally that is about to hit $45 billion. “The train’s left the station, and if you’re a budget hawk you were left at the station,” said Rep. Mark Sanford, R-S.C. Democrats blasted the sweeping spending cuts proposed by Republicans – $5.4 trillion over 10 years in the House plan and somewhat less in the Senate GOP measure – as an assault on middle-class families and the poor. “This is, like Yogi Berra said, ‘deja vu all over again.’ Republicans used their Trumpcare bill to sneak in tax cuts for the rich,” said Senate Minority Leader Chuck Schumer, D-N.Y. “Now they’re using their tax cut plan … and they’re sneaking in cuts to Medicaid and Medicare. But it’s the same playbook.” Republished with permission from the Associated Press.