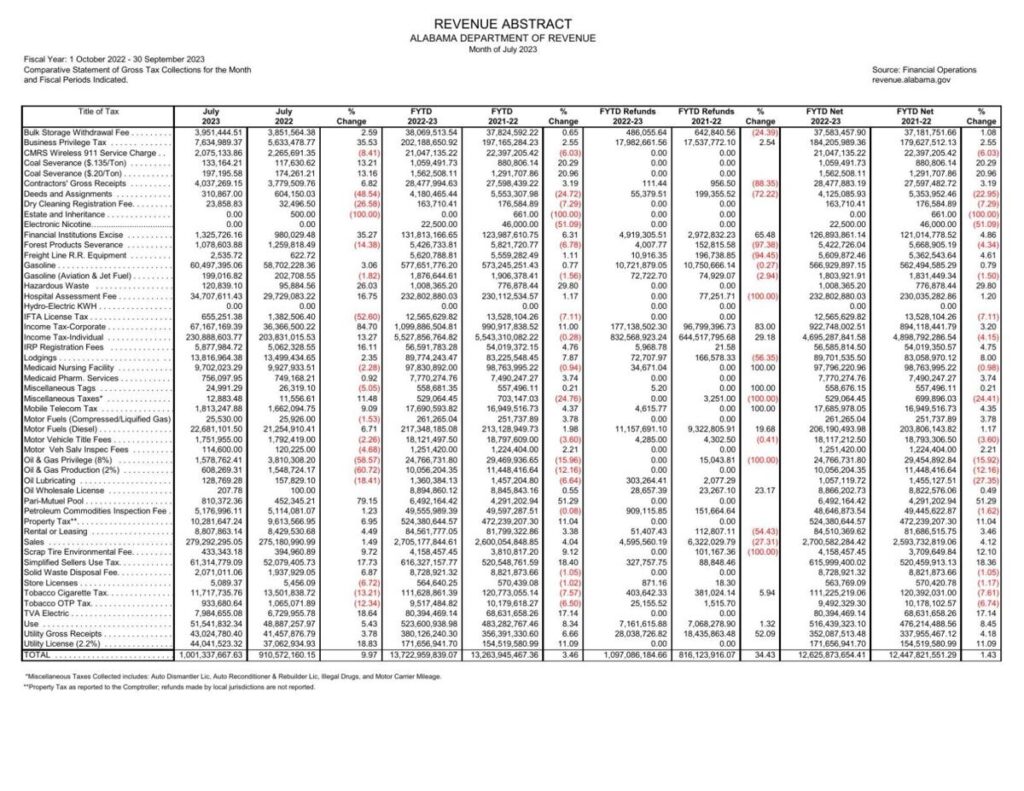

Alabama’s tax revenues continue to outperform last year’s numbers, as the state brought in nearly 10% more revenue than July 2022 to mark three consecutive months with gains.

After a 13.39% reduction in tax revenue from the year before in April, collections have rebounded in May (2.63% gain over the same time last year), June (5.42%), and July (9.97%).

The Alabama Department of Revenue reported slightly more than $1 billion in tax receipts in July, compared to $910.6 million in July 2022.

For the fiscal year that ends on Sept. 30, the state’s tax collections are up 3.46%, improving from $13.26 billion to $13.72 billion.

Corporate income taxes were among the big gainers. Collections added up to 84.7% more in July than the same time last year; the Yellowhammer State collected $67.2 million versus $36.4 million.

Also on the increase in July were individual income tax collections, as the state received $230.8 million in July compared to $203.8 million last year, an improvement of 13.27%.

Use tax, which is assessed on all out-of-state sales such as online retailers, had a gain of 5.43% compared to July 2022 with revenues of $51.5 million versus $48.9 million.

Sales tax revenues were up slightly at 1.49%, going from $275.2 million in July 2022 to $279.3 million this past month.

Gasoline tax revenues were also up in July, improving 3.06% to $60.5 million after tallying collections of $58.7 million in July 2022.

Cigarette taxes were down by 13.21%, shrinking from $13.5 million in July 2022 to $11.7 million this July.

The state’s 2% tax on oil and gas production had a precipitous 60.7% drop in July, going from $1.54 million in July 2022 to slightly more than $608,000 this past month.

Republished with the permission of The Center Square.

Related

Share via: