Trip Pittman: Education is an investment in Alabama’s future

In the special session that starts on Tuesday, Governor Bentley and the legislature will continue to work to pass a General Fund (GF) budget before the start of the 2016 fiscal year on October 1st. The challenges facing the GF budget are exploding costs associated with Medicaid, prisons, mental health, public safety and human resources, but Medicaid is the primary driver of costs. In 2004, Medicaid received a state appropriation of $200 million, which constituted 15% of the GF budget. By fiscal year 2015, Medicaid received $700 million, or 36% of the GF budget. For 2016, Medicaid has requested $750 million dollars. Unfortunately, because the federal government establishes Medicaid’s regulations there is little that Alabama can do to contain these cost increases. While the costs for programs like Medicaid have risen, Alabama’s economy and the state’s tax revenues are still recovering from the worst economic downturn since the Great Depression, meaning fewer dollars are available to solve rising costs for all of state government including education. In order to account for decreased education funding during the Great Recession, over the past few years the legislature made sound fiscal reforms that were difficult at the time but which have established a more secure foundation for education. Those reforms included changes to the Teacher Retirement System (TRS) and to the Public Education Employees Health Insurance Plan (PEEHIP), to stabilize and protect those programs. Further reforms included the elimination of the Deferred Option Benefit Plan (DROP) that had spiraled out of control. Classroom sizes were increased (we still have yet to return classroom sizes to their pre-recession ratios) and the legislature passed tenure reform, the Alabama Accountability Act, and a law expanding education choices for families by allowing the formation of charter schools. The Republican majority has accomplished all these reforms while fully funding Education appropriations over the last five years without proration and paying $437 million of debt back to the Alabama Trust Fund. These reforms were only possible with the 2011 passage of a budget reform law referred to as the Rolling Reserve Act (RRA). The RRA forces the legislature to write responsible budgets based on historical data rather than estimates, and established a stabilization account as a firewall to ensure our classrooms will not be thrown back into the devastating cycle of proration if the economy slows. Yet even with all these cost-saving reforms, funding for education is still $500 million less now than it was seven years ago at the start of the Great Recession. So the solution to the General Fund deficit should not be to dip into an Education budget still on the mend. To solve the underlying challenges in the GF budget, increased revenue coupled with structural reform is required. Options for additional revenue include a tax increase of $0.25 cents per pack of cigarettes, or perhaps reforming the business privilege tax to free small businesses from this expense while asking large and multi-state businesses to pay a little more. Other options could include a small tax on the purchase of soft drinks, an increase to the state sales tax, or removing or reducing the federal FICA deduction on individual tax returns. Some legislators, opposed to additional revenue measures but also somehow opposed to GF budget cuts, want to divert money from the education to the GF budget. They talk of shifting more of the Use Tax (which collected approximately $225 million in 2014) from Education to the GF budget without any replacement. Some even propose combining the budgets or raiding the Education budget’s stabilization account and diverting its projected balance to the General Fund, ignoring the fact that the stabilization account exists to prevent budget proration in uncertain economic times like we currently face. I hope my fellow legislators will oppose measures to raid education resources and thereby hinder essential on-going reforms. To divert almost a quarter billion dollars annually away from education avoids solving the underlying GF budget problems and will achieve nothing more than kicking the can down the road. Similarly, characterizing the projected, non-recurring funds in the Education budget’s stabilization account as a surplus is incorrect. Balancing the GF budget upon mere projections of non-recurring revenue is fiscally irresponsible and would have long-term negative consequences. The Education budget is Alabama’s jobs budget. By that I mean the Education budget invests in our workforce and economy by funding Alabama’s nationally recognized Pre-K program, our K-12 schools, community and technical colleges, and universities and research institutions. These investments are the key to Alabama’s future prosperity and will ensure our citizens can continue to pursue the American dream of economic independence and political liberty. Which legislators will stand with me and call for fiscally responsible solutions for the GF budget that do not involve the diversion of desperately needed education funds? The 21st-century economy will challenge us like never before and to succeed our children need the best education we can offer. A budget challenge exists, but it is with the General Fund, not the Education budget, and the legislature and Governor Bentley need to solve the General Fund deficit without compromising our future. # # # Senator Trip Pittman, a small business owner, represents District 32 (Baldwin County) in the Alabama Senate. He is Chairman of the Finance and Taxation Education Committee.

Planned Parenthood sues Alabama over end to Medicaid funds

Planned Parenthood has filed a federal lawsuit over Gov. Robert Bentley‘s effort to cut off Medicaid payments to the organization’s Alabama clinics. Planned Parenthood Southeast said Friday that the move penalizes low-income women who seek contraceptive and preventative health care services at the clinics. The lawsuit was filed in Montgomery federal court. Bentley earlier this month announced he was terminating provider agreements with Planned Parenthood. The governor said he was disturbed by hidden-camera videos that accuse the organization of selling fetal organs after abortions. Planned Parenthood has denied the allegations and says the videos, shot by abortion opponents, are edited to be misleading. Bentley’s press office did not have an immediate response to the lawsuit. Planned Parenthood has a similar lawsuit against Louisiana Gov. Bobby Jindal. Republished with permission of The Associated Press.

Robert Bentley: Cuts are a ‘true crisis’ for the state

Gov. Robert Bentley is continuing the tough talk as he tries to ramp up support for tax increases ahead of a second special session on the budget. The governor said in a Wednesday speech that the state will face a “true crisis” if budget cuts go into effect. The governor said funding cuts to Medicaid, mental health and law enforcement will harm all Alabamians. Bentley said if state parks close because of cuts that he might put up signs naming the lawmakers responsible. The governor is trying to convince legislators to approve $300 million in taxes to fill a projected budget shortfall. A special session ended this month without a budget agreement. The governor said he will call a second special session in early September. Republished with permission of The Associated Press.

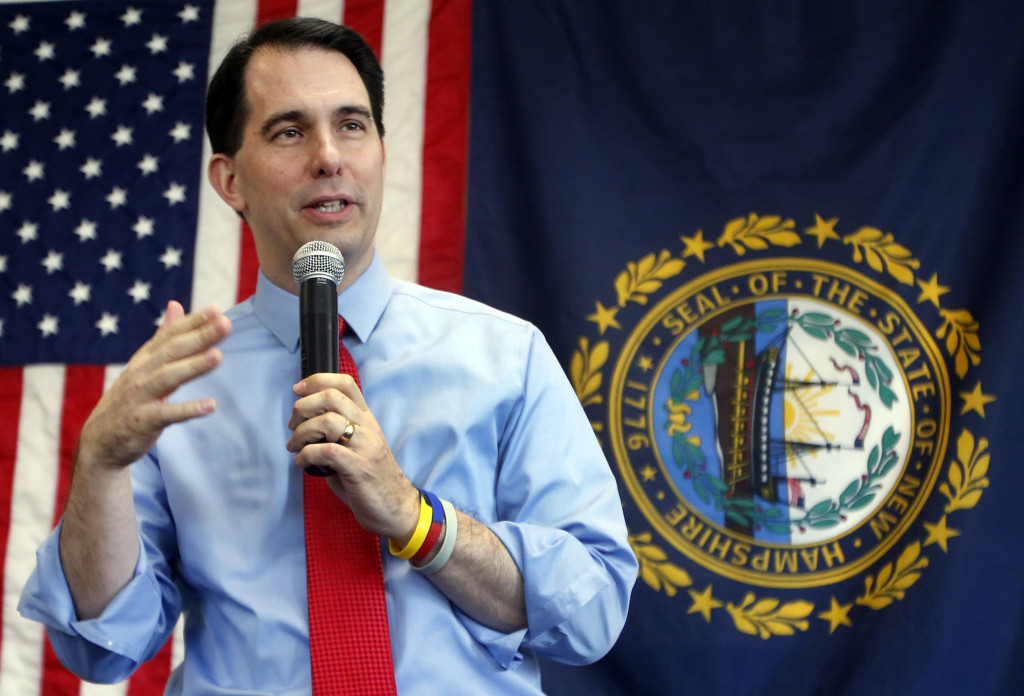

GOP hopeful Scott Walker offers health plan with tax credits

Republican presidential candidate Scott Walker‘s plan for replacing President Barack Obama‘s health care law would extend refundable tax credits to help pay for private health insurance based on age instead of income, restructure Medicaid and allow people to shop for insurance across state lines. The Wisconsin governor provided details of his proposal to The Associated Press in advance of a Tuesday speech in suburban Minneapolis where he was to outline his first major policy initiative of the presidential campaign. Walker’s plan does not include cost figures or an estimate of the number of people who would be covered, making it nearly impossible to compare with current law. For the period from April to June of this year, 11.4 percent of U.S. adults were uninsured, which translates to about 16 million people gaining coverage since the rollout of Obama’s health care law in 2013. Walker’s campaign said the plan would be paid for by eliminating $1 trillion in taxes that are levied under the current law and by making other changes to Medicaid and how health insurance is taxed. The Supreme Court in June upheld a key portion of the Affordable Care Act allowing for federal subsidies to defray the cost of coverage, a major defeat for opponents of the law. Walker and other Republican candidates have insisted they would repeal the law, starting on the first day of a GOP presidency. The biggest hurdle Walker, and any opponent of the law, faces is getting it repealed. That would take 60 votes in the Senate, and Walker’s plan does not address how he would undo the law in any other way. Walker, in excerpts of his speech released by his campaign, blamed fellow Republicans with not doing enough to repeal the law. “Republican leaders in Washington told us during the campaign last year that we needed a Republican Senate to repeal Obamacare,” Walker said in the prepared remarks. “Well, Republicans have been in charge of both houses of Congress since January and there still isn’t a bill on the president’s desk to repeal Obamacare.” Topher Spiro, vice president for health policy at the Center for American Progress, a think tank often aligned with the White House, said Walker’s plan would be a step backward. “The math only adds up if he’s slashing Medicaid and increasing taxes on middle-class people with employer plans,” Spiro said. While the Walker plan would repeal the Affordable Care Act, it appears to use some similar kinds of tools to promote coverage. For example, there would be no requirement for individuals to carry health insurance or face fines, as there is currently. But, in order to be guaranteed affordable coverage without regard to pre-existing medical problems, individuals would have to “maintain continuous, creditable coverage.” There’s merit to Walker staking out his position on the issue, even though he doesn’t explain how the law would be repealed, said economist Douglas Holtz-Eakin, president of the American Action Forum, a center-right think tank. “There’s a lot of this that is fairly standard conservative health policy reform,” Holtz-Eakin said. “The basic plan looks familiar.” Walker, similar to current law, would also provide tax credits to help with the cost of coverage for people whose employers don’t offer insurance. But unlike current law, those credits of between $900 and $3,000 would be based on age and not be keyed to a person’s income. So they may not help low- to moderate-income people as much as the existing tax breaks do. Walker’s plan calls for eliminating unspecified regulations in the current law, a move that Walker claims would lower premiums by 25 percent. Other elements of the plan would include extending a $1,000 refundable tax credit for anyone who signs up for a health savings account, allowing people to shop for health insurance across state lines, reorganizing Medicaid into smaller programs, and giving states more regulatory authority. He would also allow for new health insurance purchasing agreements and deregulate the long-term care insurance market. The reality of outright repealing the law as Walker wants to do is stark: Doing away with it completely would kick 19 million people off insurance in the first year, according to the Congressional Budget Office. Walker isn’t the first Republican to put forward a detailed plan for replacing Obama’s law. Louisiana Gov. Bobby Jindal released his plan last year and Florida Sen. Marco Rubio outlined his approach in an opinion piece published Monday. And while alternatives have been introduced in Congress, none has gotten traction as Republicans have yet to coalesce around any particular idea. Republished with permission of The Associated Press.

Senate committee undoes Medicaid cut, revives old budget

A Senate budget committee on Friday resurrected a cut-filled budget that Gov. Robert Bentley vetoed in June as lawmakers remain at an impasse over taxes and revenue. The action essentially puts state politicians back to where they started when summer began, with state agencies facing more than $200 million in cuts and no agreement on how to fill the shortfall. Lawmakers anticipate a second special session later this fall. “I think we will be back in a second special session,” Senate Finance and Taxation Committee Chairman Arthur Orr, R-Decatur, said. The Senate committee rejected a House-passed budget that would have focused the bulk of the cuts on the state Medicaid Agency to try to build pressure for a solution. Senators said that was too risky of a strategy, adding that could lead to the collapse of the healthcare program for the elderly, poor and disabled. However, they weren’t happy with the cuts they approved in the absence of a revenue solution. “We’re replacing a sorry budget with a crappy budget,” Sen. Cam Ward, R-Alabaster, said. That spending plan, which Bentley vetoed in June and would likely do again, would have cut funding to Medicaid, the Department of Human Resources, prisons and the Department of Mental Health by about 5 percent. Other state agencies would see deeper reductions. Orr said Alabama citizens would be negatively affected by the cuts if they went into effect when the fiscal year begins Oct. 1. “You would see state parks beginning the shutdown process. You would see employees beginning to get pink slips. You would see programs beginning to be cut, shut down and abolished,” Orr said. The Senate is expected to vote on the budget Monday. The special session must end Tuesday. Lawmakers have been working since March on how to fill a projected shortfall in the general fund Proposals such a cigarette tax, a soda tax, ending income tax deductions, tightening corporate tax loopholes and yanking the money from the separate education budget haven’t gotten enough support to get to a floor vote. Senate and House leaders are meeting with Bentley on Friday to talk about the final days of the special session and the outlook for a second. Republished with permission of the Associated Press.

Alabama House approves large Medicaid cut

The Alabama House of Representatives on Wednesday narrowly approved a deep cut to the state’s Medicaid program as lawmakers continue to deadlock on a solution to the budget shortfall. The controversial budget cut came out of frustration over the stalemate and is largely seen as a way to build pressure on lawmakers to find some sort of compromise. House Ways And Means General Fund Committee Chairman Steve Clouse said it will put the focus of the budget debate on Medicaid, which consumes more than one-third of the general fund and is the largest funding challenge for lawmakers. Clouse said the health care program for the poor and disabled is also the “foundation for our health care system in the state of Alabama” – but he said many voters don’t understand the importance of funding it the way they do schools, roads or even prisons. “I think people need to realize the importance of Medicaid to our communities, to hospitals, to nursing homes, rural health clinics, doctors and nurses,” Clouse said. House members voted 46-44 for the budget amendment that would give Medicaid a $156 million reduction. The budget now goes to the Alabama Senate, where lawmakers have been even less supportive of tax increases. The proposed cut drew harsh criticism, and no praise, during three hours of debate on the House floor. “The services we are going to eliminate in this process are going to be life-threatening to many people,” said Rep. Pebblin Warren, D-Tuskegee. Black lawmakers lashed out at the plan, saying it would hurt the 1 million people – most of them children or elderly and disabled adults – who depend on Medicaid. They criticized Republicans’ opposition to expanding Medicaid under the federal Affordable Care Act. “I would like to see us have more discussion about expanding Medicaid instead of trying to totally disband Medicaid,” said Rep. Napoleon Bracy, D-Mobile. State Health Officer Don Williamson said he was uncertain the program could function under such cuts. Clouse proposed the funding cut Tuesday after the House budget committee rejected a 25-cent-per-pack cigarette tax increase that House leaders hoped would be a key plank of a spending plan. House members on Wednesday at first voted down the budget cut by a one-vote margin. Lawmakers came back and narrowly approved it. Gov. Robert Bentley called lawmakers into special session to address a projected shortfall in the state’s general fund. Lawmakers have so far rejected Bentley’s call for $302 million in new taxes but have yet to get a solution of their own through either chamber. “It’s chaos. The tension here is so thick, and there are so many factions,” said Rep. Patricia Todd, D-Birmingham. Clouse said his preference is to have a second special session just on Medicaid funding. Regardless, he thought a second special session would be required as lawmakers continue to deadlock. Senate Finance and Taxation General Fund Chairman Arthur Orr said he thought the chance of getting an answer in a single special session was, “less than 50 percent.” “And declining,” Orr said. Republished with permission of The Associated Press.

John Rice: Tell your lawmakers to make do without the excesses the governor wants.

Gov. Robert Bentley is welcoming lawmakers back to town today to raise taxes and pass the state General Fund Budget. We have been hearing how much state government is in need of much, much, much more money from the taxpayers. This just is not the case. In looking at the governor’s original proposed budget, there are $100 million in cuts that could come right off of the top without getting into the pockets of taxpayers. The only problem with these solutions is that they would interfere with Gov. Robert Bentley’s play pretties and pet projects. We say the governor is one man and one man’s whims should not affect 1.5 million Alabama taxpaying households. The Governor’s original proposed budget included $11 million for trooper vehicle purchases which is enough to buy every trooper on the road a new patrol car. Does every trooper need a new patrol car next year? Heavens, no. And does every one of the 1,500 law enforcement state employees, including secretaries, need $2,500 worth of new equipment in addition to all of those cars? The answer is no. In Medicaid, so much more money is supposedly needed just to keep the same services. If this is the case, Doctor Bentley, why was spending on Medicaid physicians proposed by you to increase 25%, or by $135 million? Not ballooning this one expenditure area would dramatically lower what you supposedly need. Worse, Governor Bentley proposed Medicaid administrative costs (otherwise known as feeding the bureaucracy) to increase by $47 million, or a whopping 17% increase. What happened to the governor’s promise of smaller government? What about this prison funding crisis? Here, the governor was proposing $29 million more for professional services contracts, or an increase of 24%. The governor proposed that Alabama next year should spend about the same on no-bid prison contracts as it does on the pay for all of the prison guards seeing after the inmates. This is wrong, and this is outrageous. If state government is in such dire straights, then why did Governor Bentley propose a transfer of another $1 million for the Wynfield Mansion next year after spending $500,000 over the last two years? So, Governor, you and Mrs. Bentley need two state mansions in the same capital city? This is ridiculous. We know the Alabama Governor’s Mansion is not as opulent as the Wynton Blount Mansion, but if Alabama’s Governor’s Mansion was good enough for James “Big Jim” Folsom and George Wallace, then it is good enough for you. Why did the governor just start paying for a new state jet for another nearly $1 million a year? Why did the governor propose that state office building costs double next year to $23 million plus more money to support another $20 million or so for buildings in the capital complex? And, of this, why should State Capitol maintenance and repair cost nearly two-thirds more next year for a whopping $11 million more? Maybe that money is for monument removal, who knows. Another $11 million added for state phones. When does it end? These items here mentioned account for $100 million of the supposed crisis. Instead of aggrandizement in the state capital complex along with planes, trains, and automobiles, Governor Bentley needs to forego the trappings of power and operate state government on a shoestring budget. Tell your lawmakers no new taxes. Tell your lawmakers to make do with the taxes that they have and do without the excesses that the governor wants. John Rice is president of Alabama Foundation for Limited Government.

Bradley Byrne: Reforming and reducing federal spending

At this very moment, the national debt sits at over $18 trillion dollars, and it shows no signs of going down anytime soon. Our spending problems are reaching crisis level, and we are set to leave behind a catastrophe for the next generation. Take my grandson MacGuire for example. Before his first birthday, his share of the national debt is already over $40,000. We cannot turn a blind eye to this problem and pretend that it will just get better. Congress must get serious about reining in spending. As you may know, there are two basic types of federal spending: mandatory and discretionary. Discretionary spending is what most people think of as essential government functions. This is money that goes to things like our military, highways, national parks, agriculture, and medical research. The good thing about discretionary spending is that each year Congress has the ability to set these spending levels through the appropriations process. Discretionary spending has become a smaller and smaller portion of the federal budget over the last few decades. In fact, it now makes up only around one-third of all federal spending. Mandatory spending, along with the interest on the debt, makes up the other two-thirds of the federal budget. However, unlike discretionary spending, mandatory spending does not require an annual appropriation from Congress. As long as someone meets the requirements, these programs dole out money without any action from Congress. Within mandatory spending are what we call means based entitlement programs. This includes programs like Medicaid, Obamacare, food stamps, and other welfare programs. While some of these programs serve an important purpose, there are serious questions about their effectiveness as costs skyrocket. In Fiscal Year 2012 alone, the federal government spent almost $800 billion on over 92 various programs aimed at lifting Americans out of poverty. Despite that record spending, too many Americans simply stopped looking for work. The system is clearly failing the very people it was designed to help. It is not a surprise that spending on these programs increased during the recent economic downturn, but it is surprising that spending on these programs continues to rise even as the economy improves. I fear that these programs are actually driving up the national debt and fueling a dangerous cycle of government dependence. I believe we must reform these programs and put a real focus on job training to help connect Americans with the skills they need to find work. We could block grant money to the state governments each year and allow individual states to craft poverty fighting programs based on their state’s specific societal and economic needs. Why is it so critical we get mandatory spending under control? In 1965, only 34% of the federal budget was consumed by mandatory spending programs. In 2014, over 66% of the budget was made up of mandatory spending. Without action, the Congressional Budget Office estimates that by 2040, over 75% of federal spending will be on auto-pilot. That would leave only 25% of the budget to go towards some of the federal governments most basic responsibilities, like providing for the common defense. I know that reforming these programs will not be easy, but I did not run for Congress to make easy decisions. Before I leave Congress, I want to be able to look my grandson MacGuire in the eyes and know that I have been a part of a real effort to rein in spending and put our nation on a fiscally stable path for the next generation. I hope my colleagues will join me in addressing our nation’s spending crisis and working toward a better future for the next generation. Bradley Byrne is a member of the U.S. Congress representing Alabama’s 1st Congressional District.

John Rice: State government is acting more like Washington, D.C., every day

State government is acting more like Washington, D.C., every day. The state General Fund is spending close to $1 million more a day than the state General Fund can support. This means that for every five dollars state government is spending close to one of those dollars is being spent without continuous revenue behind it. How is this possible? This is possible because of using one-time money, and the Legislature swiping money from the Alabama Trust Fund. State General Fund agencies have not seen a balanced budget without these type of budget shenanigans in a decade. Alabama state government does not have a revenue problem. Alabama state government has a spending problem. Gov. Robert Bentley spent millions on campaign ads promising, “More Jobs. Less Government. No New Taxes.” Just nine months after he was running for office, the governor has broken his two biggest promises. He has proposed now two tax increase packages, and he is pushing for bigger government/more spending. Governor Bentley originally proposed spending more than $500 million more out of the pockets of state taxpayers in attempt to increase everyone’s taxes. The governor actually proposed new taxes that would have the typical family paying more than $1,800 a year for state services (excluding roads and schools). That is way too much for Alabamians to pay for prisons, Medicaid, and a smattering of other things. The governor needs to scale back his wish list and give us a balanced budget like he promised without increasng taxes or come up with non-tax increase solutions if he wants to spend more money. Has something changed since nine months ago, when Governor Bentley and every lawmaker was elected by riding on a no new taxes/less government band wagon? No, nothing has changed. They all knew they had taken money out of the Alabama Trust Fund to spend on everyday expenses for state government and they knew they were going to have to scale back this year. Promising No New Taxes and Less Government knowing full well the hole would be there from not having the Alabama Trust Fund money means either they were promising to scale back government after the election, or they flat knew that they were purposely deceiving the voters of Alabama in a calculated strategy of lying about their true intent to raises taxes after Election Day. Any lawmaker not falling in the categories of intent to shrink spending, or intent to lying to voters about breaking their no new tax campaign promise, must just be an imbecile. Just a decade ago, Alabama families were paying less than $1,000 a year for state services and now the governor wants to push that amount to $1,800? What has changed? What are Alabamians getting now that they did not get 10 years ago? Show us the money. State General Fund spending for Medicaid has tripled since 2004. And this is when emergency room treatment of Medicaid patients is on the rise and where only 20 percent of Medicaid emergency room visits are for emergency treatment, according to the Partnership for Medicaid. Instead of ballooning Medicaid spending, the governor and bureaucrats need to get emergency room spending in check and put some meaningful restrictions on the overuse of health care. And prisons? Ten years ago state dollars going to prisons was right at $300 million. Now? The governor has requested almost $520 million for Corrections, or 70 percent more. This is when the cost for the no-bid crony prison medical contract has tripled in 12 years to a huge $80 million a year. Inflation accounted for 22 percent increases in spending over the past ten years. What accounts for the other 50 percent to over 100 percent increase in numerous agencies? Thank goodness the Legislature had the sense to kill Governor Bentley’s half-billion dollar tax package, but Governor Bentley, just did not get the hint. Even though the governor failed to get legislators to vote for his tax package, now he is coming with another tax increase plan. The governor now wants to take more income tax from working Alabamians, and he has even proposed a soft drink tax if the income tax hike does not pan out. He wants to increase the tax on cigarettes and businesses for the privilege of operating in Alabama. Here is a prediction: many lawmakers who vote to abolish the FICA income tax deduction, vote to tax soft drinks, or vote to increase the tax on cigarettes or businesses is not coming back to Montgomery in three years because promises are promises. If politicians break a simple promise like not raising taxes, then what words can we believe coming from the mouth of that politician? None. People are tired of state government throwing money down a rat hole. People are tired of paying more for less. People have to pay more as it is while they are making less take home pay. Raising taxes is not an option. Here is an idea. Balance the budget with what you have, Governor Bentley and lawmakers. Come with solutions that do not call for raising one penny on the taxpayers if you just must spend more. We all pay enough as it is, and we elected all of you because you promised not to raise taxes, and not to increase an already bloated state government. The state legislature goes back to Montgomery on Aug. 3 to consider Governor Bentley’s tax increases. All Alabama taxpayers should tell their legislators to keep their promise to not raise taxes. John Rice is the president of Alabama Foundation for Limited Government.

Katherine Robertson: Legislature can still finish strong

The Alabama Legislature caught its share of grief after adjourning the Regular Session without passing a budget. The alleged infighting between the House and Senate and the bickering over how to solve the shortfall dominated the headlines in early June as the session wrapped up. Yet nearly eight weeks later, it’s easier to examine the full body of work and praise a great deal of what has been accomplished. Heading into next week’s Special Session, Republicans should focus on preserving their record over the past five years and on finishing strong. A brief reminder of how this Session began: the governor sent over a budget that relied almost entirely on tax increases to close the General Fund shortfall. Rather than being able to make a few tweaks here and there, legislators opposed to tax increases were forced back to the drawing board with far fewer resources, particularly staff, to aid in their research and decisionmaking. It was hardly surprising that they chose to close the gap with cuts, as the base of the Republican super majority rightfully refused tax increases that would, by and large, ask the people to hand over more of their hard-earned money to fund Medicaid and prisons. While the budget quandary remains unsolved, the Legislature tackled several complex policy matters that will have a positive long-term impact on the General Fund. For instance, managed care reforms to Medicaid that passed in 2013 were duplicated for long-term care services in hope of slowing perpetual increases in Medicaid spending. The Senate also declared its opposition to Medicaid expansion, recognizing that the state’s required obligations through expansion would ultimately add a 10 percent increase to state money spent on Medicaid (not including unknown administrative costs). In another act of legislating for the long-term, the comprehensive prison reform bill was signed into law. Corrections spending accounts for 4.3 percent of all state spending and a whopping 21.4 percent of General Fund expenditures. Along with Medicaid, this spending has increased by 25 percent over the last 20 years with no signs of slowing. Aspects of the prison reform law do require additional front-end funds; but, over time, this investment should help to level out corrections spending as the strains of overcrowding are eased. On the last day of the session, a bill was passed to reform judicial public pensions. Public pensions are an oft-overlooked aspect of state spending, but this year alone, the state put almost $1 billion — nearly five times the amount of the shortfall — into the pension system. The estimates for 2016 are no better. The Judicial Retirement Fund has the worst funding percentage of the state’s three pension systems, and the reform passed this session addresses the state’s liability in this regard. It will result in immediate cost-savings with an even greater savings impact expected over time. Despite some flirting with the governor’s proposed tax increases, most were dead on arrival, as was gambling. Instead, new legislative study committees were established on issues such as tax reform, structural pension reform, and proposed privatization of the state’s ABC Board. This indicates an ongoing willingness to deal with fundamental problems in Alabama’s state government, rather than abdicating this duty and opting for budget gimmicks and quick fixes. Republicans should take pride in these accomplishments and refuse to agree to proposals that would taint their record. There is no denying the pressures that they face from various positions of leadership, powerful special interests, and bleak budget spreadsheets. Still, legislators are sent to Montgomery to make tough calls. This group campaigned on a commitment to govern with the best interests of the people in mind — not to make their decisions on weekly polls or chances at personal gain. U.S. Sen. Jeff Sessions made headlines in Alabama this week with remarks he hoped would embolden Republicans. He said, “We don’t need to be timid. We need to do the right thing. We need to do the bold thing. The government can’t do everything for us. Our values are good values … and we need to define those values. We believe in limited government and lower taxes.” When legislators return on Aug. 3, they will be given another opportunity to take the senator’s advice and finish strong. Based on the grit of those legislators we work with behind the scenes, I, for one, still have faith that they will. Katherine Robertson is vice president for the Alabama Policy Institute (API), a nonprofit research and education organization dedicated to the preservation of free markets, limited government and strong families.

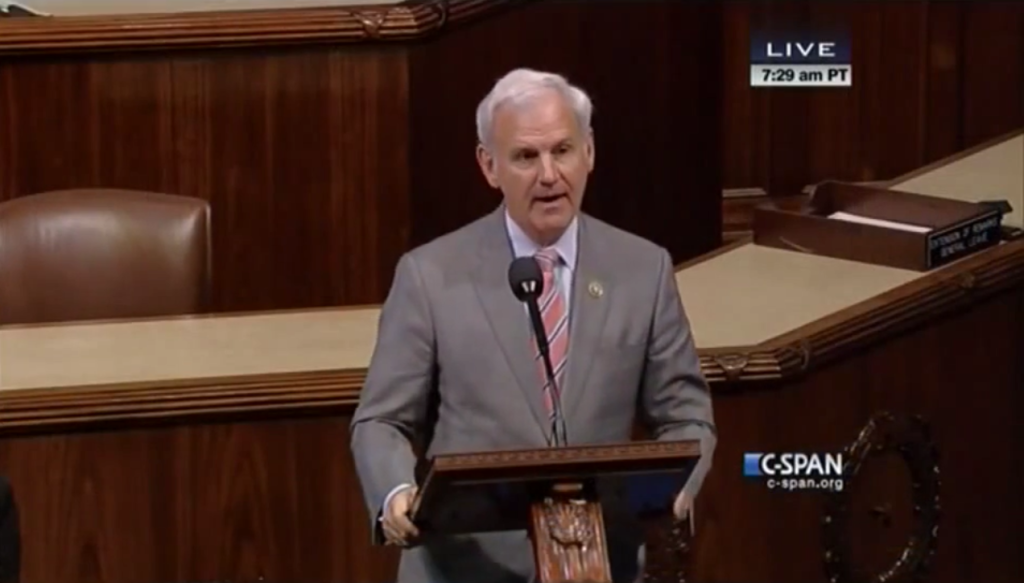

Email Insights: Bradley Byrne highlights federal spending crisis

U.S. Rep. Bradley Byrne took to the floor of the U.S. House of Representatives Tuesday to deliver a speech on how out-of-control federal spending is reaching crisis level and could result in a catastrophe for the next generation. In an email Tuesday afternoon, Byrne released the following video of his speech where he talked specifically about means based entitlement programs, including Medicaid, Obamacare, food stamps, among other welfare programs, noting spending within these programs has ballooned in recent years, despite improvements in the economy. We have reached a point where we must get serious about reining in our out-of-control spending or else we may fall victim to a similar fate that many nations throughout history have experienced. A full transcript of the video can be found below. Mr. Speaker, I rise this morning to talk about one of the biggest problems facing our nation – out-of-control spending. At this very moment the national debt sits at over $18 trillion dollars. We have not arrived at this point because of the actions of one party or one administration. Over the years, both parties have enacted programs that increased our debt. That said, we have reached a point where we must get serious about reining in our out-of-control spending or else we may fall victim to a similar fate that many nations throughout history have experienced. Here in the United States, our spending problems are reaching crisis level, and we are effectively leaving behind a catastrophe for the next generation. The basis of the American dream is that if you work hard, you can leave behind a better future for your children and grandchildren. That fundamentally American vision is in jeopardy due in part to our irresponsible spending. I am a new and very proud grandfather. My grandson, MacGuire, is about to turn one and already his share of the national debt – before his first birthday – is over $40,000. We cannot turn a blind eye to this problem and pretend that it will just get better. Let me explain why. There are two basic forms of federal spending: mandatory spending and discretionary spending. Mr. Speaker, when most people think of the federal government, they are probably thinking about discretionary programs. This is money that goes to things like our military, highways, national parks, agriculture, and medical research. The good thing about discretionary spending is that each year Congress has the ability to control these spending levels through the appropriations process. Since Republicans took control of the House in 2010, we have had some success in cutting funding to various federal agencies. For example, agencies like the IRS and EPA have seen their budgets cut in response to egregious executive overreach. While it may seem like it covers the majority of government operations, discretionary spending actually only makes up about one third of all federal spending. The other portion is what we call mandatory spending. This, along with the interest on the national debt, makes up almost two thirds of all federal spending. Now here’s the really bad part about mandatory spending: it is on auto-pilot. Unlike discretionary spending, mandatory spending does not require annual appropriations from Congress. Instead, as long as someone meets the requirements, these programs dole out money without any action from Congress. Within these mandatory spending programs are what we call means based entitlement programs, including things like Medicaid, Obamacare, food stamps, welfare, and the like. For example, in Fiscal Year 2012, the federal government spent almost $800 billion on over 92 programs aimed at lifting Americans out of poverty. Despite that record spending, too many Americans simply stopped looking for work. The system is failing the very people it was designed to help. While many of these means based entitlement programs have good intentions, they aren’t supposed to be permanent. These programs were created to help lift people out of poverty, not keep them there. That’s why it shouldn’t be a surprise that during the recent economic downturn spending on these means based entitlement programs ballooned. What is surprising however is that as the economy has improved, the spending on these programs has not gone down. In fact, spending on some of these programs remains at all-time highs. Now, Republicans and Democrats both agree that Americans shouldn’t be stuck in poverty, and that’s why we should put party politics aside and come together to address this dangerous cycle of government dependence. We need to reform these means based entitlement programs to put a real focus on workforce training to help connect Americans with the skills they need to get a good paying job that meets workforce demands. We could block grant, through the appropriations process, money to the state governments and allow them to craft poverty fighting programs based on their state’s specific societal problems and economic needs. Now, Mr. Speaker, I know that reforming these mandatory spending programs won’t be easy, but I didn’t run for Congress to come up here and make easy decisions. I doubt my colleagues did either. Before I leave this body, I want to be able to look at my grandson MacGuire and know that I have been a part of a real effort to rein in spending and put our nation on a fiscally stable path for the next generation. We won’t be able to make any real progress toward that goal without serious reforms to these means based entitlement programs. That is what is driving our debt, and we cannot keep looking the other way as the national debt skyrockets. So, Mr. Speaker, I call on my colleagues to join me in addressing our nation’s spending crisis. Let’s come together and make the tough choices, let’s get our spending under control, and let’s leave behind a better America for the next generation.”

Anne-Marie Kaulfers: Fund Alabama Medicaid so children, adults have access to life-saving services

I see numerous children with diabetes and endocrine diseases who are on Alabama Medicaid. In fact, I’m one of the few pediatric endocrinologists in the state that does. As a specialist in Mobile, I also take care of patients covered by Mississippi Medicaid and Florida Medicaid. There’s a vast difference between the three programs in the reimbursement to doctors and covered services, both for children and adults. This disparity is a direct result of funding provided by each state’s legislature. Alabama Medicaid is one of the hardest to qualify for in the country. They are also one of the most efficient – if not the leanest – run operations. Yes, the state’s $600+ million share matched by nearly $6 billion in federal dollars, provider taxes, and intergovernmental transfers sounds like a lot of money. But let me give you an example of how well Alabama Medicaid manages your tax dollars. An insurance policy on the healthcare exchange would cost $2,292 for the annual premium and $4,000 out-of-pocket for an 8-year-old boy for a total of $6,292. Alabama Medicaid spends on average $4,474 per covered individual. That means the cheapest private insurance plan available for a child is still 40 percent more expensive than Alabama Medicaid. This year, Gov. Robert Bentley requested a 20 percent increase over the previous year’s Medicaid funding. The budget passed by the legislature and vetoed by the governor had a 5 percent cut to Medicaid as part of an effort to address a $200 million revenue gap – plus hundreds of millions in other obligations the state owes. The governor has called the Legislature back for a late-summer Special Session to address the General Fund budget, of which Medicaid consumes more than 37 percent — and growing. Some are saying to cut Medicaid because it’s “just an entitlement program.” That it is not. Medicaid is the backbone of the healthcare system in Alabama. It pays for more than half of all baby deliveries, and most of the 1-million-plus participants are children. On top of that, every dollar the state invests in the Medicaid program returns nearly three dollars from the federal government. How would you like that guaranteed rate of return from your bank? During the past few years in an effort to trim costs, Alabama Medicaid has been forced to cut too many essential services that are covered by nearly every other state Medicaid program and by private health plans. This growing disparity in access to care for Medicaid recipients is penny wise and pound foolish. It is accelerating the cost curve rather than slowing it down. Every day, I see costly and debilitating complications suffered by children, and hear about it constantly from doctors who treat adults. This is usually caused by a lack of adequate access to effective therapies to help control their diabetes. As a result, treatment for kidney disease, loss of vision, emergency room visits for hypoglycemia, and other diseases are driving healthcare spending upward. With properly funded Medicaid services, we could slow the rate of growth in overall system costs. So as the debate begins about what agencies or programs to cut or what revenues to increase, keep in mind that Alabama Medicaid can’t be an effective steward of your money without the tools to properly manage and contain the cost of chronic diseases like diabetes. Strategically spending dollars now can save many more down the road. Let’s also not forget that Medicaid is the critical foundation for most hospitals around the state, including my hospital, Children’s Specialty Clinic in Mobile, and the world-renowned Children’s Hospital in Birmingham. Join me in asking the state Legislature to fully fund Medicaid and continue to implement smart healthcare management that will provide real economic and clinical value to the taxpayers and patients in Alabama for many years to come. All of our citizens deserve it. Anne-Marie Kaulfers M.D. is a Pediatric Endocrinologist at Children’s Specialty Clinic, part of the University of South Alabama Health System in Mobile, Ala.